chapter xxvi - District Courts, Maharashtra

chapter xxvi - District Courts, Maharashtra

chapter xxvi - District Courts, Maharashtra

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

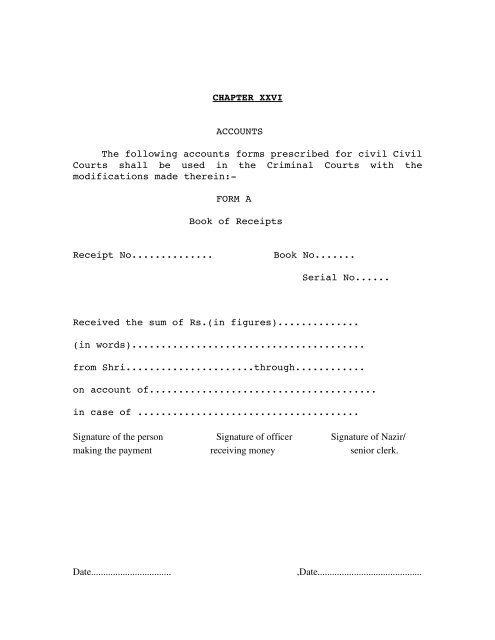

CHAPTER XXVIACCOUNTSThe following accounts forms prescribed for civil Civil<strong>Courts</strong> shall be used in the Criminal <strong>Courts</strong> with themodifications made therein:FORM ABook of ReceiptsReceipt No..............Book No.......Serial No......Received the sum of Rs.(in figures)..............(in words)........................................from Shri......................through............on account of.......................................in case of ......................................Signature of the person Signature of officer Signature of Nazir/making the payment receiving money senior clerk.Date.................................,Date...........................................

Date;.....................................Note: The Nazir should make an endorsement under hissignature in the Register of Muddemal Property when theamount is credited in the Criminal Court Deposit, and thereceipt in the Form 'A' should not be issued in favour ofNazir or a Senior Clerk acknowledging the payment made byhimself when the cash other than the marked currency notesof which is useful as a piece of evidence is deposited inCriminal Court Deposit.FORM CRegister of Deposit Receipts

Date of receiptNumber of Receipt, Form A.Consecutive number iof items as entered in the registerNumber of Criminal Case of Judicial Proceedings.PartiesName of person making the payment and on whose behalf the payment is madeOn what accountAmount of DepositPage of LedgerInitial of Nazir of Chief Ministerial Officer of the Court.Daily total carried to Cash Book Form I.Four use in theCourtDateAmount of each repaymentInitial of Nazir or Chief Ministerial Officer of the Court1 2 3 4 5 6 7 8 9 10 11 12 13 14

Details of RepaymentFor use in the Accountant General's OfficeDateAmount of each repaymentDateAmount of each repaymentDateAmount of each repaymentDateAmount of each repaymentDateAmount of each repaymentDateLapsedandCredited toGovernmentAmountRemarks15 16 17 18 19 20 21 22 23 24 25 26 27

FORM DREGISTER OF DEPOSIT PAYMENTRegister of Payment from Sums received by the Court in connection with Criminal Casesor Judicial Proceedings and deposited with the Court for the yearDate ofpresentrepaymentConsecutiveNumber ofItemReference to entry inRegister CDateEnteryNumberNumber ofCriminalCase orJudicialProceedingAmount ofBalance ofDepositTo whopaid1 2 3 4 5 6 7Particulars,if anyAmountpaidPage ofLedgerInitial ofNazir orChiefMinisterialOfficerDaily Totalcarried tocash BookForm ISignatureof mark ofthe partyreceivingpaymentRemarks8 9 10 11 12 13 14FORM GRegister of Receipts on account of subsistence money, expenses of witnesses, andmiscellaneous petty items required for immediate disbursement.

Date ofConsecutNo. ofName ofOn whatCriminalCase orNo.ofreceiptivenumberof itemsreceiptsForm Athepersonwho paidtheaccountProceedingNumberYearWitnesses.moneyand onwhosebehalfthepaymentis made01 02 03 04 05 06 07 09Account ofDailyPaymentsRegister HLapsedcredited toRemarks.DepositTotalCarried toCashas perFORMandGovernmentBook,Form IDateAmountDateAmount09 10 11 12 13 14 15FORM HRegister of payments on account of subsistence money, expenses of witnesses andmiscellaneous petty items required for immediate disbursement for the year 19

Date of payments.Consecutive No.of item.Reference to Register Form G.Date/Entry number.To whom paid.On what account.Amount paid.Daily total carried to cash Book Form LAcknowledgement of Receipient.Remarks.1 2 3 4 5 6 7 8 9 10Rs. P. Rs. P.Note: Disbursements on account of diet money, travelling expenses etc. should be enteredin Form H only where amounts of such expenses are deposited and entered in Form G.FORM HHRegister of Bhatta, etc.paid by Government to witnesses in the Courtof ............................................................Year ......................................................................BhattaRail etc.

Criminal Case No.Names of witnesses.Days.Rate.Amount.From.To.Rail to Road.Rate.Amount.Total.Payees Signature.Remarks.Magistrate's iniitials.1 2 3 4 5 6 7 8 9 10 11 12 13 14Note: Where disbursements have been made on Government account when no deposithas been entered in Form G, the entries of such disbursement should be made in FormHH.FORM ICash Book of the Court of ....................................................................................................CreditDebit Reference Number ofReference Number ofDate.Register.Item.From whom received.Particulars.Amount.Daily Total.Date.Register.Item.To whom paid etc.Particulars.Amount.Daily Total.1 2 3 4 5 6 7 8 9 10 11 12 13 14Rs. P. Rs. P. Rs. P. Rs. PFORM JCase No. Leadger for year.ComplainantAccused.

CreditDebitMonth and Entry No.of Amount. Entry No.of Amount Balance.Date. Register CRegister D1 2 3 4 5 6Rs. P. Rs. P.FORM KTreasury Pass Book on account of Criminal <strong>Courts</strong> Deposits With Government.Court of ................................ in account with the Treasury at ....................DebitDateCreditamountRs. P.AmountdrawnRs. P.No. anddate ofChequeBalance intheTreasuryRs. P.Signatureof theTreasuryOfficerSignatureof theNazir/SeniorClerk1 2 3 4 5 6 7

FORM LNo. Court. No. Court.19.. 19....To,The Treasury OfficerTo,The Treasury OfficeratPlease pay toAmount of Cheque Rs. the sum of Rupees andIn whose favourdebit the same toOn what account“Criminal Court Deposit”Rs.Nazir/Senior Clerk. Nazir/Senior Clerk.Judge/Magistrate. Judge/Magistrate.19..The amount to be entered in words here.FORM MApplication for refund of Lapsed DepositTHE ACCOUNTANT GENERAL BOMBAYTo,Dated:......19Sir,I have the honour to report that a claim has been preferredby...................................for lapsed deposit No.......................of 19 for Rupees..............included in my list of Deposits which lapsed on the 31 st March 19 .

2 I have satisfied myself of the validity of the claim, and request that the TreasuryOfficer may be authorised to make the refund.Yours faithfullyJudge/Magistrate.No. of 19Department.The Collector of ................is authorised to pay Rs..........on account of the lapseddeposit mentioned above, and debit the amount as a direct entry in the Treasury CashBook.Account General's OfficeBombay,Accountant General.The 19Forwarded to the ...........Judge/Magistrate for delivery to the claimant.........TREASURY.Voucher No...........of List of Payments.For ...........19Received this.......day of.............19 the sum of Rupees...........only.Stamp if requiredExamined and entered (Claimant's)Signature.Accountant

Pay Rupees...........Officer in charge ofTreasuryFORM NStatement of Lapsed Criminal <strong>Courts</strong> Deposits of the <strong>Courts</strong> for the year 19....Particulars of depositFor use in Account General's Office.Date of No. Balance Refund Order Amount Initials RemarksDepositLapsedNo. DateofRefundSanctionRs. P. Rs. P.2. For details of the instructions to be observed in the maintenance of the aboveForms, the Sessions Judges and Judicial Magistrates are directed to refer to the rules andinstructions in the Chapter on Accounts in the Civil Manual.3. The form of register showing the daily receipts of Courtfees is given below. Theentries are not to be made in detail, but should show the aggregate value of the stampsfiled in the Court during each day.FORMDaily Register of CourtFees realised in the Court of the ....Date Processfees Courtfees levied on complainantsand applications etc.Rs. P.Rs..P.Note : The totals of columns 2 and 3 respectively should be taken at the end of each

month.4. Rule 98(2) (ii) of the <strong>Maharashtra</strong> treasury Rules,1968 provides that all monetarytransactions should be entered in the Cash Book as soon as they occur and attested by thehead of the office in token of check. It would however not be necessary to write CashBook when there is no monetary transaction. It would be sufficient if a specific note ismade in red ink at the top of the next page of the cash book explaining the reasons andthe dates for which the cash book is not written under the initials of the Nazir and theJudge/Magistrate.5. It is the duty of a Judicial Magistrate to examine and initial the receipt book forcontingent charges before be signs the contingent bill for each month.6. The practice of correcting by trying to changeone figure to another should be discontinued. Therectification should invariably be made by striking out thewrong figure and fairly writing the correct one above it.The correction should be always initialed.7 In the cases under the Motor Vehicles Act, the cashdeposits received by the Police or the investigatingauthorities directly from the offenders in lieu of bailbonds under section 445 of the Code of Criminal Procedure,1973, should invariably be received and deposited in the<strong>Courts</strong> concerned along with charge sheets and credited in'C' Register under the Head of Account “Criminal CourtDeposits” .8 The amounts of fines imposed and realised by thecriminal <strong>Courts</strong> should be entered in the cash book (form 1)and not in the General Cash Book.9 Cash Books in Form No.MTR4 are meant for themaintenance of accounts in respect of Governmentmonies/deposits received and paid on account of salaryT.A., etc., i.e. Receipt and expenditure on account of payand allowances etc. of the <strong>Courts</strong> of Civil JudgescumMagistrates and Joint Civil JudgescumMagistrates. It isnot proper to enter the accounts of amounts pertaining tothe Judicial Proceeding (such as sale proceeds, forfeitedamounts etc.,) in the cash book in Form No.MTR4 . Theamounts pertaining to the Judicial Proceedings should beentered in Cash Book (1) (Form No.C.I.V. B28) prescribed

y the Civil and Criminal Manuals and not in Form No.MTR4.Where there is only one Civil cumCriminal Court at aplace, there is no necessity of maintaining a separatecash book in Form No.MTR4. According to the instructionsin Rule 98 of <strong>Maharashtra</strong> Treasury Rules, for Civil andCriminal sides of one and the same Court, and that onecommon cash book for both the sides of the Court should bemaintained. Where, however, there is more than one CivilcumCriminal<strong>Courts</strong> at any place, the common cash book inForm No.MTR4 may be maintained for all the <strong>Courts</strong> in thePrincipal Court.Fines and Compensation under Local and Special Acts.10(1) The fines realised in cases tried by Magistratesunder the Municipal and other Acts should be credited toGovernment.The Court should keep subsidiary accounts of receiptsfrom fines under the several Acts within the limits of eachLocal Body. Subsidiary Accounts should show (1) thesection and the Act under which fine has been levied and(2) the Local Body within the territorial limits of whichthe fine has been levied. The Accounts should be preparedin triplicate by the <strong>Courts</strong> concerned. One copy should beretained in the Office, the second copy should be forwardedto the Treasury Officer, and the third to the <strong>District</strong>Judge or the Chief Metropolitan Magistrate, as the case maybe monthly.The <strong>District</strong> Judge and the Chief MetropolitanMagistrate should, in turn, submit accounts of receipts ofthe fines realised under the Bombay Shops andEstablishments Act, 1948, to the Industries, Energy andLabour Department, Government of <strong>Maharashtra</strong>, by first ofSeptember every year.(2)Whenever the amounts of compensation or damages arerecovered from the accused persons in forest cases, theyshould be promptly remitted to the Sub Treasuries orTreasuries, as the case may be, along with the TreasuryChalans in triplicate. Out of these three copies, one

copy would be returned to the Court which makes thedeposit for its record, the second would be sent to theDivisional Forest Officer directly by the Sub Treasury orthe Treasury Officer, and the third one will be retainedby the Sub Treasury or the Treasury Officer for hisrecord.11 A total of cash amounts (forming muddemal) forfeited toGovernment and/or cash amounts of sale proceeds of theconfiscated articles of muddemal property, due for beingcredited to Government during the day should be made and areceipt in Form No.A prescribed in Para 1 of this Chaptershould be passed in duplicate for the total of suchamounts. In the blank space on the reverse of the receiptin duplicate, the details regarding the cash amounts(forming muddemal property) forfeited to Government and /orcash amounts of sale proceeds of the confiscated articlesof muddemal property , should be mentioned column wise asfollows :Serial Serial No.of the Property in the Property Register and its dateAmount.No.1 2 3Note: (1) A rubber stamp of the above form should be gotprepared and used by the office for the purpose. The

Property Register referred to in Column No.2 above is theProperty Register prescribed under Paragraph 69 of ChapterVI of the Criminal Manual, 1980 , in which all muddemalincluding valuable muddemal is required to be entered.(2)As soon as the receipt is passed, necessary entries(viz., receipt number and its date) should be made againstthe appropriate serial number of the Property concerned inthe Property Register maintained as per paragraph 69 ofChapter VI of the Criminal Manual, 1980 ,for all kinds ofmuddemal articles including valuable muddemal, and also inthe separate Register which is maintained as per paragraph70 of Chapter VI of the Criminal Manual, 1980 , forvaluable properties.(3)Thereafter the total amount covered by the receiptshould be shown on the receipt side of the “Cash Book “ ,Form 2 (General Form No.200e)prescribed under rule 45 ofthe Bombay Financial Rules, 1959, (hereinafter brieflyreferred to as the “Cash Book) . The amount should becredited on the same day to Government through thetreasury by Challan and thereafter on the same day, thesaid amount should be shown on the expenditure side of the“Cash Book”.(4)The original receipt should be detached from the receiptbook and annexed to the Challan returned by the Treasuryand preserved for record.(5)The Property Register should serve as a subsidiaryRegister to verify the amounts entered in the receiptspassed, the “Cash Book” and the Challans and to seewhether all Cash amounts (forming muddemal) forfeited toGovernment and/or all the amounts of sales proceeds ofconfiscated articles of muddemal property have been dulycredited to Government through the treasury.(6)The question of passing the receipt as pointed out inNote (1) above and of crediting the amount to theGovernment through the treasury after making entries inthe “Cash Book” as indicated in Note)3) above would ariseonly after the final disposal of the Criminal Case, i.e.After the expiry of the period mentioned in paragraph 73of Chapter VI of the criminal Manual, 1980.J 464118a