P.O. S.B. Manual Vol. III - India Post

P.O. S.B. Manual Vol. III - India Post

P.O. S.B. Manual Vol. III - India Post

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

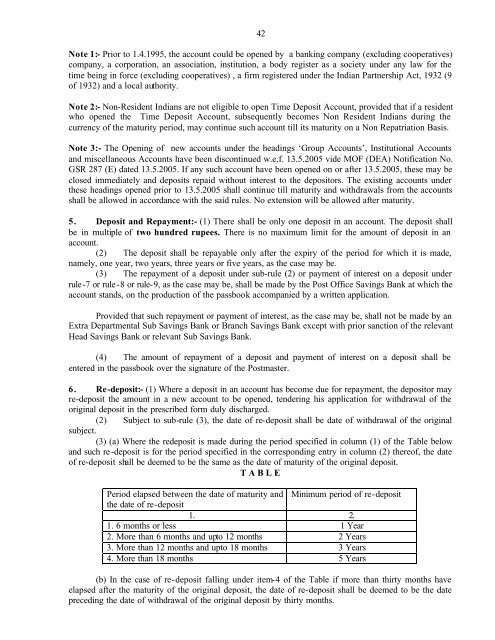

42Note 1:- Prior to 1.4.1995, the account could be opened by a banking company (excluding cooperatives)company, a corporation, an association, institution, a body register as a society under any law for thetime being in force (excluding cooperatives) , a firm registered under the <strong>India</strong>n Partnership Act, 1932 (9of 1932) and a local authority.Note 2:- Non-Resident <strong>India</strong>ns are not eligible to open Time Deposit Account, provided that if a residentwho opened the Time Deposit Account, subsequently becomes Non Resident <strong>India</strong>ns during thecurrency of the maturity period, may continue such account till its maturity on a Non Repatriation Basis.Note 3:- The Opening of new accounts under the headings ‘Group Accounts’, Institutional Accountsand miscellaneous Accounts have been discontinued w.e.f. 13.5.2005 vide MOF (DEA) Notification No.GSR 287 (E) dated 13.5.2005. If any such account have been opened on or after 13.5.2005, these may beclosed immediately and deposits repaid without interest to the depositors. The existing accounts underthese headings opened prior to 13.5.2005 shall continue till maturity and withdrawals from the accountsshall be allowed in accordance with the said rules. No extension will be allowed after maturity.5. Deposit and Repayment:- (1) There shall be only one deposit in an account. The deposit shallbe in multiple of two hundred rupees. There is no maximum limit for the amount of deposit in anaccount.(2) The deposit shall be repayable only after the expiry of the period for which it is made,namely, one year, two years, three years or five years, as the case may be.(3) The repayment of a deposit under sub-rule (2) or payment of interest on a deposit underrule-7 or rule-8 or rule-9, as the case may be, shall be made by the <strong>Post</strong> Office Savings Bank at which theaccount stands, on the production of the passbook accompanied by a written application.Provided that such repayment or payment of interest, as the case may be, shall not be made by anExtra Departmental Sub Savings Bank or Branch Savings Bank except with prior sanction of the relevantHead Savings Bank or relevant Sub Savings Bank.(4) The amount of repayment of a deposit and payment of interest on a deposit shall beentered in the passbook over the signature of the <strong>Post</strong>master.6. Re-deposit:- (1) Where a deposit in an account has become due for repayment, the depositor mayre-deposit the amount in a new account to be opened, tendering his application for withdrawal of theoriginal deposit in the prescribed form duly discharged.(2) Subject to sub-rule (3), the date of re-deposit shall be date of withdrawal of the originalsubject.(3) (a) Where the redeposit is made during the period specified in column (1) of the Table belowand such re-deposit is for the period specified in the corresponding entry in column (2) thereof, the dateof re-deposit shall be deemed to be the same as the date of maturity of the original deposit.T A B L EPeriod elapsed between the date of maturity and Minimum period of re-depositthe date of re-deposit1. 2.1. 6 months or less 1 Year2. More than 6 months and upto 12 months 2 Years3. More than 12 months and upto 18 months 3 Years4. More than 18 months 5 Years(b) In the case of re-deposit falling under item-4 of the Table if more than thirty months haveelapsed after the maturity of the original deposit, the date of re-deposit shall be deemed to be the datepreceding the date of withdrawal of the original deposit by thirty months.