2011-12 - Diamines And Chemicals Limited

2011-12 - Diamines And Chemicals Limited

2011-12 - Diamines And Chemicals Limited

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

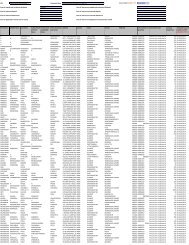

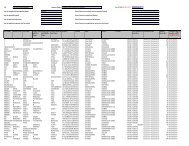

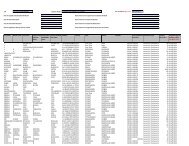

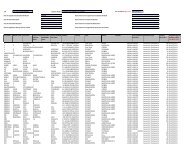

Annexure referred to in paragraph 3 of the Auditors’Report of even date to the members ofDIAMINES AND CHEMICALS LIMITED on the accounts for the year ended March 31, 20<strong>12</strong>.On the basis of such checks as we considered appropriate and in terms of information and explanationsgiven to us, we state that:i. a. The Company is generally maintaining proper records to show full particulars, including quantitativedetails and situation of fixed assets.b. No physical verification of fixed assets has been conducted by the management during the year.Hence, we are unable to comment on material discrepancy, if any, about fixed assets.c. The Company has not disposed off any substantial part of its fixed assets during the year so as toaffect its going concern.ii. a. The Inventory, except materials lying with third parties for which confirmations are obtained, hasbeen physically verified by the management during the year. In our opinion, the frequency ofverification is reasonable.b. In our opinion and according to the information and explanations given to us, the procedures ofphysical verification of inventories followed by the management are reasonable and adequate inrelation to the size of the Company and the nature of its business.c. The Company is maintaining proper records of inventory. The discrepancies noticed on verificationbetween physical inventories and book records were not material in relation to the operations ofthe Company and the same have been properly dealt with in the books of account.iii. a. As per the information furnished, the Company has not granted any loans, secured or unsecured,to companies, firms or other parties covered in the register maintained under Section 301 of theCompanies Act, 1956;As the Company has not granted any such loans, Clause (iii)(b) of the Order relating to the rate ofinterest and other terms and conditions, whether prima facie prejudicial to the interest of theCompany, Clause (iii)(c) relating to regularity of the receipt of principal amount and interest andClause (iii)(d) relating to steps for recovery of overdue amount of more than rupees one lakh, arenot applicable.b. As per the information furnished, the Company had taken an unsecured inter corporate depositfrom a company and an unsecured loan from a director covered in the register maintained underSection 301 of the Companies Act, 1956. The maximum amount involved during the year and theyear-end balance was ` 4,800,000. In our opinion, the rate of interest and other terms and conditionsof these deposits are not, prima facie, prejudicial to the interest of the Company.The Company isregular in repayment of the principal amounts as stipulated and as also in the payment of interest.iv.22In our opinion and according to the information and explanations given to us, there is an adequateinternal control system commensurate with the size of the Company and the nature of its business forpurchase of inventory and fixed assets and for the sale of goods. However, the Company is notengaged in the sale of any service. During the course of our audit, we have not observed any continuingfailure to correct major weaknesses in internal control system.v. a. According to the records of the Company examined by us and the information and explanationsgiven to us, the particulars of contracts or arrangements referred to in Section 301 of the Act havebeen entered in the Register required to be maintained under that Section; andb. In our opinion and according to the information and explanations given to us, the transactionsmade in pursuance of contracts or arrangements entered into the register in pursuance of Section301 of the Act and exceeding the value of Rupees Five Lakhs in respect of any party during theyear, have been made at prices which are reasonable, having regard to prevailing market pricesat the relevant time, wherever applicable.vi.vii.In our opinion and according to the information and explanations given to us, the Company has notaccepted any deposit from the public during the year and hence, the question of complying with theprovisions of Section 58A and 58AA or any other relevant provisions of the Act and the rules framedthereunder does not arise.In our opinion, the Company has an internal audit system commensurate with its size and nature of itsbusiness.viii. We have broadly reviewed the cost records maintained by the Company pursuant to the Companies(Cost Accounting Records) Rules, <strong>2011</strong> prescribed by the Central Government under section 209(1)(d)of the Companies Act, 1956 and are of the opinion that prima facie the prescribed cost records havebeen maintained. We have, however, not made a detailed examination of the cost records with a viewto determine whether they are accurate or complete.