Taxes Consolidation Act, 1997. - Houses of the Oireachtas

Taxes Consolidation Act, 1997. - Houses of the Oireachtas

Taxes Consolidation Act, 1997. - Houses of the Oireachtas

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

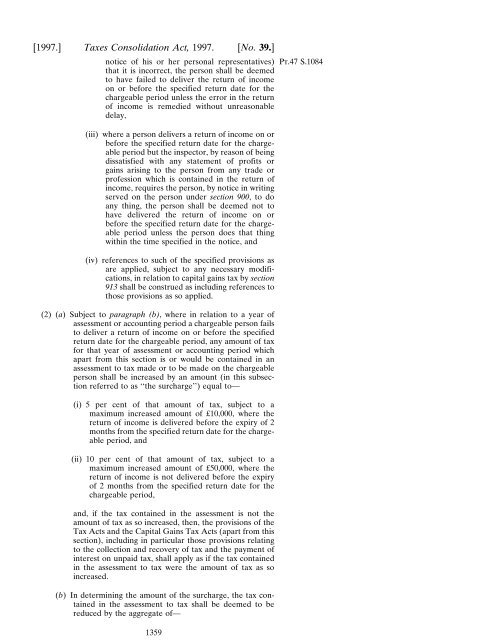

[<strong>1997.</strong>] <strong>Taxes</strong> <strong>Consolidation</strong> <strong>Act</strong>, <strong>1997.</strong> [No. 39.]notice <strong>of</strong> his or her personal representatives)that it is incorrect, <strong>the</strong> person shall be deemedto have failed to deliver <strong>the</strong> return <strong>of</strong> incomeon or before <strong>the</strong> specified return date for <strong>the</strong>chargeable period unless <strong>the</strong> error in <strong>the</strong> return<strong>of</strong> income is remedied without unreasonabledelay,(iii) where a person delivers a return <strong>of</strong> income on orbefore <strong>the</strong> specified return date for <strong>the</strong> chargeableperiod but <strong>the</strong> inspector, by reason <strong>of</strong> beingdissatisfied with any statement <strong>of</strong> pr<strong>of</strong>its orgains arising to <strong>the</strong> person from any trade orpr<strong>of</strong>ession which is contained in <strong>the</strong> return <strong>of</strong>income, requires <strong>the</strong> person, by notice in writingserved on <strong>the</strong> person under section 900, todoany thing, <strong>the</strong> person shall be deemed not tohave delivered <strong>the</strong> return <strong>of</strong> income on orbefore <strong>the</strong> specified return date for <strong>the</strong> chargeableperiod unless <strong>the</strong> person does that thingwithin <strong>the</strong> time specified in <strong>the</strong> notice, and(iv) references to such <strong>of</strong> <strong>the</strong> specified provisions asare applied, subject to any necessary modifications,in relation to capital gains tax by section913 shall be construed as including references tothose provisions as so applied.(2) (a) Subject to paragraph (b), where in relation to a year <strong>of</strong>assessment or accounting period a chargeable person failsto deliver a return <strong>of</strong> income on or before <strong>the</strong> specifiedreturn date for <strong>the</strong> chargeable period, any amount <strong>of</strong> taxfor that year <strong>of</strong> assessment or accounting period whichapart from this section is or would be contained in anassessment to tax made or to be made on <strong>the</strong> chargeableperson shall be increased by an amount (in this subsectionreferred to as ‘‘<strong>the</strong> surcharge’’) equal to—(i) 5 per cent <strong>of</strong> that amount <strong>of</strong> tax, subject to amaximum increased amount <strong>of</strong> £10,000, where <strong>the</strong>return <strong>of</strong> income is delivered before <strong>the</strong> expiry <strong>of</strong> 2months from <strong>the</strong> specified return date for <strong>the</strong> chargeableperiod, and(ii) 10 per cent <strong>of</strong> that amount <strong>of</strong> tax, subject to amaximum increased amount <strong>of</strong> £50,000, where <strong>the</strong>return <strong>of</strong> income is not delivered before <strong>the</strong> expiry<strong>of</strong> 2 months from <strong>the</strong> specified return date for <strong>the</strong>chargeable period,and, if <strong>the</strong> tax contained in <strong>the</strong> assessment is not <strong>the</strong>amount <strong>of</strong> tax as so increased, <strong>the</strong>n, <strong>the</strong> provisions <strong>of</strong> <strong>the</strong>Tax <strong>Act</strong>s and <strong>the</strong> Capital Gains Tax <strong>Act</strong>s (apart from thissection), including in particular those provisions relatingto <strong>the</strong> collection and recovery <strong>of</strong> tax and <strong>the</strong> payment <strong>of</strong>interest on unpaid tax, shall apply as if <strong>the</strong> tax containedin <strong>the</strong> assessment to tax were <strong>the</strong> amount <strong>of</strong> tax as soincreased.(b) In determining <strong>the</strong> amount <strong>of</strong> <strong>the</strong> surcharge, <strong>the</strong> tax containedin <strong>the</strong> assessment to tax shall be deemed to bereduced by <strong>the</strong> aggregate <strong>of</strong>—1359Pt.47 S.1084