2010 IRS Form 990 - Gator Boosters, Inc.

2010 IRS Form 990 - Gator Boosters, Inc.

2010 IRS Form 990 - Gator Boosters, Inc.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

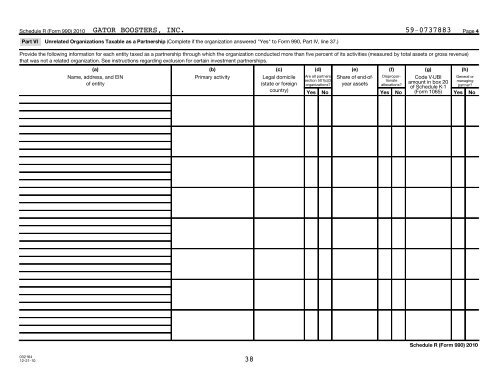

Schedule R (<strong>Form</strong> <strong>990</strong>) <strong>2010</strong>GATOR BOOSTERS, INC. 59-0737883Page 4Part VIUnrelated Organizations Taxable as a Partnership (Complete if the organization answered "Yes" to <strong>Form</strong> <strong>990</strong>, Part IV, line 37.)Provide the following information for each entity taxed as a partnership through which the organization conducted more than five percent of its activities (measured by total assets or gross revenue)that was not a related organization. See instructions regarding exclusion for certain investment partnerships.(a) (b) (c) (d) (e) (f) (g) (h)Name, address, and EINof entityPrimary activityLegal domicile(state or foreigncountry)Are all partners Share of end-ofyearassetsamount in box 20DisproportionatemanagingCode V-UBI General orsection 501(c)(3)organizations?allocations?partner?of Schedule K-1Yes No Yes No (<strong>Form</strong> 1065) Yes NoSchedule R (<strong>Form</strong> <strong>990</strong>) <strong>2010</strong>03216412-21-1038