PC10 Pension Credit - Communities and Local Government

PC10 Pension Credit - Communities and Local Government

PC10 Pension Credit - Communities and Local Government

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

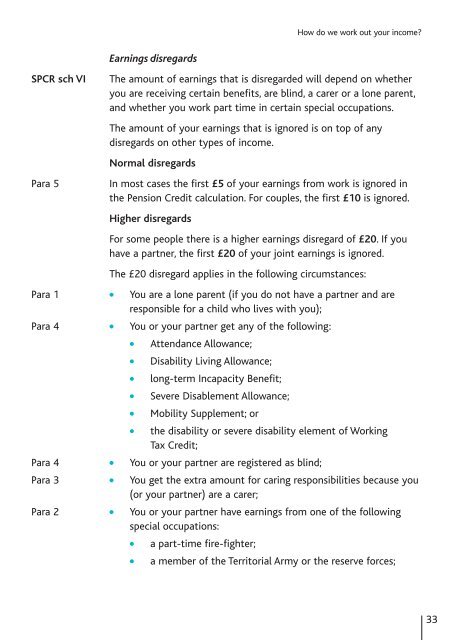

How do we work out your income?SPCR sch VIPara 5Earnings disregardsThe amount of earnings that is disregarded will depend on whetheryou are receiving certain benefits, are blind, a carer or a lone parent,<strong>and</strong> whether you work part time in certain special occupations.The amount of your earnings that is ignored is on top of anydisregards on other types of income.Normal disregardsIn most cases the first £5 of your earnings from work is ignored inthe <strong>Pension</strong> <strong>Credit</strong> calculation. For couples, the first £10 is ignored.Higher disregardsFor some people there is a higher earnings disregard of £20. If youhave a partner, the first £20 of your joint earnings is ignored.The £20 disregard applies in the following circumstances:Para 1 ● You are a lone parent (if you do not have a partner <strong>and</strong> areresponsible for a child who lives with you);Para 4 ● You or your partner get any of the following:●●●●●Attendance Allowance;Disability Living Allowance;long-term Incapacity Benefit;Severe Disablement Allowance;Mobility Supplement; or● the disability or severe disability element of WorkingTax <strong>Credit</strong>;Para 4 ● You or your partner are registered as blind;Para 3 ● You get the extra amount for caring responsibilities because you(or your partner) are a carer;Para 2 ● You or your partner have earnings from one of the followingspecial occupations:●●a part-time fire-fighter;a member of the Territorial Army or the reserve forces;33