COIF Charities Property Fund - CCLA

COIF Charities Property Fund - CCLA

COIF Charities Property Fund - CCLA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

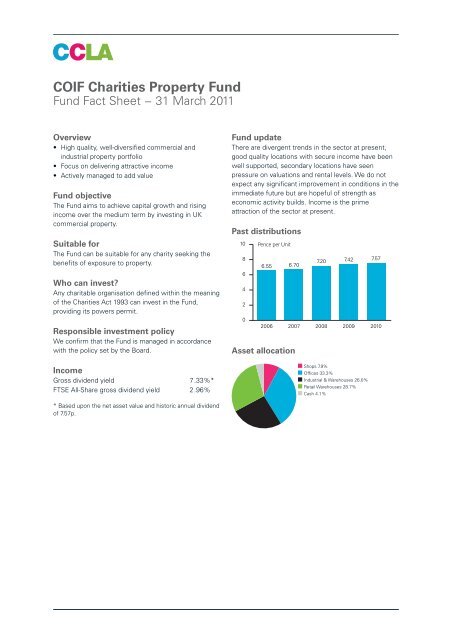

<strong>COIF</strong> <strong>Charities</strong> <strong>Property</strong> <strong>Fund</strong><strong>Fund</strong> Fact Sheet − 31 March 2011Overview• High quality, well-diversified commercial andindustrial property portfolio• Focus on delivering attractive income• Actively managed to add value<strong>Fund</strong> objectiveThe <strong>Fund</strong> aims to achieve capital growth and risingincome over the medium term by investing in UKcommercial property.Suitable forThe <strong>Fund</strong> can be suitable for any charity seeking thebenefits of exposure to property.Who can invest?Any charitable organisation defined within the meaningof the <strong>Charities</strong> Act 1993 can invest in the <strong>Fund</strong>,providing its powers permit.Responsible investment policyWe confirm that the <strong>Fund</strong> is managed in accordancewith the policy set by the Board.IncomeGross dividend yield 7.33%*FTSE All-Share gross dividend yield 2.96%<strong>Fund</strong> updateThere are divergent trends in the sector at present,good quality locations with secure income have beenwell supported, secondary locations have seenpressure on valuations and rental levels. We do notexpect any significant improvement in conditions in theimmediate future but are hopeful of strength aseconomic activity builds. Income is the primeattraction of the sector at present.Past distributions10 Pence per Unit864206.55 6.707.20 7.42 7.572006 2007 2008 2009 2010Asset allocation■ Shops 7.9%■ Offices 33.3%■ Industrial & Warehouses 26.0%■ Retail Warehouses 28.7%■ Cash 4.1%* Based upon the net asset value and historic annual dividendof 7.57p.

Discrete year total return performance (gross)12 months to 31 March 2011 2010 2009 2008 2007<strong>COIF</strong> <strong>Charities</strong> <strong>Property</strong> <strong>Fund</strong> +11.3% +21.3% -23.8% -10.8% +19.3%Annualised total return performance (gross)Performance to 31 March 2011 1 year 3 years 5 years<strong>COIF</strong> <strong>Charities</strong> <strong>Property</strong> <strong>Fund</strong> +11.3% +0.9% +1.8%Gross performance shown before management fees and expenses with gross income reinvested: net returns will differ after thededuction of fees and charges. Past performance is no guarantee of future returns. Investments in long term funds can go downas well as up and you may not get back the original amount invested. The properties within the <strong>Fund</strong> are valued by an externalproperty valuer; any such valuations are a matter of opinion rather than fact. The performance of the <strong>Fund</strong> may be adverselyaffected by a downturn in the property market which could impact on the capital and or income value of the <strong>Fund</strong>.Top ten property holdings – total 46.8%Milton Keynes, Snowdon DriveBristol, Aztec WestLondon, College HillChorley, Chorley Retail ParkSouthampton, Winchester RoadGlasgow, West George StreetHereford, Salmon Retail ParkNorthampton, Brackmills Ind. Est.Glasgow, West Regent StreetNorthampton, St. Peters WayKey facts<strong>Fund</strong> size £140mNumber of holdings 36Income units Accumulation unitsOffer (buying) price 105.13p (xd) 172.11pNet asset value 103.33p (xd) 169.15pBid (selling) price 101.73p (xd) 166.53pBid/offer spread 3.3% 3.3%Launch date August 2002Unit typesIncome/AccumulationMinimum initial investment £10,000Minimum subsequent investmentNilDealing dayLast Thursday of the month*Sedol numbers3196229 Inc, 3196177 AccISIN numbersGB0031962292 Inc, GB0031961773 AccDividend payment datesEnd February, May, August & NovemberAnnual management charge (taken 100% from capital) 0.65%*** Dealing instructions must be received by 5pm on the business day preceding the dealing day. If Thursday is a bank holiday, thedealing day will be the previous working day. Units are only realisable on each monthly dealing date and redemptions may notbe readily realisable; a period of notice not exceeding six months may be imposed for the redemption of units.** The annual management charge is deducted from capital which may restrict capital growth.<strong>CCLA</strong> INVESTMENT MANAGEMENT LTD80 Cheapside, London EC2V 6DZClient Service Freephone: 0800 022 3505Fax:0844 561 5126clientservices@ccla.co.ukwww.ccla.co.ukThe <strong>Fund</strong> is a Common Investment <strong>Fund</strong> established by the Charity Commission under the <strong>Charities</strong> Act 1993 section 24 andinvestment in the <strong>Fund</strong> is only available to charities within the meaning of section 96 of the <strong>Charities</strong> Act.<strong>CCLA</strong> Investment Management Limited (registered in England no. 2183088 at the office above) is authorised and regulated bythe Financial Services Authority and is the manager of the <strong>COIF</strong> Charity <strong>Fund</strong>s (registered charity nos. 218873, 803610,1046249, 1093084, 1121433 and 1132054).A21/APR11