Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

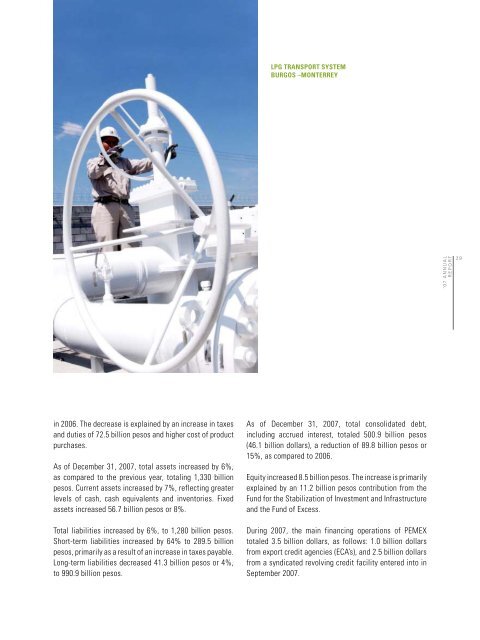

LPG transport systemBurgos –Monterrey‘ 0 7 A N N U A LR E P O R T2 9in 2006. The decrease is explained by an increase in taxesand duties of 72.5 billion pesos and higher cost of productpurchases.As of December 31, 2007, total assets increased by 6%,as compared to the previous year, totaling 1,330 billionpesos. Current assets increased by 7%, reflecting greaterlevels of cash, cash equivalents and inventories. Fixedassets increased 56.7 billion pesos or 8%.Total liabilities increased by 6%, to 1,280 billion pesos.Short-term liabilities increased by 64% to 289.5 billionpesos, primarily as a result of an increase in taxes payable.Long-term liabilities decreased 41.3 billion pesos or 4%,to 990.9 billion pesos.As of December 31, 2007, total consolidated debt,including accrued interest, totaled 500.9 billion pesos(46.1 billion dollars), a reduction of 89.8 billion pesos or15%, as compared to 2006.Equity increased 8.5 billion pesos. The increase is primarilyexplained by an 11.2 billion pesos contribution from theFund for the Stabilization of Investment and Infrastructureand the Fund of Excess.During 2007, the main financing operations of PEMEXtotaled 3.5 billion dollars, as follows: 1.0 billion dollarsfrom export credit agencies (ECA’s), and 2.5 billion dollarsfrom a syndicated revolving credit facility entered into inSeptember 2007.