Taxes Consolidation Act, 1997. - Houses of the Oireachtas

Taxes Consolidation Act, 1997. - Houses of the Oireachtas

Taxes Consolidation Act, 1997. - Houses of the Oireachtas

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

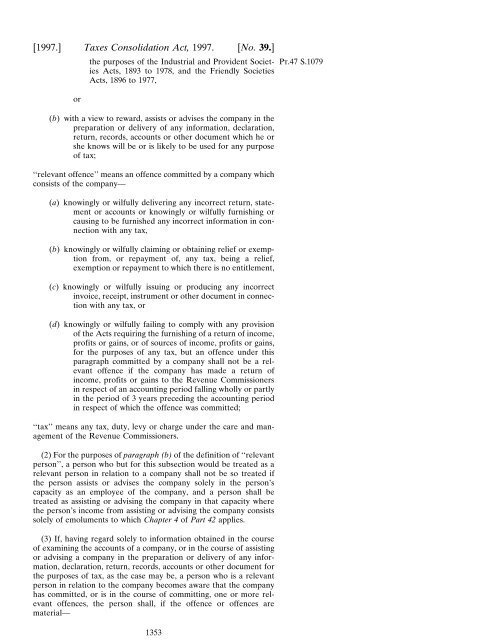

[<strong>1997.</strong>] <strong>Taxes</strong> <strong>Consolidation</strong> <strong>Act</strong>, <strong>1997.</strong> [No. 39.]or<strong>the</strong> purposes <strong>of</strong> <strong>the</strong> Industrial and Provident Societies<strong>Act</strong>s, 1893 to 1978, and <strong>the</strong> Friendly Societies<strong>Act</strong>s, 1896 to 1977,(b) with a view to reward, assists or advises <strong>the</strong> company in <strong>the</strong>preparation or delivery <strong>of</strong> any information, declaration,return, records, accounts or o<strong>the</strong>r document which he orshe knows will be or is likely to be used for any purpose<strong>of</strong> tax;‘‘relevant <strong>of</strong>fence’’ means an <strong>of</strong>fence committed by a company whichconsists <strong>of</strong> <strong>the</strong> company—(a) knowingly or wilfully delivering any incorrect return, statementor accounts or knowingly or wilfully furnishing orcausing to be furnished any incorrect information in connectionwith any tax,(b) knowingly or wilfully claiming or obtaining relief or exemptionfrom, or repayment <strong>of</strong>, any tax, being a relief,exemption or repayment to which <strong>the</strong>re is no entitlement,(c) knowingly or wilfully issuing or producing any incorrectinvoice, receipt, instrument or o<strong>the</strong>r document in connectionwith any tax, or(d) knowingly or wilfully failing to comply with any provision<strong>of</strong> <strong>the</strong> <strong>Act</strong>s requiring <strong>the</strong> furnishing <strong>of</strong> a return <strong>of</strong> income,pr<strong>of</strong>its or gains, or <strong>of</strong> sources <strong>of</strong> income, pr<strong>of</strong>its or gains,for <strong>the</strong> purposes <strong>of</strong> any tax, but an <strong>of</strong>fence under thisparagraph committed by a company shall not be a relevant<strong>of</strong>fence if <strong>the</strong> company has made a return <strong>of</strong>income, pr<strong>of</strong>its or gains to <strong>the</strong> Revenue Commissionersin respect <strong>of</strong> an accounting period falling wholly or partlyin <strong>the</strong> period <strong>of</strong> 3 years preceding <strong>the</strong> accounting periodin respect <strong>of</strong> which <strong>the</strong> <strong>of</strong>fence was committed;‘‘tax’’ means any tax, duty, levy or charge under <strong>the</strong> care and management<strong>of</strong> <strong>the</strong> Revenue Commissioners.(2) For <strong>the</strong> purposes <strong>of</strong> paragraph (b) <strong>of</strong> <strong>the</strong> definition <strong>of</strong> ‘‘relevantperson’’, a person who but for this subsection would be treated as arelevant person in relation to a company shall not be so treated if<strong>the</strong> person assists or advises <strong>the</strong> company solely in <strong>the</strong> person’scapacity as an employee <strong>of</strong> <strong>the</strong> company, and a person shall betreated as assisting or advising <strong>the</strong> company in that capacity where<strong>the</strong> person’s income from assisting or advising <strong>the</strong> company consistssolely <strong>of</strong> emoluments to which Chapter 4 <strong>of</strong> Part 42 applies.(3) If, having regard solely to information obtained in <strong>the</strong> course<strong>of</strong> examining <strong>the</strong> accounts <strong>of</strong> a company, or in <strong>the</strong> course <strong>of</strong> assistingor advising a company in <strong>the</strong> preparation or delivery <strong>of</strong> any information,declaration, return, records, accounts or o<strong>the</strong>r document for<strong>the</strong> purposes <strong>of</strong> tax, as <strong>the</strong> case may be, a person who is a relevantperson in relation to <strong>the</strong> company becomes aware that <strong>the</strong> companyhas committed, or is in <strong>the</strong> course <strong>of</strong> committing, one or more relevant<strong>of</strong>fences, <strong>the</strong> person shall, if <strong>the</strong> <strong>of</strong>fence or <strong>of</strong>fences arematerial—1353Pt.47 S.1079