You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

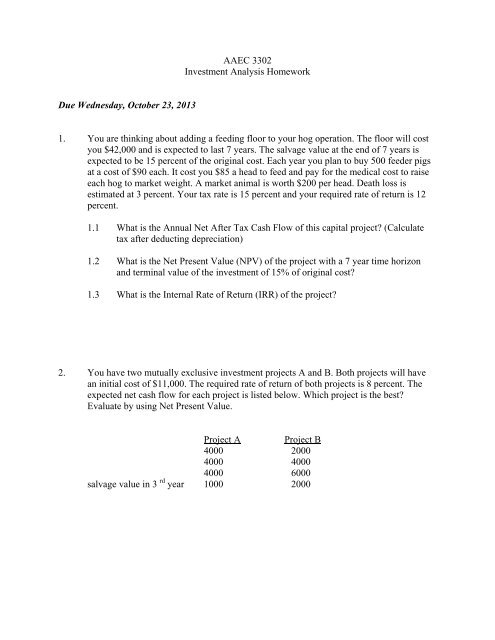

AAEC 3302Investment Analysis <strong>Homework</strong>Due Wednesday, October 23, 20131. You are thinking about adding a feeding floor to your hog operation. The floor will costyou $42,000 and is expected to last 7 years. The salvage value at the end of 7 years isexpected to be 15 percent of the original cost. Each year you plan to buy 500 feeder pigsat a cost of $90 each. It cost you $85 a head to feed and pay for the medical cost to raiseeach hog to market weight. A market animal is worth $200 per head. Death loss isestimated at 3 percent. Your tax rate is 15 percent and your required rate of return is 12percent.1.1 What is the Annual Net After Tax Cash Flow of this capital project? (Calculatetax after deducting depreciation)1.2 What is the Net Present Value (NPV) of the project with a 7 year time horizonand terminal value of the investment of 15% of original cost?1.3 What is the Internal Rate of Return (IRR) of the project?2. You have two mutually exclusive investment projects A and B. Both projects will havean initial cost of $11,000. The required rate of return of both projects is 8 percent. Theexpected net cash flow for each project is listed below. Which project is the best?Evaluate by using Net Present Value.Project A Project B4000 20004000 40004000 6000salvage value in 3 rd year 1000 2000

3. An owner of a large ranch is considering the purchase of a tractor with a front-end loaderto clean his corrals instead of hiring workers that do it with a pitch fork. He has given youthe following information and has asked you to evaluate this investment. The equipmentcosts $55,000. The rancher expects that he will save $12,500 a year that is usually paid toworkers that clean out the corral by hand. However, he will incur an additional cost of$1,500 for fuel, repairs and maintenance. The rancher plans on keeping the equipment for3 years before replacing it with a new one. He thinks he can sell the old equipment for$38,000 in three years. The rancher anticipates that his marginal tax rate will be 20percent over the next three years. The IRS will allow the rancher to depreciate the tractorover seven years using the straight-line method with a salvage value of 30%. The rancherrequires at least a 15% rate of return on capital.3.1. Layout the cash flow for the investment.3.2. Calculate the Net Present Value given a 3 year time horizon and sale of the tractorat the end of the time horizon.3.3 What is the Internal Rate of Return?4. A vegetable producer is considering the purchase of a mechanical harvester and hascollected the following information: purchase price of $80,000, increase in annual cashflow before taxes of $18,000, salvage value (terminal value) of 20,000, and a depreciablelife of 7 years.4.1 Compute the payback period and the simple rate of return for this investment.4.2 Ignoring income taxes, compute the NPV and the IRR of this investment for a 7year time horizon and a before tax required rate of return of 12.0%. Based on youranswer, is this machine an acceptable investment alternative?4.3 Convert the before-tax cash flows to after-tax cash flows. Use the straight-linedepreciation method and a useful life of 7 years. The income tax rate is 20%. Ifthe after-tax required rate of return is 10%, is this an acceptable investment usingthe NPV and IRR methods of analysis?