Producer Price Index Manual: Theory and Practice ... - METAC

Producer Price Index Manual: Theory and Practice ... - METAC

Producer Price Index Manual: Theory and Practice ... - METAC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

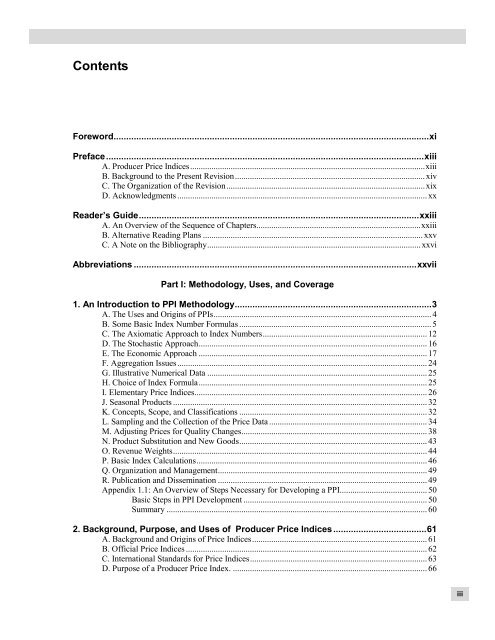

Contents<br />

Foreword.............................................................................................................................xi<br />

Preface..............................................................................................................................xiii<br />

A. <strong>Producer</strong> <strong>Price</strong> Indices..............................................................................................................xiii<br />

B. Background to the Present Revision......................................................................................... xiv<br />

C. The Organization of the Revision.............................................................................................xix<br />

D. Acknowledgments ..................................................................................................................... xx<br />

Reader’s Guide...............................................................................................................xxiii<br />

A. An Overview of the Sequence of Chapters.............................................................................xxiii<br />

B. Alternative Reading Plans ....................................................................................................... xxv<br />

C. A Note on the Bibliography.................................................................................................... xxvi<br />

Abbreviations ................................................................................................................xxvii<br />

Part I: Methodology, Uses, <strong>and</strong> Coverage<br />

1. An Introduction to PPI Methodology..............................................................................3<br />

A. The Uses <strong>and</strong> Origins of PPIs...................................................................................................... 4<br />

B. Some Basic <strong>Index</strong> Number Formulas .......................................................................................... 5<br />

C. The Axiomatic Approach to <strong>Index</strong> Numbers............................................................................. 12<br />

D. The Stochastic Approach........................................................................................................... 16<br />

E. The Economic Approach ........................................................................................................... 17<br />

F. Aggregation Issues..................................................................................................................... 24<br />

G. Illustrative Numerical Data ....................................................................................................... 25<br />

H. Choice of <strong>Index</strong> Formula........................................................................................................... 25<br />

I. Elementary <strong>Price</strong> Indices............................................................................................................. 26<br />

J. Seasonal Products ....................................................................................................................... 32<br />

K. Concepts, Scope, <strong>and</strong> Classifications ........................................................................................ 32<br />

L. Sampling <strong>and</strong> the Collection of the <strong>Price</strong> Data .......................................................................... 34<br />

M. Adjusting <strong>Price</strong>s for Quality Changes....................................................................................... 38<br />

N. Product Substitution <strong>and</strong> New Goods........................................................................................ 43<br />

O. Revenue Weights....................................................................................................................... 44<br />

P. Basic <strong>Index</strong> Calculations............................................................................................................ 46<br />

Q. Organization <strong>and</strong> Management..................................................................................................49<br />

R. Publication <strong>and</strong> Dissemination .................................................................................................. 49<br />

Appendix 1.1: An Overview of Steps Necessary for Developing a PPI......................................... 50<br />

Basic Steps in PPI Development ...................................................................................... 50<br />

Summary .......................................................................................................................... 60<br />

2. Background, Purpose, <strong>and</strong> Uses of <strong>Producer</strong> <strong>Price</strong> Indices.....................................61<br />

A. Background <strong>and</strong> Origins of <strong>Price</strong> Indices.................................................................................. 61<br />

B. Official <strong>Price</strong> Indices ................................................................................................................. 62<br />

C. International St<strong>and</strong>ards for <strong>Price</strong> Indices................................................................................... 63<br />

D. Purpose of a <strong>Producer</strong> <strong>Price</strong> <strong>Index</strong>. ...........................................................................................66<br />

iii

<strong>Producer</strong> <strong>Price</strong> <strong>Index</strong> <strong>Manual</strong><br />

E. PPI Uses..................................................................................................................................... 69<br />

F. A Family of PPI’s....................................................................................................................... 70<br />

3. Coverage <strong>and</strong> Classifications.......................................................................................73<br />

A. Population Coverage ................................................................................................................. 73<br />

B. <strong>Price</strong> coverage............................................................................................................................ 75<br />

C. Geographic coverage ................................................................................................................. 80<br />

D. Statistical Units.......................................................................................................................... 80<br />

E. Classification.............................................................................................................................. 81<br />

Part II: Compilation Issues<br />

4. Weights <strong>and</strong> Their Sources ..........................................................................................89<br />

A. Introduction ............................................................................................................................... 89<br />

B. Role of Weights ......................................................................................................................... 89<br />

C. Appropriate Weights <strong>and</strong> Structure for PPI............................................................................... 90<br />

D. Elementary Aggregate or Stratum Level Weights..................................................................... 94<br />

E. Product <strong>and</strong> Transaction Weights ..............................................................................................97<br />

F. Practical Steps for Selecting <strong>and</strong> Determining Weights........................................................... 100<br />

5. Sampling Issues in <strong>Price</strong> Collection ..........................................................................102<br />

A. Introduction ............................................................................................................................. 102<br />

B. Common Problems in <strong>Price</strong> Survey Sampling......................................................................... 102<br />

C. Starting Position....................................................................................................................... 103<br />

D. Sample Design......................................................................................................................... 106<br />

E. An Example of Sample Selection <strong>and</strong> Recruitment of Establishments.................................... 113<br />

F. Sample Maintenance <strong>and</strong> Rotation........................................................................................... 117<br />

G. Summary of Sampling Strategies for the PPI.......................................................................... 119<br />

6. <strong>Price</strong> Collection ...........................................................................................................121<br />

A. Introduction ............................................................................................................................. 121<br />

B. Timing <strong>and</strong> Frequency of <strong>Price</strong> Collection.............................................................................. 121<br />

C. Product Specification............................................................................................................... 124<br />

D. Collection Procedures.............................................................................................................. 124<br />

E. Respondent Relations............................................................................................................... 134<br />

F. Verification .............................................................................................................................. 135<br />

G. Related <strong>Price</strong> Issues................................................................................................................. 136<br />

7. Treatment of Quality Change......................................................................................140<br />

A. Introduction ............................................................................................................................. 140<br />

B. What Is Meant by Quality Change .......................................................................................... 146<br />

C. An Introduction to Methods of Quality Adjustment When Matched Items Are Unavailable . 154<br />

D. Implicit Methods ..................................................................................................................... 157<br />

E. Explicit Methods...................................................................................................................... 166<br />

F. Choosing a Quality-Adjustment Method ................................................................................. 179<br />

G. High-Technology <strong>and</strong> Other Sectors with Rapid Turnover of Models.................................... 182<br />

H. Long-Run <strong>and</strong> Short-Run Comparisons .................................................................................. 191<br />

Appendix 7.1. Data for Hedonic Regression Illustration ............................................................. 195<br />

8. Item Substitution, Sample Space, <strong>and</strong> New Goods ..................................................197<br />

A. Introduction ............................................................................................................................. 197<br />

B. Sampling Issues <strong>and</strong> Matching ................................................................................................ 198<br />

C. Information Requirements for a Strategy for Quality Adjustment .......................................... 201<br />

iv

Contents<br />

D. The Incorporating of New Goods............................................................................................ 202<br />

E. Summary.................................................................................................................................. 207<br />

Appendix 8.1. Appearance <strong>and</strong> Disappearance of Products <strong>and</strong> Establishments......................... 208<br />

9. PPI Calculation in <strong>Practice</strong> .........................................................................................213<br />

A. Introduction ............................................................................................................................. 213<br />

B. Calculation of <strong>Price</strong> Indices for Elementary Aggregates......................................................... 213<br />

C. Calculation of Higher-Level Indices........................................................................................ 229<br />

D. Data Editing............................................................................................................................. 244<br />

10. Treatment of Specific Products................................................................................251<br />

A. Introduction ............................................................................................................................. 251<br />

B. Agriculture, ISIC 01 ................................................................................................................ 252<br />

C. Clothing, ISIC 18..................................................................................................................... 256<br />

D. Petroleum Refining ISIC 23 .................................................................................................... 257<br />

E. Steel Mills, ISIC 27.................................................................................................................. 259<br />

F. Electronic Computers, ISIC 30 ................................................................................................ 261<br />

G. Motor Vehicles, ISIC 34.......................................................................................................... 263<br />

H. Shipbuilding, ISIC 35.............................................................................................................. 265<br />

I. Construction, ISIC 45 ............................................................................................................... 267<br />

J. Retail Trade, ISIC 52................................................................................................................ 270<br />

K. Telecommunication, ISIC 642................................................................................................. 273<br />

L. Commercial Banking, ISIC 65................................................................................................. 274<br />

M. Insurance, ISIC 66 .................................................................................................................. 279<br />

N. Software Consultancy <strong>and</strong> Supply, ISIC 7220 ........................................................................ 281<br />

O. Legal Services, ISIC 7411....................................................................................................... 282<br />

P. General Medical Hospitals, ISIC 8511..................................................................................... 288<br />

11. Errors <strong>and</strong> Bias in the PPI ........................................................................................295<br />

A. Introduction ............................................................................................................................. 295<br />

B. Errors <strong>and</strong> Bias ........................................................................................................................ 297<br />

C. Use, Coverage, <strong>and</strong> Valuation ................................................................................................. 299<br />

D. Sampling Error <strong>and</strong> Bias on Initiation..................................................................................... 300<br />

E. Sampling Error <strong>and</strong> Bias: The Dynamic Universe................................................................... 301<br />

F. <strong>Price</strong> Measurement: Response Error <strong>and</strong> Bias, Quality Change, <strong>and</strong> New Goods................... 301<br />

G. Substitution Bias...................................................................................................................... 303<br />

Part III: Operational Issues<br />

12. Organization <strong>and</strong> Management ................................................................................307<br />

A. Introduction ............................................................................................................................. 307<br />

B. Initiation of the <strong>Price</strong> Collection Process................................................................................. 307<br />

C. Quality in Field Data Collection.............................................................................................. 308<br />

D. Quality Checks in <strong>Price</strong> Collection ......................................................................................... 310<br />

E. PPI Production <strong>and</strong> Quality Assurance.................................................................................... 313<br />

F. Performance Management, Development, <strong>and</strong> Training.......................................................... 316<br />

G. Quality Management <strong>and</strong> Quality Management Systems........................................................ 317<br />

13. Publication, Dissemination, <strong>and</strong> User Relations.....................................................321<br />

A. Introduction ............................................................................................................................. 321<br />

B. Types of Presentation .............................................................................................................. 321<br />

C. Dissemination Issues ............................................................................................................... 327<br />

v

<strong>Producer</strong> <strong>Price</strong> <strong>Index</strong> <strong>Manual</strong><br />

D. User Consultation .................................................................................................................... 328<br />

E. Press release example .............................................................................................................. 330<br />

Part IV: Conceptual <strong>and</strong> Theoretical Issues<br />

14. The System of <strong>Price</strong> Statistics .................................................................................335<br />

A. Introduction ............................................................................................................................. 335<br />

B. Major Goods <strong>and</strong> Services <strong>Price</strong> Statistics <strong>and</strong> National Accounts......................................... 336<br />

C. International Comparisons of Expenditure on Goods <strong>and</strong> Services......................................... 365<br />

15. Basic <strong>Index</strong> Number <strong>Theory</strong> .....................................................................................370<br />

A. Introduction ............................................................................................................................. 370<br />

B. Decomposition of Value Aggregates into <strong>Price</strong> <strong>and</strong> Quantity Components............................ 371<br />

C. Symmetric Averages of Fixed–Basket <strong>Price</strong> Indices............................................................... 375<br />

D. Annual Weights <strong>and</strong> Monthly <strong>Price</strong> Indices............................................................................ 379<br />

E. Divisia <strong>Index</strong> <strong>and</strong> Discrete Approximations............................................................................ 391<br />

F. Fixed-Base Versus Chain Indices ............................................................................................ 394<br />

Appendix 15.1: Relationship Between Paasche <strong>and</strong> Laspeyres Indices....................................... 399<br />

Appendix 15.2: Relationship Between Lowe <strong>and</strong> Laspeyres Indices........................................... 399<br />

Appendix 15.3: Relationship Between Young <strong>Index</strong> <strong>and</strong> its Time Antithesis ............................. 401<br />

16. Axiomatic <strong>and</strong> Stochastic Approaches to <strong>Index</strong> Number <strong>Theory</strong>..........................403<br />

A. Introduction ............................................................................................................................. 403<br />

B. The Levels Approach to <strong>Index</strong> Number <strong>Theory</strong> ...................................................................... 405<br />

C. First Axiomatic Approach to Bilateral <strong>Price</strong> Indices............................................................... 408<br />

D. Stochastic Approach to <strong>Price</strong> Indices ...................................................................................... 417<br />

E. Second Axiomatic Approach to Bilateral <strong>Price</strong> Indices........................................................... 423<br />

F. Test properties of Lowe <strong>and</strong> Young indices............................................................................. 431<br />

Appendix 16.1: Proof of Optimality of Törnqvist Theil <strong>Price</strong> <strong>Index</strong> in Second Bilateral Test<br />

Approach ...................................................................................................................................... 432<br />

17. Economic Approach..................................................................................................435<br />

A. Introduction ............................................................................................................................. 435<br />

B. Fisher-Shell output price index: the case of one establishment ............................................... 438<br />

C. Economic approach to an intermediate input price index for an establishment....................... 451<br />

D. Economic Approach to the Value-Added Deflator for an Establishment................................ 455<br />

E. Approximations to Superlative Indices: Midyear Indices........................................................ 457<br />

Appendix 17.1: The Relationship Between Divisia <strong>and</strong> Economic Approaches.......................... 460<br />

18. Aggregation Issues ...................................................................................................463<br />

A. Introduction ............................................................................................................................. 463<br />

B. Aggregation over Establishments ............................................................................................ 464<br />

C. Laspeyres, Paasche, Superlative Indices <strong>and</strong> Two-Stage Aggregation.................................... 470<br />

D. Value-added Deflators—Relationships Between <strong>Producer</strong> <strong>Price</strong> Indices ............................... 472<br />

E. Aggregation of Establishment Deflators into a National Value-Added Deflator..................... 478<br />

F. National Value-added Deflator Versus the Final-Dem<strong>and</strong> Deflator ........................................ 479<br />

19. <strong>Price</strong> Indices Using an Artificial Data Set................................................................485<br />

A. Introduction ............................................................................................................................. 485<br />

B. <strong>Price</strong> Indices for Final-dem<strong>and</strong> Components........................................................................... 485<br />

C. Midyear Indices ....................................................................................................................... 493<br />

D. Additive Percentage Change Decompositions for the Fisher <strong>Index</strong> ........................................ 495<br />

vi

Contents<br />

E. Industry <strong>Price</strong> Indices .............................................................................................................. 498<br />

F. National producer price indices................................................................................................ 504<br />

20. Elementary Indices....................................................................................................508<br />

A. Introduction ............................................................................................................................. 508<br />

B. Ideal Elementary Indices ......................................................................................................... 508<br />

C. Elementary Indices Used in <strong>Practice</strong> ....................................................................................... 511<br />

D. Numerical Relationships between the Frequently Used Elementary Indices .......................... 512<br />

E. The Axiomatic Approach to Elementary Indices..................................................................... 514<br />

F. The Economic Approach to Elementary Indices...................................................................... 516<br />

G. Sampling Approach to Elementary Indices ............................................................................. 518<br />

H. A Simple Stochastic Approach to Elementary Indices............................................................ 523<br />

I. Conclusion ................................................................................................................................ 524<br />

21. Quality Change <strong>and</strong> Hedonics..................................................................................525<br />

A. New <strong>and</strong> Disappearing Items <strong>and</strong> Quality Change: Introduction ............................................ 525<br />

B. Hedonic <strong>Price</strong>s <strong>and</strong> Implicit Markets....................................................................................... 527<br />

C. Hedonic Indices ....................................................................................................................... 539<br />

D. New Goods <strong>and</strong> Services......................................................................................................... 544<br />

Appendix 21.1: Some Econometric Issues................................................................................... 545<br />

22. Treatment of Seasonal Products..............................................................................553<br />

A. Problem of Seasonal Products ................................................................................................ 553<br />

B. A Seasonal Product Data Set ................................................................................................... 557<br />

C. Year-over-Year Monthly Indices............................................................................................. 558<br />

D. Year-over-Year Annual Indices............................................................................................... 564<br />

E. Rolling-Year Annual Indices ................................................................................................... 567<br />

F. Predicting Rolling-Year <strong>Index</strong> Using Current Period Year-over-Year Monthly <strong>Index</strong> ........... 570<br />

G. Maximum Overlap Month-to-Month <strong>Price</strong> Indices................................................................. 574<br />

H. Annual Basket Indices with Carryforward of Unavailable <strong>Price</strong>s........................................... 580<br />

I. Annual Basket Indices with Imputation of Unavailable <strong>Price</strong>s................................................. 582<br />

J. Bean <strong>and</strong> Stine Type C or Rothwell Indices............................................................................. 583<br />

K. Forecasting Rolling-Year Indices Using Month-to-month Annual Basket Indices................. 585<br />

L. Conclusions.............................................................................................................................. 592<br />

Glossary...........................................................................................................................594<br />

Bibliography ....................................................................................................................615<br />

Tables<br />

Table 3.1. ISIC <strong>and</strong> NACE............................................................................................................. 82<br />

Table 3.2. ISIC <strong>and</strong> NAICS............................................................................................................ 83<br />

Table 5.1. Step 1 for Establishment Sample Selection................................................................. 114<br />

Table 5.2. Step 2 for Establishment Sample Selection................................................................. 114<br />

Table 5.3. Step 3 for Establishment Sample Selection................................................................. 114<br />

Table 5.4. Selection of Products Using the Ranking Method....................................................... 115<br />

Table 7.1. Estimating a Quality-Adjusted <strong>Price</strong>........................................................................... 156<br />

Table 7.2. Example of Overlap Method of Quality Adjustment .................................................. 158<br />

Table 7.3. Example of the Bias from Implicit Quality Adjustment for r 2 = 1.00 ......................... 163<br />

Table 7.4. Hedonic Regression Results for Dell <strong>and</strong> Compaq PCs.............................................. 172<br />

Table 7.5. Example of Long-Run <strong>and</strong> Short-Run Comparisons................................................... 191<br />

Table 8.1 Sample Augmentation Example................................................................................... 207<br />

Table 9.1. Calculation of <strong>Price</strong> Indices for an Elementary Aggregate ......................................... 216<br />

vii

<strong>Producer</strong> <strong>Price</strong> <strong>Index</strong> <strong>Manual</strong><br />

Table 9.2. Properties of Main Elementary Aggregate <strong>Index</strong> Formulas........................................ 219<br />

Table 9.3. Imputation of Temporarily Missing <strong>Price</strong>s.................................................................. 224<br />

Table 9.4. Disappearing Products <strong>and</strong> Their Replacements with No Overlap ............................. 225<br />

Table 9.5. Disappearing <strong>and</strong> Replacement Products with Overlapping <strong>Price</strong>s............................. 226<br />

Table 9.6. The Aggregation of the Elementary <strong>Price</strong> Indices....................................................... 231<br />

Table 9.7. <strong>Price</strong> Updating of Weights Between Weight <strong>and</strong> <strong>Price</strong> Reference Periods................. 234<br />

Table 9.8. Calculation of a Chained <strong>Index</strong> ................................................................................... 237<br />

Table 9.9. Calculation of a Chained <strong>Index</strong> Using Linking Coefficients....................................... 238<br />

Table 9.10. Decomposition of <strong>Index</strong> Change from January 2002 to January 2003...................... 243<br />

Table 14.1. Production Account for an Establishment, Institutional Unit, or Sector ................... 340<br />

Table 14.2. Production Account with Product Detail for an Establishment/LKAU..................... 342<br />

Table 14.3. Industry/Activity Production Account with Detail for Products <strong>and</strong><br />

Market/Nonmarket............................................................................................ 343<br />

Table 14.4. Use of Income Account for Institutional Units <strong>and</strong> Sectors...................................... 345<br />

Table 14.5. Use of Income Account with Product Detail for Institutional Units <strong>and</strong> Sectors...... 348<br />

Table 14.6. Use of income account with product detail for the total economy ............................ 348<br />

Table 14.8. Capital Account with Product Detail......................................................................... 352<br />

Table 14.9. External Account of Goods <strong>and</strong> Services.................................................................. 353<br />

Table 14.10. External Account of Goods <strong>and</strong> Services with Product Detail................................ 354<br />

Table 14.11. The Supply <strong>and</strong> Use Table (SUT) ........................................................................... 355<br />

Table 14.12. Location <strong>and</strong> Coverage of the Major <strong>Price</strong> Indices in the Supply <strong>and</strong> Use Table... 357<br />

Table 14.13. Definition of Scope, <strong>Price</strong> Relatives, Coverage, <strong>and</strong> Weights for Major <strong>Price</strong><br />

Indices ............................................................................................................... 360<br />

Table 14.14. Generation of Income Account for Establishment, Institutional Unit, or<br />

Institutional Sector ............................................................................................ 363<br />

Table 14.15. Generation of Income Account for Establishment <strong>and</strong> Industry with Labor<br />

Services (Occupational) Detail.......................................................................... 364<br />

Table 14.16. A Framework for <strong>Price</strong> Statistics ............................................................................ 366<br />

Table 19.1. <strong>Price</strong>s for Eight Commodities ................................................................................... 487<br />

Table 19.2. Quantities for Eight Commodities............................................................................. 487<br />

Table 19.3. Net Expenditures <strong>and</strong> net Expenditure Shares for Eight Commodities..................... 487<br />

Table 19.4. Fixed-Base Laspeyres, Paasche, Carli, <strong>and</strong> Jevons Indices....................................... 488<br />

Table 19.5. Chained Laspeyres, Paasche, Carli, <strong>and</strong> Jevons Indices............................................ 488<br />

Table 19.6. Asymmetrically Weighted Fixed-Base Indices ......................................................... 489<br />

Table 19.7. Asymmetrically Weighted Indices Using the Chain Principle.................................. 490<br />

Table 19.8. Symmetrically Weighted Fixed-Base Indices ........................................................... 491<br />

Table 19.9. Symmetrically Weighted Indices Using the Chain Principle .................................... 491<br />

Table 19.10. Fixed-Base Superlative Single-Stage <strong>and</strong> Two-Stage Indices................................. 491<br />

Table 19.11. Chained Superlative Single-Stage <strong>and</strong> Two-Stage Indices ..................................... 493<br />

Table 19.12. Chained Arithmetic- <strong>and</strong> Geometric-Type Midyear Indices ................................... 493<br />

Table 19.13. Fixed-Base Arithmetic- <strong>and</strong> Geometric-Type Midyear Indices .............................. 494<br />

Table 19.14. An Additive Percentage Change Decomposition of the Fisher <strong>Index</strong> ..................... 495<br />

Table 19.15. Van Ijzeren’s Decomposition of the Fisher <strong>Price</strong> <strong>Index</strong>.......................................... 495<br />

Table 19.16. <strong>Price</strong> <strong>and</strong> Quantity Data for the Agriculture Sector ................................................ 497<br />

Table 19.17. <strong>Price</strong> <strong>and</strong> Quantity Data for the Manufacturing Sector ........................................... 497<br />

Table 19.19. Quantity Data for the Service Sector....................................................................... 499<br />

Table 19.20. Agriculture Sector Fixed-Base Laspeyres, Paasche, Fisher, <strong>and</strong> Törnqvist Value-<br />

Added Deflators ................................................................................................ 499<br />

Table 19.21. Agriculture Sector Chained Laspeyres, Paasche, Fisher, <strong>and</strong> Törnqvist <strong>Price</strong><br />

Value Deflators ................................................................................................. 499<br />

Table 19.22. Manufacturing Sector Fixed-Base Laspeyres, Paasche, Fisher, <strong>and</strong> Törnqvist<br />

Value Deflators ................................................................................................. 501<br />

viii

Contents<br />

Table 19.23 Manufacturing Sector Chained Laspeyres, Paasche, Fisher, <strong>and</strong> Törnqvist Value-<br />

Added Deflators ................................................................................................ 501<br />

Table 19.24. Services Sector Fixed-Base Laspeyres, Paasche, Fisher, <strong>and</strong> Törnqvist Value-<br />

Added Deflators ................................................................................................ 501<br />

Table 19.25. Services Sector Chained Laspeyres, Paasche, Fisher, <strong>and</strong> Törnqvist Value-<br />

Added Deflators ................................................................................................ 502<br />

Table 19.26. Fixed-Base National Laspeyres, Paasche, Fisher, <strong>and</strong> Törnqvist Output <strong>Producer</strong><br />

<strong>Price</strong> Indices...................................................................................................... 503<br />

Table 19.27. Chained National Laspeyres, Paasche, Fisher, <strong>and</strong> Törnqvist Output <strong>Producer</strong><br />

<strong>Price</strong> Indices...................................................................................................... 503<br />

Table 19.28. Fixed-Base National Laspeyres, Paasche, Fisher, <strong>and</strong> Törnqvist Intermediate<br />

Input <strong>Producer</strong> <strong>Price</strong> Indices ............................................................................. 503<br />

Table 19.29. Chained National Laspeyres, Paasche, Fisher, <strong>and</strong> Törnqvist Intermediate Input<br />

<strong>Producer</strong> <strong>Price</strong> Indices....................................................................................... 504<br />

Table 19.30. Fixed-Base National Laspeyres, Paasche, Fisher, <strong>and</strong> Törnqvist Value-Added<br />

Deflators Deflators............................................................................................ 506<br />

Table 19.31. Chained national Laspeyres, Paasche, Fisher, <strong>and</strong> Törnqvist Value-Added<br />

Deflators Deflators............................................................................................ 506<br />

Table 19.32. Two-stage Fixed-base National Laspeyres, Paasche, Fisher, <strong>and</strong> Törnqvist<br />

Value-Added Deflators ..................................................................................... 506<br />

Table 19.33. Two-Stage Chained National Laspeyres, Paasche, Fisher, <strong>and</strong> Törnqvist Value-<br />

Added Deflators ................................................................................................ 507<br />

Table 22.1. Artificial Seasonal Data Set: <strong>Price</strong>s........................................................................... 555<br />

Table 22.2. Artificial Seasonal Data Set: Quantities .................................................................... 556<br />

Table 22.3. Year-over-Year Monthly Fixed-Base Laspeyres Indices .......................................... 561<br />

Table 22.4. Year-over-Year Monthly Fixed-Base Paasche Indices.............................................. 561<br />

Table 22.5. Year-over-Year Monthly Fixed-Base Fisher Indices ................................................ 561<br />

Table 22.6. Year-over-Year Approximate Monthly Fixed-Base Paasche Indices........................ 561<br />

Table 22.7. Year-over-Year Approximate Monthly Fixed-Base Fisher Indices .......................... 562<br />

Table 22.8. Year-over-Year Monthly Chained Laspeyres Indices ............................................... 562<br />

Table 22.9. Year-over-Year Monthly Chained Paasche Indices .................................................. 562<br />

Table 22.10. Year-over-Year Monthly Chained Fisher Indices ................................................... 563<br />

Table 22.11. Year-over-Year Monthly Approximate Chained Laspeyres Indices ....................... 563<br />

Table 22.12. Year-over-Year Monthly Approximate Chained Paasche Indices .......................... 563<br />

Table 22.13. Year-over-Year Monthly Approximate Chained Fisher <strong>Price</strong> Indices .................... 564<br />

Table 22.14. Annual Fixed-Base Laspeyres, Paasche, <strong>and</strong> Fisher <strong>Price</strong> Indices......................... 566<br />

Table 22.15. Annual Approximate Fixed-Base Laspeyres, Paasche, Fisher, <strong>and</strong> Geometric<br />

Laspeyres Indices.............................................................................................. 566<br />

Table 22.16. Annual Chained Laspeyres, Paasche, <strong>and</strong> Fisher <strong>Price</strong> Indices............................... 567<br />

Table 22.17. Annual Approximate Chained Laspeyres, Paasche, <strong>and</strong> Fisher <strong>Price</strong> Indices......... 567<br />

Table 22.18. Rolling-Year Laspeyres, Paasche, <strong>and</strong> Fisher <strong>Price</strong> Indices.................................... 569<br />

Table 22.19. Rolling-Year Approximate Laspeyres, Paasche, <strong>and</strong> Fisher <strong>Price</strong> Indices.............. 571<br />

Table 22.20. Rolling-Year Fixed-Base Laspeyres <strong>and</strong> Seasonally Adjusted Approximate<br />

Rolling-Year <strong>Price</strong> Indices................................................................................ 574<br />

Table 22.21. Month-to-Month Maximum Overlap Chained Laspeyres, Paasche, <strong>and</strong> Fisher<br />

<strong>Price</strong> Indices...................................................................................................... 577<br />

Table 22.22. Month-to-Month Chained Laspeyres, Paasche, <strong>and</strong> Fisher <strong>Price</strong> Indices ............... 579<br />

Table 22.23. Lowe, Young, Geometric Laspeyres, <strong>and</strong> Centered Rolling-Year Indices with<br />

Carryforward <strong>Price</strong>s .......................................................................................... 581<br />

Table 22.24. Lowe, Young, Geometric Laspeyres, <strong>and</strong> Centered Rolling-Year Indices with<br />

Imputed <strong>Price</strong>s................................................................................................... 584<br />

Table 22.25. Lowe with Carryforward <strong>Price</strong>s, Normalized Rothwell, <strong>and</strong> Rothwell Indices ...... 587<br />

ix

<strong>Producer</strong> <strong>Price</strong> <strong>Index</strong> <strong>Manual</strong><br />

Table 22.26. Seasonally Adjusted Lowe, Young, <strong>and</strong> Geometric Laspeyres Indices with<br />

Carryforward <strong>Price</strong>s <strong>and</strong> Centered Rolling-Year <strong>Index</strong> .................................... 588<br />

Table 22.27. Seasonally Adjusted Lowe, Young, <strong>and</strong> Geometric Laspeyres Indices with<br />

Imputed <strong>Price</strong>s, Seasonally Adjusted Rothwell <strong>and</strong> Centered Rolling-Year<br />

Indices ............................................................................................................... 589<br />

Figures<br />

Figure 7.1. Quality Adjustment for Different Sized Items ........................................................... 170<br />

Figure 7.2. Scatter Diagram.......................................................................................................... 171<br />

Figure 7.3. Flow Chart for Making Decisions on Quality Change............................................... 180<br />

Figure 11.1. Outline of Sources of Error <strong>and</strong> Bias ....................................................................... 295<br />

Figure 17.1. The Lasperyres <strong>and</strong> Paasche Bounds to the Output <strong>Price</strong> <strong>Index</strong> ............................. 441<br />

Figure 21.1. Consumption <strong>and</strong> Production Decisions for Combinations of Characteristics ........ 528<br />

Figure 22.1. Rolling-Year Fixed-Base <strong>and</strong> Chained Laspeyres, Paasche, <strong>and</strong> Fisher Indices ..... 572<br />

Figure 22.2. Rolling-Year Approximate Laspeyres, Paasche, <strong>and</strong> Fisher <strong>Price</strong> Indices .............. 573<br />

Figure 22.3. Rolling-Year Fixed-Base Laspeyres <strong>and</strong> Seasonally Adjusted Approximate<br />

Rolling-Year <strong>Price</strong> Indices................................................................................ 575<br />

Figure 22.4 Lowe, Young, Geometric Laspeyres, <strong>and</strong> Centered Rolling-Year Indices with<br />

Carryforward <strong>Price</strong>s .......................................................................................... 583<br />

Figure 22.5 Lowe, Young, Geometric Laspeyres, <strong>and</strong> Centered Rolling-Year Indices with<br />

Imputed <strong>Price</strong>s................................................................................................... 585<br />

Figure 22.6. Lowe <strong>and</strong> Normalized Rothwell Indices.................................................................. 586<br />

Figure 22.7a. Seasonally Adjusted Lowe, Young, Geometric Laspeyres, <strong>and</strong> Centered Rolling<br />

Indices ............................................................................................................... 586<br />

Figure 22.7b. Lowe, Young, Geometric Laspeyres, <strong>and</strong> Centered Rolling Indices Using X-11<br />

Seasonal Adjustment......................................................................................... 590<br />

Figure 22.8a. Seasonally Adjusted Lowe, Young, <strong>and</strong> Geometric Laspeyres Indices with<br />

Imputed <strong>Price</strong>s; Seasonally Adjusted Rothwell <strong>and</strong> Centered Rolling-Year<br />

Indices ............................................................................................................... 591<br />

Figure 22.8b. Lowe, Young, <strong>and</strong> Geometric Laspeyres Indices Using X-11 Seasonal<br />

Adjustment with Imputer <strong>Price</strong>s <strong>and</strong> Centered Rolling-Year Indices ............... 592<br />

Boxes<br />

Box 14.1. Institutional Sectors in the System of National Accounts 1993.................................... 338<br />

Box 14.2. Industry/Activity Coverage of the <strong>Producer</strong> <strong>Price</strong> <strong>Index</strong> Output Value Aggregate..... 344<br />

Box 14.3. The Treatment of Housing <strong>and</strong> Consumer Durables in the 1993 SNA <strong>and</strong> CPIs ......... 346<br />

Appendices<br />

Appendix 1.1: An Overview of Steps Necessary for Developing a PPI......................................... 50<br />

Appendix 7.1. Data for Hedonic Regression Illustration ............................................................. 195<br />

Appendix 8.1. Appearance <strong>and</strong> Disappearance of Products <strong>and</strong> Establishments......................... 208<br />

Appendix 15.1: Relationship Between Paasche <strong>and</strong> Laspeyres Indices....................................... 399<br />

Appendix 15.2: Relationship Between Lowe <strong>and</strong> Laspeyres Indices........................................... 399<br />

Appendix 15.3: Relationship Between Young <strong>Index</strong> <strong>and</strong> its Time Antithesis ............................. 401<br />

Appendix 16.1: Proof of Optimality............................................................................................. 432<br />

Appendix 17.1: The Relationship Between the Divisia <strong>and</strong> Economic Approaches.................... 460<br />

Appendix 21.1: Some Econometric Issues................................................................................... 545<br />

Appendix G.1: Some Basic <strong>Index</strong> Number Formulas <strong>and</strong> Terminology...................................... 612<br />

x

Foreword<br />

This <strong>Producer</strong> <strong>Price</strong> <strong>Index</strong> <strong>Manual</strong> replaces the United Nations <strong>Manual</strong> on <strong>Producer</strong>s’ <strong>Price</strong> Indices<br />

for Industrial Goods issued in 1979 (Series M, No. 66). The development of the PPI <strong>Manual</strong> has been<br />

undertaken under the joint responsibility of five organizations—the International Labour Organization<br />

(ILO), International Monetary Fund (IMF), Organisation for Economic Co-operation <strong>and</strong> Development<br />

(OECD), United Nations Economic Commission for Europe (UNECE), <strong>and</strong> World Bank—<br />

through the mechanism of an Inter-Secretariat Working Group on <strong>Price</strong> Statistics (IWGPS). It is published<br />

jointly by these organizations.<br />

The <strong>Manual</strong> contains detailed, comprehensive information <strong>and</strong> explanations for compiling a PPI. It<br />

provides an overview of the conceptual <strong>and</strong> theoretical issues that statistical offices should consider<br />

when making decisions on how to deal with the various problems in the daily compilation of a PPI,<br />

<strong>and</strong> it is intended for use by both developed <strong>and</strong> developing countries. The chapters cover many<br />

topics; they elaborate on the different practices currently in use, propose alternatives whenever<br />

possible, <strong>and</strong> discuss the advantages <strong>and</strong> disadvantages of each alternative. Given the comprehensive<br />

nature of the <strong>Manual</strong>, we expect it to satisfy the needs of many users.<br />

The main purpose of the <strong>Manual</strong> is to assist producers of the PPI, particularly countries that are revising<br />

or setting up their PPI. The <strong>Manual</strong> draws on a wide range of experience <strong>and</strong> expertise in an attempt<br />

to describe practical <strong>and</strong> suitable measurement methods. It should also help countries to produce<br />

their PPIs in a comparable way, so that statistical offices <strong>and</strong> international organizations can make<br />

meaningful international comparisons. Because it brings together a large body of knowledge on the<br />

subject, the <strong>Manual</strong> may be used for self-learning or as a teaching tool for training courses on the PPI.<br />

Other PPI users, such as businesses, policymakers, <strong>and</strong> researchers, make up another targeted<br />

audience of the <strong>Manual</strong>. The <strong>Manual</strong> will inform them not only about the different methods that are<br />

employed in collecting data <strong>and</strong> compiling such indices, but also about the limitations, so that the<br />

results may de interpreted correctly.<br />

The drafting <strong>and</strong> revision process has required many meetings over a five-year period, in which PPI<br />

experts from national <strong>and</strong> international statistical offices, universities, <strong>and</strong> research organizations have<br />

participated. The <strong>Manual</strong> owes much to their collective advice <strong>and</strong> wisdom.<br />

The electronic version of the <strong>Manual</strong> is available on the Internet at www.imf.org. The IWGPS views<br />

the <strong>Manual</strong> as a “living document” that it will amend <strong>and</strong> update to address particular points in more<br />

detail. This is especially true for emerging discussions <strong>and</strong> recommendations made by international<br />

groups reviewing the PPI, such as the International Working Group on Service Sector Statistics (the<br />

Voorburg Group) <strong>and</strong> the International Working Group on <strong>Price</strong> Indices (the Ottawa Group).<br />

The IWGPS welcomes user’s comments on the manual, which should be sent to the IMF<br />

Statistics Department (e-mail: TEGPPI@imf.org). They will be taken into account in any future<br />

revisions.<br />

xi

<strong>Producer</strong> <strong>Price</strong> <strong>Index</strong> <strong>Manual</strong><br />

A. Sylvester Young Heinrich Brüngger<br />

Director<br />

Director<br />

Statistics Department<br />

Statistics Division<br />

International Labour Organization<br />

United Nations Economic<br />

Commission for Europe<br />

Rodrigo Rato<br />

Managing Director<br />

International Monetary Fund<br />

Enrico Giovanini<br />

Director<br />

Statistical Directorate<br />

Organisation for Economic Co-operation<br />

<strong>and</strong> Development<br />

Shaida Badiee<br />

Director<br />

Development Data Group<br />

World Bank<br />

xii

Preface<br />

The ILO, IMF, OECD, UNECE, <strong>and</strong> World Bank, together with experts from a number of national<br />

statistical offices <strong>and</strong> universities, have collaborated since 1998 in developing this <strong>Producer</strong> <strong>Price</strong> <strong>Index</strong><br />

<strong>Manual</strong>. In addition, these organizations have consulted with a large number of potential users of<br />

the PPI <strong>Manual</strong> to get practical input. The developing organizations endorse the principles <strong>and</strong> recommendations<br />

contained in this <strong>Manual</strong> as good practice for statistical agencies in conducting a PPI<br />

program. Because of practical constraints, however, some of the current recommendations may not be<br />

immediately attainable by all statistical offices <strong>and</strong>, therefore, should serve as guideposts for agencies<br />

as they revise <strong>and</strong> improve their PPI programs. In some instances, there are no clear-cut answers to<br />

specific index number problems such as specific sample designs, the appropriate index estimation<br />

formula to use with given data inputs, making adjustments for quality changes, <strong>and</strong> h<strong>and</strong>ling the appearance<br />

of new products. Statistical offices will have to rely on the underlying principles laid out in<br />

this <strong>Manual</strong> <strong>and</strong> economic <strong>and</strong> statistical theory to derive practical solutions.<br />

A. <strong>Producer</strong> <strong>Price</strong> Indices<br />

PPIs measure the rate of change in the prices of goods <strong>and</strong> services bought <strong>and</strong> sold by producers. An<br />

output PPI measures the rate of change in the prices of products sold as they leave the producer. An<br />

input PPI measures the rate of change in the prices of the inputs of goods <strong>and</strong> services purchased by<br />

the producer. A value-added PPI is a weighted average of the two.<br />

The PPI <strong>Manual</strong> serves the needs of different audiences. On the one h<strong>and</strong> are the compilers of PPIs.<br />

This <strong>Manual</strong> <strong>and</strong> other manuals, guides, <strong>and</strong> h<strong>and</strong>books are important to compilers for several reasons.<br />

First, there is a need for countries to compile statistics in comparable ways so they can make reliable<br />

international comparisons of economic performance <strong>and</strong> behavior using the best international<br />

practices. Second, statisticians in each country should not have to decide on methodological issues<br />

alone. The <strong>Manual</strong> draws on a wide range of experience <strong>and</strong> expertise in an attempt to outline practical<br />

<strong>and</strong> suitable measurement methods <strong>and</strong> issues. Such measurement methods <strong>and</strong> issues are not always<br />

straightforward, <strong>and</strong> the <strong>Manual</strong> benefits from recent theoretical <strong>and</strong> practical work in the area.<br />

Third, much of the written material in some areas of PPI measurement covers a range of publications.<br />

This <strong>Manual</strong> brings together a large amount of what is known on the subject. It may therefore be useful<br />

for reference <strong>and</strong> training. Fourth, the <strong>Manual</strong> provides an independent reference on methods<br />

against which a statistical agency’s current methods, <strong>and</strong> the case for change, can be assessed. The<br />

<strong>Manual</strong> should serve the needs of users. Users should not only be aware of the methods employed by<br />

statistical offices in collecting data <strong>and</strong> compiling the indices, but also of the potential such indices<br />

have for errors <strong>and</strong> biases, so that users can properly interpret the results. For example, index number<br />

theory presents many issues on formula bias, <strong>and</strong> the <strong>Manual</strong> deals extensively with the subject.<br />

Collecting data for PPIs is not a trivial matter. In practical terms, PPIs require sampling, from a representative<br />

sample of establishments, a set of well-defined products whose overall price changes are representative<br />

of those of the millions of transactions taking place. Statistical offices then monitor the<br />

prices of these same products on a periodic basis (usually monthly) <strong>and</strong> weight their price changes according<br />

to their net revenue. However, the quality of the commodities produced may be changing,<br />

with new establishments <strong>and</strong> commodities appearing <strong>and</strong> old ones disappearing on both a seasonal <strong>and</strong><br />

permanent basis. Statistical offices need to closely monitor potential changes in quality. Yet the index<br />

compilers must complete the task of producing a representative index in a timely manner monthly.<br />

xiii

<strong>Producer</strong> <strong>Price</strong> <strong>Index</strong> <strong>Manual</strong><br />

It is also important to have a well-developed theoretical basis for compiling such indices that is readily<br />

accessible for practitioners <strong>and</strong> users alike. There should be a firm underst<strong>and</strong>ing of user needs <strong>and</strong><br />

how the index delivered fits both. Fortunately, there is a great body of research in this area, much of<br />

which is fairly recent. This <strong>Manual</strong> covers the theoretical basis of index numbers to help support some<br />

of the practical considerations.<br />

This <strong>Manual</strong> provides guidelines for statistical offices or other agencies responsible for compiling a<br />

PPI, bearing in mind the limited resources available. Calculating a PPI cannot be reduced to a simple<br />

set of rules or a st<strong>and</strong>ard set of procedures that can be mechanically followed in all circumstances.<br />

Although there are certain general principles that may be universally applicable, the procedures followed<br />

in practice have to take account of particular circumstances. Statistical offices have to make<br />

choices. These include procedures for the collection or processing of the price data <strong>and</strong> the methods of<br />

aggregation. Other important factors governing methodology are the main use of the index, the nature<br />

of the markets <strong>and</strong> pricing practices within the country, <strong>and</strong> the resources available to the statistical office.<br />

The <strong>Manual</strong> explains the underlying economic <strong>and</strong> statistical concepts <strong>and</strong> principles needed to<br />

enable statistical offices to make their choices in efficient <strong>and</strong> cost-effective ways <strong>and</strong> to recognize the<br />

full implications of their choices.<br />

The <strong>Manual</strong> draws on the experience of many statistical offices throughout the world. The procedures<br />

they use are not static, but continue to evolve <strong>and</strong> improve, for a variety of reasons. First, research<br />

continually refines the economic <strong>and</strong> statistical theory underpinning PPIs <strong>and</strong> strengthens it. For example,<br />

recent research has provided clearer insights about the relative strengths <strong>and</strong> weaknesses of the<br />

various formulas <strong>and</strong> methods used to process the basic price data collected for PPI purposes. Second,<br />

recent advances in information <strong>and</strong> communications technology have affected PPI methods. Both<br />

theoretical <strong>and</strong> data developments can impinge on all the stages of compiling a PPI. New technology<br />

can affect the methods used to collect prices <strong>and</strong> relay them to the central statistical office. It can also<br />

improve the processing <strong>and</strong> checking, including the methods used to adjust prices for changes in the<br />

quality of the goods <strong>and</strong> services covered. Finally, improved formulas help in calculating more accurate<br />

higher-level indices.<br />

B. Background to the Present Revision<br />

Some international st<strong>and</strong>ards for economic statistics have evolved mainly to compile internationally<br />

comparable statistics. However, st<strong>and</strong>ards may also be developed to help individual countries benefit<br />

from the experience <strong>and</strong> expertise accumulated in other countries. All countries st<strong>and</strong> to gain by exchanging<br />

information about index methods. The UN published the existing <strong>Manual</strong> on <strong>Producer</strong>s’<br />

<strong>Price</strong> Indices for Industrial Goods (United Nations, 1979) over 25 years ago. The methods <strong>and</strong> procedures<br />

presented then are now outdated. <strong>Index</strong> number theory <strong>and</strong> practice <strong>and</strong> improvements in technology<br />

have advanced greatly over the past two decades.<br />

B.1 Concerns with Current <strong>Index</strong> Methods<br />

The PPI <strong>Manual</strong> takes advantage of the wealth of recent research on index number theory. It recommends<br />

many new practices instead of just codifying existing statistical agency practices. There are a<br />

number of reasons for this.<br />

First, the st<strong>and</strong>ard methodology for a typical PPI is based on a Laspeyres price index with fixed quantities<br />

from an earlier base period. The construction of this index can be thought of in terms of selecting<br />

a basket of goods <strong>and</strong> services representative of base-period revenues, valuing this at base-period<br />

prices, <strong>and</strong> then repricing the same basket at current-period prices. The target PPI in this case is defined<br />

to be the ratio of these two revenues. Practicing statisticians use this methodology because it has<br />

at least three practical advantages. It is easily explained to the public, it can use often expensive <strong>and</strong><br />

untimely weighting information from the date of the last (or an even earlier) survey or administrative<br />

xiv

Preface<br />

source (rather than requiring sources of data for the current month), <strong>and</strong> it need not be revised if users<br />

accept the Laspeyres premise. One notable advantage of the Laspeyres approach under the ease of explanation<br />

heading is its consistency in aggregation. It produces various breakdowns or subaggregates<br />

related to one another in a particularly simple way.<br />

Statistical agencies implement the Laspeyres index by putting it into price-relative (price change from<br />

the base period) <strong>and</strong> revenue-share (from the base period) format. In this form, the Laspeyres index<br />

can be written as the sum of base-period revenue shares of the items in the index times their corresponding<br />

price relatives. Unfortunately, simple as it may appear, there still are a number of practical<br />

problems with producing the Laspeyres index exactly. Consequently, statistical agency practice has<br />

introduced some approximations to the theoretical Laspeyres target.<br />

• Until recently it has been impossible to get accurate revenue shares for the base period down<br />

to the finest level of commodity aggregation, so statistical agencies settle for getting baseperiod<br />

revenue weights at the level of 100 to 1,000 products.<br />

• For each of the chosen product aggregates, agencies collect a sample of representative prices<br />

for specific transactions from establishments rather than attempting to enumerate every possible<br />

transaction. They use equally weighted (rather than revenue-weighted) index formulas to<br />

aggregate these elementary product prices into an elementary aggregate index, which will be<br />

used as the price relative for each of the 100 to 1,000 product groups in the final Laspeyres<br />

formula. Practitioners recognize that this two-stage procedure is not exactly consistent with<br />

the Laspeyres methodology (which requires weighting at each stage of aggregation). However,<br />

for a number of theoretical <strong>and</strong> practical reasons, practitioners judge that the resulting<br />

elementary index price relatives will be sufficiently accurate to insert into the Laspeyres formula<br />

at the final stage of aggregation.<br />

The above st<strong>and</strong>ard index methodology dates back to the work of Mitchell (1927) <strong>and</strong> Knibbs (1924)<br />

<strong>and</strong> other pioneers who introduced it about 80 years ago, <strong>and</strong> it is still used today.<br />

Although most statistical agencies have traditionally used the Laspeyres index as their target index,<br />

both economic <strong>and</strong> index number theory suggest that some other types of indices may be more appropriate<br />

target indices to aim for: namely, the Fisher, Walsh, or Törnqvist-Theil indices. As is well<br />

known, the Laspeyres index has an upward bias compared with these target indices. Of course, these<br />

target indices may not be achievable by a statistical agency, but it is necessary to have some sort of<br />

theoretical target to aim for. Having a target concept is also necessary, so that the index that is actually<br />

produced by a statistical agency can be evaluated to see how close it comes to the theoretical ideal. In<br />

the theoretical chapters of the this <strong>Manual</strong>, it is noted that there are four main approaches to index<br />

number theory:<br />

(1) Fixed-basket approaches <strong>and</strong> symmetric averages of fixed baskets (Chapter 15);<br />

(2) The stochastic (statistical estimator) approach to index number theory (Chapter 16);<br />

(3) Test (axiomatic) approaches (Chapter 16); <strong>and</strong><br />

(4) The economic approach (Chapter 17).<br />

Approaches 3 <strong>and</strong> 4 will be familiar to many price statisticians <strong>and</strong> expert users of the PPI, but perhaps<br />

a few words about approaches 1 <strong>and</strong> 2 are in order.<br />

The Laspeyres index is an example of a fixed-basket index. The concern from a theoretical point of<br />

view is that it has an equally valid “twin” for the two periods under consideration—the Paasche index,<br />

which uses quantity weights from the current period. If there are two equally valid estimators for the<br />

same concept, then statistical theory tells us to take the average of the two estimators in order to obtain<br />

a more accurate estimator. There is more than one way of taking an average, however, so the question<br />

xv

<strong>Producer</strong> <strong>Price</strong> <strong>Index</strong> <strong>Manual</strong><br />

of the “best” average to take is not trivial. The <strong>Manual</strong> suggests that the “best” averages that emerge<br />

for fixed-base indices are the geometric mean of the Laspeyres <strong>and</strong> Paasche indices (Fisher ideal index)<br />

or using the geometric average of the quantity weights in both periods (Walsh index). From the<br />

perspective of a statistical estimator, the “best” index number is the geometric average of the price<br />

relatives weighted by the average revenue share over the two periods (Törnqvist-Theil index).<br />

There is one additional result from index number theory that should be mentioned here—the problem<br />

of defining the price <strong>and</strong> quantity of a product that should be used for each period in the index number<br />

formula. The problem is that the establishment may have sales for a particular product specification in<br />

the period under consideration at a number of different prices. So the question arises, what price<br />

would be most representative of the sales of this transaction for the period The answer to this question<br />

is obviously the unit value for the transaction for the period, since this price will match up with<br />

the quantity sold during the period to give a product that is equal to the value of sales. 1<br />

Now consider concerns about the st<strong>and</strong>ard PPI methodology. There are six main areas of concern with<br />

the st<strong>and</strong>ard methodology: 2<br />

(1) At the final stage of aggregation, the st<strong>and</strong>ard PPI index is not a true Laspeyres index, since<br />

the revenue weights pertain to a reference base year that is different from the base month (or<br />

quarter) for prices. Thus the expenditure weights are chosen at an annual frequency, whereas<br />

the prices are collected at a monthly frequency. To be a true Laspeyres index, the base-period<br />

revenues should coincide with the reference period for the base prices. In practice, the actual<br />

index used by many statistical agencies at the last stage of aggregation has a weight reference<br />

period that precedes the base-price period. Indices of this type are likely to have some upward<br />

bias compared with a true Laspeyres index, especially if the expenditure weights are priceupdated<br />

from the weight reference period to the Laspeyres base period. It follows that they<br />

must have definite upward biases compared with theoretical target indices such as the Fisher,<br />

Walsh, or Törnqvist-Theil indices.<br />

(2) At the early stages of aggregation, unweighted averages of prices or price relatives are used.<br />

Until relatively recently, when enterprise data in electronic form have become more readily<br />

available, it was thought that the biases that might result from the use of unweighted indices<br />

were not particularly significant. However, recent evidence suggests that there is potential for<br />

significant upward bias at lower levels of aggregation compared with results that are generated<br />

by the preferred target indices mentioned above.<br />

(3) The third major concern with the st<strong>and</strong>ard PPI methodology is that, although statistical agencies<br />

generally recognize that there is a problem with the treatment of quality change <strong>and</strong> new<br />

goods, it is difficult to work out a coherent methodology for these problems in the context of<br />

a fixed-base Laspeyres index. The most widely received good practice in quality-adjusting<br />

price indices is “hedonic regression,” which characterizes the price of a product at any given<br />

time as a function of the characteristics it possesses relative to its near substitutes. In fact,<br />

there is a considerable amount of controversy on how to integrate hedonic regression methodology<br />

into the PPI’s theoretical framework. The theoretical <strong>and</strong> practical chapters in the<br />

<strong>Manual</strong> devote a lot of attention to these methodological problems. The problems created by<br />

the disappearance of old goods <strong>and</strong> the appearance of new models are now much more severe<br />

than they were when the traditional PPI methodology was developed some 80 years ago<br />

(then, the problem was mostly ignored). For many categories of products, those priced at the<br />

beginning of the year are simply no longer available by the end of the year. Thus, there is a<br />

1 Note that the <strong>Manual</strong> does not endorse taking unit values over heterogeneous items at this first stage of aggregation;<br />

it endorses only taking unit values over identical items in each period.<br />

2 These problems are not ranked in order of importance; they all seem equally important.<br />

xvi

Preface<br />

tremendous concern with sample attrition, which impacts on the overall methodology; i.e., at<br />

lower levels of aggregation, it becomes necessary (at least in many product categories) to<br />

switch to chained indices rather than use fixed-base indices. Certain unweighted indices have<br />

substantial bias when chained.<br />

(4) A fourth major area of concern is related to the first concern: the treatment of seasonal commodities.<br />

The use of an annual set of products or the use of annual revenue shares is justified<br />