Presentation - World Services Group

Presentation - World Services Group

Presentation - World Services Group

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

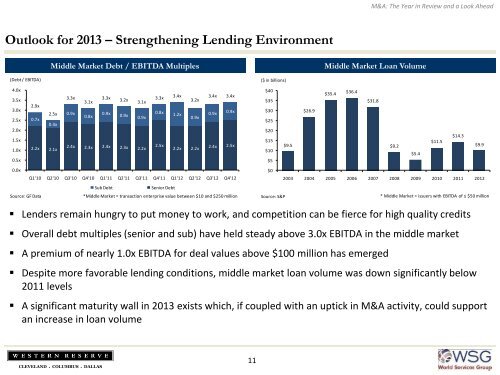

M&A: The Year in Review and a Look AheadOutlook for 2013 – Strengthening Lending EnvironmentMiddle Market Debt / EBITDA MultiplesMiddle Market Loan Volume(Debt / EBITDA)4.0x3.3x3.3x3.1x3.2x3.3x3.4x3.4x 3.4x3.5x3.1x3.2x2.9x3.0x0.9x0.9x0.8x0.8x0.9x1.2x0.9x0.9x2.5x0.7x0.9x0.9x2.5x0.4x2.0x1.5x1.0x 2.2x 2.1x2.4x 2.3x 2.4x 2.3x 2.2x2.5x2.2x 2.2x2.4x 2.5x0.5x0.0xQ1'10 Q2'10 Q3'10 Q4'10 Q1'11 Q2'11 Q3'11 Q4'11 Q1'12 Q2'12 Q3'12 Q4'12Sub DebtSenior DebtSource: GF Data*Middle Market = transaction enterprise value between $10 and $250 million($ in billions)$40$35.4$36.4$35$31.8$30$26.9$25$20$14.3$15$9.5$9.2$11.5$9.9$10$5.4$5$02003 2004 2005 2006 2007 2008 2009 2010 2011 2012Source: S&P* Middle Market = issuers with EBITDA of ≤ $50 million• Lenders remain hungry to put money to work, and competition can be fierce for high quality credits• Overall debt multiples (senior and sub) have held steady above 3.0x EBITDA in the middle market• A premium of nearly 1.0x EBITDA for deal values above $100 million has emerged• Despite more favorable lending conditions, middle market loan volume was down significantly below2011 levels• A significant maturity wall in 2013 exists which, if coupled with an uptick in M&A activity, could supportan increase in loan volumeCLEVELAND ● COLUMBUS ● DALLAS11