Sample Residential Program Term Sheet

Sample Residential Program Term Sheet

Sample Residential Program Term Sheet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

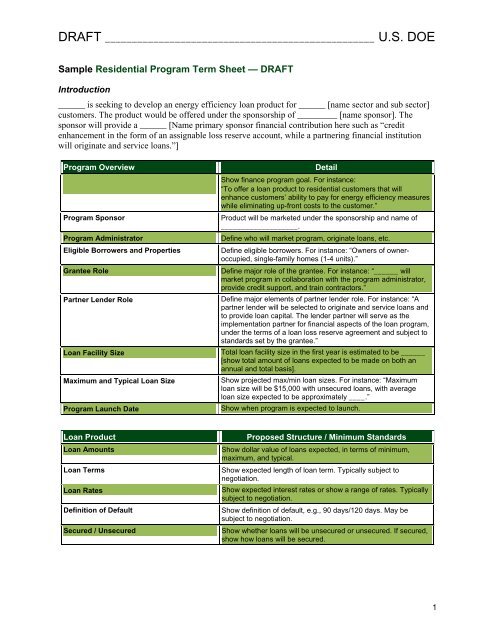

DRAFT __________________________________________________ U.S. DOE <strong>Sample</strong> <strong>Residential</strong> <strong>Program</strong> <strong>Term</strong> <strong>Sheet</strong> — DRAFTIntroduction______ is seeking to develop an energy efficiency loan product for ______ [name sector and sub sector]customers. The product would be offered under the sponsorship of _________ [name sponsor]. Thesponsor will provide a ______ [Name primary sponsor financial contribution here such as “creditenhancement in the form of an assignable loss reserve account, while a partnering financial institutionwill originate and service loans.”]<strong>Program</strong> OverviewDetail<strong>Program</strong> GoalShow finance program goal. For instance:“To offer a loan product to residential customers that willenhance customers’ ability to pay for energy efficiency measureswhile eliminating up-front costs to the customer.”<strong>Program</strong> SponsorProduct will be marketed under the sponsorship and name of___________________.<strong>Program</strong> AdministratorDefine who will market program, originate loans, etc.Eligible Borrowers and PropertiesDefine eligible borrowers. For instance: “Owners of owneroccupied,single-family homes (1-4 units).”Grantee RoleDefine major role of the grantee. For instance: “______ willmarket program in collaboration with the program administrator,provide credit support, and train contractors.”Partner Lender Role Define major elements of partner lender role. For instance: “Apartner lender will be selected to originate and service loans andto provide loan capital. The lender partner will serve as theimplementation partner for financial aspects of the loan program,under the terms of a loan loss reserve agreement and subject tostandards set by the grantee.”Loan Facility SizeTotal loan facility size in the first year is estimated to be ______[show total amount of loans expected to be made on both anannual and total basis].Maximum and Typical Loan SizeShow projected max/min loan sizes. For instance: “Maximumloan size will be $15,000 with unsecured loans, with averageloan size expected to be approximately ____.”<strong>Program</strong> Launch DateShow when program is expected to launch.Loan ProductLoan AmountsLoan <strong>Term</strong>sLoan RatesDefinition of DefaultSecured / UnsecuredProposed Structure / Minimum StandardsShow dollar value of loans expected, in terms of minimum,maximum, and typical.Show expected length of loan term. Typically subject tonegotiation.Show expected interest rates or show a range of rates. Typicallysubject to negotiation.Show definition of default, e.g., 90 days/120 days. May besubject to negotiation.Show whether loans will be unsecured or unsecured. If secured,show how loans will be secured.1

DRAFT __________________________________________________ U.S. DOE Loan ProductEligible MeasuresEligible BorrowersProposed Structure / Minimum StandardsEnergy efficiency measures include__________. For instance:“Measures as defined through an energy audit” or “specificmeasures such as duct sealing, air sealing, attic insulation, highefficiency replacement heating and cooling equipment. Forelectric utilities also include shade screens.”Define eligible borrowers. For instance: “<strong>Residential</strong>homeowners” or “Small commercial entities as defined by ___.”Underwriting StandardsUnderwriting ProcedureMinimum FICOForeclosure / RepossessionUnpaid Collection Accounts, Judgments,Tax LiensIncome Verification RequiredDefine desired characteristic of underwriting. For instance:“Underwriting to take place quickly, with a goal of conditionalapproval within 1 to 2 hours of application.”Define a minimum FICO credit score that the sponsor would liketo see. For instance: “640 FICO or better.”Define foreclosure/repossession as related to borrowerqualification.Define. For instance: “No unpaid collection accounts, judgments,or liens outstanding allowed.”Define whether income needs be verified and under whatcircumstances.Debt-to-Income Ratio Define acceptable debt-to-income ratios. For instance: “50%debt-to-income ratio or better.”Sources of Capital and CreditEnhancementsCredit Enhancement StructureLoss Reserve SegregationDetailsIf program is based on a credit enhancement, define that creditenhancement. For instance: “A loan loss reserve in the amountof ___% of the value of either the outstanding loans or the loancommitment will be provided to a participating lender, andavailable to that lender subject to the terms established in aLoan Loss Reserve (LRF) Agreement. This LRF Agreementshall specify underwriting standards, definitions of default,collection methods, and other related requirements. The lenderwill be authorized to withdraw ___% of the value of an individualdefaulted loan after payment is ___ days late.”If program is based on a loss reserve, define the trackingmechanism and who holds that loss reserve. For instance:“Loss reserve to be held in an interest-bearing account at theparticipating financial institution.”Loan Product Marketing andContractor NetworkMarketingContractor NetworkMarketing MaterialsDetailsDefine who will market the product. For instance: “Loan productto be marketed through a network of contractors who will betrained on loan product features.”Contractor network to be trained and monitored by ________.Define who will be responsible for marketing the program. Forinstance: “Sponsor to develop and assist in development ofmarketing materials to be provided by contractors.”2