REMUNERATION REPORTContinuedInformation subject to auditDirectors’ emolumentsThe directors’ emoluments in <strong>the</strong> year ended 31 March <strong>2007</strong> in total have been audited and were as follows:Emoluments paid for <strong>the</strong> period 1 April 2006 to 31 March <strong>2007</strong><strong>2007</strong><strong>2007</strong> 2006 <strong>2007</strong> TotalSalary/ Salary/ expense <strong>2007</strong> (excluding <strong>2007</strong> <strong>2007</strong> 2006fees fees allowances Benefits* bonus) bonus Total TotalName £ £ £ £ £ £ £ £Executive directorsEAG Mackay 950,000 875,000 – 120,032 1,070,032 1,450,000 2,520,032 2,356,981MI Wyman 575,000 525,000 – 152,227 727,227 565,000 1,292,227 1,180,739Total (A) 3,812,259 3,537,720Non-executive directorsGC Bible – – – – – – – –NJ De Lisi – – – – – – – –ME Doherty 58,500 – – 172 58,672 – 58,672 –Lord Fellowes 87,500 76,000 – 37 87,537 – 87,537 76,019JM Kahn 205,500 155,000 – 1,675 207,175 – 207,175 155,760PJ Manser 80,000 71,000 – 238 80,238 – 80,238 71,115J Manzoni 62,500 56,000 – 234 62,734 – 62,734 56,115MQ Morland 74,500 66,000 – 222 74,722 – 74,722 66,114Ning Gaoning – – – – – – – 14,698CA Pérez Dávila 50,000 17,802 – 190 50,190 – 50,190 17,838MC Ramaphosa 55,500 50,000 – 42 55,542 – 55,542 50,100Lord Renwick of Clifton 59,000 53,000 – – 59,000 – 59,000 53,000A Santo Domingo Dávila 50,000 17,802 – 230 50,230 – 50,230 17,847Total (B) 786,040 578,606Grand total (A + B) 4,598,299 4,116,326Mr Bible and Ms De Lisi have waived <strong>the</strong>ir fees. Mr Ning waived his fees and resigned from <strong>the</strong> board on 28 July 2005. Ms De Lisi resigned from <strong>the</strong> board on30 April <strong>2007</strong> and Mr DS Devitre was appointed to <strong>the</strong> board in her place on 16 May <strong>2007</strong>.Mr Perez Dávila and Mr Santo Domingo Dávila were appointed to <strong>the</strong> board effective 9 November 2005.The total emoluments <strong>report</strong>ed for 2006 and <strong>2007</strong> exclude retirement contributions made by <strong>the</strong> company to <strong>the</strong> pension schemes as detailed above.Retirement contributions were paid on behalf of Mr Mackay and Mr Wyman in <strong>the</strong> amounts of £215,000 and £172,500 respectively being within <strong>the</strong> annualallowance and contributions of £70,000 in excess of <strong>the</strong> annual allowance were paid on behalf of Mr Mackay. In 2006 retirement contributions were paid on behalfof Mr Mackay and Mr Wyman to <strong>the</strong> extent allowed by <strong>the</strong> earnings cap, in <strong>the</strong> amounts of £54,806 and £25,766 respectively and contributions in excess of <strong>the</strong>earnings cap were £207,694 and £131,734 respectively.During <strong>the</strong> year <strong>the</strong> group’s apartment in London was made available to Mr Mackay to occupy intermittently, subject to tax on this use for his account.Mr Mackay receives from Reckitt Benckiser <strong>plc</strong> an annual fee of £65,000 which he is permitted to retain, relating to his appointment as a non-executive directorof Reckitt Benckiser <strong>plc</strong>. A proportion of this fee is applied to <strong>the</strong> purchase of Reckitt Benckiser <strong>plc</strong> ordinary shares.* The items included within benefits are given on page 52.Share incentive plansThe interests of <strong>the</strong> executive directors in shares of <strong>the</strong> company provided in <strong>the</strong> form of options and awards since listing on 8 March 1999 areshown in <strong>the</strong> tables below, which have been audited. During <strong>the</strong> year to 31 March <strong>2007</strong> <strong>the</strong> highest and lowest market prices for <strong>the</strong> company’sshares were £12.26 and £9.21 respectively and <strong>the</strong> market price on 31 March <strong>2007</strong> was £11.15.The tables below contain <strong>the</strong> aggregate expected values of each option grant or performance share award. The expected values of grants andawards made prior to November 2002 are <strong>the</strong> values previously disclosed in <strong>the</strong> Directors’ Remuneration Reports up to 2003 and were calculatedby Mercer. The expected values for <strong>the</strong> grants and awards made in 2003, 2004, 2005 and 2006 have been calculated by Mercer using:■■A binomial valuation model for <strong>the</strong> options that uses daily share price data and takes account of <strong>the</strong> option grant date, exercise price andrisk-free rate of return, with assumptions as to dividend yield, future volatility and forfeiture; andA Monte Carlo simulation model for <strong>the</strong> performance share awards using <strong>the</strong> same inputs and assumptions as for <strong>the</strong> binomial model,but which projects, many thousands of times, <strong>the</strong> share price of <strong>the</strong> company along with <strong>the</strong> share prices of <strong>the</strong> comparator group stocksto determine correlations between <strong>the</strong> companies. This produces a distribution of share prices and TSR rankings thus allowing complexmarket-based hurdles to be modelled.The methods of calculation of expected values have not been audited by PricewaterhouseCoopers LLP.54<strong>SABMiller</strong> <strong>plc</strong> <strong>Annual</strong> Report <strong>2007</strong> Remuneration <strong>report</strong>

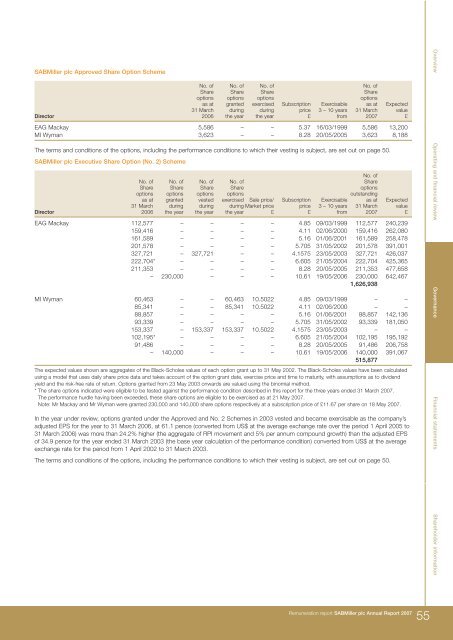

<strong>SABMiller</strong> <strong>plc</strong> Approved Share Option SchemeNo. of No. of No. of No. ofShare Share Share Shareoptions options options optionsas at granted exercised Subscription Exercisable as at Expected31 March during during price 3 – 10 years 31 March valueDirector 2006 <strong>the</strong> year <strong>the</strong> year £ from <strong>2007</strong> £EAG Mackay 5,586 – – 5.37 16/03/1999 5,586 13,200MI Wyman 3,623 – – 8.28 20/05/2005 3,623 8,188The terms and conditions of <strong>the</strong> options, including <strong>the</strong> performance conditions to which <strong>the</strong>ir vesting is subject, are set out on page 50.<strong>SABMiller</strong> <strong>plc</strong> Executive Share Option (No. 2) SchemeNo. ofNo. of No. of No. of No. of ShareShare Share Share Share optionsoptions options options options outstandingas at granted vested exercised Sale price/ Subscription Exercisable as at Expected31 March during during during Market price price 3 – 10 years 31 March valueDirector 2006 <strong>the</strong> year <strong>the</strong> year <strong>the</strong> year £ £ from <strong>2007</strong> £EAG Mackay 112,577 – – – – 4.85 09/03/1999 112,577 240,239159,416 – – – – 4.11 02/06/2000 159,416 262,080161,589 – – – – 5.16 01/06/2001 161,589 258,478201,578 – – – – 5.705 31/05/2002 201,578 391,001327,721 – 327,721 – – 4.1575 23/05/2003 327,721 426,037222,704* – – – – 6.605 21/05/2004 222,704 425,365211,353 – – – – 8.28 20/05/2005 211,353 477,658– 230,000 – – – 10.61 19/05/2006 230,000 642,4671,626,938MI Wyman 60,463 – – 60,463 10.5022 4.85 09/03/1999 – –85,341 – – 85,341 10.5022 4.11 02/06/2000 – –88,857 – – – – 5.16 01/06/2001 88,857 142,13693,339 – – – – 5.705 31/05/2002 93,339 181,050153,337 – 153,337 153,337 10.5022 4.1575 23/05/2003 – –102,195* – – – – 6.605 21/05/2004 102,195 195,19291,486 – – – – 8.28 20/05/2005 91,486 206,758– 140,000 – – – 10.61 19/05/2006 140,000 391,067515,877The expected values shown are aggregates of <strong>the</strong> Black-Scholes values of each option grant up to 31 May 2002. The Black-Scholes values have been calculatedusing a model that uses daily share price data and takes account of <strong>the</strong> option grant date, exercise price and time to maturity, with assumptions as to dividendyield and <strong>the</strong> risk-free rate of return. Options granted from 23 May 2003 onwards are valued using <strong>the</strong> binomial method.* The share options indicated were eligible to be tested against <strong>the</strong> performance condition described in this <strong>report</strong> for <strong>the</strong> three years ended 31 March <strong>2007</strong>.The performance hurdle having been exceeded, <strong>the</strong>se share options are eligible to be exercised as at 21 May <strong>2007</strong>.Note: Mr Mackay and Mr Wyman were granted 230,000 and 140,000 share options respectively at a subscription price of £11.67 per share on 18 May <strong>2007</strong>.In <strong>the</strong> year under review, options granted under <strong>the</strong> Approved and No. 2 Schemes in 2003 vested and became exercisable as <strong>the</strong> company’sadjusted EPS for <strong>the</strong> year to 31 March 2006, at 61.1 pence (converted from US$ at <strong>the</strong> average exchange rate over <strong>the</strong> period 1 April 2005 to31 March 2006) was more than 24.2% higher (<strong>the</strong> aggregate of RPI movement and 5% per annum compound growth) than <strong>the</strong> adjusted EPSof 34.9 pence for <strong>the</strong> year ended 31 March 2003 (<strong>the</strong> base year calculation of <strong>the</strong> performance condition) converted from US$ at <strong>the</strong> averageexchange rate for <strong>the</strong> period from 1 April 2002 to 31 March 2003.The terms and conditions of <strong>the</strong> options, including <strong>the</strong> performance conditions to which <strong>the</strong>ir vesting is subject, are set out on page 50.Overview Operating and financial review Governance Financial statementsShareholder informationRemuneration <strong>report</strong> <strong>SABMiller</strong> <strong>plc</strong> <strong>Annual</strong> Report <strong>2007</strong>55