Guidelines on key concepts of the AIFMD - Esma - Europa

Guidelines on key concepts of the AIFMD - Esma - Europa

Guidelines on key concepts of the AIFMD - Esma - Europa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

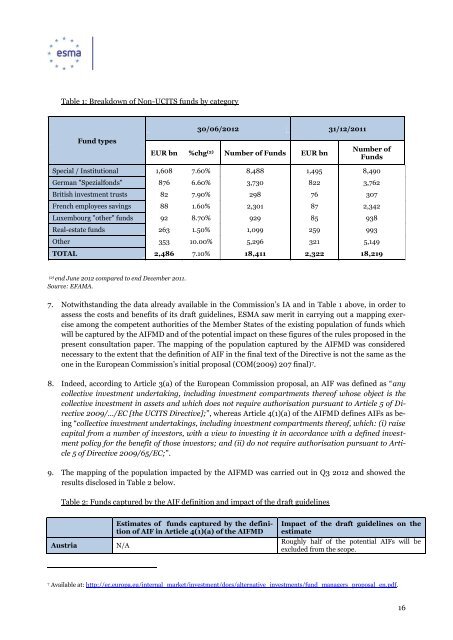

Table 1: Breakdown <strong>of</strong> N<strong>on</strong>-UCITS funds by categoryFund types30/06/2012 31/12/2011EUR bn %chg (2) Number <strong>of</strong> Funds EUR bnNumber <strong>of</strong>FundsSpecial / Instituti<strong>on</strong>al 1,608 7.60% 8,488 1,495 8,490German "Spezialf<strong>on</strong>ds" 876 6.60% 3,730 822 3,762British investment trusts 82 7.90% 298 76 307French employees savings 88 1.60% 2,301 87 2,342Luxembourg "o<strong>the</strong>r" funds 92 8.70% 929 85 938Real-estate funds 263 1.50% 1,099 259 993O<strong>the</strong>r 353 10.00% 5,296 321 5,149TOTAL 2,486 7.10% 18,411 2,322 18,219(2)end June 2012 compared to end December 2011.Source: EFAMA.7. Notwithstanding <strong>the</strong> data already available in <strong>the</strong> Commissi<strong>on</strong>’s IA and in Table 1 above, in order toassess <strong>the</strong> costs and benefits <strong>of</strong> its draft guidelines, ESMA saw merit in carrying out a mapping exerciseam<strong>on</strong>g <strong>the</strong> competent authorities <strong>of</strong> <strong>the</strong> Member States <strong>of</strong> <strong>the</strong> existing populati<strong>on</strong> <strong>of</strong> funds whichwill be captured by <strong>the</strong> <strong>AIFMD</strong> and <strong>of</strong> <strong>the</strong> potential impact <strong>on</strong> <strong>the</strong>se figures <strong>of</strong> <strong>the</strong> rules proposed in <strong>the</strong>present c<strong>on</strong>sultati<strong>on</strong> paper. The mapping <strong>of</strong> <strong>the</strong> populati<strong>on</strong> captured by <strong>the</strong> <strong>AIFMD</strong> was c<strong>on</strong>siderednecessary to <strong>the</strong> extent that <strong>the</strong> definiti<strong>on</strong> <strong>of</strong> AIF in <strong>the</strong> final text <strong>of</strong> <strong>the</strong> Directive is not <strong>the</strong> same as <strong>the</strong><strong>on</strong>e in <strong>the</strong> European Commissi<strong>on</strong>’s initial proposal (COM(2009) 207 final) 7 .8. Indeed, according to Article 3(a) <strong>of</strong> <strong>the</strong> European Commissi<strong>on</strong> proposal, an AIF was defined as “anycollective investment undertaking, including investment compartments <strong>the</strong>re<strong>of</strong> whose object is <strong>the</strong>collective investment in assets and which does not require authorisati<strong>on</strong> pursuant to Article 5 <strong>of</strong> Directive2009/…/EC [<strong>the</strong> UCITS Directive];”, whereas Article 4(1)(a) <strong>of</strong> <strong>the</strong> <strong>AIFMD</strong> defines AIFs as being“collective investment undertakings, including investment compartments <strong>the</strong>re<strong>of</strong>, which: (i) raisecapital from a number <strong>of</strong> investors, with a view to investing it in accordance with a defined investmentpolicy for <strong>the</strong> benefit <strong>of</strong> those investors; and (ii) do not require authorisati<strong>on</strong> pursuant to Article5 <strong>of</strong> Directive 2009/65/EC;”.9. The mapping <strong>of</strong> <strong>the</strong> populati<strong>on</strong> impacted by <strong>the</strong> <strong>AIFMD</strong> was carried out in Q3 2012 and showed <strong>the</strong>results disclosed in Table 2 below.Table 2: Funds captured by <strong>the</strong> AIF definiti<strong>on</strong> and impact <strong>of</strong> <strong>the</strong> draft guidelinesAustriaEstimates <strong>of</strong> funds captured by <strong>the</strong> definiti<strong>on</strong><strong>of</strong> AIF in Article 4(1)(a) <strong>of</strong> <strong>the</strong> <strong>AIFMD</strong>N/AImpact <strong>of</strong> <strong>the</strong> draft guidelines <strong>on</strong> <strong>the</strong>estimateRoughly half <strong>of</strong> <strong>the</strong> potential AIFs will beexcluded from <strong>the</strong> scope.7Available at: http://ec.europa.eu/internal_market/investment/docs/alternative_investments/fund_managers_proposal_en.pdf.16