under Delhi Value Added Tax Act, 2004 - TaxGuru

under Delhi Value Added Tax Act, 2004 - TaxGuru

under Delhi Value Added Tax Act, 2004 - TaxGuru

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

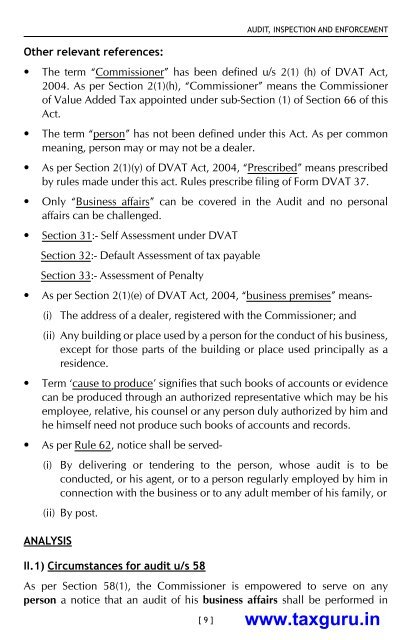

other relevant references:[ 9 ]AUDiT, iNSPecTioN AND eNfoRceMeNT• The term “Commissioner” has been defined u/s 2(1) (h) of DVAT <strong>Act</strong>,<strong>2004</strong>. As per Section 2(1)(h), “Commissioner” means the Commissionerof <strong>Value</strong> <strong>Added</strong> <strong>Tax</strong> appointed <strong>under</strong> sub-Section (1) of Section 66 of this<strong>Act</strong>.• The term “person” has not been defined <strong>under</strong> this <strong>Act</strong>. As per commonmeaning, person may or may not be a dealer.• As per Section 2(1)(y) of DVAT <strong>Act</strong>, <strong>2004</strong>, “Prescribed” means prescribedby rules made <strong>under</strong> this act. Rules prescribe filing of Form DVAT 37.• Only “Business affairs” can be covered in the Audit and no personalaffairs can be challenged.• Section 31:- Self Assessment <strong>under</strong> DVATSection 32:- Default Assessment of tax payableSection 33:- Assessment of Penalty• As per Section 2(1)(e) of DVAT <strong>Act</strong>, <strong>2004</strong>, “business premises” means-(i) The address of a dealer, registered with the Commissioner; and(ii) Any building or place used by a person for the conduct of his business,except for those parts of the building or place used principally as aresidence.• Term ‘cause to produce’ signifies that such books of accounts or evidencecan be produced through an authorized representative which may be hisemployee, relative, his counsel or any person duly authorized by him andhe himself need not produce such books of accounts and records.• As per Rule 62, notice shall be served-(i) By delivering or tendering to the person, whose audit is to beconducted, or his agent, or to a person regularly employed by him inconnection with the business or to any adult member of his family, or(ii) By post.ANALySISII.1) circumstances for audit u/s 58As per Section 58(1), the Commissioner is empowered to serve on anyperson a notice that an audit of his business affairs shall be performed inwww.taxguru.in