CTLR Ext Audit - Corporate Executive Board

CTLR Ext Audit - Corporate Executive Board

CTLR Ext Audit - Corporate Executive Board

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

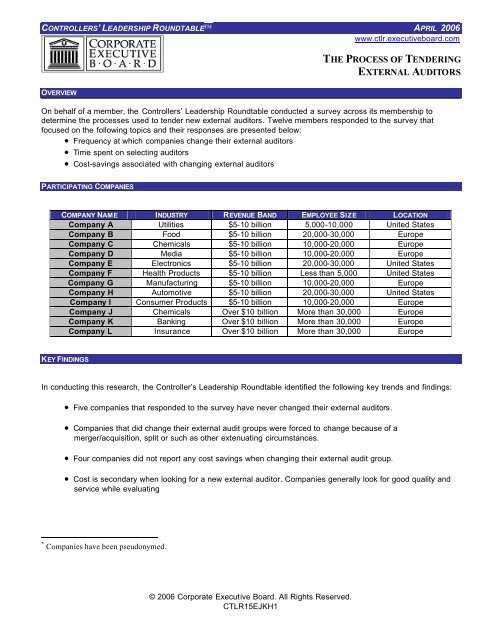

CONTROLLERS’ LEADERSHIP ROUNDTABLE APRIL 2006www.ctlr.executiveboard.comTHE PROCESS OF TENDERINGEXTERNAL AUDITORSOVERVIEWOn behalf of a member, the Controllers’ Leadership Roundtable conducted a survey across its membership todetermine the processes used to tender new external auditors. Twelve members responded to the survey thatfocused on the following topics and their responses are presented below:• Frequency at which companies change their external auditors• Time spent on selecting auditors• Cost-savings associated with changing external auditorsPARTICIPATING COMPANIESCOMPANY NAME * INDUSTRY REVENUE BAND EMPLOYEE SIZE LOCATIONCompany A Utilities $5-10 billion 5,000-10,000 United StatesCompany B Food $5-10 billion 20,000-30,000 EuropeCompany C Chemicals $5-10 billion 10,000-20,000 EuropeCompany D Media $5-10 billion 10,000-20,000 EuropeCompany E Electronics $5-10 billion 20,000-30,000 United StatesCompany F Health Products $5-10 billion Less than 5,000 United StatesCompany G Manufacturing $5-10 billion 10,000-20,000 EuropeCompany H Automotive $5-10 billion 20,000-30,000 United StatesCompany I Consumer Products $5-10 billion 10,000-20,000 EuropeCompany J Chemicals Over $10 billion More than 30,000 EuropeCompany K Banking Over $10 billion More than 30,000 EuropeCompany L Insurance Over $10 billion More than 30,000 EuropeKEY FINDINGSIn conducting this research, the Controller’s Leadership Roundtable identified the following key trends and findings:• Five companies that responded to the survey have never changed their external auditors.• Companies that did change their external audit groups were forced to change because of amerger/acquisition, split or such as other extenuating circumstances.• Four companies did not report any cost savings when changing their external audit group.• Cost is secondary when looking for a new external auditor. Companies generally look for good quality andservice while evaluating* Companies have been pseudonymed.© 2006 <strong>Corporate</strong> <strong>Executive</strong> <strong>Board</strong>. All Rights Reserved.<strong>CTLR</strong>15EJKH1

CONTROLLERS’ LEADERSHIP ROUNDTABLE PAGE 2TENDERING EXTERNAL AUDITORSwww.ctlr.executiveboard.comCHANGING EXTERNAL AUDITORSThe graph below shows the participants responses on how frequently companies change their external auditors:Frequency of Changing <strong>Ext</strong>ernal <strong>Audit</strong>orsNumber of Companies6543215Company D chose tochange auditors to followgood corporategovernance and toincorporate new ideas.4Company H and Iwere forced tochange their auditorsdue to the demise ofArthur Anderson in2002.12Company G chose tochange its externalauditors to low er costs .0Never 3-5 years Every 10 years Every 20 yearsTime periodn=12Source: Controllers’ Leadership Roundtable ResearchTIME COMMITMENTA majority of the companies responded that changing the external auditors takes a significant amount of time. Thefollowing chart illustrates their responses:TABLE 1: TIME COMMITMENTSIGNIFICANT AMOUNT OF TIMENOT A SIGNIFICANT AMOUNT OF TIMECompany H: The old auditors gave no notice when theyresigned, therefore, not a significant amount of time wasspent on selecting new auditorsCompany D: Three external firms met with top 20Finance Managers to get scores and feedback. TheCFO and Controllers later review the feedback andthen it was approved by the <strong>Audit</strong> Committee.Company F: <strong>Ext</strong>ernal firms were asked to submitproposals for an external financial report assessmentand outsourced internal audit activities.Company G: Management spent two months to tenderand one month to decide. Two days were spent on thefinal selection.Company K: There was a six week time line betweenthe request for proposal and the submitted writtenproposal, then four weeks until the oral presentations,along with additional time that the <strong>Audit</strong> Committeespent on the proposal.Company I: Management took control and presented arecommendation to the audit committee. The changehappened quickly.© 2006 <strong>Corporate</strong> <strong>Executive</strong> <strong>Board</strong>. All Rights Reserved.<strong>CTLR</strong>15EJKH1

CONTROLLERS’ LEADERSHIP ROUNDTABLE PAGE 3TENDERING EXTERNAL AUDITORSwww.ctlr.executiveboard.comCOST SAVINGSThe costs associated with changing external auditors at responding companies were not significant.The four respondents, who chose to change their external auditors, did not have significant cost savings(Companies D, H, I and K). Most responding companies stated that costs savings do not correlate with the level ofservice.Companies report that there other factors that impact costs, such as:• Implementing Sarbanes-Oxley has increased the costs of external audit in the past few years• The internal costs associated with educating new external auditors on culture, process and businesspracticesCompanies F and G did see cost savings as a result of switching external auditors, although they believe that thecosts will go up after 2-3 years.PROFESSIONAL SERVICES NOTEThe Controllers’ Leadership Roundtable has worked to ensure the accuracy of the information it provides to its members.This project relies upon data obtained from many sources, however, and the Controllers’ Leadership Roundtable cannotguarantee the accuracy of the information or its analysis in all cases. Furthermore, the Controllers’ LeadershipRoundtable is not engaged in rendering legal, accounting, or other professional services. Its projects should not beconstrued as professional advice on any particular set of facts or circumstances. Members requiring such services areadvised to consult an appropriate professional. Neither <strong>Corporate</strong> <strong>Executive</strong> <strong>Board</strong> nor its programs are responsible forany claims or losses that may arise from any errors or omissions in their reports, whether caused by <strong>Corporate</strong> <strong>Executive</strong><strong>Board</strong> or its sources.© 2006 <strong>Corporate</strong> <strong>Executive</strong> <strong>Board</strong>. All Rights Reserved.<strong>CTLR</strong>15EJKH1