Capital Buffers and Risk-weighted Assets Under Basel III - METAC

Capital Buffers and Risk-weighted Assets Under Basel III - METAC

Capital Buffers and Risk-weighted Assets Under Basel III - METAC

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

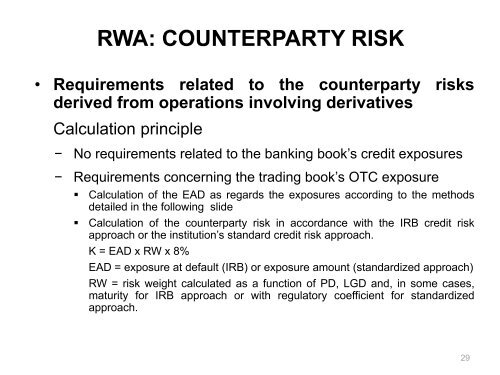

RWA: COUNTERPARTY RISK• Requirements related to the counterparty risksderived from operations involving derivativesCalculation principle−−No requirements related to the banking book’s credit exposuresRequirements concerning the trading book’s OTC exposure• Calculation of the EAD as regards the exposures according to the methodsdetailed in the following slide• Calculation of the counterparty risk in accordance with the IRB credit riskapproach or the institution’s st<strong>and</strong>ard credit risk approach.K = EAD x RW x 8%EAD = exposure at default (IRB) or exposure amount (st<strong>and</strong>ardized approach)RW = risk weight calculated as a function of PD, LGD <strong>and</strong>, in some cases,maturity for IRB approach or with regulatory coefficient for st<strong>and</strong>ardizedapproach.29