under Delhi Value Added Tax Act, 2004 - TaxGuru

under Delhi Value Added Tax Act, 2004 - TaxGuru

under Delhi Value Added Tax Act, 2004 - TaxGuru

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

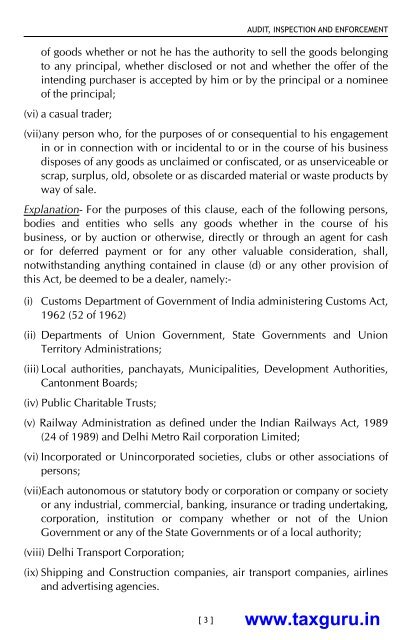

AUDiT, iNSPecTioN AND eNfoRceMeNTof goods whether or not he has the authority to sell the goods belongingto any principal, whether disclosed or not and whether the offer of theintending purchaser is accepted by him or by the principal or a nomineeof the principal;(vi) a casual trader;(vii) any person who, for the purposes of or consequential to his engagementin or in connection with or incidental to or in the course of his businessdisposes of any goods as unclaimed or confiscated, or as unserviceable orscrap, surplus, old, obsolete or as discarded material or waste products byway of sale.Explanation- For the purposes of this clause, each of the following persons,bodies and entities who sells any goods whether in the course of hisbusiness, or by auction or otherwise, directly or through an agent for cashor for deferred payment or for any other valuable consideration, shall,notwithstanding anything contained in clause (d) or any other provision ofthis <strong>Act</strong>, be deemed to be a dealer, namely:-(i) Customs Department of Government of India administering Customs <strong>Act</strong>,1962 (52 of 1962)(ii) Departments of Union Government, State Governments and UnionTerritory Administrations;(iii) Local authorities, panchayats, Municipalities, Development Authorities,Cantonment Boards;(iv) Public Charitable Trusts;(v) Railway Administration as defined <strong>under</strong> the Indian Railways <strong>Act</strong>, 1989(24 of 1989) and <strong>Delhi</strong> Metro Rail corporation Limited;(vi) Incorporated or Unincorporated societies, clubs or other associations ofpersons;(vii)Each autonomous or statutory body or corporation or company or societyor any industrial, commercial, banking, insurance or trading <strong>under</strong>taking,corporation, institution or company whether or not of the UnionGovernment or any of the State Governments or of a local authority;(viii) <strong>Delhi</strong> Transport Corporation;(ix) Shipping and Construction companies, air transport companies, airlinesand advertising agencies.[ 3 ]www.taxguru.in