Preventing Alcohol-related Harm in Australia - Department of Health

Preventing Alcohol-related Harm in Australia - Department of Health

Preventing Alcohol-related Harm in Australia - Department of Health

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

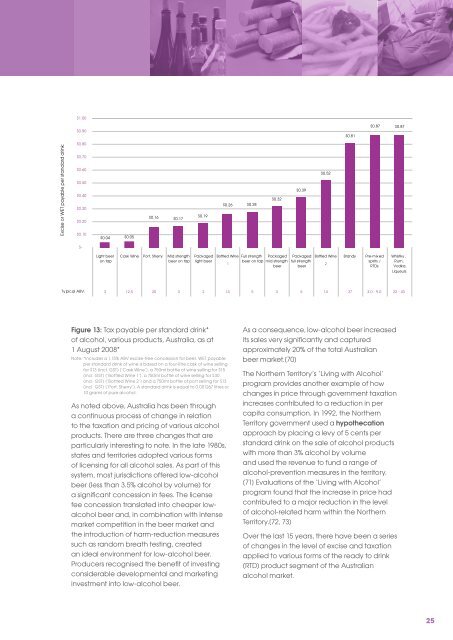

$1.00$0.90$0.81$0.87$0.87Excise or WET payable per standard dr<strong>in</strong>k:$0.80$0.70$0.60$0.50$0.40$0.30$0.20$0.10$0.04$0.05$0.16$0.17$0.19$0.26$0.28$0.32$0.39$0.52$-Light beeron tapCask W<strong>in</strong>e Port, Sherry Mid strengthbeer on tapPackagedlight beerBottled W<strong>in</strong>e1Full strengthbeer on tapPackagedmid strengthbeerPackagedfull strengthbeerBottled W<strong>in</strong>e2BrandyPre-mixedspirits /RTDsWhistky,Rum,Vodka,LiqueursTypical ABV:2 12.5 20 3 2 14 5 3 5 14 37 3.0 - 9.0 22 - 43Figure 13: Tax payable per standard dr<strong>in</strong>k*<strong>of</strong> alcohol, various products, <strong>Australia</strong>, as at1 August 2008*Note: *Includes a 1.15% ABV excise-free concession for beer. WET payableper standard dr<strong>in</strong>k <strong>of</strong> w<strong>in</strong>e is based on a four-litre cask <strong>of</strong> w<strong>in</strong>e sell<strong>in</strong>gfor $13 (<strong>in</strong>cl. GST) [‘Cask W<strong>in</strong>e’], a 750ml bottle <strong>of</strong> w<strong>in</strong>e sell<strong>in</strong>g for $15(<strong>in</strong>cl. GST) [‘Bottled W<strong>in</strong>e 1’], a 750ml bottle <strong>of</strong> w<strong>in</strong>e sell<strong>in</strong>g for $30(<strong>in</strong>cl. GST) [‘Bottled W<strong>in</strong>e 2’] and a 750ml bottle <strong>of</strong> port sell<strong>in</strong>g for $13(<strong>in</strong>cl. GST) [‘Port, Sherry’]. A standard dr<strong>in</strong>k is equal to 0.001267 litres or10 grams <strong>of</strong> pure alcohol.As noted above, <strong>Australia</strong> has been througha cont<strong>in</strong>uous process <strong>of</strong> change <strong>in</strong> relationto the taxation and pric<strong>in</strong>g <strong>of</strong> various alcoholproducts. There are three changes that areparticularly <strong>in</strong>terest<strong>in</strong>g to note. In the late 1980s,states and territories adopted various forms<strong>of</strong> licens<strong>in</strong>g for all alcohol sales. As part <strong>of</strong> thissystem, most jurisdictions <strong>of</strong>fered low-alcoholbeer (less than 3.5% alcohol by volume) fora significant concession <strong>in</strong> fees. The licensefee concession translated <strong>in</strong>to cheaper lowalcoholbeer and, <strong>in</strong> comb<strong>in</strong>ation with <strong>in</strong>tensemarket competition <strong>in</strong> the beer market andthe <strong>in</strong>troduction <strong>of</strong> harm-reduction measuressuch as random breath test<strong>in</strong>g, createdan ideal environment for low-alcohol beer.Producers recognised the benefit <strong>of</strong> <strong>in</strong>vest<strong>in</strong>gconsiderable developmental and market<strong>in</strong>g<strong>in</strong>vestment <strong>in</strong>to low-alcohol beer.As a consequence, low-alcohol beer <strong>in</strong>creasedits sales very significantly and capturedapproximately 20% <strong>of</strong> the total <strong>Australia</strong>nbeer market.[70]The Northern Territory’s ‘Liv<strong>in</strong>g with <strong>Alcohol</strong>’program provides another example <strong>of</strong> howchanges <strong>in</strong> price through government taxation<strong>in</strong>creases contributed to a reduction <strong>in</strong> percapita consumption. In 1992, the NorthernTerritory government used a hypothecationapproach by plac<strong>in</strong>g a levy <strong>of</strong> 5 cents perstandard dr<strong>in</strong>k on the sale <strong>of</strong> alcohol productswith more than 3% alcohol by volumeand used the revenue to fund a range <strong>of</strong>alcohol-prevention measures <strong>in</strong> the territory.[71] Evaluations <strong>of</strong> the ‘Liv<strong>in</strong>g with <strong>Alcohol</strong>’program found that the <strong>in</strong>crease <strong>in</strong> price hadcontributed to a major reduction <strong>in</strong> the level<strong>of</strong> alcohol-<strong>related</strong> harm with<strong>in</strong> the NorthernTerritory.[72, 73]Over the last 15 years, there have been a series<strong>of</strong> changes <strong>in</strong> the level <strong>of</strong> excise and taxationapplied to various forms <strong>of</strong> the ready to dr<strong>in</strong>k(RTD) product segment <strong>of</strong> the <strong>Australia</strong>nalcohol market.25