Reactions to the EDHEC Study - Faculty and Research

Reactions to the EDHEC Study - Faculty and Research

Reactions to the EDHEC Study - Faculty and Research

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

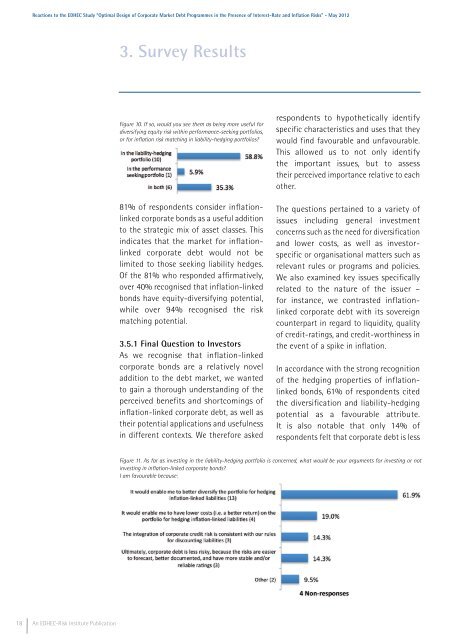

<strong>Reactions</strong> <strong>to</strong> <strong>the</strong> <strong>EDHEC</strong> <strong>Study</strong> “Optimal Design of Corporate Market Debt Programmes in <strong>the</strong> Presence of Interest-Rate <strong>and</strong> Inflation Risks” - May 20123. Survey ResultsFigure 10. If so, would you see <strong>the</strong>m as being more useful fordiversifying equity risk within performance-seeking portfolios,or for inflation risk matching in liability-hedging portfolios?81% of respondents consider inflationlinkedcorporate bonds as a useful addition<strong>to</strong> <strong>the</strong> strategic mix of asset classes. Thisindicates that <strong>the</strong> market for inflationlinkedcorporate debt would not belimited <strong>to</strong> those seeking liability hedges.Of <strong>the</strong> 81% who responded affirmatively,over 40% recognised that inflation-linkedbonds have equity-diversifying potential,while over 94% recognised <strong>the</strong> riskmatching potential.3.5.1 Final Question <strong>to</strong> Inves<strong>to</strong>rsAs we recognise that inflation-linkedcorporate bonds are a relatively noveladdition <strong>to</strong> <strong>the</strong> debt market, we wanted<strong>to</strong> gain a thorough underst<strong>and</strong>ing of <strong>the</strong>perceived benefits <strong>and</strong> shortcomings ofinflation-linked corporate debt, as well as<strong>the</strong>ir potential applications <strong>and</strong> usefulnessin different contexts. We <strong>the</strong>refore askedrespondents <strong>to</strong> hypo<strong>the</strong>tically identifyspecific characteristics <strong>and</strong> uses that <strong>the</strong>ywould find favourable <strong>and</strong> unfavourable.This allowed us <strong>to</strong> not only identify<strong>the</strong> important issues, but <strong>to</strong> assess<strong>the</strong>ir perceived importance relative <strong>to</strong> eacho<strong>the</strong>r.The questions pertained <strong>to</strong> a variety ofissues including general investmentconcerns such as <strong>the</strong> need for diversification<strong>and</strong> lower costs, as well as inves<strong>to</strong>rspecificor organisational matters such asrelevant rules or programs <strong>and</strong> policies.We also examined key issues specificallyrelated <strong>to</strong> <strong>the</strong> nature of <strong>the</strong> issuer –for instance, we contrasted inflationlinkedcorporate debt with its sovereigncounterpart in regard <strong>to</strong> liquidity, qualityof credit-ratings, <strong>and</strong> credit-worthiness in<strong>the</strong> event of a spike in inflation.In accordance with <strong>the</strong> strong recognitionof <strong>the</strong> hedging properties of inflationlinkedbonds, 61% of respondents cited<strong>the</strong> diversification <strong>and</strong> liability-hedgingpotential as a favourable attribute.It is also notable that only 14% ofrespondents felt that corporate debt is lessFigure 11. As far as investing in <strong>the</strong> liability-hedging portfolio is concerned, what would be your arguments for investing or notinvesting in inflation-linked corporate bonds?I am favourable because:18 An <strong>EDHEC</strong>-Risk Institute Publication