Reactions to the EDHEC Study - Faculty and Research

Reactions to the EDHEC Study - Faculty and Research

Reactions to the EDHEC Study - Faculty and Research

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

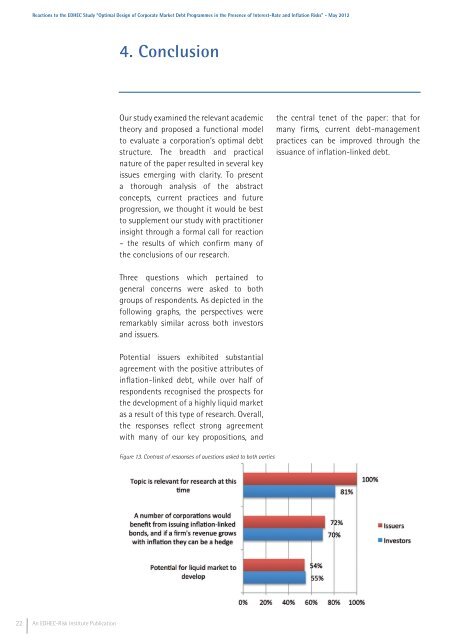

<strong>Reactions</strong> <strong>to</strong> <strong>the</strong> <strong>EDHEC</strong> <strong>Study</strong> “Optimal Design of Corporate Market Debt Programmes in <strong>the</strong> Presence of Interest-Rate <strong>and</strong> Inflation Risks” - May 20124. ConclusionOur study examined <strong>the</strong> relevant academic<strong>the</strong>ory <strong>and</strong> proposed a functional model<strong>to</strong> evaluate a corporation’s optimal debtstructure. The breadth <strong>and</strong> practicalnature of <strong>the</strong> paper resulted in several keyissues emerging with clarity. To presenta thorough analysis of <strong>the</strong> abstractconcepts, current practices <strong>and</strong> futureprogression, we thought it would be best<strong>to</strong> supplement our study with practitionerinsight through a formal call for reaction– <strong>the</strong> results of which confirm many of<strong>the</strong> conclusions of our research.<strong>the</strong> central tenet of <strong>the</strong> paper: that formany firms, current debt-managementpractices can be improved through <strong>the</strong>issuance of inflation-linked debt.Three questions which pertained <strong>to</strong>general concerns were asked <strong>to</strong> bothgroups of respondents. As depicted in <strong>the</strong>following graphs, <strong>the</strong> perspectives wereremarkably similar across both inves<strong>to</strong>rs<strong>and</strong> issuers.Potential issuers exhibited substantialagreement with <strong>the</strong> positive attributes ofinflation-linked debt, while over half ofrespondents recognised <strong>the</strong> prospects for<strong>the</strong> development of a highly liquid marketas a result of this type of research. Overall,<strong>the</strong> responses reflect strong agreementwith many of our key propositions, <strong>and</strong>Figure 13. Contrast of responses of questions asked <strong>to</strong> both parties22 An <strong>EDHEC</strong>-Risk Institute Publication