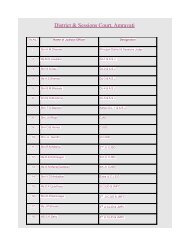

The Bombay Court Fees ACT, 1959 - District Courts, Maharashtra

The Bombay Court Fees ACT, 1959 - District Courts, Maharashtra

The Bombay Court Fees ACT, 1959 - District Courts, Maharashtra

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FEES IN THE HIGH COURT AND IN THE COURT OF SMALL CAUSES ATBOMBAY.Levy of feesin High <strong>Court</strong>on itsoriginal side.3. <strong>The</strong> fees payable for the time being to the clerks and officers (other than the Sheriffsand attorney ) of the High <strong>Court</strong>;or chargeable in that <strong>Court</strong> under No. 10 of the first and Nos.11,14,17,20 and 21 of thesecond schedule to this act annexed;Levy of fees in <strong>Bombay</strong>small Cause <strong>Court</strong>.and the fees for the time being chargeable in the <strong>Court</strong> of small causes at<strong>Bombay</strong> and its Office, Shall be collected in manner hereinafter appearing.Procedure in4.(1)When any difference arises between the Officer whose duty it is to seethat case of difference any fee is paid under this Chapter and any suitor or attorney as to the asto necessity necessity of paying a fee or the amount thereof, the question shall, whenamount of feethe difference arises in the High <strong>Court</strong>, be referred to the Taxing Officer,whose decision thereon, shall be final, subject to revision, on anapplication, made within ( Thirty days ) from the date of the decision, bythe Suitor or attorney or such officer as may be appointed in this behalf bythe State Government, by the Chief Justice or by such Judge of the High<strong>Court</strong> as the Chief Justice shall appoint either generally or specially in thisbehalf. <strong>The</strong> Chief Justice shall declare who shall be taxing officer withinthe meaning of this sub-section.(2)When any such difference arises in the <strong>Court</strong> of Small causes of<strong>Bombay</strong>, the question shall be referred to the Clerk of the <strong>Court</strong>, whosedecision thereon shall be final, subject to revision, on an application,made within 2 [thirty days] from the date of the decision, by the partyconcerned or such officer as may be appointed in this behalf by the StateGovernment, by the Chief Judge of the Small Cause <strong>Court</strong> or by suchJudge of that <strong>Court</strong> as the Chief Judge, shall appoint either generally orspecially in this behalf.CHAPTER IIICOMPUTATION OF FEES.<strong>Fees</strong> on documents 5.(1) No document of any of the kinds specified as a chargeable in the first orfiled ,etc., in courts second Schedule to this Act annexed shall be filed, exhibited or recorded in any oror in public offices. <strong>Court</strong> of Justice, or shall be received or furnished by any public Officer, unless inrespect of such document there has been paid a fee of an amount not less than that,indicated by either of the said Schedules as the proper fee for such document.(2)When any difference arises between the officer whose duty it is to see that any fee is paid under thisAct and any suitor or his pleader, as to the necessity of paying a fee or the amount thereof, the questionshall, when the question arises, in the High <strong>Court</strong>, be referred to the taxing Officer whose decisionthereon shall be final, subject to revision, on an application, made within (Thirty days) from the date ofthe decision, by the suitor or his pleader or such officer as may be appointed in this behalf by the StateGovernment, by the Chief Justice or by such Judge of the High <strong>Court</strong> as the Chief Justice shall appointeither generally or specially in this behalf.(3) When any such difference arises in the City Civil <strong>Court</strong>, <strong>Bombay</strong>, the question shall be referred to theRegistrar, of the City Civil <strong>Court</strong> whose decision shall be final , subject to revision, on an application,made within (Thirty days) from the date of the decision, by the party concerned or such officer as may beappointed in this behalf by the State Government, by the Principal Judge or such other Judge of the said<strong>Court</strong> as the principal Judge shall appoint either generally or specially in this behalf.(4) When such difference arises in any other <strong>Court</strong>, the question shall be referred to the final decision ofthe Judge presiding over such <strong>Court</strong>.* * * * * * * * *(6) <strong>The</strong> amount of fee payable under this Act in the suits next hereinafter Computation of feesmentioned shall be computed as follow.payable in certainsuits.(i) In suits for money (including suits for damages or compensation, orarrears maintenance, of annuities, or of other sums payable periodically)-for money

according to the amount claim;(ii) In suits for maintenance (with or without a prayer for the creation of a charge) for maintenance3.and for annuities or other sums payable periodically according to the value of the and annuities.subject matter of the suit, and such value shall be deemed to be , in the case of a suitfor maintenance, the amount claimed to be payable for one year and in any other case,ten times such amount :Provided that if in a suit for maintenance the plaintiff obtains a decree for maintenance the defendantshall be liable to make good the deficit, if any, between the fees payable on ten times the amount awardedfor one year and the fee already paid by the plaintiff : and the amount of such deficit shall, withoutprejudice to any other mode of recovery, be recoverable as an arrear of land revenue ;(iii) In suits for moveable property other than money, where the subject matter has amarket-value— according to cush value at the date of presenting the plaint,x of1940similarclaim inrespect ofmoveableproperty(iv) (a) In suits for declaration to obtain adjudication against recovery ofmoney from the plaintiff, whether the recovery is as land revenue or arrearsof or order of a court or any certificate or award other than under theArbitration Act, 1940 or in any other manners one fourth of ad valorem feeleviable on the amount sought to be recovered according to the scaleprescribed under Article 1 of Schedule I with minimum fee of 3 [sixtyrupees];1. <strong>The</strong>se words were substitued for the words "sixty days" by Mah.28 of 1970, s.22. Sub-section (5) was deleted by Mah.59 of 1977 s.8.3. <strong>The</strong>se words were substituted for the words "thirty rupees" by Mah18 of 2002, s.2(a)(1)Provided that, when in addition any consequential relief other thanpossession is sought , the amount of fee shall be one half of an ad valoremfee on the amount sought to be recovered :Provided further that when the consequential reliefs also sought includea relief for possession the amount of fee shall be the full ad valorem fee onthe amount sought to be recovered ;(b) In suits for declaration similar to those falling under sub – paragraph (a)in respect of moveable property- one fourth of ad valorem feel eviable on thevalue of the moveable property subject to the minimum fees as under subparagraph(a):for othermoveable propertyhaving a marketvalue.agaist recovery ofany money due as atax etc.For Statuswithmonetaryattribute.Provided that when in addition any consequential relief other thanpossession is sought, the amount of fee shall be one-half of ad valorem feeleviable on the value of such property :Provided further that when the consequential reliefs also sought include arelief for possession the amount of fee shall be the full ad valorem feeleviable on such value ;( c ) In suits for declaration of the status of plaintiff, to which remunerationhonorarium, grant, salary, income, allowance or return is attached, onefourthof ad valorem fee leviable on the emoluments or value of return forone year :Provided that when in addition any consequential relief other thanpossession is sought the amount of fee shall be one-half of ad valorem fee onsuch emoluments or value of return :Provided further that when the consequential reliefs also sought include arelief for possession the amount of fee shall be the full ad valorem fee onsuch emoluments or value of return ;

forownershipetc. ofimmoveable propertyetc.(d) in suits for declaration in respect of ownership, or nature of tenancy,title, tenure, right, lease, freedom or exemption from, or non-liability to,attachment with or without sale or other attributes , of immoveable property,such as a declaration that certain land is personal property of the Ruler ofany former Indian State or public trust property or property of any class orcommunity-one-fourth ad valorem fee leviable for a suit for possession onthe basis of title of the subject-matter, subject to a minimum fee of 1 [ onehundred rupees ]:Provided that, if the question is of attachment with or without sale theamount of fee shall be the ad valorem fee according to the value of theproperty sought to be protected from attachment with or without sale or thefee 2 [ Sixty Rupees ]. whichever is less :Provided further that, where the defendant is or class under or through alimited owner, the amount of fee shall be 3 [one-third]of such ad valoremfee, subject to the minimum fee specified above :1 <strong>The</strong>se words were substituted for the words "Forty Rupees" by Mah.. 18 of 2002, s. 2(a)(2)(i).2 <strong>The</strong>se words were substituted for the words " Thirty Rupees" ibid., s.2 (a)(2)(ii)3. <strong>The</strong>se words were substituted for the words " One-sixth " by Mah. 23 of 1996, s.2(b)(ii)Provided also that , in any of the cases falling under this clause exceptits first proviso, when in addition any consequential relief other thanpossession is sought the amount of fee shall be one-half of ad valorem feeand when the consequential relief also sought include a relief for possessionthe amount of fee shall be the full ad valorem fee ;(e) In suits for declaration of easement or right to benefits arising out ofimmoveable property, with or without an injunction or other consequentialrelief, the amount of fee shall be as shown in the Table below : -1 T A B L Edeclaration foreasements etc.Bom.LIX of1949.Area(1)(a) <strong>The</strong> area within the limits of the MunicipalCorporation of Brihan Mumbai or theCorporation of the City of the Nagpur or anyMunicipal Corporation constituted under the<strong>Bombay</strong> Provisicial Municipal CorporationsAct, 1949.Fee(2)one-fourth of thead valorem feeleviablefor a suit forpossession of theservient tenamentor the dominanttenement,whichever is less,subject to aminimum fee of onehundred rupees.Mah. XL of1965(b) Areas within the limits of Municipal Councilsconstituted under the <strong>Maharashtra</strong> Municipal Councils,Nagar Panchayats and Industrial Townships Act, 1965.one-sixth of the advalorem feeleviable for a suitfor possession ofthe servienttenement,or thedominant tenement,whichever is less,subject to aminimum fee of onehundred rupees.( c ) Any other area in the State of <strong>Maharashtra</strong> . One hundredrupees". ]

foravoidanceofacquisitionproceedings.foraccountsfor otherdeclarations.(f) In suits for declaration of status to which no direct monetary attribute isattached such as a declaration that the plaintiff is a married husband or wifeof the defendant or divorce husband or wife of the defendant or adeclaration about legitimacy of children or about citizenship rights or aboutan adoption 2 [one hundred rupees].Provided that where injunction or other consequential relief is alsosought in such case, the amount of fee shall be 3 [one hundred fifty rupees](g) In suits for declaration of a charge in favour of the plaintiff onmoveable or immoveable property- one half of ad valorem fee payable onthe charge amount :Provided that where injunction or other consequential relief is alsosought in such cases, the amount of fee shall be the full ad valorem feepayable on the charge amount :(h) In suits for declaration in respect of periodical charge or moneyreturnin favour of or against the plaintiff- one half of ad valorem fee payable onthe charge for 5 years if the charge is annual and on the charge for one yearif the period of the charge is less than one year ;4 (ha) In suits for declaration that any sale, for contract for sale ortermination of contract for sale, of any moveable or immoveable property isvoid 5 [one half] of ad valorem fee leviable on the value of the property;1. This table was substituted by Mah. 18 of 2002 s. 2 (a) (3) .2. <strong>The</strong>se words were substituted for the words " sisty rupees ", ibid , s. 2 (a) (4) (i)3. <strong>The</strong>se words were substituted for the words " one hundred rupees ", ibid., s. 2 (a)(4)(ii)4. Sub-paragraphs (ha) amd (hb) were inserted by Mah. 9 of 1970, s. 4(a)5. <strong>The</strong>se words were substituted for the word, " One-fourth" by Mah. 23 of 1996, s.2(1)(e)and (f)(hb) In suits for declaration that any proceedings for compulsory acquisition of any moveable orimmoveable property are void 1 [one half of ad voleloram fee leviable on the value of the property;](i) In suits for accounts-according to the amount at which the relief sought is valued in the plaintor memorandum of appeal, subject to the provisions of section 8. and subject to a minimum fee of2 [one hundred rupees];(j)In suits where declaration is sought, with or without injunctions or other consequential reliefand the subject-matter in dispute is not susceptible of monetary evaluation and which are nototherwise provided for by this Act 3 [ ad valorem fee payable, as if the amount orvalue of the subject matter was 4 [one thousand rupees;]In all suits under clauses (a) to (i) the plaintiff shall state the amount atwhich he values the relief sought, with the reasons for the valuation;For other statuswithout monetaryattribute.for charge onproperty.for periodicalmoney returns.for aoidence ofsale, contract forsale, etc.forpossessionof landshouses andgardens.(v) In suits for the possession of land, houses and gardens-according to thevalue of the subject-matter ; and such value shall be deemed to be where thesubject-matter is a house or garden -according to the market value of thehouse or garden and where the subject – matter is land and -(a) where the land is held on settlement for a period not exceeding thirtyyears and pays the full assessment to Government--- a sum equal to 5 [fortytimes] the survey assessment;(b) Where the land is held on a permanent settlement, or on a settlementfor any period exceeding thirty years, and pays full assessment toGovernment-a sum equal to 6 [eighty times] the survey assessment; and( c ) where the whole or any part of the annual survey assessment isremitted – a sum computed under sub-paragraph (a) or sub-paragraph (b),asthe case may be, in addition to 6 [eighty times] the assessment or, the portionof assessment so remitted;to enforce a (vi) In suits to enforce a right of pre-emption-according to the valueright of(computed in accordance with paragraph (v) of this section) of the land,preemption' house or garden in respect of which the right is claimed;

for share injointpropertyfor interestof assigneeof landrevenue(vii) In suit for partition and separate possession of a share of joint familyproperty or of joint property, or to enforce a right to a share in any propertyon the ground that it is joint family property or joint property whether or notthe plaintiff is in actual or constructive possession of the property of whichhe claims to be a co-parcener or co-owner-according to the value of theshare in respect of which the suit is instituted;Explanation :- For the purposes of this paragraph, if the property in which ashare is claimed consists of or includes any land assessed to land revenue forthe purpose of agriculture, the value of such land shall be deemed to be thevalue as determined under paragraph (v) of this section;(viii) In suits for the interest of an assignee of land-revenue, 7 [fiftytimes]his net profits as such for the year next before the date of presentingthe plaint;1. <strong>The</strong>se words were substituted for the words " one fourth" by Mah.23 of 1996, s. 2 (1)(e)and (f)2. <strong>The</strong>se words were substituted for the words " Forty rupees" by Mah.18 of 2002, s. 2 (5).3. <strong>The</strong>se words were substituted for the words " Thirty rupees" by Mah.9 of 1970, s. 4(b).4. <strong>The</strong>se words were substituted for the words " one fourth" by Mah.23 of 1996, s. 2 (1)(e)and (f)s. 2 (6).5. <strong>The</strong>se words were substituted for the words "twenty times" ibid., s.2 (6) (b) (1)6. <strong>The</strong>se words were substituted for the words "forty times" ibid., s.2 (6) (b) (2)7. <strong>The</strong>se words were substituted for the words "thirty times" ibid., s.2 (6) (c) .(ix) In suit to set aside an attachment of land or of an interest in landor revenue – according to the amount for which the land or interest wasattached :Provided that, where such amount exceeds the value of land or interestthe amount of fee shall be computed as if the suit were for the possession ofsuch land or interest ;(x) In suits against a mortgagee for the recovery of the property mortgaged,and in suits by a mortgagee to foreclose the mortgage,or, when the mortgage is made by conditional sale, to have the sale declaredabsolute.according to the principle money expressed to be secured by theinstrument of mortgage;(xi) In suits for specific performance ----(a) of a contract of sale---according to the amount of the consideration,(b) of a contract of mortgage— according to the amount agreed to besecured,( c ) of a contract of lease-- according to the aggregate amount of the fineor premium (if any) and of the rent agreed to be paid during the first year ofthe term. ,(d) of an award— according to the amount or value of the property indispute;(xii) In the following suits between landlord and tenant : -(a) for the delivery by a tenant of the counterpart of a lease,(b) to enhance the rent of a tenant having a right of occupancy,( c ) for the delivery by a landlord of a lease,(d) for the recovery of immoveable property from a tenant including atenant holding over after the determination of a tenancy,(e) to contest a notice of ejectment,(f) to recover the occupancy of immovable property from which a tenanthas been illegally ejected by the landlord, and(g) for abatement of rent ----according to the amount of the rent of the immovable propert towhich the suit refers, payable for the year next be fore the date of presentingthe plaint.7. (1) <strong>The</strong> amount of fee payable under this Act on a memorandum ofappeal against and order relating to compensation under any Act for thetime being in force for the acquisition of land for public, purposes shall becomputed according to the difference between the amount awarded and theamount claimed by the Appellant.to set aside anattachment.to redeem.to foreclose.for specificperformance.between landlordand tenant.Fee onmemorandum ofappeal againstorder or award.

VI of 1939 (2) <strong>The</strong> amount of fee payable under this Act on a memorandum ofappeal against VI of an award of a Claims Tribunal preferred under Section110-D of the * Motor Vehicles Act, 1939, shall be computed as follows :Inquiry astovaluationof suits.Investigation toascertainpropervaluation.Power ofpersonsmakinginquiryundersection 8 &9(i) If such appeal is preferred by the insurer or owner of the motorvehicle – the full ad-valorem fee leviable on the amount at which the reliefis valued in the memorandum of appeal according to the scale prescribedunder Article 1 of Schedule I;(ii) If such appeal is preferred by any other person---one half of ad-valoremfee leviable on the amount at which the relief is valued in the memorandumof appeal according to the said scale :*Now See the Motor Vehicle Act, 1988.Provided that, if such person succeeds in the appeal, he shall beliable to make good the deficit, if any, between the full ad valorem feepayable on the relief awarded in the appeal according to the said scale andthe fee already paid by him; and the amount of such deficit shall, withoutprejudice to any other mode of recovery, be recoverable as an arrear of landrevenue.8.. If the <strong>Court</strong> is of opinion that the subject— matter of any suit hasbeen wrongly valued or if an application is made to the <strong>Court</strong> for therevision of any valuation made, the <strong>Court</strong> may revise the valuation anddetermine the correct valuation and may hold such inquiry as it thinks fit forsuch purpose.9. (1) For the purpose of an inquiry under section 8 the <strong>Court</strong> maydepute or issue a commission to, any suitable person to make such local orother investigation as may be necessary and to report thereon to the <strong>Court</strong>.Such report and any evidence recorded by such person shall be evidence inthe enquiry.(2) <strong>The</strong> <strong>Court</strong> may, from time to time, direct such party to the suit as itthinks fit to deposit such sum as the <strong>Court</strong> thinks reasonable as the cost ofthe inquiry. and if the costs are not deposited within such time as the <strong>Court</strong>shall fix, may, notwithstanding anything contained in any other Act, rejectthe plaint or as the case, may be the appeal, if such party is the plaintiff orthe appellant and, in any other case, may recover the costs as a publicdemand.Provided that, when any plaint or appeal is rejected under thissection the <strong>Court</strong> fee already paid shall not be liable to be refunded.10. (1) <strong>The</strong> <strong>Court</strong> when making an inquiry under section 8 and any personmaking an investigation under section 9 shall have respectively for thepurposes of such inquiry of investigation, the powers vested in a <strong>Court</strong>under the Code of Civil Procedure, 1908, in respect of the following mattersnamely : -relating tocompensation incertain cases.V of 1908(a)oath(b)(c)(d)enforcing the attendance of any person and examining him onor affirmation ;compelling the production of documents or material objects;issuing commissions of the examination of witnesses;taking or receiving evidence on affidavits.(2) An inquiry or investigation referred to in sub-section (1) shall bedeemed to be a judicial proceeding within the meaning of sections 193 and228 of the Indian Penal Code.XLV of 1860

Cost ofinquiry asto valuationand refundof excessfee.11. If in the result of an inquiry u/sec.8 the <strong>Court</strong> finds that the subjectmatter of the suit has been undervalued, the <strong>Court</strong> may order the partyresponsible for the undervaluation to pay all or any part of the costs of theinquiry.If in the result of such inquiry the <strong>Court</strong> finds that the subject-matterof the suit has not been undervalued the <strong>Court</strong> may, in its discretion, orderthat all or any part of such costs shall be paid by Government or by anyparty to the suit at whose instance the inquiry has been undertaken, and ifany amount exceeding the proper amount of fee has been paid shall refundthe excess amount so paid.12. (1) <strong>The</strong> State Government may appoint generally, or in any case, orfor any specified class of cases, in any local area, one or more officers to becalled inspecting officers.(2) <strong>The</strong> inspecting officer may, subject to the control of the <strong>Court</strong>concerned, examine the records of any case which is pending or has beendisposed of, with a view to finding out whether proper fees have been paidtherein.(3) If on such examination, the inspecting officer finds that the fee,payable under this Act on any document filed, exhibited or recorded in suchcase as has not been paid or has been insufficiently paid, be shall report thefact to the Presiding Officer of the <strong>Court</strong>.(4) Such Presiding Officer after satisfying himself of the correctness ofsuch report shall record a provisional finding that the proper fee has notbeen paid and determine the amount of the fee payable and such further sumas he thinks reasonable as the costs of the inquiry and the person fromwhom the fee or the difference thereof, if any, and the costs shall berecoverable.(5) After recording a finding under sub-section (4) , the PresidingOfficer shall issue a notice to the person referred to in that sub-section toshow case why he should not be ordered to pay the fee and the costsdetermined hereunder, and, if sufficient cause is not shown, the presidingofficer shall conform the finding and make an order requiring such personto pay the proper fee and the costs before a specified date.(6) If such person fails to pay the fee and the costs in accordance withthe provisions of sub-section (5), they shall, on the certificate of suchpresiding officer, be recoverable as an arrear of land revenue.Appointment ofinspecting officersand recovery in casesreported by them.13. (1) In a suit for the recovery of possession of immovable property andmesne profits or for mesne profits or for an account,the difference, if any,between the fee actually paid and the fee which would have been payablehad the suit comprised the whole of the profits or amount found due shall,on delivery of judgment, be taxed by the <strong>Court</strong> and shall be leviable from theplaintiff and if not paid by him within thirty days from the date of thejudgment be recoverable according to the law and under the rules for thetime being in force for the recovery of arrears of land revenue(2) <strong>The</strong> <strong>Court</strong> shall send a copy of decree passed in such suit to theCollector.'(3) No decree for mesne profits passed in any such suit by the <strong>Court</strong> shallbe executed, until a certificate to the effect that such difference is paid orrecovered, signed by the <strong>Court</strong> which passed the decree or by the Collectorwho recovered the amount is, produced along with the application for suchexecution.Explanation : - For the purpose of this section, " Plaintiff " includes anyparty to a suit to whom any profits or amount are or is found to be due.Taxing of <strong>Court</strong>feesand theirrecovery in suitsfor mesne profits oraccount.

Refund offee paid onmemorandum of appeal.Refund offee onapplicationfor reviewjudgment.Refund ofwhere<strong>Court</strong>reservses ormodifies itsformerdecision onground ofmistake.Period oflimitationfor refundof feesunderSection15,16 or 17Multifarious suits.Writtenexaminations ofcomplainants.14. (1) Every question relating to valuation for the purpose ofdetermining the amount of any fee chargeable under this Chapter on aplaint or memorandum of appeal shall be decided by the <strong>Court</strong> in whichsuch plaint or memorandum as the case may be, is filed, and such decisionshall be final as between the parties to the suit.(2) But whenever any such suit comes before a <strong>Court</strong> of appealreference or revision, if such <strong>Court</strong> considers that the said question has beenwrongly decided to the detriment of the revenue, it shall required the partyby whom such fee has been paid to pay so much additional fees as wouldhave been payable had the question been rightly decided .15. If an appeal or plaint, which has been rejected by the lower <strong>Court</strong> onany of the grounds mentioned in the Code of Civil Procedure, 1908, isordered to be received or if a suit is remained in appeal, on any of thegrounds mentioned in rule 23 of Order XLI in the first Schedule to the sameCode for a second decision by the Lower court, the Appellate <strong>Court</strong> shallgrant to the appellant a certificate , authorising him to receive back from theCollector the full amount of fee paid on the memorandum of appeal:Provided that if, in the case of remand in appeal, the order of remandshall not cover the whole of the subject-matter of the suit, the certificate sogranted shall not authorise the appellant to receive back more than so muchfee as would have been originally payable on the part or parts of suchsubject-matter in respect whereof the suit has been remanded.16. Where an application for review of judgment is presented on or afterthe 1 [thirtieth day] from the date of the decree, the <strong>Court</strong>, unless the delaywas caused by the applicant's laches, may, in its discretion, grant him acertificate authorizing him to receive back from the Collector so much of thefee paid on the application as exceeds the fee which would have beenpayable had it been presented before such day.17. Where an application for a review of judgment is admitted, andwhere, on the rehearing, the <strong>Court</strong> reverses or modifies its former decisionon the ground of mistake in law or fact, the applicant shall be entitled to acertificate from the <strong>Court</strong> authorizing him to receive back from theCollector so much of the fee paid on the application as exceeds the feepayable on any other application to such <strong>Court</strong> under the second schedule tothis Act, No.1, clause (c) or clause (f).But, nothing in the former part of this section shall entitle theapplicant to such certificate where the reversal or modification is due,wholly or in part, to fresh evidence which might have been produced at theoriginal hearing.2 [17A. Where the certificate is granted to any person under section 15,16or 17 no fee thereunder shall be refunded, unless such person presents it tothe Collector or such other authority as may be prescribed by rules, forencashment, within two years from the date of issue of the certificate by the<strong>Court</strong>].18. Where a suit embraces two or more distinct subjects, the plaint ormemorandum of appeal shall be chargeable with the aggregate amount ofthe fees to which the plaints or memoranda of appeal in suit embracingseparately each of such subjects would be liable under this Act.Nothing in the former part of this section shall be deemed to affectthe power conferred by the Code of Civil Procedure, 1908, Schedule I, OrderII, rule 6.19. When the first or only examination of a a person who complaints ofthe offence of wrongful confinement, or wrongful restraint, or of any offenceother than an offence for which police officers may arrest without a warrant,and who has not already presented a petition on which a fee has been leviedunder this Act, is reduced to writing under the provisions of the 3 [Code ofCriminal Procedure, 1973], the complainant shall pay a fee of 5 [ten rupees]unless the <strong>Court</strong> thinks fit to remit such payment.Decision ofquestions as tovaluation.V of 1908V of 1908.'[II of 1974]

XLV of1860I of 19561. <strong>The</strong>se words were substituted for the words " ninetieth day " by Mah. 50 of 1976 s. 22. Section 17 A was inserted by Mah. 18 of 1966 s. 2.3. <strong>The</strong>se words were substituted for the words "Code of Criminal Procedure, 1898, by Mah. 23 of1996, s. 3 (a).4.<strong>The</strong>se words were substituted for the words " V of 1898 " , ibid.5. This words were substituted for the words " two rupee " by Mah. 18 of 2002, s. 320. 1 [1] Nothing contained in this Act shall render the following documents chargeable with any fee: -(i) power-of attorney to institute or defend a suit when executed by amember of any of the Armed Forces of the Union not in Civil employment.(ii) Application for certificate copies of documents or for any otherpurpose in the course of a criminal proceeding presented by or on behalf onthe State Government to a criminal <strong>Court</strong>.(iii) Written statements called for by the <strong>Court</strong> after the first hearing of asuit.(iv) Probate of a will, letters of administration, and, save as regards debtsand securities, a certificate under <strong>Bombay</strong> Regulation VIII of 1827 or anycorresponding law in force, where the amount or value of the property inrespect of which the probate or letters or certificate shall be granted does notexceed one thousand rupees.(v) Application or petition to a Collector or other officer making asettlement of land-revenue , or to a Board of Revenue, or a Commissioner ofRevenue, relating to matters connected with the assessment of land or theascertainment of rights thereto or interest therein, if presented , previous tothe final confirmation of such settlement.(vi) Application relating to a supply for irrigation of water belonging toGovernment.(vii) Application for leave to extend cultivation, or to relinquish land,when presented to an officer of land-revenue by a person holding, underdirect engagement with Government, land of which the revenue is settled,but not permanently.(viii) Application for service of notice of relinquishment of land or ofenhancement of rent.(ix) Written authority to an agent to distrain.(x) Petition, application, charge or information respecting any offencewhen presented, made or laid to or before a Police Officer, or to orbefore the Heads of Villages or the village Police.(xi) Petition by a prisoner, or other person in duress or under restraintofany <strong>Court</strong> or its Officer.(xii)(xiii)(xiv)(xv)Complaint of a public servant ( as defined in the Indian PenalCode), a Municipal Officer, or an officer or servant of a RailwayCompany.Application for the payment of money due by Government to theapplicant.Petition of appeal against any municipal tax.Applications for compensation under any law for the time being inforce relating to the acquisition of property for public purposes,other than those chargeable under Article 15 of Schedule I.1[2) Nothing contained in this Act shall render an application to the <strong>Court</strong>under section 543 of the Companies Act, 1956, chargeable with any fee :Exemption ofcertain documents.Provided that, if the applicant succeeds, the person, director, managingagent, secretary and treasurer, manager, liquidator or officer of thecompany concerned against whom and order is made by the <strong>Court</strong> underthat section, shall be liable to pay the fee leviable on a plaint in a suit for thesame relief as is ordered by the <strong>Court</strong>; and the amount of such fee shall,without prejudice to any other mode of recovery, be recoverable as an arrearof [land revenue. ].1. Section 20 was renumbered as sub-section (1) and sub-section (2) wasadded by Mah. 18 of 1960, s.2.CHAPTER IVPROBATES, LETTERS OF ADMINISTRATION AND CERTIFICATESOF ADMINISTRATION.

Reliefwhere toohigh acourt-feehas beenpaid.21. Where any person on applying for the probate of a will or letters ofadministration has estimated the property of the deceased to be of greatervalue than the same has afterwards proved to be, and has consequently paidtoo high a court-fee thereon if within six months after the true value of theproperty has been ascertained, such person produces the probate or letters tothe Chief Controlling Revenue Authority for the local area in which theprobate or letters has or have granted.,Relief whendebts duefrom adeceasedperson havebeen paidout of hisestate.and delivers to such Authority a particular inventory and valuation ofthe property of the deceased, verified by affidavit or affirmation.and if such Authority is satisfied that a greater fee was paid on theprobate or letters than the law required.the said authority may -----(a) Cancel the stamp on the probate or letters if such stamp has not beenalready canceled;(b) Substitute another stamp for denoting the court-fee which shouldhave been paid thereon; and( c ) Make an allowance for the difference between them as in the case ofspoiled stamps, or repay the same in money, at his discretion.22. Whenever it is proved to the satisfaction of such Authority, that anexecutor or administrator has paid debts due from the deceased to such anamount as being deducted out of the amount or value of the estate, reducedthe same to a sum which, if it had been the whole gross amount or value ofthe estate, would have occasioned a less court-fee to be paid on the probateor letters of administration granted in respect of such estate than has beenactually paid thereon under this Act.Such Authority may return the difference, provided the same beclaimed within three years after the date of such probate or letters.Relief incase ofservantgrants.But then, by reason of any legal proceeding, the debts due from thedeceased have not been ascertained and paid, or his effects have not beenrecovered and made available, and in consequence thereof the executor oradministrator is prevented from claiming the return of such differencewithin the said term of three year, the said authority may allow such furthertime for making the claim as may appear to be reasonable under thecircumstances.23. Whenever a grant of probate or letters of administration has been or ismade in respect of the whole of the property belonging to an estate, and thefull fee chargeable under this Act has been or is paid thereon , no fee shallbe chargeable under the same Act when a like grant is made in respect ofthe whole or any part of the same property belonging to the same estate.Whenever such a grant has been or is made in respect of anyproperty forming part of an estate, the amount of fees then actually paidunder this Act shall be deducted when a like grant is made in respect ofproperty belonging to the same estate, identical with or including theproperty to which the former grant relates.24. <strong>The</strong> probate of the will or the letters of administration of the effects ofany person deceased heretobefore or hereafter granted shall be deemed validand available by his executors or administrators for recovering, transferringor assigning any moveable or immovable property whereof or whereto thedeceased was possessed or entitled, either wholly or partially as a trustee,notwithstanding the amount or value of such property is not included in theamount of value of the estates in respect of which a court-fee was paid onsuch probate or letters of administrationProbates declaredvalid as to trustproperty, thoughnot covered bycourt-fee.

25. Where any person on applying for probate or letters of administrationhas estimated the estate of the deceased to be of less value than the same hasafterwards, proved to be, and has in consequence paid too low a <strong>Court</strong>-feethereon, the Chief Controlling Revenue Authority for the local area inwhich the probate or letters has or have been granted may, on the value ofthe estate of the deceased being verified by affidavit or affirmation, cause theprobate or letters of administration to be duly stamped on payment of thefull court-fee which ought to have been originally paid thereon in respect ofsuch value and of the further penalty, if the probate or letters is or areproduced within one year from the date of the grant, of five times, or, if it orthey is or are produced after one y ear from such date, of twenty times, suchproper court-fee without any deduction of the court fee originally paid onsuch probate or letters :Provided that if the application be made within six months after theascertainment of the true value of the estate and the discovery that too low acourt-fee was at first paid on the probate or letters, and if the said Authorityis satisfied that such fee was paid in consequence of a mistake or if its notbeing known at the time that some particular part of the estate belonged tothe deceased, and without any intention of fraud or to delay the payment ofthe proper court-fee the said Authority may remit the said penalty, and causethe probate or letters to be duly stamped on payment only of the sumwanting to make up the fee which should have been at first paid thereon.Provision for casewhere too low acourt-fee has beenpaid onprobates,etc.26. In case of letters of administration on which too low a court fee hasbeen paid at first, the said Authority shall not cause the same to be fullystamped manner aforesaid until the administrator has given such security tothe <strong>Court</strong> by which the letter of administration have been granted as oughtby law to have been given on the granting thereof in case the full value ofthe estate of the deceased had been then ascertained.27. Where too low a court fee has been paid on any probate or letters ofadministration in consequence of any mistake, or of its not being known atthe time that some particular part of the estate belonged to the deceased, ifany executor or administrator acting under such probate or letters does not,within six months after the discovery of the mistake or of any effects notknown at the time to have belonged to the deceased, apply to the saidAuthority and pay what is wanting to make up the <strong>Court</strong> fee which ought tohave been paid at first ion such probate or letters, he shall forfeit the sum ofone thousand rupees and also a further sum at the rate of ten rupees percent. on the amount of the sum wanting to make up the proper court fee.Administrator togive propersecurity beforeletters stampedunder section 25.Executors, etc. notpaying full courtfee on probates etc.within six monthsafter discovery ofunder payment.

28. (1) Where an application for probate or letters of administration ismade in any <strong>Court</strong> other than the High <strong>Court</strong>, the <strong>Court</strong> shall cause noticeof the application to be given to the Collector.(2) where such an application as aforesaid is made to the High <strong>Court</strong>,the High <strong>Court</strong> shall cause notice of the application to be given to the ChiefControlling Revenue Authority.(3) <strong>The</strong> Collector within the local limits of whose revenue-jurisdictionthe property of the deceased or any part thereof, is, may at any time inspector cause to be inspected, and take or cause to be taken copies of, the recordof any case in which application for probate or letters of administration hasbeen made; and if, on such inspection or otherwise, he is of opinion that thepetitioner has underestimated the value of the property of the deceased, theCollector shall forward his report, giving therein his reasons for his opinionand his estimate of the true valuation, to the Prothonotary of the High <strong>Court</strong>or the <strong>Court</strong>, as the case may be, serving at the same time a copy of hisreport on the petitioners.(4) If within thirty days from the date of receipt of the copy of theCollector's report served on him under sub-section (3) petitioner does notfile in <strong>Court</strong> his objections to the Collector's valuation, the court shall makean order amending the petitioner's valuation, in accordance with the reportof the Collector.(5) If within the aforesaid period the petitioner files in court hisobjection, the <strong>Court</strong> shall hold, or cause to be held, an inquiry in accordancewith the provisions of sections 9, 10 and 11 as if the application were a suit,and shall record a finding as to the true value, as near as may be , at whichthe property of the deceased should have been estimated. <strong>The</strong> Collectorshall be deemed to be a party to the inquiry.(6) <strong>The</strong> finding of the <strong>Court</strong> recorded under sub-section (5) shall befinal but, shall not bar the entertainment and disposal by the ChiefControlling Revenue Authority of any application under section 25.(7) <strong>The</strong> State Government may make rules for the guidance ofCollectors in the exercise of the powers conferred by sub-section (3).Notice ofapplications forprobate or lettersof administration tobe given toRevenueAuthorities, andprocedure thereon.Payment of<strong>Court</strong>-fee inrespect ofprobate andletters ofadministration .Recovery ofPenalties,etc.Sections 5and 40 notto apply toprobates orletters ofadministration.29. (1) No order entitling the petitioner to the grant of probate or lettersof administrations shall be made upon an application for such grant untilthe petitioner has filed in the <strong>Court</strong> a valuation of the property in the formset forth in the third Schedule, and the court is satisfied that the feementioned in No. 10 of the first schedule has been paid on such valuation.(2) <strong>The</strong> grant of probate or letters of administration shall not bedelayed by reason of any report made by the Collector under section 28, subsection(3)30. (1) Any excess fee found to be payable on an inquiry held undersection 28, and any penalty or forfeiture under section 27, may, on thecertificate of the Chief Controlling Revenue Authority, be recovered fromthe executor or administrator as if it were an arrear of land-revenue by anyCollector.(2) <strong>The</strong> Chief Controlling Revenue Authority may remit the wholeor any part of any such penalty or forfeiture as aforesaid or any part of anypenalty under section 25 or if any court-fees under section 25 in excess ofthe full court-fee which ought to have been paid.31. Nothing in section 5 or section 40 shall apply to probates orletters of administration.

CHAPTER VPROCESS FEES.Rules as tocosts ofprocesses.32. <strong>The</strong> High <strong>Court</strong> shall make rules as to the following matters : -(i) the fees chargeable for serving and executing processes issued by such<strong>Court</strong> in its appellate jurisdiction, and by the other Civil and Revenue <strong>Court</strong>established within the local limits of such jurisdiction ;(ii) the fees chargeable for serving and executing processes issued by theCriminal <strong>Court</strong>, established within such limits in the case of offences otherthan offences for which police officers may arrest without a warrant; and(iii) the remuneration of the peons and all other persons employed byleave of a <strong>Court</strong> in the service of execution of process.<strong>The</strong> High <strong>Court</strong> may from time to time alter and add to the rules somade.All such rules, alterations and additions shall, after beingconfirmed by the State Government, be published in the Official Gazette,and shall thereupon have the force of law.Confirmation andpublication ofrules.IX of 188733. A table in the English and regional languages,showing the feeschargeable for such service and execution, shall be exposed to view in aconspicuous part of each <strong>Court</strong>.34. Subject to rules to be made by the High <strong>Court</strong> and approved bythe State Government, every <strong>District</strong> Judge of the <strong>Bombay</strong> City Civil <strong>Court</strong>and every Magistrate of a <strong>District</strong> shall fix, and may from time to time alter,the number of peons necessary to be employed for the service and executionof processes issued out of his <strong>Court</strong>, and each of the <strong>Court</strong>s subordinatethereto.and for the purposes of this section, every <strong>Court</strong> of Small Causes establishedunder the Provincial Small Cause <strong>Court</strong>s Act, 1887, shall be deemed to besubordinate to the <strong>Court</strong> of the <strong>District</strong> Judge.35. Subject to rules to be framed by the Chief Controlling Revenueauthority and approved by the state Government, every officer perofrmingthe functions of a Collector of a <strong>District</strong> shall fix, and may from time to timealter, the number of peons necessary to be employed for the service andexecution of processes issued out of his <strong>Court</strong> or the <strong>Court</strong>s subordinate tohim.CHAPTER VIOF THE MODE OF LEVYING FEES36. All fees shall be charged and collected under this Act at the ratein force on the date on which the document chargeable to court-fee is or waspresented37. All fees referred to in section 3 or chargeable under this Act shallbe collected by stamps.38. <strong>The</strong> stamps used to denote any fees charegable under this Actshall be impressed or adhesive or partly impressed or partly adhesive, as theState Government may, by notification in the Official gazette from time totime, direct.39. <strong>The</strong> State Government may from time to time, make rules forregulating-(a) the supply of stamps to be used under this Act.(b) the number of stamps to be used for denoting any fee chargeableunder this act,( c ) the renewal of damaged or spoiled stamps, and(d) the keeping accounts of all stamps used under this act :Provided that in the case of stamps used under section 3 in the High <strong>Court</strong>,such rules shall be made, with the concurrence of the Chief Justice of such<strong>Court</strong>.All such rules shall be published in the Official Gazette, and shallthereupon have the force of law.Tables of processfees.Number of peons in<strong>District</strong> andsubordinate courts.Number of peons inmofussil SmallCauses <strong>Court</strong>sNumber of peons inrevenue <strong>Court</strong>s.Rate of fee in forceon date ofpresentation ofdocument to beapplicable.collection of fees bystamps.Stamps to beimpressed oradhesive.Rules for supply,number, renewaland keepingaccounts of stamps.

Stampingdocumentsinadvertentlyreceived.Amendeddocument.40. No document which ought to bear a stamp under this Act shall be ofany validity, unless and until it is properly stamped.But, if any such document is through mistake or inadvertencereceived, filed or used in any <strong>Court</strong> or office without being properlystamped, the presiding Judge or the head of the office, as the case may be,or, in the case of the High <strong>Court</strong>, any Judge of such <strong>Court</strong>, may, if he thinksfit, order that such document be stamped as he may direct ; and, on suchdocument being stamped accordingly, the same and every proceedingrelative thereto shall be as valid as if it had been properly stamped in thefirst instance.41. Where any such document is a amended in order merely to correct amistake and to make it conform to the original intention of the parties, itshall not be necessary to impose fresh stamp.Cancellation ofStamps.42. No document requiring a stamp under this Act shall be filed oracted upon in any proceeding in any <strong>Court</strong> or office until the stamp has beencanceled.Such Officer as the <strong>Court</strong> or the head of office may from time totime appoint shall, on receiving any such document, forthwith effect suchcancellation by punching out the figure-head so as to leave the amountdesignated on the stamp untouched, and the part removed by punching shallbe burnt or otherwise destroyed.CHAPTER VII.MISCELLANEOUS.

Repaymentof fee incertaincircumstances.Admissionin criminalcases ofdocumentsfor whichproper feehas not beenpaid.43. (1) When any suit in a <strong>Court</strong>1 [or any proceeding instituted bypresenting a petition to a <strong>Court</strong> under the Hindu Marriage Act, 1955] issettled by agreement of parties before any evidence is recorded, or anyappeal or cross objection is settled by agreement of parties before it is calledon for effective hearing by the <strong>Court</strong>, half the amount of the fee paid by theplaintiff.2 [petitioner] appeallant, or respondent on the plaint. 2 [petition] appeal orcross objection, as the case may be, shall be repaid to him by the <strong>Court</strong> :Provided that, no such fee shall be repaid if the amount of fee paiddoes not exceed 3 [twenty five rupees] or the claim for repayment is not madewithin one year from the date on which the suit, 2 [proceeding] appeal orcross objection was settled by agreement.(2) <strong>The</strong> State Government may, from time to time, by order, provide forrepayment to the plaintiffs, 2 [petitioners] appellants or respondents of anypart of the fee paid by them on plaints 2 [petitions] appeals or crossobjections in suit 2 [proceeding] or appeals disposed of under suchcircumstances and subject to such conditions as may be specified in theorder.Explanation : - For the purpose of this section, effective, hearingshall exclude the dates when the appeal is merely adjourned without beingheard or argued.44. Whenever the filing or exhibition in a Criminal <strong>Court</strong> of adocument in respect of which the proper fee has not been paid is, in theopinion of the presiding Judge, necessary to prevent a failure of justice,nothing contained in section 5 shall be deemed to prohibit such filing orexhibition.1. <strong>The</strong>se words were inserted by Mah. 33 of 1967, S. 2 (a) (i)2.<strong>The</strong>se words were inserted, ibid., s. 2.3. <strong>The</strong>se words were substituted for the words ""45. (1) <strong>The</strong> State Government may, from time to time make rules for relating sale of the sale ofstamps to be used under this Act, the persons by whom alone such sale is to be conducted, and theduties and remuneration of such persons.(2) All such rules shall be punished in the Official Gazette and shall thereupon have the force oflaw.(3) Any person appointed to sell stamps who disobeys any rule made under this section, and anyperson not so appointed who sells or offers for sale any stamp, shall, on conviction, be punished withimprisonment for a term which may extend to six months, or with fine may extend to 1 [two thousandrupees but which shall not be less than five hundred rupees] , or with both.46. <strong>The</strong> State Government may, from time to time, by notification in the Official Gazette, reduce orremit, in the whole or in any part of the territories under its administration all or any of the feesmentioned in the first and second schedules to this Act annexed, any may in like manner cancel orvary such order.XXV of 1955Sale of Stamps.Power to reduce orremit fees.47 Nothing in Chapters II and VI of this Act applies to the fees which any officer of the High <strong>Court</strong>is allowed to receive in addition to a fixed salary.2 [* * *]48. Nothing in this Act shall be deemed to effect the stamp duties chargeable under any otherlaw for ths time being in force relating tio stamp duties.49. (1) On the commencement of this Act, the laws specified in column 3 of the Schedule IVhereto annexed shall be repealed in the manner and to the extent specified in column 4 thereof :Provided that, such repeal shall not affect the previous operation iof any of the laws sorepealed and anything done or any action taken (including any appointment, notification, order,rule, form, application, reference, notice, report or certificate made or issued) under any such lawshall, in so far as it is not inconsistent with the provisions of this Act, be deemed to have been doneor taken under the corresponding provision of this Act and shall coantinue to be in forceaccordingly, unless and until supreseded by anything done or any action taken under this Act :Provided further that, all the fees shall be charged and collected under this Act at therate in force on the date on which the document chareable to <strong>Court</strong>-fee is or was presented.2(a) All stamps in deniominations of annas four or multiples thereof shall be deemed to bestamps of the value of twenty-five naya paise or, as the case may be, multiples thereof and validaccordingly .1. <strong>The</strong>se words were substituted for the words ' five hundred rupees ' by Mah. 18 of 2002 s. 52. Section 47-A was deleted, ibid., s. 6.Saving of fees tocertain officers ofHigh <strong>Court</strong>.Saving as to stampduties.Repeal and saving.

Amendmentof suitsvaluationAct.3 [Reductionof <strong>Court</strong>-feefromamount ofstamp dutypayable onfinal orderofpartition.]Rules madebyGovernment to be laidbefore StateLegislature.(b) If any person is possessed of a stamp or stamps in any denominations other thandenominations of annas four or multiples thereof, and such stamps or stamps has or have not beenspoiled , the collector shall repay to such person the value of such stamp or stamps in moneycalculated in accordance with the provisions of sub section (2) of Section 14 of the Indian CoinageAct, 1906, upon such person delivering up, with in six months from the commencement of this Act,such stamp or stamps to the Collector.50. On the commencement of this Act, the laws specified in column 3 of Schedule V theretoannexed shall be amended in the manner and to the extent specified in column 4 thereof.51. Notwithstanding anything contained in the <strong>Bombay</strong> Stamp Act, 1958 , where court-fee ispaid in a suit for partition in accordance with the provisions of clause (vii) of section 6 of this Act1 [the stamp duty] payable on a final order for effecting a partition passed by any Revenue Authorityor any Civil <strong>Court</strong> under article 46 in Schedule 1 to the <strong>Bombay</strong> Stamp Act, 1958 2 [shall bereduced by the amount of the <strong>Court</strong>-fee paid in such suit. ].52.. All rules made by the State Government under this Act shall be laid before each House of theState Legislature as soon as may be after they are made and shall be subject to such modifications asthe State Legislature may make during the session in which they are so laid or the sessionimmediately following --IIIrd of 1906Bom.LX of 1958Bom.LX of 1958SCHEDULE IAd volorem fees.Number...... (2)Proper fee.4[1. Plaint or memorandum of appeal (nototherwise) provided for in this Act) or, ofcross objection presented to any Civil orRevenue <strong>Court</strong> .When the amount or value of the subjectmatter in dispute does not exceed onethousand rupees.When the such amount or value exceedsone thousand rupees, for every onehundred rupees, o part thereof, in excessof one thousand rupees, up to fivethousand rupees.When the such amount or value exceedsfive thousand rupees, for every onehundred rupees, or part thereof, in excessof five thousand rupees, up to tenthousand rupees.two hundredrupees.Twelverupees.Fifteenrupees.1.<strong>The</strong>se words were substituted for the words "no stamp duty shall be" by Mah.34 of 1994, s.2(i).2. <strong>The</strong>se words were added, ibid., s.2(ii). s. 2(iii)3. <strong>The</strong> marginal note was substituted ,ibid., 2002, s. 7.4. Article 1 was substituted by Mah.18 of

Number.1.....Proper fee.2. Plaint in a suit for possession under1 [section 6 of the specific Relief Act, 1963.3. Plaint, application or petition(includingmemorandum of appeal), to set aside ormodify any award otherwise than under theArbitration Act, 1940.4. Plaint, application or petition (includingmemorandum of appeal) which is capable ofbeing treated as a suit, to set aside a decree ororder having the force of decree.<strong>The</strong>se words and figures were substituted forthe words and figures the specific relief Act,1877, Section 9 by Mah. 23 of 1966, s.4(b).5. Plaint in a suit , application or petition(including memorandum of appeal) to setaside alienation to which the plaintiff,applicant or appellant, as the case may be,was a party, either directly or through a legalguardian other than de facto or adhocguardian, manager or partner of court.when such amount or value exceeds tenthousand rupees, for every five hundredrupees, or part thereof, in excess of tenthousand rupees , up to twenty thousandrupees.When such amount or value exceedstwenty thousand rupees, for every onethousand rupees, or part thereof, inexcess of twenty thousand rupees, up tothirty thousand rupees.When such amount or value exceedsthirty thousand rupees, for every twothousand rupees, or part thereof, inexcess of thirty thousand rupees, up tofifty thousand rupees.When such amount or value exceeds fiftythousand rupees, for every five thousandrupees , or part thereof, in excess of fiftythousand rupees, upto one lakh of rupees.When such amount or value exceeds onelakh of rupees, for every ten thousandrupees, or part thereof, in excess of onelakh of rupees, upto eleven lakh ofrupees.When suchd amount or value exceedseleven lakh of rupees, for every one lakhof rupees, or aprt thereof, in excess ofeleven lakh of rupees :provided that, the maximum fee leviableon the plaint or memorandum of appealor of cross objection shall be three lakhof rupees ]. . . . .. . . . .. . . . . . .. . . . . . . .Seventy five rupees.One hundredrupees.One hundredrupees.One hundred andfifty rupees.Two hundredrupees.One thousandtwo hundredrupees.A fee of one-halfthe amountprescribed XLII ofin the scale under1963 Article 1.A fee on the amountor value of theaward sought to beset aside ormodified .according to thescale prescribedunder Article 1.<strong>The</strong> same fee as isleviable on a plaintin a suit to obtainthe relief granted inthe decree ororder, as the casemay be.A fee on the extentof the value ofalienation to be setaside, according tothe scaleprescribedunder Aricle AXLII of1963x of1940

6. Plaint in a suit (including memorandum ofappeal) for possession between the guardianand ward, trustee and beneficiary, principaland agent, wife and husband, executor oradministrator and beneficiary, receiver andowner of property and between personshaving fiduciary relationship.7. Any other plaint, application or petition( including memorandum of appeal ) , toobtain substantive relief capable of beingvalued in terms of monetary gain orprevention of monetary loss, including caseswherein application or petition is eithertreated as a plant or is described as the modeof obtaining the relief as aforesaid.8. Application for review of judgment ifpresented on or after the 1 [thirtieth day]from the date of the decree.9. Application for review of judgment ifpresented before the1 [thirtieth day] fromthe date of the decree.1.<strong>The</strong>se words were substituted for the words'ninetieth day by Mah.50 of 1976,s.3........... . . . . . . . . ................... . . . . . . . .A fee of one half ofthe amountprescribed in thescale under Article1.A fee on the amountof the monetarygain, or loss to beprevented,according to thescale prescribedunder Article 1.<strong>The</strong> fee leviable onthe plaint ormemorandum ofappeal.One half of the feeleviable on theplaint ormemorandum ofappeal.1[10. Probate of a will or letters ofadministration with or without will annexed.When the amount or value of theproperty in respect of which the grant ofprobate or letters is made exceeds onethousand rupees on the amount of valueup to fifty thousand rupees.Two per cent.When the amount or value of theproperty in respect of which the grant ofprobate or letters is made exceeds fiftythousand rupees, on the part of theamount in excess of to fifty thousandrupees up to two lakh rupees.When the amount or value of theproperty in respect of which the grant ofprobate or letters is made exceeds twolakh rupees on the part of amount ofvalue in excess of two lakh rupeesWhen the amount or value of theproperty in respect of which the grant ofprobate or letters is made exceeds threelakh rupees on the part of amount ofvalue up to three lakh rupees .Provided that, when after the grant of acertificate under part X of the IndianSuccession Act, 1925 or under <strong>Bombay</strong>Regulation VIII of 1827. Or anycorresponding law for the time beingenforce, in respect of any propertyincluded in an state , a grant of probate orletters of administration is made inrespect of the same estate, the fee payablein respect of the latter grant shall bereduced by the amount of the fee paid inrespect of the former grant]Four per cent.Six per cent.Seven and half percent. Subject to themaximum of75,000/- Rs.XXXIXof 1950 ,Reg.VIIIof 1827.XXXIX of1925.11.Certificate under part – X of the IndianSuccession Act, 1925.. . . . .<strong>The</strong> fee leviable inthe case of aprobate [Article10} on the amountor value of anydebt or securityspecified in thecertificate undersection 374 of theAct , and 1[twotimes ] this fee on

12. Certificate under Bobay Regulation VIIIof 1827 or under any corresponding Law inforce.13. Plaint presented with an originatingsummons under the Rules of the High <strong>Court</strong>of <strong>Bombay</strong>, (Original Side), 1 [1980]3 [* * * * * * **]the amount orvalue of any debtor security to whichthe certificate isextended undersection 376 of theAct.Note: - (1) <strong>The</strong>amount of a debt isits amountincluding intereston the day onwhich the inclusionof the debt in thecertificate isapplied for so faras such amountcan be ascertained;2. Whether or notany power withrespect to asecurity specified ina certificate hasbeen conferredunder the Act ; andwhere such a powerhas been soconferred, whetherthe power is for thereceiving of interestor dividend on, orfor the negotiationor transfer of thesecurity, or for theboth purposes thevalue of thesecurity is it ismarket value on theday on which theinclusion of thesecurity in thecertificate isapplied for so faras such value canbe ascertained .. . . . . .<strong>The</strong> fee leviable inthe case of aprobate (Art. 10)on the amount orthe value of theproperty in respectof which thecertificate isgranted.. . ..<strong>The</strong> fee leviable ona plaint any suit orthe same reliefsubject to aminimum fee of2 [one hundredrupees]Reg.VIIIof 1827.I of1894.HyderabadIX of1309 Fasli.15. Application to the Collector for areference to the <strong>Court</strong> under section 18 of theLand Acquisition Act, 1894, in itsApplication to the1 [<strong>Bombay</strong> area ] orVidarbha region2 [of the State of<strong>Maharashtra</strong>] 3 [**] or section 14 of the LandAcquisition Act, in its application to theHyderabad area of that State, as the case maybe.. . . .One half of the advolorm fee on thedifference if any,between the amountawarded by theCollector and theamount claimed bythe applicantaccording to thescheme prescribedunder Article 1 ofSchedule 1, subjectto a minimum fee of4 [fifty rupees].

XLIIIof196116. Application or petition made by anyassessee to the High <strong>Court</strong> 5[under subsection(2)ofsection 256 of the Income TaxAct, 1961. ]. . .One-half of advoloram feeleviable on theamount in dispute6[ (namely, thedifference betweenthe amount of taxactually assessedand the amount oftax admitted by theassessessee aspayable by him)]subject to theminimum fee of7 [one hundredtwenty five rupees]16 A. An appeal filed after the Ist June 1999and pending before the High <strong>Court</strong>against the order passed in appeal by theAppellate Tribunal under section 260 -A(2) of the Income Tax Act, 1961.16B. An appeal filed after the Ist June 1999and pending before the High <strong>Court</strong>against the order passed in appeal by theAppellate Tribunal under section 27 -Aof Wealth Tax Act, 1957.17. Application or petition made by anypersons [other than the Collector or theCommissioner] to the High <strong>Court</strong> under anyprovision of the Sales Tax law for the timebeing in force in any part of the 2 [State of<strong>Maharashtra</strong>]Ad volorem feeleviable on theamount in disputethat is thedifference betweenthe amount of tax .actually assessedand the amount oftax admitted by theassessee as payableby him subject tomaximum fee ofRs. 10,000/-One half of theAd volorem feeleviable on theamount of disputethat is thedifference betweenthe amount of tax .actually assessedand the amount oftax admitted by theassessee as payableby him subject tomaximum of Rs.5,000/-....One half of theAd volorem feeleviable on theamount in dispute3 [namely, thedifference between theamount ]of taxactually assessed andthe amount of taxadmitted by theassessee as payable byhim )] subject tominimum fee of 4[onehundred fifty]43 of1961.27 of1957.1. Articles 16 A and 16 B were inserted by Mah. 26 of 2000, s. 2 (b)2. <strong>The</strong>se words were submitted for the words " State of <strong>Bombay</strong> " , by Mah. 23 of 96, s.4 (f) (i)3. This portion was submitted for the brackets and words " ( namely , the difference between the amount actually assessed and theamount admitted by the assessee assessable )" , by Mah. 18 of 1960, S. 3 (c ) .4. <strong>The</strong>se wods were submitted for the words " one hundred " , by Mah.18 of 2002, s. 7 (f) .Schedule I – Contd.Table of Rates of ad volorem fees leviable on the institution of suits.1[when the amount When the amount But does not Proper fee.or value of the subject But does not Proper value of the exceed.matter exceeds exceed. Fee. subject-matterexceeds.(1) (2) (3) (1) (2) (3)Rs Rs. Rs. Rs Rs. Rs..... 1000 200 5000 5100 6951000 1100 212 5100 5200 7101100 1200 224 5200 5300 7251200 1300 236 5300 5400 7401300 1400 248 5400 5500 755

1400 1500 260 5500 5600 7701500 1600 272 5600 5700 7851600 1700 284 5700 5800 8001700 1800 296 5800 5900 8151800 1900 308 5900 6000 8301900 2000 320 6000 6100 8452000 2100 332 6100 6200 8602100 2200 344 6200 6300 8752200 2300 356 6300 6400 8902300 2400 368 6400 6500 9052400 2500 380 6500 6600 9202500 2600 392 6600 6700 9352600 2700 404 6700 6800 9502700 2800 416 6800 6900 9652800 2900 428 6900 7000 9802900 3000 440 7000 7100 9953000 3100 452 7100 7200 10103100 3200 464 7200 7300 10253200 3300 476 7300 7400 10403300 3400 488 7400 7500 10553400 3500 500 7500 7600 10703500 3600 512 7600 7700 10853600 3700 524 7700 7800 11003700 3800 536 7800 7900 11153800 3900 548 7900 8000 11303900 4000 560 8000 8100 11454000 4100 572 8100 8200 11604100 4200 584 8200 8300 11754200 4300 596 8300 8400 11904300 4400 608 8400 8500 12054400 4500 620 8500 8600 12204500 4600 632 8600 8700 12354600 4700 644 8700 8800 12504700 4800 656 8800 8900 12654800 4900 668 8900 9000 12804900 5000 680 9000 9100 12959100 9200 1310 21000 22000 31309200 9300 1325 22000 23000 32309300 9400 1340 23000 24000 33309400 9500 1355 24000 25000 34309500 9600 1370 25000 26000 35309600 9700 1385 26000 27000 36309700 9800 1400 27000 28000 37309800 9900 1415 28000 29000 38309900 10000 1430 29000 30000 393010000 10500 1505 30000 32000 403010500 11000 1580 32000 34000 413011000 11500 1655 34000 36000 4230

11500 12000 1730 36000 38000 433012000 12500 1805 38000 40000 443012500 13000 1880 40000 42000 453013000 13500 1955 42000 44000 463013500 14000 2030 44000 46000 473014000 14500 2105 46000 48000 483014500 15000 2180 48000 50000 493015000 15500 2255 50000 55000 508015500 16000 2330 55000 60000 523016000 16500 2405 60000 65000 538016500 17000 2480 65000 70000 553017000 17500 2555 70000 75000 568017500 18000 2630 75000 80000 583018000 18500 2705 80000 85000 598018500 19000 2780 85000 90000 613019000 19500 2855 90000 95000 628019500 20000 2930 95000 100000 643020000 21000 3030and the fees increases at the rate of Rupees 200 for every Rupees 10,000 or part thereof over Rupees one lakh upto Rupees 11,00,000over Rs. 11,00,000 at the rate of Rupees 1,200 of every rupees 1,00,000 or part thereof, upto a maximum fee of Rupees 3,00,000 forexample : -1,00,000 6430 9,00,000 224302,00,000 8430 10,00,000 244303,00,000 10430 11,00,000 264304,00,000 12430 12,00,000 276305,00,000 14430 13,00,000 288306,00,000 16430 14,00,000 300307,00,000 18430 15,00,000 312308,00,000 20430

Number1. Application or petition<strong>Bombay</strong> <strong>Court</strong>SCHEDULEfixed feesfees Act,II.(2)(a) when presented to any officer of theExcise Department or to any Magistrateby any person having dealings with theGovernment, and when the subject matterof such application of relates exclusive tothose dealings. ;or when presented to any officer ofland-revenue by any person holdingtamporarily settled land under directengagement with Government and whenthe subject matter of the application or apetition relates exclusively to suchengagement ;or when presented to any MunicipalCommissioner under any Act for the timebeing in force for the conservancy orimprovement of any place, if theapplication or petition relates solely tosuch conservancy or improvement :Proper fee(3)1[five rupee].or when presented to any Civil <strong>Court</strong>other than a principle Civil <strong>Court</strong> oforiginal jurisdiction,;IX of1887.or to any <strong>Court</strong> of Small Causesconstituted under the provincial SmallCause <strong>Court</strong>s Act, 1887 , or to aCollector or other officer of revenue or toa public officer in relation to any suit orcase in which is the amount of value ofthe subject-matter is less than fiftyrupees;1 [* * * ]Or when presented to any Civil,Criminal, or Revenue <strong>Court</strong>, or to anyBoard or executive officer for thepurpose of obtaining a copy ortranslation of any judgment , decree ororder passed by such <strong>Court</strong>, Board orOfficer, or of any other document onrecord in such <strong>Court</strong> or office.2 [***]3[c](i) When containing a complaintor charge of any offence other than theoffence under the Negotiable InstrumentAct 1881.(ii) Complaint of charge of an offenceu/sec. 138 of the Negotiable InstrumentAct, 1881.(d) When presented to any competentAuthority for the purpose of obtaining acertificate of Domicile(e) when presented to a ChiefControlling Revenue or ExecutiveAuthority or to a Commissioner ofRevenue or to any Chief Officer Charged with executive administration of adivision and not otherwise provided forby this Act.(f) When presented to the High<strong>Court</strong>-(i)2[..] For directions, orders or writsunder Act Article 226 of the Constitutionfor any purpose other than theenforcement of the fundamental rightsconferred by Part III thereof;(ii) for directions orders or writs, underarticle 226 for the enforcement of any ofthe fundamental rights conferred by partIII of the Constitution or for the exerciseof its jurisdiction under Article 227thereof;Five rupees.Two hundredrupees.4[Ten rupees}1[ten rupees]3 [One hundredtwenty-five rupees]4[two hundred andfifty rupees]26 of1881.26 of1881.(iii) In any other case not otherwiseprovided for by this Act .5 [Twenty Rupees]

IX of 1887.V of 19082. Revision application when presented tothe High <strong>Court</strong> under section 25 of theProvincial Small Cause courts Act, 1887 orsection 115 of the Code of civil Procedure,19083. Application to any civil <strong>Court</strong> that recordsmay be called for from another court.4. First Application (other than a petitioncontaining a criminal charge or information)for the summons of a witness or other personto attend either to give evidence or to producea document, or in respect of the production orfiling of an exhibit not being an affidavitmade for the immediate purpose of beingproduced in <strong>Court</strong>......5. Application for leave to sue as a pauper. . . .When the <strong>Court</strong> grants the applicationand is of opinion that the transmission ofsuch records involves the use of the post.. . .6 [Fifty rupees],1 [Five rupees] inaddition to any feelevied on theapplication underclause (a). clause ©or clause (f ) ofArticle 1 of thisSchedule.2[five rupees].3 [Five rupees].6. Application for leave to appeal as apauper.7. Plaint or memorandum of appeal in a suitto obtain possession under the Mamlatdars<strong>Court</strong> Act, 1906.8. Plaint or memoradum of appeal in a suitto establish or disprove a rith of occupancy.1. <strong>The</strong>se words were substituted for the words "four rupees", by Mah.18 of 2002, s.8(c ),2. <strong>The</strong>se words were substituted for the words "one rupees", ibid.,s.8(e).3. <strong>The</strong>se words were substituted for the words "two rupees", ibid.,s.8(f)(i)4. <strong>The</strong>se words were substituted for the words "four rupees", ibid.,s.8(f)(2).5.<strong>The</strong>se words were substituted for the words "ten rupees", ibid.,s.8(f)(2)6. <strong>The</strong>se words were substituted for the words "ten rupees", ibid.,s.8(g).7. <strong>The</strong>se words were substituted for the words "two rupees", ibid.,s.8(h).V of 1898.V of 1908IV of 18691 [9.Bail- bond or other instrument ofobligation given in pursuance of an ordermade by a court or Magistrate under anysection of the *code of Criminal Procedure,1898, other than section 109 or 110 thereofor under the Code of civil Procedure,1908and not otherwise provided for by this Act.10. Bail-bonds in criminal cases,recognizance to prosecute and recognizancesfor personal appearance or otherwise.11. Undertaking under section 49 of theIndian Divorce Act, 1869.(a) When presented to a <strong>District</strong> <strong>Court</strong>.(b) when presented to aCommissioner or the High <strong>Court</strong>............ . . . . .......... .......12. Mukhtarnama or Vakalatnama . when presented for the conduct of anyone case-(a) to any Civil or Criminal <strong>Court</strong> otherthan the High <strong>Court</strong>, or to any Revenue<strong>Court</strong> or to any collector or Magistrate,or other executive officer;(b) to the High <strong>Court</strong>13. Memorundam of appeal when the appealis not from a decree or an order having theforce of a decree, and is presented -(a) to any Civil <strong>Court</strong> other than theHigh <strong>Court</strong>, or to any Revenue <strong>Court</strong> orExecutive officer other than the High<strong>Court</strong> or Chief Controlling Revenue orExecutive Authority;1.<strong>The</strong>se article were substituted for the words "one rupee",ibid,s.8(j).2.<strong>The</strong>se words were substituted for the articles nine and ten respectively by Mah. 12 of 1976, s.2.3. <strong>The</strong>se words were substituted for the words "five rupees", by Mah. 18 of 2002 , s.(i).4. <strong>The</strong>se words were substituted for the words "five rupee", ibid,s.8(k).5. <strong>The</strong>se words were substituted for the words "three rupee", ibid,s.8(l))l).6.<strong>The</strong>se words were substituted for the words "five rupees", ibid,s.8(1)(2).7. <strong>The</strong>se words were substituted for the words "two rupees", ibid,s.8(m) (l).*See now the Code of Criminal Procedure, 1973 (2 of 1974.)4 [five rupees].5 [Twenty rupees.]6 [twenty-fiverupees.]7[ Ten rupees]2 [Ten rupees]3 [Five rupees]4 [Ten rupees]5 [Ten rupees]6 [Fifteen rupees]7 [five rupees]Bom.IIof 1906.