Capital Buffers and Risk-weighted Assets Under Basel III - METAC

Capital Buffers and Risk-weighted Assets Under Basel III - METAC

Capital Buffers and Risk-weighted Assets Under Basel III - METAC

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

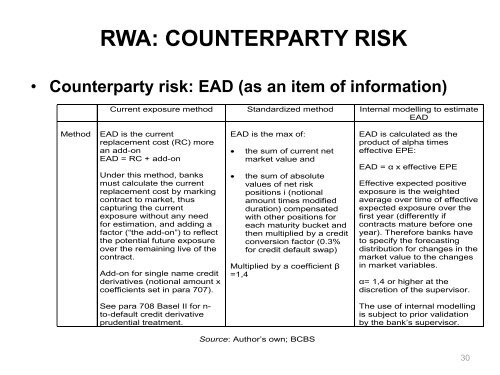

RWA: COUNTERPARTY RISK• Counterparty risk: EAD (as an item of information)Current exposure method St<strong>and</strong>ardized method Internal modelling to estimateEADMethod EAD is the currentreplacement cost (RC) morean add-onEAD = RC + add-on<strong>Under</strong> this method, banksmust calculate the currentreplacement cost by markingcontract to market, thuscapturing the currentexposure without any needfor estimation, <strong>and</strong> adding afactor (“the add-on”) to reflectthe potential future exposureover the remaining live of thecontract.Add-on for single name creditderivatives (notional amount xcoefficients set in para 707).See para 708 <strong>Basel</strong> II for n-to-default credit derivativeprudential treatment.EAD is the max of:• the sum of current netmarket value <strong>and</strong>• the sum of absolutevalues of net riskpositions i (notionalamount times modifiedduration) compensatedwith other positions foreach maturity bucket <strong>and</strong>then multiplied by a creditconversion factor (0.3%for credit default swap)Multiplied by a coefficient β=1,4EAD is calculated as theproduct of alpha timeseffective EPE:EAD = α x effective EPEEffective expected positiveexposure is the <strong>weighted</strong>average over time of effectiveexpected exposure over thefirst year (differently ifcontracts mature before oneyear). Therefore banks haveto specify the forecastingdistribution for changes in themarket value to the changesin market variables.α= 1,4 or higher at thediscretion of the supervisor.The use of internal modellingis subject to prior validationby the bank’s supervisor.Source: Author’s own; BCBS30