under Delhi Value Added Tax Act, 2004 - TaxGuru

under Delhi Value Added Tax Act, 2004 - TaxGuru

under Delhi Value Added Tax Act, 2004 - TaxGuru

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

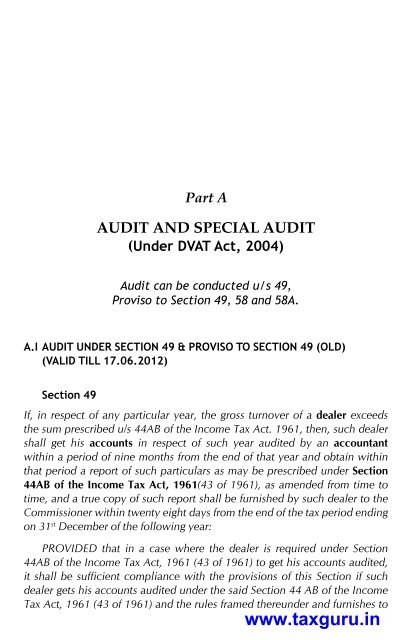

Part AaUDIT aND SPECIaL aUDIT(Under DVAT <strong>Act</strong>, <strong>2004</strong>)Audit can be conducted u/s 49,Proviso to Section 49, 58 and 58A.A.I AUDIT UNDER SEcTIoN 49 & PRoVISo To SEcTIoN 49 (oLD)(VALID TILL 17.06.2012)Section 49If, in respect of any particular year, the gross turnover of a dealer exceedsthe sum prescribed u/s 44AB of the Income <strong>Tax</strong> <strong>Act</strong>. 1961, then, such dealershall get his accounts in respect of such year audited by an accountantwithin a period of nine months from the end of that year and obtain withinthat period a report of such particulars as may be prescribed <strong>under</strong> Section44AB of the Income <strong>Tax</strong> <strong>Act</strong>, 1961(43 of 1961), as amended from time totime, and a true copy of such report shall be furnished by such dealer to theCommissioner within twenty eight days from the end of the tax period endingon 31 st December of the following year:PROVIDED that in a case where the dealer is required <strong>under</strong> Section44AB of the Income <strong>Tax</strong> <strong>Act</strong>, 1961 (43 of 1961) to get his accounts audited,it shall be sufficient compliance with the provisions of this Section if suchdealer gets his accounts audited <strong>under</strong> the said Section 44 AB of the Income<strong>Tax</strong> <strong>Act</strong>, 1961 (43 of 1961) and the rules framed there<strong>under</strong> and furnishes towww.taxguru.in