Towards a Sustainable and Efficient State The Development ...

Towards a Sustainable and Efficient State The Development ...

Towards a Sustainable and Efficient State The Development ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

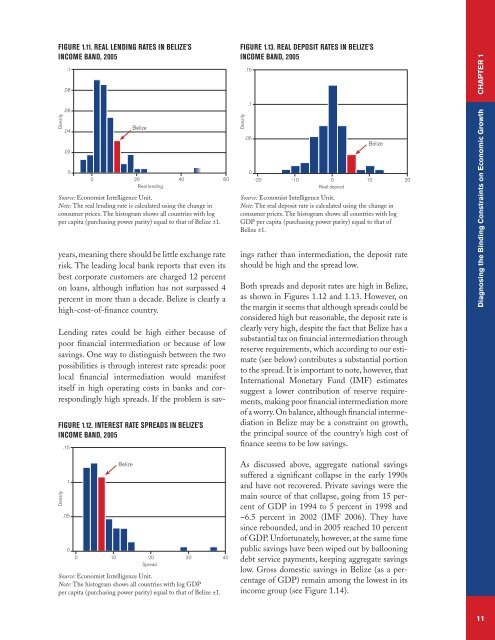

Figure 1.11. Real Lending Rates in Belize’sIncome B<strong>and</strong>, 2005.1.08Figure 1.13. Real Deposit Rates in Belize’sIncome B<strong>and</strong>, 2005.15chapter 1Density.06.04.020Belize0 20 40 60Real lendingSource: Economist Intelligence Unit.Note: <strong>The</strong> real lending rate is calculated using the change inconsumer prices. <strong>The</strong> histogram shows all countries with logper capita (purchasing power parity) equal to that of Belize ±1.years, meaning there should be little exchange raterisk. <strong>The</strong> leading local bank reports that even itsbest corporate customers are charged 12 percenton loans, although inflation has not surpassed 4percent in more than a decade. Belize is clearly ahigh-cost-of-finance country.Lending rates could be high either because ofpoor financial intermediation or because of lowsavings. One way to distinguish between the twopossibilities is through interest rate spreads: poorlocal financial intermediation would manifestitself in high operating costs in banks <strong>and</strong> correspondinglyhigh spreads. If the problem is sav-Figure 1.12. Interest Rate Spreads in Belize’sIncome B<strong>and</strong>, 2005.15Density.1.050Belize-20 -10 010 20Real depositSource: Economist Intelligence Unit.Note: <strong>The</strong> real deposit rate is calculated using the change inconsumer prices. <strong>The</strong> histogram shows all countries with logGDP per capita (purchasing power parity) equal to that ofBelize ±1.ings rather than intermediation, the deposit rateshould be high <strong>and</strong> the spread low.Both spreads <strong>and</strong> deposit rates are high in Belize,as shown in Figures 1.12 <strong>and</strong> 1.13. However, onthe margin it seems that although spreads could beconsidered high but reasonable, the deposit rate isclearly very high, despite the fact that Belize has asubstantial tax on financial intermediation throughreserve requirements, which according to our estimate(see below) contributes a substantial portionto the spread. It is important to note, however, thatInternational Monetary Fund (IMF) estimatessuggest a lower contribution of reserve requirements,making poor financial intermediation moreof a worry. On balance, although financial intermediationin Belize may be a constraint on growth,the principal source of the country’s high cost offinance seems to be low savings.Diagnosing the Binding Constraints on Economic GrowthDensity1.050Belize0 10 2030 40SpreadSource: Economist Intelligence Unit.Note: <strong>The</strong> histogram shows all countries with log GDPper capita (purchasing power parity) equal to that of Belize ±1.As discussed above, aggregate national savingssuffered a significant collapse in the early 1990s<strong>and</strong> have not recovered. Private savings were themain source of that collapse, going from 15 percentof GDP in 1994 to 5 percent in 1998 <strong>and</strong>−6.5 percent in 2002 (IMF 2006). <strong>The</strong>y havesince rebounded, <strong>and</strong> in 2005 reached 10 percentof GDP. Unfortunately, however, at the same timepublic savings have been wiped out by ballooningdebt service payments, keeping aggregate savingslow. Gross domestic savings in Belize (as a percentageof GDP) remain among the lowest in itsincome group (see Figure 1.14).11