INTERMEDIATE FINANCIALS and ACCOUNTING RED FLAGS

INTERMEDIATE FINANCIALS and ACCOUNTING RED FLAGS

INTERMEDIATE FINANCIALS and ACCOUNTING RED FLAGS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

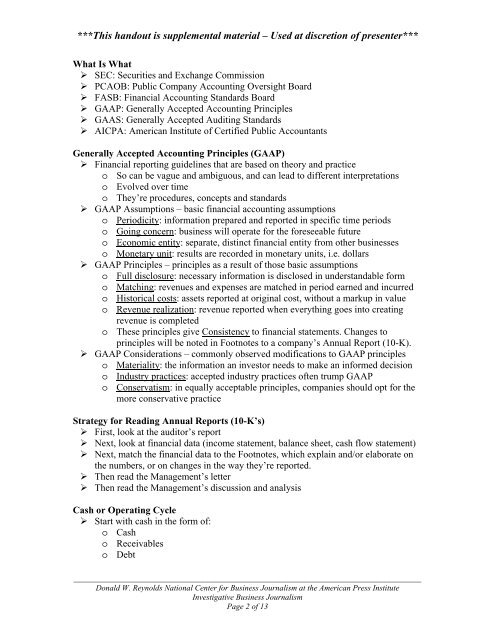

***This h<strong>and</strong>out is supplemental material – Used at discretion of presenter***What Is What‣ SEC: Securities <strong>and</strong> Exchange Commission‣ PCAOB: Public Company Accounting Oversight Board‣ FASB: Financial Accounting St<strong>and</strong>ards Board‣ GAAP: Generally Accepted Accounting Principles‣ GAAS: Generally Accepted Auditing St<strong>and</strong>ards‣ AICPA: American Institute of Certified Public AccountantsGenerally Accepted Accounting Principles (GAAP)‣ Financial reporting guidelines that are based on theory <strong>and</strong> practiceo So can be vague <strong>and</strong> ambiguous, <strong>and</strong> can lead to different interpretationso Evolved over timeo They’re procedures, concepts <strong>and</strong> st<strong>and</strong>ards‣ GAAP Assumptions – basic financial accounting assumptionso Periodicity: information prepared <strong>and</strong> reported in specific time periodso Going concern: business will operate for the foreseeable futureo Economic entity: separate, distinct financial entity from other businesseso Monetary unit: results are recorded in monetary units, i.e. dollars‣ GAAP Principles – principles as a result of those basic assumptionso Full disclosure: necessary information is disclosed in underst<strong>and</strong>able formo Matching: revenues <strong>and</strong> expenses are matched in period earned <strong>and</strong> incurredo Historical costs: assets reported at original cost, without a markup in valueo Revenue realization: revenue reported when everything goes into creatingrevenue is completedo These principles give Consistency to financial statements. Changes toprinciples will be noted in Footnotes to a company’s Annual Report (10-K).‣ GAAP Considerations – commonly observed modifications to GAAP principleso Materiality: the information an investor needs to make an informed decisiono Industry practices: accepted industry practices often trump GAAPo Conservatism: in equally acceptable principles, companies should opt for themore conservative practiceStrategy for Reading Annual Reports (10-K’s)‣ First, look at the auditor’s report‣ Next, look at financial data (income statement, balance sheet, cash flow statement)‣ Next, match the financial data to the Footnotes, which explain <strong>and</strong>/or elaborate onthe numbers, or on changes in the way they’re reported.‣ Then read the Management’s letter‣ Then read the Management’s discussion <strong>and</strong> analysisCash or Operating Cycle‣ Start with cash in the form of:o Casho Receivableso Debt______________________________________________________________________________________Donald W. Reynolds National Center for Business Journalism at the American Press InstituteInvestigative Business JournalismPage 2 of 13