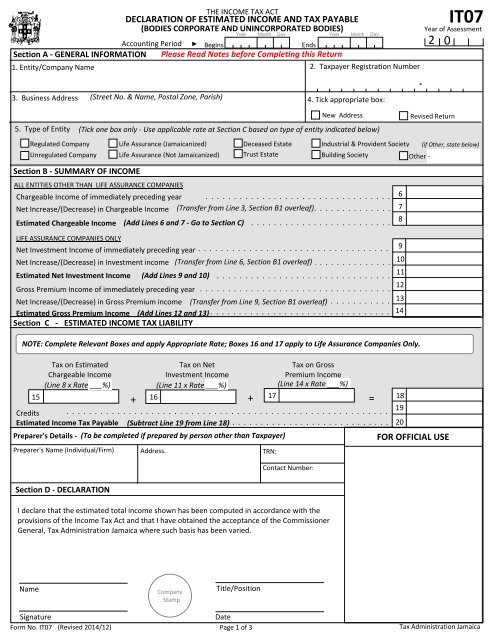

DECLARATION OF ESTIMATED INCOME AND TAX PAYABLE

DECLARATION OF ESTIMATED INCOME AND TAX PAYABLE

DECLARATION OF ESTIMATED INCOME AND TAX PAYABLE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

3. Business Address5. Type of EntitySection B ‐ SUMMARY <strong>OF</strong> <strong>INCOME</strong>ALL ENTITIES OTHER THAN LIFE ASSURANCE COMPANIES<strong>DECLARATION</strong> <strong>OF</strong> <strong>ESTIMATED</strong> <strong>INCOME</strong> <strong>AND</strong> <strong>TAX</strong> <strong>PAYABLE</strong>(BODIES CORPORATE <strong>AND</strong> UNINCORPORATED BODIES)(Street No. & Name, Postal Zone, Parish)THE <strong>INCOME</strong> <strong>TAX</strong> ACTAccounting Period ► BeginsEndsSection A ‐ GENERAL INFORMATION1. Entity/Company NamePlease Read Notes before Completing this Return2. Taxpayer Registration NumberRegulated CompanyUnregulated Company4. Tick appropriate box:New Address(Tick one box only ‐ Use applicable rate at Section C based on type of entity indicated below)Life Assurance (Jamaicanized)Life Assurance (Not Jamaicanized)Deceased EstateTrust EstateChargeable Income of immediately preceding year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Net Increase/(Decrease) in Chargeable Income (Transfer from Line 3, Section B1 overleaf). . . . . . . . . . . . . .Estimated Chargeable Income (Add Lines 6 and 7 ‐ Go to Section C) . . . . . . . . . . . . . . . . . . . . . . . . .YearMonthDayYearMonthDay‐Revised ReturnIT07Year of Assessment2 0Industrial & Provident Society (if Other, state below)Building SocietyOther ‐678LIFE ASSURANCE COMPANIES ONLYNet Investment Income of immediately preceding year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Net Increase/(Decrease) in Investment income (Transfer from Line 6, Section B1 overleaf) . . . . . . . . . . . . . .Estimated Net Investment Income (Add Lines 9 and 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Gross Premium Income of immediately preceding year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Net Increase/(Decrease) in Gross Premium income (Transfer from Line 9, Section B1 overleaf). . . . . . . . . . . .Estimated Gross Premium Income (Add Lines 12 and 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Section C ‐ <strong>ESTIMATED</strong> <strong>INCOME</strong> <strong>TAX</strong> LIABILITY91011121314NOTE: Complete Relevant Boxes and apply Appropriate Rate; Boxes 16 and 17 apply to Life Assurance Companies Only.Tax on EstimatedChargeable IncomeTax on NetInvestment IncomeTax on GrossPremium Income(Line 8 x Rate ___%)(Line 11 x Rate ___%)(Line 14 x Rate ___%)15 16 +17+Credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Estimated Income Tax Payable (Subtract Line 19 from Line 18) . . . . . . . . . . . . . . . . . . . . . . . . . . . .Preparer's Details ‐ (To be completed if prepared by person other than Taxpayer)Preparer's Name (Individual/Firm) Address. TRN:Contact Number:=181920FOR <strong>OF</strong>FICIAL USESection D ‐ <strong>DECLARATION</strong>I declare that the estimated total income shown has been computed in accordance with theprovisions of the Income Tax Act and that I have obtained the acceptance of the CommissionerGeneral, Tax Administration Jamaica where such basis has been varied.NameCompanyStampTitle/PositionSignatureForm No. IT07(Revised 2014/12)DatePage 1 of 3Tax Administration Jamaica

Section B1 ‐ Detail of Changes to Previous Year's Chargeable IncomeALL ENTITIES OTHER THAN LIFE ASSURANCE COMPANIESNet Income arising for the first time in current yearReductions to Income of Previous Year of Assessment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .(State reason below) . . . . . . . . . . . . . . . . . . . . .Net Increase/Decrease in Income (Subtract Line 2 from Line 1 ‐ Transfer to Section B, Line 7 overleaf)LIFE ASSURANCE COMPANIES ONLYInvestment Income arising for the first time in current year . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Reductions to Investment Income of Previous Year of Assessment (State reason below) . . . . . . . . . . . . . .Net Increase/Decrease in Investment Income (Subtract Line 5 from Line 4 ‐ Transfer to Section B, Line 10 overleaf)Gross Premium Income arising for the first time in current year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Reductions to Gross Premium Income of Previous Year of Assessment (State reason below) . . . . . . . . . . . . . . .Net Increase/Decrease in Gross Premium Income (Subtract Line 8 from Line 7 ‐ Transfer to Section B, Line 13 overleaf)123456789REASON FOR REDUCTION TO <strong>INCOME</strong>Every taxpayer is required, by law, to compute his estimated income and tax thereon during each year and pay such tax to theCollector of Taxes in four (4) equal instalments on or before the 15th March, 15th June, 15th September and 15th Decemberunless his only source of income is employment. Estimates should be based on the total income for the year immediatelypreceeding the year of assessment.Section B ‐ SOURCES <strong>OF</strong> <strong>INCOME</strong>Line 6 or 9 and 12 ‐ Chargeable or Investment and Gross Premium Income of immediately preceding yearEnter the amount filed/returned as Chargeable or Investment and Gross Premium Income (as the case may be) for thepreceeding year of assessment.Section C ‐ <strong>ESTIMATED</strong> <strong>INCOME</strong> <strong>TAX</strong> LIABILITYINSTRUCTIONSNOTESSection B1 ‐ Detail of Changes to Previous Year's Chargeable IncomeLine 1 or 4 and 7 ‐ Income arising for the first time in current yearEnter total value of any expected new source of income and/or any increase in current source(s) of income.Line 2, 5 and 8 ‐ Reductions to ... Income of Previous Year of AssessmentEnter total value of reductions to income of the previous year of assessment. Any reduction MUST be supported with anexplanation in Section B1 above.Line 15 ‐ Tax on Estimated IncomeEnter the tax amount calculated on the Estimated Income subject to tax (Line 8). Note that the tax rate applicable is dependenton the entity type indicated at Line 5.Page 2 of 3

Organization Name<strong>ESTIMATED</strong> QUARTERLY <strong>TAX</strong> PAYMENT(VOUCHER 4)Due on or before 15th DecemberYear of Assessment2 0Taxpayer Registration NumberIT07AddressSignature(Apt. No., Street No. & Name, Postal Zone and Parish)DateEstimated Income Tax Payable$Income Tax Payment$Organization NameTO BE DETACHED <strong>AND</strong> VOUCHER SENT TO COLLECTOR <strong>OF</strong> <strong>TAX</strong>ES WITH PAYMENT<strong>ESTIMATED</strong> QUARTERLY <strong>TAX</strong> PAYMENT(VOUCHER 3)Due on or before 15th SeptemberYear of Assessment2 0Taxpayer Registration NumberIT07AddressSignature(Apt. No., Street No. & Name, Postal Zone and Parish)DateEstimated Income Tax Payable$Income Tax Payment$Organization NameTO BE DETACHED <strong>AND</strong> VOUCHER SENT TO COLLECTOR <strong>OF</strong> <strong>TAX</strong>ES WITH PAYMENT<strong>ESTIMATED</strong> QUARTERLY <strong>TAX</strong> PAYMENT(VOUCHER 2)Due on or before 15th JuneYear of Assessment2 0Taxpayer Registration NumberIT07AddressSignature(Apt. No., Street No. & Name, Postal Zone and Parish)DateEstimated Income Tax Payable$Income Tax Payment$Organization NameTO BE DETACHED <strong>AND</strong> VOUCHER SENT TO COLLECTOR <strong>OF</strong> <strong>TAX</strong>ES WITH PAYMENT<strong>ESTIMATED</strong> QUARTERLY <strong>TAX</strong> PAYMENT(VOUCHER 1)Due on or before 15th MarchYear of Assessment2 0Taxpayer Registration NumberIT07AddressSignature(Apt. No., Street No. & Name, Postal Zone and Parish)DatePage 3 of 3Estimated Income Tax Payable$Income Tax Payment$