PC10 Pension Credit - Communities and Local Government

PC10 Pension Credit - Communities and Local Government

PC10 Pension Credit - Communities and Local Government

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

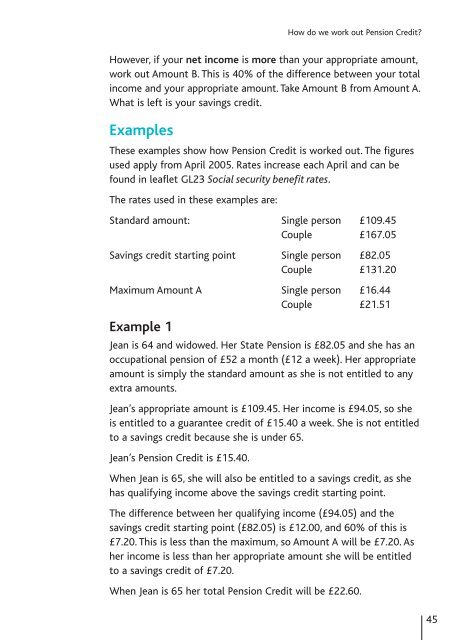

How do we work out <strong>Pension</strong> <strong>Credit</strong>?However, if your net income is more than your appropriate amount,work out Amount B. This is 40% of the difference between your totalincome <strong>and</strong> your appropriate amount. Take Amount B from Amount A.What is left is your savings credit.ExamplesThese examples show how <strong>Pension</strong> <strong>Credit</strong> is worked out. The figuresused apply from April 2005. Rates increase each April <strong>and</strong> can befound in leaflet GL23 Social security benefit rates.The rates used in these examples are:St<strong>and</strong>ard amount: Single person £109.45Couple £167.05Savings credit starting point Single person £82.05Couple £131.20Maximum Amount A Single person £16.44Couple £21.51Example 1Jean is 64 <strong>and</strong> widowed. Her State <strong>Pension</strong> is £82.05 <strong>and</strong> she has anoccupational pension of £52 a month (£12 a week). Her appropriateamount is simply the st<strong>and</strong>ard amount as she is not entitled to anyextra amounts.Jean’s appropriate amount is £109.45. Her income is £94.05, so sheis entitled to a guarantee credit of £15.40 a week. She is not entitledto a savings credit because she is under 65.Jean’s <strong>Pension</strong> <strong>Credit</strong> is £15.40.When Jean is 65, she will also be entitled to a savings credit, as shehas qualifying income above the savings credit starting point.The difference between her qualifying income (£94.05) <strong>and</strong> thesavings credit starting point (£82.05) is £12.00, <strong>and</strong> 60% of this is£7.20. This is less than the maximum, so Amount A will be £7.20. Asher income is less than her appropriate amount she will be entitledto a savings credit of £7.20.When Jean is 65 her total <strong>Pension</strong> <strong>Credit</strong> will be £22.60.45