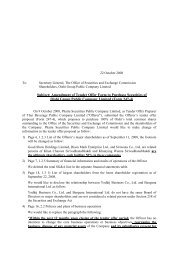

Annual Report 2006 - Thai Beverage Public Company Limited

Annual Report 2006 - Thai Beverage Public Company Limited

Annual Report 2006 - Thai Beverage Public Company Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

122reduced to nil and recognition of further losses is discontinued except to the extent that the Group has incurred legal orconstructive obligations or made payments on behalf of the associate.Business combinationsBusiness combinations involving businesses under common control have been accounted for in a manner similar to a poolingof interests, whereby the assets, liabilities and contingent liabilities transferred have been accounted for at book values. Business combinations are accounted for using the purchase method. The cost of an acquisition is measured at the fairvalue of the assets given, equity instruments issued and liabilities incurred or assumed at the date of exchange, plus costsdirectly attributable to the acquisition.(b) Foreign currenciesForeign currency transactionsTransactions in foreign currencies are translated to <strong>Thai</strong> Baht at the foreign exchange rates ruling at the date of the transactions. Monetary assets and liabilities denominated in foreign currencies at the balance sheet date are translated to <strong>Thai</strong> Baht at the foreignexchange rates ruling at that date. Foreign exchange differences arising on translation are recognised in the statement of income.Non-monetary assets and liabilities measured at cost in foreign currencies are translated to <strong>Thai</strong> Baht using the foreignexchange rates ruling at the dates of the transactions.Foreign entitiesThe assets and liabilities of foreign entities are translated to <strong>Thai</strong> Baht at the average foreign exchange rates ruling at thebalance sheet date.The revenues and expenses of foreign entities are translated to <strong>Thai</strong> Baht at rates approximating the average foreignexchange rates ruling at the dates of the transactions.Foreign exchange differences arising on translation are recognised in a separate component of equity until disposal of the investments.(c) Derivative financial instrumentsForward exchange contracts are treated as off-balance sheet items.(d) Cash and cash equivalentsCash and cash equivalents comprise cash balances, call deposits and highly liquid short-term investments. Bank overdraftsthat are repayable on demand are a component of financing activities for the purpose of the statement of cash flows.(e) Trade and other accounts receivableTrade and other accounts receivables (including balances with related parties) are stated at their invoice value less allowancefor doubtful accounts.