The determinants of the number of banks: Empirical results ... - LEAD

The determinants of the number of banks: Empirical results ... - LEAD

The determinants of the number of banks: Empirical results ... - LEAD

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

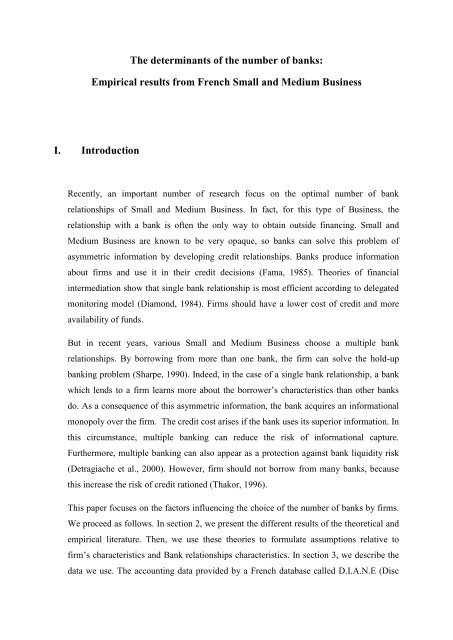

<strong>The</strong> <strong>determinants</strong> <strong>of</strong> <strong>the</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong>:<strong>Empirical</strong> <strong>results</strong> from French Small and Medium BusinessI. IntroductionRecently, an important <strong>number</strong> <strong>of</strong> research focus on <strong>the</strong> optimal <strong>number</strong> <strong>of</strong> bankrelationships <strong>of</strong> Small and Medium Business. In fact, for this type <strong>of</strong> Business, <strong>the</strong>relationship with a bank is <strong>of</strong>ten <strong>the</strong> only way to obtain outside financing. Small andMedium Business are known to be very opaque, so <strong>banks</strong> can solve this problem <strong>of</strong>asymmetric information by developing credit relationships. Banks produce informationabout firms and use it in <strong>the</strong>ir credit decisions (Fama, 1985). <strong>The</strong>ories <strong>of</strong> financialintermediation show that single bank relationship is most efficient according to delegatedmonitoring model (Diamond, 1984). Firms should have a lower cost <strong>of</strong> credit and moreavailability <strong>of</strong> funds.But in recent years, various Small and Medium Business choose a multiple bankrelationships. By borrowing from more than one bank, <strong>the</strong> firm can solve <strong>the</strong> hold-upbanking problem (Sharpe, 1990). Indeed, in <strong>the</strong> case <strong>of</strong> a single bank relationship, a bankwhich lends to a firm learns more about <strong>the</strong> borrower‟s characteristics than o<strong>the</strong>r <strong>banks</strong>do. As a consequence <strong>of</strong> this asymmetric information, <strong>the</strong> bank acquires an informationalmonopoly over <strong>the</strong> firm. <strong>The</strong> credit cost arises if <strong>the</strong> bank uses its superior information. Inthis circumstance, multiple banking can reduce <strong>the</strong> risk <strong>of</strong> informational capture.Fur<strong>the</strong>rmore, multiple banking can also appear as a protection against bank liquidity risk(Detragiache et al., 2000). However, firm should not borrow from many <strong>banks</strong>, becausethis increase <strong>the</strong> risk <strong>of</strong> credit rationed (Thakor, 1996).This paper focuses on <strong>the</strong> factors influencing <strong>the</strong> choice <strong>of</strong> <strong>the</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong> by firms.We proceed as follows. In section 2, we present <strong>the</strong> different <strong>results</strong> <strong>of</strong> <strong>the</strong> <strong>the</strong>oretical andempirical literature. <strong>The</strong>n, we use <strong>the</strong>se <strong>the</strong>ories to formulate assumptions relative t<strong>of</strong>irm‟s characteristics and Bank relationships characteristics. In section 3, we describe <strong>the</strong>data we use. <strong>The</strong> accounting data provided by a French database called D.I.A.N.E (Disc

for Economic Analysis) edited by Bureau Van Dijk. We also sent a questionnaire byelectronic mail to several Small and Medium Business stemming from <strong>the</strong> same Frenchdatabase, to collect a qualitative data. Next, we present an econometric analysis. Section 4presents econometric <strong>results</strong>. Finally, in section 5 we summarize and conclude.II.Review <strong>of</strong> literatureAccording to <strong>the</strong> financial intermediation <strong>the</strong>ory, we distinguished between two types <strong>of</strong>bank financing: single bank relationship and multiple bank lending. Single banking hasgenerally been considered as beneficial for Small and Medium Business because itfacilitates efficient usages <strong>of</strong> loans; it‟s based on cost minimization. This kind <strong>of</strong> firms,are known to be very opaque, may find it difficult to credibly signal <strong>the</strong>ir quality in orderto access <strong>the</strong> capital markets. A bank can solve this problem <strong>of</strong> information asymmetry bycreating information. In that sense, a bank acquires through time private information about<strong>the</strong> firm, leading to an informational advantage (Fama, 1985). Much <strong>of</strong> this information isobtained in <strong>the</strong> subsequent monitoring role that is <strong>of</strong>ten seen as a defining characteristic <strong>of</strong>bank financing (Diamond, 1984). It thus appears that a single bank relationship reduceinformation asymmetry and credit rationing. <strong>The</strong>se elements enable to formulate <strong>the</strong> firsthypo<strong>the</strong>ses to test: <strong>the</strong> most informational opaque firms should be characterized by areduced <strong>number</strong> <strong>of</strong> <strong>banks</strong>.However, this private information about firms, allows <strong>banks</strong> to accrue monopoly power.Information asymmetries about <strong>the</strong> firm‟s quality credit prevent o<strong>the</strong>r <strong>banks</strong> fromidentifying <strong>the</strong> real type <strong>of</strong> each borrower (Sharpe, 1990). Indeed, firm with single bankrelationship may be informationally captured by its bank. This hold-up problem allowsbank to extract rents from <strong>the</strong> firm and makes credit costly, but it can present an advantagein terms <strong>of</strong> credit availability for firms. To limit a single bank‟s ability to extract rents,one <strong>of</strong> solution is <strong>the</strong> diversification <strong>of</strong> financing sources (Rajan, 1992). In fact,competition among <strong>banks</strong> reduces <strong>the</strong> adverse effects <strong>of</strong> <strong>the</strong> hold-up problem. <strong>The</strong>nhypo<strong>the</strong>sis n°2 is that: <strong>number</strong> <strong>of</strong> <strong>banks</strong> increases with <strong>the</strong> duration <strong>of</strong> bankingrelationship.Moreover, multiple bank lending relationships protect firm from an illiquidity risk <strong>of</strong>banking origin (Detragiache et al., 2000). <strong>The</strong> SMB and those have a single bankingrelationship are strongly exposed to adverse selection. So, if <strong>the</strong> informed bank cannotrenew <strong>the</strong> initial loan, <strong>the</strong> firm in liquidity need has to apply for loans from non-informed

anks. <strong>The</strong>se <strong>banks</strong> probably may refuse to extend credit because <strong>of</strong> adverse selection.Thus, firm has to liquidate prematurely a pr<strong>of</strong>itable project. To save <strong>the</strong> risk <strong>of</strong>illiquidity, firm borrow from more than one bank. Firm rationed by its main bank ischaracterized by a high <strong>number</strong> <strong>of</strong> <strong>banks</strong> to fill <strong>the</strong> needed financing, that‟sour hypo<strong>the</strong>sis n°3.Fur<strong>the</strong>rmore, firm‟s quality has an impact on <strong>the</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong>. According, to a modeldeveloped by Yosha (1995), high quality firms will choose a single banking relationshipto prevent information leaks to competitors. Whereas, low quality firms will prefermultiple banking lending to prevent from aggressive price reactions <strong>of</strong> competing firms.It follows that, <strong>the</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong> depend on <strong>the</strong> degree <strong>of</strong> revelation <strong>of</strong> firm‟sconfidential information; several <strong>banks</strong> permitted information leakage to competitors.Battacharya and Chiesa (1995) share <strong>the</strong> same opinion, <strong>the</strong> single banking lending preventinformation leakage. So, firms developing Researches & Developments activities preferventure capital financing or single banking relationship. We formulate <strong>the</strong> followinghypo<strong>the</strong>sis n°4: <strong>the</strong> most pr<strong>of</strong>itable firm reduces its <strong>number</strong> <strong>of</strong> <strong>banks</strong> to prevent anyinformation leak.Concerning <strong>the</strong> empirical literature review, <strong>the</strong> different studies present conflicting <strong>results</strong>.Early empirical studies were mainly concerned with consequences <strong>of</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong> on<strong>the</strong> cost and availability <strong>of</strong> credit. Using US data, Petersen and Rajan (1994) and Cole(1998) find that borrower from fewer <strong>banks</strong> increase <strong>the</strong> availability <strong>of</strong> credit for smallerfirms. Harh<strong>of</strong>f and Korting (1998) examine <strong>the</strong> impact <strong>of</strong> relationship strength inGermany. <strong>The</strong>y find that firms obtain more credit from mainly one bank. More recently,Brunner and Krahnen (2005) find an average <strong>number</strong> <strong>of</strong> 5,7 bank relationships perGerman firm. Similarly, Foglia and al. (1998) analyzing a sample <strong>of</strong> 1900 Italian Smalland Medium Business, find that single bank relationship increases <strong>the</strong> availability <strong>of</strong>credit, and <strong>the</strong>y do not found any significant effect <strong>of</strong> <strong>the</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong> on <strong>the</strong> interestrates. But recently, Bonfim and al. (2009) find that firms can reduce <strong>the</strong> cost <strong>of</strong> credit byincreasing <strong>the</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong>. Using listed Norwegian firms, Degryse and Ongena(2001) find that less pr<strong>of</strong>itable, younger, more leveraged and larger firms choose <strong>the</strong>multiple banking relationships. Farinha and Santos (2004) analyzing about 1577 youngPortuguese firms, find that firms with poor performance and firms with large growthoptions switch with from single banking to multiple lending relations. Indeed, a young

firm establishes a relationship with one bank and earns a good reputation to initiatemultiple relationships later.Ongena and Smith (2000) present an overview <strong>of</strong> international studies on single versusmultiple banking relationships. Using a sample <strong>of</strong> 1079 large firms from 20 Europeancountries, <strong>the</strong>y find that more than 20% use eight or more <strong>banks</strong>, while less than 15%choose single bank relationship. Firms maintain more bank relationships in countries withinefficient judicial systems and poor enforcement <strong>of</strong> creditor rights.Finally, <strong>the</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong> can also be related to bank liquidity risk. This assumption isempirically validated by Detragiache and al. (2000) and Tirry (2007). Indeed, Detragiacheand al. (2000) show that in <strong>the</strong>ir sample <strong>of</strong> 1849 small and medium sized Italian firms, <strong>the</strong><strong>number</strong> <strong>of</strong> <strong>banks</strong> increase with firm size, leverage, and age <strong>of</strong> <strong>the</strong> firm. Firms with a lowerpr<strong>of</strong>itability choose single banking relationship. Bank fragility has a positive impact on<strong>the</strong> <strong>number</strong> <strong>of</strong> bank. Similarly, using a sample <strong>of</strong> Italian, Tirry (2007) finds that firmswhich are more likely to become rationed increase <strong>the</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong>.<strong>The</strong> extant knowledge on <strong>the</strong> relationship between bank and firms is rich but suffers froma lack <strong>of</strong> established empirical <strong>results</strong>. In fact, little evidence is provided in France due to<strong>the</strong> lack <strong>of</strong> specific data. Refait (2003) finds that <strong>the</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong> increase with <strong>the</strong>risk <strong>of</strong> <strong>the</strong> firm. Ziane (2003) suggests that firm‟s size, pr<strong>of</strong>itability and <strong>the</strong> degree <strong>of</strong>information opacity reduce <strong>the</strong> <strong>number</strong> <strong>of</strong> credit relationships.From <strong>the</strong> literature review, we formulate hypo<strong>the</strong>ses based on relations between Small andMedium Business and <strong>the</strong> <strong>number</strong> <strong>of</strong> bank lending relationships. We will test <strong>the</strong>m on <strong>the</strong>French data. To sum up, <strong>the</strong> different hypo<strong>the</strong>ses are:‣ H1:Most informational opaque firms should be characterized by a reduced<strong>number</strong> <strong>of</strong> <strong>banks</strong>.‣ H2: <strong>The</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong> increases with <strong>the</strong> duration <strong>of</strong> banking relationship.‣ H3: Firms rationed by his main bank are characterized by a high <strong>number</strong> <strong>of</strong> <strong>banks</strong>to satisfy <strong>the</strong> needed financing.

‣ H4: Most pr<strong>of</strong>itable firm reduces its <strong>number</strong> <strong>of</strong> <strong>banks</strong> to prevent any informationleak.III.Data and Methodology3.1 DataOur source <strong>of</strong> data is D.I.A.N.E (Disc for Economic Analysis) edited by Bureau Van Dijk.<strong>The</strong>se data concern bank-firm relationships during 2008 in French. We exclude firmsbelonging to <strong>the</strong> sector <strong>of</strong> financial activities, agricultural for balance sheet complexity.Thus, <strong>the</strong> manpower <strong>of</strong> selected firms is lower than 500 employees. We use two types <strong>of</strong>data: a qualitative data and an accounting data. Indeed, we sent a questionnaire byelectronic mail to 4200 Small and Medium Business stemming from <strong>the</strong> French database,to collect a qualitative data. <strong>The</strong> <strong>number</strong> <strong>of</strong> answers until now is about 56 or 1, 33% <strong>of</strong> <strong>the</strong>panel; only 48 answers are exploitable for this study. <strong>The</strong> data from this survey areunique and are not available in any databases used in similar studies. We have specificdata regarding <strong>the</strong> identity <strong>of</strong> <strong>the</strong> main bank <strong>of</strong> each firm, <strong>the</strong> proportion financed by <strong>the</strong>main bank, <strong>the</strong> total <strong>number</strong> <strong>of</strong> <strong>banks</strong>, a direct measure <strong>of</strong> credit rationing, etc. We extract<strong>the</strong> accounting data from <strong>the</strong> same database to complete <strong>the</strong>se answers.3.2 VariablesWe expect to empirically examine <strong>the</strong> <strong>determinants</strong> <strong>of</strong> <strong>the</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong> for FrenchSMB. Thus, <strong>the</strong> dependant variable is <strong>number</strong> <strong>of</strong> <strong>banks</strong>. Regarding <strong>the</strong> independentvariables, <strong>the</strong>y are three types; Variables measuring firm‟s characteristic, bankrelationships characteristics and a set <strong>of</strong> X variables that may influence <strong>the</strong> choice <strong>of</strong> <strong>the</strong><strong>number</strong> <strong>of</strong> <strong>banks</strong>. We use ordinary least squares (OLS).<strong>The</strong> estimated equation is:Number <strong>of</strong> Banks = f (firm‟s characteristics, bank relationships characteristics, X)NBi= α + β1 Firm‟s characteristicsi + β2 Bank relationships characteristicsi+ β3 Xi + εi

‣ Dependent variable:NB. Number <strong>of</strong> <strong>banks</strong> in relation with <strong>the</strong> firm during 2008.‣ Independent variables:Firm’s characteristicsFirm‟s characteristics describe opacity and quality <strong>of</strong> <strong>the</strong> firm, which refer to <strong>the</strong> first, and<strong>the</strong> fourth hypo<strong>the</strong>ses <strong>of</strong> <strong>the</strong> study. We define quality as <strong>the</strong> firm's ability to meet its debts.It‟s an inverse measure <strong>of</strong> its risk <strong>of</strong> default.Size. We use <strong>the</strong> logarithm <strong>of</strong> total assets. Based on <strong>the</strong> assumption <strong>of</strong> opacity <strong>of</strong> <strong>the</strong> firm,we expect a positive relationship between firm size and <strong>the</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong>. A large firmusually has large financing needs that can not be satisfied by a single bank.Age. We use <strong>the</strong> logarithm <strong>of</strong> <strong>the</strong> <strong>number</strong> <strong>of</strong> years since <strong>the</strong> establishment <strong>of</strong> <strong>the</strong> firm. Anold firm is less opaque than a young firm. We expect a positive relationship between firmage and <strong>the</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong>.LC. <strong>The</strong> legal structure is taken into account through a dummy variable taken <strong>the</strong> value 1when <strong>the</strong> firm is limited company and 0 if not. This choice is explained by <strong>the</strong> fact thateach company is obliged to regularly certify <strong>the</strong>ir financial statements.Leverage. It is corresponded to <strong>the</strong> value <strong>of</strong> total financial debt reported to <strong>the</strong> value <strong>of</strong>equity.Liquidity. We define <strong>the</strong> liquidity as <strong>the</strong> ratio <strong>of</strong> liquid assets to debt coming due in <strong>the</strong>near time. A significant liquidity is associated with a lower risk <strong>of</strong> default.Flexibility. Financial flexibility measures <strong>the</strong> ratio between gross operating surplus andinterest payments.Pr<strong>of</strong>itability. We employ operating pr<strong>of</strong>it to total assets.Bank relationships characteristicsRAT. Credit rationing is measured by a binary variable taking <strong>the</strong> value 1 if <strong>the</strong> firm isrationed by <strong>the</strong>ir main bank and 0 o<strong>the</strong>rwise. <strong>The</strong> answers given by firms to <strong>the</strong>questionnaire gives us a direct measure <strong>of</strong> rationing.

DURAT. Measures <strong>the</strong> duration <strong>of</strong> <strong>the</strong> relationship with <strong>the</strong> main bank according to fourpossibilities (-2 years, 2-5 years, 5-10 years, +10 years).BQP. Measures <strong>the</strong> percentage represented by <strong>the</strong> main bank financing according to fourclasses <strong>of</strong> importance (- 25%, 25-50%, 50-75%, + 75%).X variablesWe consider a set <strong>of</strong> variables (X) which can influence <strong>the</strong> choice <strong>of</strong> <strong>the</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong>.GRP. It is a dummy variable measured from responses to <strong>the</strong> questionnaire, whichindicates if <strong>the</strong> firm is a subsidiary <strong>of</strong> a group or not.MSH. <strong>The</strong> importance <strong>of</strong> firm‟s main shareholder is measured by a dummy variableaccording to four possibilities (- 25%, 25-50%, 50-75%, + 75%).MSHMG. To measure <strong>the</strong> informational asymmetry between shareholders and managers,we use a dummy variable indicating if <strong>the</strong> main shareholder is also <strong>the</strong> manager or not.SC. <strong>The</strong> supplier credit is considered as an alternative to bank credit for business rationed.We define it as <strong>the</strong> ratio <strong>of</strong> supplier credit to financial debt.Table 1 presents <strong>the</strong> descriptive statistics for variables used in our regression.Table 1. Descriptive statisticsVariables Obs Mean Std. Dev. Min Maxnb 52 4.134615 5.42698 1 38size 52 17.11923 1.397411 13.4188 20.0948age 52 3.163202 0.9687325 0.6931 4.7095leverage 52 0.7749904 1.497608 0 8.5221liquidity 52 2.934038 4.270822 0.59 28.48flexibility 51 25.79366 56.42484 -9.0233 341.2487pr<strong>of</strong>itabily 52 0.0838404 0.089307 -0.1226 0.3068sc 49 8.442314 30.80165 0.0039 209.5712IV. ResultsEconometric <strong>results</strong> are presented in <strong>the</strong> following Table

Table 2. Determinants <strong>of</strong> <strong>the</strong> Number <strong>of</strong> Banks(1) (2) (3)VARIABLES nb nbnbsize 0.299 1.125* 1.033*(0.798) (0.613) (0.594)age -0.695 -1.407 -1.198(1.129) (0.877) (0.855)lc -1.329 -3.460* -3.120(3.028) (1.996) (1.938)leverage 0.131 -0.484 -0.344(0.831) (0.642) (0.624)liquidity -0.597 -0.627* -0.686**(0.408) (0.347) (0.337)flexibility 0.00187 -0.00785 -0.00572(0.0176) (0.0137) (0.0133)pr<strong>of</strong>itability -17.12 -26.63** -20.50*(12.89) (10.46) (10.62)rat 5.504** 3.333*(2.361) (1.787)durat0 0(0)durat1 3.377(3.677)durat2 -1.824(3.748)durat3 -0.474(3.375)bqp0 1.798(3.380)bqp1 -0.370(3.042)bqp2 0(0)bqp3 -0.229(3.483)grp -3.429* -2.326 -2.267(1.917) (1.621) (1.567)msh0 0 -1.955 -3.678(0) (3.958) (3.935)msh1 4.656 0 0(4.963) (0) (0)msh2 10.15** 5.595** 5.043*(4.432) (2.689) (2.615)msh3 4.273 -0.0884 -0.847(4.005) (2.387) (2.342)mshmg 1.773 -0.648 0.195(2.542) (1.576) (1.589)sc -0.00926(0.0279)Constant -1.470 -4.433 -4.741(15.91) (10.72) (10.36)Observations 45 48 48R-squared 0.586 0.465 0.515Robust standard errors in paren<strong>the</strong>ses*** p

Regression (1) exposes <strong>results</strong> concerning all variables. <strong>The</strong> variable representing Firm‟ssize measured by <strong>the</strong> variable (SIZE) is no significant and has a positive impact on <strong>the</strong><strong>number</strong> <strong>of</strong> <strong>banks</strong>. On <strong>the</strong> o<strong>the</strong>r hand, coefficients <strong>of</strong> <strong>the</strong> variable measuring firm‟s age(AGE) and legal structure (LC) do not present a level <strong>of</strong> significance to confirm that mostinformational opaque firms should be characterized by a reduced <strong>number</strong> <strong>of</strong> <strong>banks</strong>.However, <strong>the</strong> variable (Grp) is significant and has a negative effect on <strong>the</strong> <strong>number</strong> <strong>of</strong><strong>banks</strong>. It appears that firms pertaining to a group have a reduced <strong>number</strong> <strong>of</strong> <strong>banks</strong>. Thisresult cannot validate assumption 1. Variable (MSH2) has a significant and a positiveinfluence on <strong>the</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong>. In fact, it appears that firms whose share <strong>of</strong> capital heldby <strong>the</strong> main shareholder is between 50% and 75% maintain relationships with a higher<strong>number</strong> <strong>of</strong> <strong>banks</strong>.Concerning <strong>the</strong> impact <strong>of</strong> firm‟s quality on <strong>the</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong>, <strong>results</strong> do not validate <strong>the</strong>fourth hypo<strong>the</strong>sis. <strong>The</strong> variables Leverage and Flexibility establish a positive and nosignificant link with <strong>the</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong>. However, Liquidity and Pr<strong>of</strong>itability have asignificant and negative effect on <strong>the</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong>.Relating to <strong>the</strong> second assumption, <strong>results</strong> show that <strong>the</strong> duration <strong>of</strong> <strong>the</strong> main bank‟srelationship (DURAT) is not significant. While, hypo<strong>the</strong>sis 3 is validated since variable(Rat) influences positively, and to a significant degree <strong>the</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong>.Results <strong>of</strong> Regression (2) show that <strong>the</strong> variable (SIZE) presents a positive level <strong>of</strong>significance to confirm assumption 1. However, variable (LC) has a significant and anegative impact on <strong>the</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong>. So, <strong>the</strong> most informational opaque firm shouldincrease its <strong>number</strong> <strong>of</strong> <strong>banks</strong>. Concerning <strong>the</strong> impact <strong>of</strong> firm‟s quality, <strong>results</strong> validate <strong>the</strong>fourth assumption. (Liquidity) and (Pr<strong>of</strong>itability) have a positive and a significant impacton <strong>the</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong>. Similarly to <strong>the</strong> conclusion presented by Degryse and Ongena(2000) and Petersen and Rajan (1994), it proves that most pr<strong>of</strong>itable firms arecharacterized by a reduced <strong>number</strong> <strong>of</strong> <strong>banks</strong>.Finally, Regression (3) confirms <strong>results</strong>. <strong>The</strong> variable (RAT) establishes a positive and asignificant effect on <strong>the</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong>.

V. Conclusion<strong>The</strong> present paper analyzed <strong>the</strong> <strong>determinants</strong> <strong>of</strong> <strong>the</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong>. We formulatehypo<strong>the</strong>ses relative to <strong>the</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong>, firm‟s characteristics and Bank relationshipscharacteristics.For Small and Medium Business, <strong>the</strong> relationship with a bank is <strong>of</strong>ten <strong>the</strong> only way toobtain outside financing. In fact, Small and Medium Business are known to be veryopaque, so <strong>banks</strong> can solve this problem <strong>of</strong> asymmetric information by developing creditrelationships. Banks produce information about firms and use it in <strong>the</strong>ir credit decisions.<strong>The</strong>ories <strong>of</strong> financial intermediation show that single bank relationship is most efficientaccording to delegated monitoring model. Firms should have a lower cost <strong>of</strong> credit andmore availability <strong>of</strong> funds. But in recent years, various Small and Medium Business choosea multiple bank relationship. By borrowing from more than one bank, <strong>the</strong> firm can solve<strong>the</strong> hold-up banking problem. Indeed, in <strong>the</strong> case <strong>of</strong> a single bank relationship, a bankwhich lends to a firm learns more about <strong>the</strong> borrower‟s characteristics than o<strong>the</strong>r <strong>banks</strong> do.As a consequence <strong>of</strong> this asymmetric information, <strong>the</strong> bank acquires an informationalmonopoly over <strong>the</strong> firm. <strong>The</strong> credit cost arises if <strong>the</strong> bank uses its superior information. Inthis circumstance, multiple banking can reduce <strong>the</strong> risk <strong>of</strong> informational capture.Fur<strong>the</strong>rmore, multiple banking can also appear as a protection against bank liquidity risk.In order to study <strong>the</strong> <strong>determinants</strong> <strong>of</strong> <strong>the</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong>, we use a sample <strong>of</strong> French data.Tests validate hypo<strong>the</strong>ses 1, 3 and 4. Indeed, our <strong>results</strong> show that firm‟s size positivelyinfluences <strong>the</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong>, whereas liquidity and pr<strong>of</strong>itability decrease this <strong>number</strong>.Moreover, firms exposed to credit rationing are characterized by a more important <strong>number</strong><strong>of</strong> <strong>banks</strong>. Hypo<strong>the</strong>sis 2 is not validated. Indeed, <strong>the</strong> duration <strong>of</strong> <strong>the</strong> main bank‟srelationship has no a significant effect on <strong>the</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong>.My data search is actually in progress. As a consequence, ano<strong>the</strong>r part will be added to thisarticle as soon as I collect more data. This part is about <strong>the</strong> impact <strong>of</strong> <strong>the</strong> <strong>number</strong> <strong>of</strong> <strong>banks</strong>„effects on price and non price terms <strong>of</strong> <strong>the</strong> loan contract: credit cost, availability <strong>of</strong> creditand guarantees.

REFERENCESBoot A, (2000), “ Relationship banking: what do we know?”, Journal <strong>of</strong> FinancialIntermediation, vol. IX, p. 7-25.Berger A. N., L.F Klapper et E.F Udell (2001), “ <strong>The</strong> ability <strong>of</strong> bank to lend informationallyopaque small business”, Journal <strong>of</strong> Banking and Finance, vol. 25, pp. 2127-2167.Carletti E. (2004), "<strong>The</strong> structure <strong>of</strong> bank relationships, endogenous monitoring and loanrates", Document de Travail, Université de Mannheim, janvier 2002.Carletti E., V. Cerasi et Daltung S. [2006] ”Multiple-bank lending: diversification and freeriding in monitoring”, Working Paper.Cole R. (1998), “<strong>The</strong> importance <strong>of</strong> relationships, Endogenous Monitoring and Loans Rates”,Journal <strong>of</strong> Financial Intermediation.D'auria C., A. Foglia et P. M. Reedtz (1999), “Bank interest rates and credit relationships inItaly”, Journal <strong>of</strong> Banking and Finance, vol. 23 pp. 1067-1093.De Bodt E., F. Lobez et J.-C. Statnik (2001) "Credit rationning, customer relationship and <strong>the</strong><strong>number</strong> <strong>of</strong> <strong>banks</strong> – an empirical analysis", document de travail du GERME, Universitéde Lille 2.Detragiache E., P. Garella et L. Guiso (2000), “Multiple versus Single Banking Relationships:<strong>The</strong>ory and Evidence”, Journal <strong>of</strong> Finance, vol. 55, n°2, juin, pp. 1133-1161.Diamond D.W. (1984), “Financial intermediation and delegated monitoring”, Review <strong>of</strong>Economic Studies, vol. 51, juillet, pp. 393-414.Diamond D, (1991), “ Monitoring and reputation: <strong>the</strong> choice between bank loans and directlyplaced debt”, Journal <strong>of</strong> Political Economy, Vol. IC, p. 689-721.Fama E.F. (1985), “What‟s different about <strong>banks</strong>? ”, Journal <strong>of</strong> Monetary Economics, vol.15, pp. 29- 39.Foglia A., Laviola S et P. Marullo Reedtz (1998), "Multiple banking relationships and <strong>the</strong>fragility <strong>of</strong> corporate borrowers", Journal <strong>of</strong> Banking and Finance, vol. 22, n° 10-11 pp.1441-1456.Lefilliatre D. (2002), "La multibancarité", Cahiers études et recherches de l'observatoire desentreprises, Banque de France.Leland H et Pyle D, (1997), « Informational asymetries, financial structure, and financialintermediation », <strong>The</strong> journal <strong>of</strong> Finance, Vol. LXXXIX, p. 371-387.

Lobez, F. et J.-C. Statnick (2004), "<strong>The</strong> informative content <strong>of</strong> bank debt concentration",document de travail du GERME, université Lille 2.Nakamura L, (1994), « Small borrowers and <strong>the</strong> survival <strong>of</strong> <strong>the</strong> small bank: is mousebankmighty or Mickey ? », Federal Reserve Bank <strong>of</strong> Philadelphia Business Review,Novembre/Decembre, p. 3-15.Ongena S. Smith D. (2000), “What determines <strong>the</strong> <strong>number</strong> <strong>of</strong> bank relationships? Crosscountryevidence”, Journal <strong>of</strong> Financial Intermediation, Vol. 9, pp. 26-56, 2000.Ongena S. Smith D. (2001), "<strong>The</strong> duration <strong>of</strong> bank relationships", Journal <strong>of</strong> FinancialEconomics, vol. 61, pp. 449-475.Rajan R.G. (1992), “Insiders and Outsiders: <strong>The</strong> Choice between Informed and Arm's lengthDebt”, Journal <strong>of</strong> Finance, vol. XLVII, n°4, septembre, pp. 1367-1400.Refait C. (2004), « La multibancarité des entreprises : choix du nombre de banques vs choixdu nombre de banques principales ? », Revue Economique, vol.54, pp. 649-662.Sharpe S.A. (1990), “Asymmetric information, bank lending and implicit contracts: A stylisedmodel <strong>of</strong> customer relationships”, Journal <strong>of</strong> Finance, vol. XLV, n°4, septembre, pp.1069-1087.Stiglitz J, et Weiss A, (1981), „ Credit rationing in markets with imperfect information“,American Economic Review, Vol.71, p. 393-410.Thakor A. (1996), « Capital Requirements, Monetary Policy, and Aggregate Bank Lending;<strong>The</strong>ory and <strong>Empirical</strong> Evidence”, Journal <strong>of</strong> Finance, vol. 51, pp. 279-324.Ziane, Y. (2005), “ Number <strong>of</strong> Banks and Credit Relationships: <strong>Empirical</strong> Results FromFrench Small Business Data”, document de travail, BETA.