You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

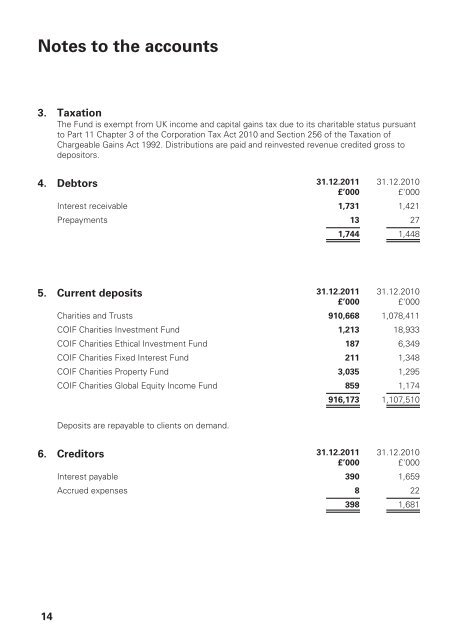

Notes to the accounts3. TaxationThe <strong>Fund</strong> is exempt from UK income and capital gains tax due to its charitable status pursuantto Part 11 Chapter 3 of the Corporation Tax Act 2010 and Section 256 of the Taxation ofChargeable Gains Act 1992. Distributions are paid and reinvested revenue credited gross todepositors.4. Debtors 31.12.2011£’00031.12.2010£'000Interest receivable 1,731 1,421Prepayments 13 271,744 1,4485. Current deposits 31.12.2011£’00031.12.2010£'000<strong>Charities</strong> and Trusts 910,668 1,078,411<strong>COIF</strong> <strong>Charities</strong> Investment <strong>Fund</strong> 1,213 18,933<strong>COIF</strong> <strong>Charities</strong> Ethical Investment <strong>Fund</strong> 187 6,349<strong>COIF</strong> <strong>Charities</strong> Fixed Interest <strong>Fund</strong> 211 1,348<strong>COIF</strong> <strong>Charities</strong> Property <strong>Fund</strong> 3,035 1,295<strong>COIF</strong> <strong>Charities</strong> Global Equity Income <strong>Fund</strong> 859 1,174916,173 1,107,510<strong>Deposit</strong>s are repayable to clients on demand.6. Creditors 31.12.2011£’00031.12.2010£'000Interest payable 390 1,659Accrued expenses 8 22398 1,68114