Translation Exposure and Firm Value, Evidence From Australian ...

Translation Exposure and Firm Value, Evidence From Australian ...

Translation Exposure and Firm Value, Evidence From Australian ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

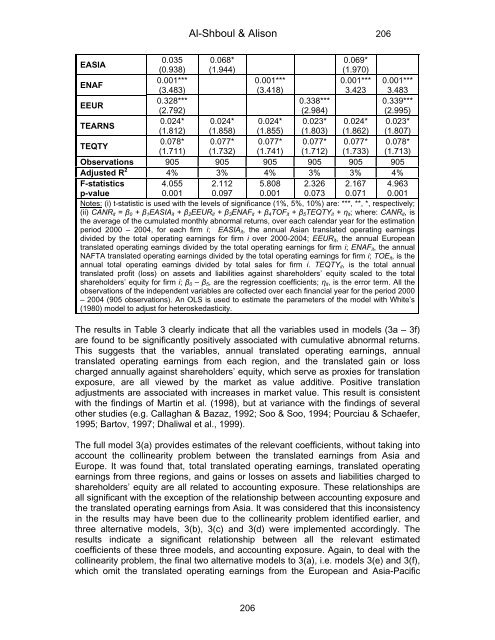

Al-Shboul & Alison 206EASIA0.035 0.068*0.069*(0.938) (1.944)(1.970)ENAF0.001***0.001***0.001*** 0.001***(3.483)(3.418)3.423 3.483EEUR0.328***0.338***0.339***(2.792)(2.984)(2.995)TEARNS0.024* 0.024* 0.024* 0.023* 0.024* 0.023*(1.812) (1.858) (1.855) (1.803) (1.862) (1.807)TEQTY0.078* 0.077* 0.077* 0.077* 0.077* 0.078*(1.711) (1.732) (1.741) (1.712) (1.733) (1.713)Observations 905 905 905 905 905 905Adjusted R 2 4% 3% 4% 3% 3% 4%F-statisticsp-value4.0550.0012.1120.0975.8080.0012.3260.0732.1670.0714.9630.001Notes: (i) t-statistic is used with the levels of significance (1%, 5%, 10%) are: ***, **, *, respectively;(ii) CANR it = β 0 + β 1 EASIA it + β 2 EEUR it + β 3 ENAF it + β 4 TOF it + β 5 TEQTY it + η it ; where: CANR it , isthe average of the cumulated monthly abnormal returns, over each calendar year for the estimationperiod 2000 – 2004, for each firm i; EASIA it , the annual Asian translated operating earningsdivided by the total operating earnings for firm i over 2000-2004; EEUR it , the annual Europeantranslated operating earnings divided by the total operating earnings for firm i; ENAF it , the annualNAFTA translated operating earnings divided by the total operating earnings for firm i; TOE it , is theannual total operating earnings divided by total sales for firm i. TEQTY it , is the total annualtranslated profit (loss) on assets <strong>and</strong> liabilities against shareholders’ equity scaled to the totalshareholders’ equity for firm i; β 0 – β 5 , are the regression coefficients; η it , is the error term. All theobservations of the independent variables are collected over each financial year for the period 2000– 2004 (905 observations). An OLS is used to estimate the parameters of the model with White’s(1980) model to adjust for heteroskedasticity.The results in Table 3 clearly indicate that all the variables used in models (3a – 3f)are found to be significantly positively associated with cumulative abnormal returns.This suggests that the variables, annual translated operating earnings, annualtranslated operating earnings from each region, <strong>and</strong> the translated gain or losscharged annually against shareholders’ equity, which serve as proxies for translationexposure, are all viewed by the market as value additive. Positive translationadjustments are associated with increases in market value. This result is consistentwith the findings of Martin et al. (1998), but at variance with the findings of severalother studies (e.g. Callaghan & Bazaz, 1992; Soo & Soo, 1994; Pourciau & Schaefer,1995; Bartov, 1997; Dhaliwal et al., 1999).The full model 3(a) provides estimates of the relevant coefficients, without taking intoaccount the collinearity problem between the translated earnings from Asia <strong>and</strong>Europe. It was found that, total translated operating earnings, translated operatingearnings from three regions, <strong>and</strong> gains or losses on assets <strong>and</strong> liabilities charged toshareholders’ equity are all related to accounting exposure. These relationships areall significant with the exception of the relationship between accounting exposure <strong>and</strong>the translated operating earnings from Asia. It was considered that this inconsistencyin the results may have been due to the collinearity problem identified earlier, <strong>and</strong>three alternative models, 3(b), 3(c) <strong>and</strong> 3(d) were implemented accordingly. Theresults indicate a significant relationship between all the relevant estimatedcoefficients of these three models, <strong>and</strong> accounting exposure. Again, to deal with thecollinearity problem, the final two alternative models to 3(a), i.e. models 3(e) <strong>and</strong> 3(f),which omit the translated operating earnings from the European <strong>and</strong> Asia-Pacific206