South Africa has led the region in terms of existing-asset securitizations, seeing numerouson-shore and offshore existing-asset transactions backed by various asset types (see"Appendix II" for a full list of transactions closed since January 2001). <strong>The</strong>re is arelatively established local market for securitizations in South Africa and transactions areusually rated using a national rating scale. This allows the whole spectrum of ratings to beused, not just those below the country rating, in order for investors to compare the creditquality of different South African-based transactions. While we do not currently have anational rating scale for South Africa, we do have national rating scales in the Ukraine,Kazakhstan, and Russia.Several existing-asset transactions have taken place in Central Europe and Russia. <strong>The</strong>seinclude a cross-border existing-asset credit card transaction in the Czech Republic (HCFFunding No. 1 B.V., September 2003), along with an RMBS issuance out of Latvia(Baltic-American Mortgage Trust LLC 2004-1, December 2004), a CMBS transaction outof Poland (Polish Retail Properties Finance PLC, November 2003), and an auto loanreceivables transaction in Russia (Russian Auto Loans Finance B.V., July 2005).Financial guarantees and political risk insurance provide credit protectionAn additional tool used by a growing number of emerging-market issuers in cross-bordertransactions to further improve ratings and lower borrowing costs is financial guarantees,such as "wraps". Numerous securitizations, primarily future flow DPRs, coming out ofTurkey and two from Egypt, have been backed by a financial guaranty, i.e., wrapped.This enables the notes in the enhanced transaction to gain a 'AAA' credit rating.Political risk insurance provides less comprehensive protection by covering clearlydefined sovereign risks, including expropriation, currency inconvertibility and nontransferability,and war risk insurance. Political risk insurance is predominantly used inexisting-asset structures. A transaction cannot be rated higher than the local currencyrating on the insurance company providing the political risk insurance. A future flowtransaction should not require political risk insurance for transferability and convertibilitysince the structure is designed to mitigate these risks.<strong>In</strong> our rating analysis, we look at the adequacy of the coverage provided by the insurance,the process for obtaining claims payments, as well as the ability and willingness of theinsurer to pay claims. <strong>In</strong> some circumstances a financial enhancement rating (FER) isrequired, which provides an explicit assessment of an insurance company's willingnessand capacity to meet its credit-enhancement insurance obligations and includes a reviewof the policies regarding the processing of claims drawn against credit enhancementinsurance policies. Political risk insurance should not be viewed as a guarantee, as theclaims procedure for political risk insurance carries a heavier administrative burden than aguarantee. Political risk insurance can certainly reduce the risk in a transaction, but eachpolicy must be evaluated on a case-by-case basis.Standard & Poor’s Page 6 of 20

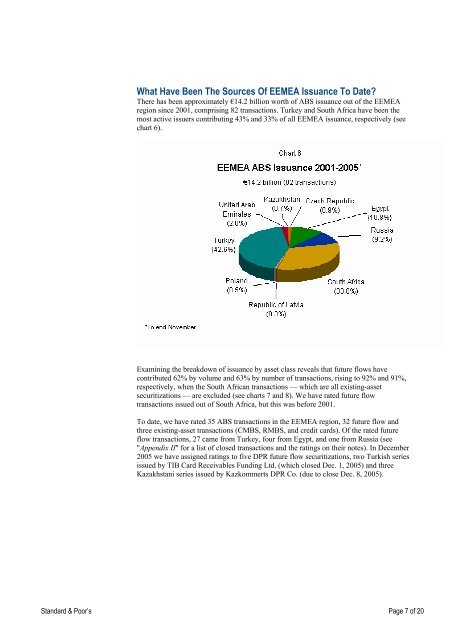

What Have Been <strong>The</strong> Sources Of <strong>EEMEA</strong> Issuance To Date?<strong>The</strong>re has been approximately €14.2 billion worth of ABS issuance out of the <strong>EEMEA</strong>region since 2001, comprising 82 transactions. Turkey and South Africa have been themost active issuers contributing 43% and 33% of all <strong>EEMEA</strong> issuance, respectively (seechart 6).Examining the breakdown of issuance by asset class reveals that future flows havecontributed 62% by volume and 63% by number of transactions, rising to 92% and 91%,respectively, when the South African transactions — which are all existing-assetsecuritizations — are excluded (see charts 7 and 8). We have rated future flowtransactions issued out of South Africa, but this was before 2001.To date, we have rated 35 ABS transactions in the <strong>EEMEA</strong> region, 32 future flow andthree existing-asset transactions (CMBS, RMBS, and credit cards). Of the rated futureflow transactions, 27 came from Turkey, four from Egypt, and one from Russia (see"Appendix II" for a list of closed transactions and the ratings on their notes). <strong>In</strong> December2005 we have assigned ratings to five DPR future flow securitizations, two Turkish seriesissued by TIB Card Receivables Funding Ltd. (which closed Dec. 1, 2005) and threeKazakhstani series issued by Kazkommerts DPR Co. (due to close Dec. 8, 2005).Standard & Poor’s Page 7 of 20