2010 IRS Form 990 - Gator Boosters, Inc.

2010 IRS Form 990 - Gator Boosters, Inc.

2010 IRS Form 990 - Gator Boosters, Inc.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

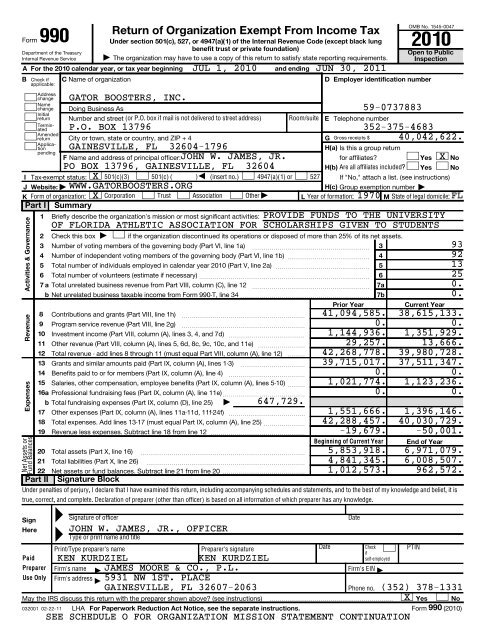

<strong>Form</strong>Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lungbenefit trust or private foundation)Department of the TreasuryInternal Revenue Service | The organization may have to use a copy of this return to satisfy state reporting requirements.A For the <strong>2010</strong> calendar year, or tax year beginning JUL 1, <strong>2010</strong> and ending JUN 30, 2011OMB No. 1545-0047Open to PublicInspectionB Check if C Name of organizationD Employer identification numberapplicable:AddresschangeNamechangeGATOR BOOSTERS, INC.Doing Business As59-0737883Initialreturn Number and street (or P.O. box if mail is not delivered to street address) Room/suite E Telephone numberTerminatedP.O. BOX 13796 352-375-4683Amendedreturn City or town, state or country, and ZIP + 4G Gross receipts $ 40,042,622.ApplicationGAINESVILLE, FL 32604-1796H(a) Is this a group returnpendingF Name and address of principal officer: JOHN W. JAMES, JR.for affiliates?Yes X NoPO BOX 13796, GAINESVILLE, FL 32604H(b) Are all affiliates included? Yes NoI Tax-exempt status: X 501(c)(3) 501(c) ( )§(insert no.) 4947(a)(1) or 527 If "No," attach a list. (see instructions)J Website: | WWW.GATORBOOSTERS.ORGH(c) Group exemption number |K <strong>Form</strong> of organization: X Corporation Trust Association Other |L Year of formation: 1970 M State of legal domicile: FLPart I Summary1 Briefly describe the organization’s mission or most significant activities: PROVIDE FUNDS TO THE UNIVERSITYOF FLORIDA ATHLETIC ASSOCIATION FOR SCHOLARSHIPS GIVEN TO STUDENTSActivities & GovernanceRevenueExpensesNet Assets orFund BalancesSignHereReturn of Organization Exempt From <strong>Inc</strong>ome Tax<strong>990</strong> <strong>2010</strong>2345689101112131415Check this box|if the organization discontinued its operations or disposed of more than 25% of its net assets.Number of voting members of the governing body (Part VI, line 1a)Number of independent voting members of the governing body (Part VI, line 1b) ~~~~~~~~~~~~~~Total number of individuals employed in calendar year <strong>2010</strong> (Part V, line 2a) ~~~~~~~~~~~~~~~~b Net unrelated business taxable income from <strong>Form</strong> <strong>990</strong>-T, line 34 16aProfessional fundraising fees (Part IX, column (A), line 11e) ~~~~~~~~~~~~~~b Total fundraising expenses (Part IX, column (D), line 25) | 647,729.true, correct, and complete. Declaration of preparer (other than officer) is based on all information of which preparer has any knowledge.Signature of officerJOHN W. JAMES, JR., OFFICERType or print name and title~~~~~~~~~~~~~~~~~~~~Total number of volunteers (estimate if necessary) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~7 a Total unrelated business revenue from Part VIII, column (C), line 12 ~~~~~~~~~~~~~~~~~~~~Contributions and grants (Part VIII, line 1h) ~~~~~~~~~~~~~~~~~~~~~Program service revenue (Part VIII, line 2g) ~~~~~~~~~~~~~~~~~~~~~Investment income (Part VIII, column (A), lines 3, 4, and 7d) ~~~~~~~~~~~~~Other revenue (Part VIII, column (A), lines 5, 6d, 8c, 9c, 10c, and 11e) ~~~~~~~~Total revenue - add lines 8 through 11 (must equal Part VIII, column (A), line 12) Grants and similar amounts paid (Part IX, column (A), lines 1-3)Benefits paid to or for members (Part IX, column (A), line 4)~~~~~~~~~~~~~~~~~~~~~~~~Salaries, other compensation, employee benefits (Part IX, column (A), lines 5-10) ~~~==34567a7bPrior YearCurrent Year41,094,585. 38,615,133.0. 0.1,144,936. 1,351,929.29,257. 13,666.42,268,778. 39,980,728.39,715,017. 37,511,347.0. 0.1,021,774. 1,123,236.0. 0.17 Other expenses (Part IX, column (A), lines 11a-11d, 11f-24f) ~~~~~~~~~~~~~ 1,551,666. 1,396,146.18 Total expenses. Add lines 13-17 (must equal Part IX, column (A), line 25) ~~~~~~~ 42,288,457. 40,030,729.19 Revenue less expenses. Subtract line 18 from line 12 -19,679. -50,001.Beginning of Current Year End of Year20 Total assets (Part X, line 16) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 5,853,918. 6,971,079.21 Total liabilities (Part X, line 26) ~~~~~~~~~~~~~~~~~~~~~~~~~~~ 4,841,345. 6,008,507.22 Net assets or fund balances. Subtract line 21 from line 20 1,012,573. 962,572.Part II Signature BlockUnder penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it isCheckPrint/Type preparer’s namePreparer’s signatureDatePTINifPaid KEN KURDZIELKEN KURDZIELself-employedPreparer Firm’s name JAMES MOORE & CO., P.L.Firm’s EINUse Only Firm’s address 5931 NW 1ST. PLACE99 GAINESVILLE, FL 32607-2063 Phone no. (352) 378-1331May the <strong>IRS</strong> discuss this return with the preparer shown above? (see instructions) X Yes No032001 02-22-11 LHA For Paperwork Reduction Act Notice, see the separate instructions.<strong>Form</strong> <strong>990</strong> (<strong>2010</strong>)SEE SCHEDULE O FOR ORGANIZATION MISSION STATEMENT CONTINUATIONDate939213250.0.

<strong>Form</strong> <strong>990</strong> (<strong>2010</strong>)GATOR BOOSTERS, INC. 59-0737883Part III Statement of Program Service Accomplishments12344aCheck if Schedule O contains a response to any question in this Part III Briefly describe the organization’s mission:THE MISSION OF GATOR BOOSTERS, INC. IS TO STRENGTHEN THE UNIVERSITY OFFLORIDA’S ATHLETIC PROGRAM BY ENCOURAGING PRIVATE GIVING AND VOLUNTEERLEADERSHIP FROM GATORS EVERYWHERE IN STRICT COMPLIANCE WITH THE RULESAND REGULATIONS OF THE NATIONAL COLLEGIATE ATHLETIC ASSOCIATION.Did the organization undertake any significant program services during the year which were not listed onthe prior <strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ?If "Yes," describe these new services on Schedule O.~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization cease conducting, or make significant changes in how it conducts, any program services? ~~~~~~If "Yes," describe these changes on Schedule O.Describe the exempt purpose achievements for each of the organization’s three largest program services by expenses.Section 501(c)(3) and 501(c)(4) organizations and section 4947(a)(1) trusts are required to report the amount of grants andYesYesPage 2allocations to others, the total expenses, and revenue, if any, for each program service reported.(Code: ) (Expenses $ 12,230,040. including grants of $ 11,823,991. ) (Revenue $ )PROVIDE FUNDS TO THE UNIVERSITY OF FLORIDA ATHLETIC ASSOCIATION FORSCHOLARSHIPS GIVEN TO STUDENTS WHO PARTICIPATE IN THE ATHLETIC PROGRAMSAT THE UNIVERSITY AND TO PROVIDE FUNDS TO THE UNIVERSITY OF FLORIDAFOUNDATION FOR ENDOWMENTS. IN TOTAL THERE WERE 463 STUDENT ATHLETESAND MANAGERS THAT WERE PROVIDED WITH SCHOLARSHIPS FROM THE ATHLETICASSOCIATION.XXNoNo4b(Code: ) (Expenses $ 26,569,488. including grants of $ 25,687,356. ) (Revenue $ )PROVIDE FUNDS TO THE UNIVERSITY OF FLORIDA ATHLETIC ASSOCIATION FORCAPITAL IMPROVEMENTS TO FACILITIES USED BY STUDENTS ENROLLED AT THEUNIVERSITY OF FLORIDA. THERE WERE 7 CAPITAL PROJECTS THAT WERE FUNDEDIN THE CURRENT YEAR. FOOTBALL STADIUM PROJECT, LACROSSE COMPLEX,FOOTBALL SCOREBOARD, BASKETBALL PRACTICE FACILITY, UAA ADMINISTRATIVEOFFICES, GOLF COURSE AND THE HEISMAN TROPHY STATUES PROJECT.4c(Code: ) (Expenses $ including grants of $ ) (Revenue $ )4d4e03200212-21-10Other program services. (Describe in Schedule O.)(Expenses $ including grants of $ ) (Revenue $ )Total program service expenses J 38,799,528.<strong>Form</strong> <strong>990</strong> (<strong>2010</strong>)216080503 789407 500381 <strong>2010</strong>.05090 GATOR BOOSTERS, INC. 500381_1

<strong>Form</strong> <strong>990</strong> (<strong>2010</strong>)GATOR BOOSTERS, INC. 59-0737883Part IV Checklist of Required Schedules123456789101112a131516171819abcdefbb20abIs the organization described in section 501(c)(3) or 4947(a)(1) (other than a private foundation)?If "Yes," complete Schedule A~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Is the organization required to complete Schedule B, Schedule of Contributors? ~~~~~~~~~~~~~~~~~~~~~~Did the organization engage in direct or indirect political campaign activities on behalf of or in opposition to candidates forpublic office? If "Yes," complete Schedule C, Part I ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Section 501(c)(3) organizations. Did the organization engage in lobbying activities, or have a section 501(h) election in effectduring the tax year? If "Yes," complete Schedule C, Part II ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Is the organization a section 501(c)(4), 501(c)(5), or 501(c)(6) organization that receives membership dues, assessments, orsimilar amounts as defined in Revenue Procedure 98-19? If "Yes," complete Schedule C, Part III ~~~~~~~~~~~~~~Did the organization maintain any donor advised funds or any similar funds or accounts where donors have the right toprovide advice on the distribution or investment of amounts in such funds or accounts? If "Yes," complete Schedule D, Part IDid the organization receive or hold a conservation easement, including easements to preserve open space,the environment, historic land areas, or historic structures? If "Yes," complete Schedule D, Part II~~~~~~~~~~~~~~Did the organization maintain collections of works of art, historical treasures, or other similar assets? If "Yes," completeSchedule D, Part III ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization report an amount in Part X, line 21; serve as a custodian for amounts not listed in Part X; or providecredit counseling, debt management, credit repair, or debt negotiation services? If "Yes," complete Schedule D, Part IV ~~Did the organization, directly or through a related organization, hold assets in term, permanent, or quasi-endowments?If "Yes," complete Schedule D, Part V ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~If the organization’s answer to any of the following questions is "Yes," then complete Schedule D, Parts VI, VII, VIII, IX, or Xas applicable.Did the organization report an amount for land, buildings, and equipment in Part X, line 10? If "Yes," complete Schedule D,Part VI ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization report an amount for investments - other securities in Part X, line 12 that is 5% or more of its totalassets reported in Part X, line 16? If "Yes," complete Schedule D, Part VII ~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization report an amount for investments - program related in Part X, line 13 that is 5% or more of its totalassets reported in Part X, line 16? If "Yes," complete Schedule D, Part VIII ~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization report an amount for other assets in Part X, line 15 that is 5% or more of its total assets reported inPart X, line 16? If "Yes," complete Schedule D, Part IX ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization report an amount for other liabilities in Part X, line 25? If "Yes," complete Schedule D, Part X ~~~~~~Did the organization’s separate or consolidated financial statements for the tax year include a footnote that addressesthe organization’s liability for uncertain tax positions under FIN 48 (ASC 740)? If "Yes," complete Schedule D, Part X ~~~~Did the organization obtain separate, independent audited financial statements for the tax year? If "Yes," completeSchedule D, Parts XI, XII, and XIII ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Was the organization included in consolidated, independent audited financial statements for the tax year?If "Yes," and if the organization answered "No" to line 12a, then completing Schedule D, Parts XI, XII, and XIII is optional~~~Is the organization a school described in section 170(b)(1)(A)(ii)? If "Yes," complete Schedule E ~~~~~~~~~~~~~~14aDid the organization maintain an office, employees, or agents outside of the United States? ~~~~~~~~~~~~~~~~Did the organization have aggregate revenues or expenses of more than $10,000 from grantmaking, fundraising, business,and program service activities outside the United States? If "Yes," complete Schedule F, Parts I and IV~~~~~~~~~~~Did the organization report on Part IX, column (A), line 3, more than $5,000 of grants or assistance to any organizationor entity located outside the United States? If "Yes," complete Schedule F, Parts II and IV ~~~~~~~~~~~~~~~~~Did the organization report on Part IX, column (A), line 3, more than $5,000 of aggregate grants or assistance to individualslocated outside the United States? If "Yes," complete Schedule F, Parts III and IV ~~~~~~~~~~~~~~~~~~~~~Did the organization report a total of more than $15,000 of expenses for professional fundraising services on Part IX,column (A), lines 6 and 11e? If "Yes," complete Schedule G, Part I ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization report more than $15,000 total of fundraising event gross income and contributions on Part VIII, lines1c and 8a? If "Yes," complete Schedule G, Part II ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization report more than $15,000 of gross income from gaming activities on Part VIII, line 9a? If "Yes,"complete Schedule G, Part III ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization operate one or more hospitals? If "Yes," complete Schedule H ~~~~~~~~~~~~~~~~~~~~If "Yes" to line 20a, did the organization attach its audited financial statements to this return? Note. Some <strong>Form</strong> <strong>990</strong> filers thatoperate one or more hospitals must attach audited financial statements (see instructions) 1234567891011a11b11c11d11e11f12a12b1314a14b151617181920aYesXXXXXXXXPage 3NoXXXXXXXXXXXXXXXXXX20b<strong>Form</strong> <strong>990</strong> (<strong>2010</strong>)03200312-21-10316080503 789407 500381 <strong>2010</strong>.05090 GATOR BOOSTERS, INC. 500381_1

<strong>Form</strong> <strong>990</strong> (<strong>2010</strong>)GATOR BOOSTERS, INC. 59-0737883Part IV Checklist of Required Schedules (continued)21222324a26272829303132333435363738bcd25aSection 501(c)(3) and 501(c)(4) organizations. Did the organization engage in an excess benefit transaction with adisqualified person during the year? If "Yes," complete Schedule L, Part I ~~~~~~~~~~~~~~~~~~~~~~~~~babcaDid the organization report more than $5,000 of grants and other assistance to governments and organizations in theUnited States on Part IX, column (A), line 1? If "Yes," complete Schedule I, Parts I and II ~~~~~~~~~~~~~~~~~~Did the organization report more than $5,000 of grants and other assistance to individuals in the United States on Part IX,column (A), line 2? If "Yes," complete Schedule I, Parts I and III ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization answer "Yes" to Part VII, Section A, line 3, 4, or 5 about compensation of the organization’s currentand former officers, directors, trustees, key employees, and highest compensated employees? If "Yes," completeSchedule J ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization have a tax-exempt bond issue with an outstanding principal amount of more than $100,000 as of thelast day of the year, that was issued after December 31, 2002? If "Yes," answer lines 24b through 24d and completeSchedule K. If "No", go to line 25 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization invest any proceeds of tax-exempt bonds beyond a temporary period exception? ~~~~~~~~~~~Did the organization maintain an escrow account other than a refunding escrow at any time during the year to defeaseany tax-exempt bonds? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization act as an "on behalf of" issuer for bonds outstanding at any time during the year? ~~~~~~~~~~~Is the organization aware that it engaged in an excess benefit transaction with a disqualified person in a prior year, andthat the transaction has not been reported on any of the organization’s prior <strong>Form</strong>s <strong>990</strong> or <strong>990</strong>-EZ? If "Yes," completeSchedule L, Part I ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Was a loan to or by a current or former officer, director, trustee, key employee, highly compensated employee, or disqualifiedperson outstanding as of the end of the organization’s tax year? If "Yes," complete Schedule L, Part II ~~~~~~~~~~~Did the organization provide a grant or other assistance to an officer, director, trustee, key employee, substantialcontributor, or a grant selection committee member, or to a person related to such an individual? If "Yes," completeSchedule L, Part III ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Was the organization a party to a business transaction with one of the following parties (see Schedule L, Part IVinstructions for applicable filing thresholds, conditions, and exceptions):A current or former officer, director, trustee, or key employee? If "Yes," complete Schedule L, Part IV ~~~~~~~~~~~A family member of a current or former officer, director, trustee, or key employee? If "Yes," complete Schedule L, Part IV ~~An entity of which a current or former officer, director, trustee, or key employee (or a family member thereof) was an officer,director, trustee, or direct or indirect owner? If "Yes," complete Schedule L, Part IV~~~~~~~~~~~~~~~~~~~~~Did the organization receive more than $25,000 in non-cash contributions? If "Yes," complete Schedule M ~~~~~~~~~Did the organization receive contributions of art, historical treasures, or other similar assets, or qualified conservationcontributions? If "Yes," complete Schedule M ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization liquidate, terminate, or dissolve and cease operations?If "Yes," complete Schedule N, Part I ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization sell, exchange, dispose of, or transfer more than 25% of its net assets? If "Yes," completeSchedule N, Part II ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization own 100% of an entity disregarded as separate from the organization under Regulationssections 301.7701-2 and 301.7701-3? If "Yes," complete Schedule R, Part I ~~~~~~~~~~~~~~~~~~~~~~~~Was the organization related to any tax-exempt or taxable entity?If "Yes," complete Schedule R, Parts II, III, IV, and V, line 1 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Is any related organization a controlled entity within the meaning of section 512(b)(13)?~~~~~~~~~~~~~~~~~~Did the organization receive any payment from or engage in any transaction with a controlled entity within the meaning ofsection 512(b)(13)? If "Yes," complete Schedule R, Part V, line 2 ~~~~~~~~~~~~~~~~~~~~ Yes XSection 501(c)(3) organizations. Did the organization make any transfers to an exempt non-charitable related organization?If "Yes," complete Schedule R, Part V, line 2 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization conduct more than 5% of its activities through an entity that is not a related organizationand that is treated as a partnership for federal income tax purposes? If "Yes," complete Schedule R, Part VI ~~~~~~~~Did the organization complete Schedule O and provide explanations in Schedule O for Part VI, lines 11 and 19?Note. All <strong>Form</strong> <strong>990</strong> filers are required to complete Schedule O No21222324a24b24c24d25a25b262728a28b28c293031323334353637YesXXXPage 4NoXXXXXXXXXXXXXXXXX38 X<strong>Form</strong> <strong>990</strong> (<strong>2010</strong>)03200412-21-10416080503 789407 500381 <strong>2010</strong>.05090 GATOR BOOSTERS, INC. 500381_1

<strong>Form</strong> <strong>990</strong> (<strong>2010</strong>)GATOR BOOSTERS, INC. 59-0737883 Page 5Part V Statements Regarding Other <strong>IRS</strong> Filings and Tax ComplianceCheck if Schedule O contains a response to any question in this Part V 1aEnter the number reported in Box 3 of <strong>Form</strong> 1096. Enter -0- if not applicable ~~~~~~~~~~~bcb3abbbcb03200512-21-10Enter the number of <strong>Form</strong>s W-2G included in line 1a. Enter -0- if not applicable ~~~~~~~~~~ 1bDid the organization comply with backup withholding rules for reportable payments to vendors and reportable gamingIf at least one is reported on line 2a, did the organization file all required federal employment tax returns? ~~~~~~~~~~Note. If the sum of lines 1a and 2a is greater than 250, you may be required to e-file. (see instructions)7 Organizations that may receive deductible contributions under section 170(c).a Did the organization receive a payment in excess of $75 made partly as a contribution and partly for goods and services provided to the payor?bcdefgh If the organization received a contribution of cars, boats, airplanes, or other vehicles, did the organization file a <strong>Form</strong> 1098-C?8 Sponsoring organizations maintaining donor advised funds and section 509(a)(3) supporting organizations. Did the supportingorganization, or a donor advised fund maintained by a sponsoring organization, have excess business holdings at any time during the year?9101113abababb14aSponsoring organizations maintaining donor advised funds.Section 501(c)(7) organizations. Enter:Section 501(c)(12) organizations. Enter:12aSection 4947(a)(1) non-exempt charitable trusts. Is the organization filing <strong>Form</strong> <strong>990</strong> in lieu of <strong>Form</strong> 1041?abcb(gambling) winnings to prize winners? 2aEnter the number of employees reported on <strong>Form</strong> W-3, Transmittal of Wage and Tax Statements,filed for the calendar year ending with or within the year covered by this return ~~~~~~~~~~Did the organization have unrelated business gross income of $1,000 or more during the year? ~~~~~~~~~~~~~~If "Yes," has it filed a <strong>Form</strong> <strong>990</strong>-T for this year? If "No," provide an explanation in Schedule O ~~~~~~~~~~~~~~~4aAt any time during the calendar year, did the organization have an interest in, or a signature or other authority over, afinancial account in a foreign country (such as a bank account, securities account, or other financial account)?~~~~~~~If "Yes," enter the name of the foreign country: JSee instructions for filing requirements for <strong>Form</strong> TD F 90-22.1, Report of Foreign Bank and Financial Accounts.5aWas the organization a party to a prohibited tax shelter transaction at any time during the tax year? ~~~~~~~~~~~~Did any taxable party notify the organization that it was or is a party to a prohibited tax shelter transaction? ~~~~~~~~~If "Yes," to line 5a or 5b, did the organization file <strong>Form</strong> 8886-T? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~6aDoes the organization have annual gross receipts that are normally greater than $100,000, and did the organization solicitany contributions that were not tax deductible? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~If "Yes," did the organization include with every solicitation an express statement that such contributions or giftswere not tax deductible? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~If "Yes," did the organization notify the donor of the value of the goods or services provided?Did the organization sell, exchange, or otherwise dispose of tangible personal property for which it was requiredto file <strong>Form</strong> 8282?Section 501(c)(29) qualified nonprofit health insurance issuers.Note. See the instructions for additional information the organization must report on Schedule O.Did the organization receive any payments for indoor tanning services during the tax year? ~~~~~~~~~~~~~~~~If "Yes," has it filed a <strong>Form</strong> 720 to report these payments? If "No," provide an explanation in Schedule O 1a2a~~~~~~~~~~~~~~~If "Yes," indicate the number of <strong>Form</strong>s 8282 filed during the year~~~~~~~~~~~~~~~~Did the organization receive any funds, directly or indirectly, to pay premiums on a personal benefit contract?Did the organization, during the year, pay premiums, directly or indirectly, on a personal benefit contract?7d10a10b11a11b12b13b13c~~~~~~~~~~~~~~~~If the organization received a contribution of qualified intellectual property, did the organization file <strong>Form</strong> 8899 as required? ~Did the organization make any taxable distributions under section 4966? ~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization make a distribution to a donor, donor advisor, or related person? ~~~~~~~~~~~~~~~~~~~Initiation fees and capital contributions included on Part VIII, line 12 ~~~~~~~~~~~~~~~Gross receipts, included on <strong>Form</strong> <strong>990</strong>, Part VIII, line 12, for public use of club facilities ~~~~~~Gross income from members or shareholders ~~~~~~~~~~~~~~~~~~~~~~~~~~Gross income from other sources (Do not net amounts due or paid to other sources againstamounts due or received from them.) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~If "Yes," enter the amount of tax-exempt interest received or accrued during the yearIs the organization licensed to issue qualified health plans in more than one state? ~~~~~~~~~~~~~~~~~~~~~Enter the amount of reserves the organization is required to maintain by the states in which theorganization is licensed to issue qualified health plans ~~~~~~~~~~~~~~~~~~~~~~Enter the amount of reserves on hand ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~140131c2b3a3b4a5a5b5c6a6b7a7b7c7e7f7g7h89a9b12a13a14aYesXXXXNoXXXXXXXXX14b<strong>Form</strong> <strong>990</strong> (<strong>2010</strong>)516080503 789407 500381 <strong>2010</strong>.05090 GATOR BOOSTERS, INC. 500381_1

<strong>Form</strong> <strong>990</strong> (<strong>2010</strong>)GATOR BOOSTERS, INC. 59-0737883 Page 6Part VI Governance, Management, and Disclosure For each "Yes" response to lines 2 through 7b below, and for a "No" responseto line 8a, 8b, or 10b below, describe the circumstances, processes, or changes in Schedule O. See instructions.Check if Schedule O contains a response to any question in this Part VI Section A. Governing Body and ManagementYes1aEnter the number of voting members of the governing body at the end of the tax year ~~~~~~ 1a93b Enter the number of voting members included in line 1a, above, who are independent ~~~~~~ 1b92234568bab9 Is there any officer, director, trustee, or key employee listed in Part VII, Section A, who cannot be reached at theorganization’s mailing address? If "Yes," provide the names and addresses in Schedule O Section B. Policies (This Section B requests information about policies not required by the Internal Revenue Code.)bb12a131415bcab16abexempt status with respect to such arrangements? Section C. Disclosure17 List the states with which a copy of this <strong>Form</strong> <strong>990</strong> is required to be filed J NONE1819Did any officer, director, trustee, or key employee have a family relationship or a business relationship with any otherofficer, director, trustee, or key employee? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization delegate control over management duties customarily performed by or under the direct supervisionof officers, directors or trustees, or key employees to a management company or other person? ~~~~~~~~~~~~~~Did the organization make any significant changes to its governing documents since the prior <strong>Form</strong> <strong>990</strong> was filed? ~~~~~Did the organization become aware during the year of a significant diversion of the organization’s assets? ~~~~~~~~~Does the organization have members or stockholders?~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~7aDoes the organization have members, stockholders, or other persons who may elect one or more members of thegoverning body? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Are any decisions of the governing body subject to approval by members, stockholders, or other persons? ~~~~~~~~~Did the organization contemporaneously document the meetings held or written actions undertaken during the yearby the following:The governing body? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Each committee with authority to act on behalf of the governing body?~~~~~~~~~~~~~~~~~~~~~~~~~~10aDoes the organization have local chapters, branches, or affiliates? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~If "Yes," does the organization have written policies and procedures governing the activities of such chapters, affiliates,and branches to ensure their operations are consistent with those of the organization?~~~~~~~~~~~~~~~~~~11aHas the organization provided a copy of this <strong>Form</strong> <strong>990</strong> to all members of its governing body before filing the form? ~~~~~Describe in Schedule O the process, if any, used by the organization to review this <strong>Form</strong> <strong>990</strong>.Does the organization have a written conflict of interest policy? If "No," go to line 13 ~~~~~~~~~~~~~~~~~~~~Are officers, directors or trustees, and key employees required to disclose annually interests that could give riseto conflicts? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Does the organization regularly and consistently monitor and enforce compliance with the policy? If "Yes," describein Schedule O how this is done ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Does the organization have a written whistleblower policy?Does the organization have a written document retention and destruction policy?~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the process for determining compensation of the following persons include a review and approval by independentpersons, comparability data, and contemporaneous substantiation of the deliberation and decision?The organization’s CEO, Executive Director, or top management officialOther officers or key employees of the organization ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~If "Yes" to line 15a or 15b, describe the process in Schedule O. (See instructions.)~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization invest in, contribute assets to, or participate in a joint venture or similar arrangement with ataxable entity during the year? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~If "Yes," has the organization adopted a written policy or procedure requiring the organization to evaluate its participationin joint venture arrangements under applicable federal tax law, and taken steps to safeguard the organization’sSection 6104 requires an organization to make its <strong>Form</strong>s 1023 (or 1024 if applicable), <strong>990</strong>, and <strong>990</strong>-T (501(c)(3)s only) available forpublic inspection. Indicate how you make these available. Check all that apply.X Own website Another’s website X Upon requestDescribe in Schedule O whether (and if so, how), the organization makes its governing documents, conflict of interest policy, and financialstatements available to the public.20 State the name, physical address, and telephone number of the person who possesses the books and records of the organization: |JOHN JAMES - 352-375-46831 GALE LEMERAND DRIVE, GAINESVILLE, FL 32611<strong>Form</strong> <strong>990</strong> (<strong>2010</strong>)03200612-21-10616080503 789407 500381 <strong>2010</strong>.05090 GATOR BOOSTERS, INC. 500381_1234567a7b8a8b910a10b11a12a12b12c131415a15b16a16bXXXYesXXXXXXXXXNoXXXXXXXNoXX

<strong>Form</strong> <strong>990</strong> (<strong>2010</strong>)GATOR BOOSTERS, INC. 59-0737883 Page 7Part VII Compensation of Officers, Directors, Trustees, Key Employees, Highest CompensatedEmployees, and Independent ContractorsCheck if Schedule O contains a response to any question in this Part VIISection A. Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees1a Complete this table for all persons required to be listed. Report compensation for the calendar year ending with or within the organization’s tax year.¥ List all of the organization’s current officers, directors, trustees (whether individuals or organizations), regardless of amount of compensation.Enter -0- in columns (D), (E), and (F) if no compensation was paid.¥ List all of the organization’s current key employees, if any. See instructions for definition of "key employee."¥ List the organization’s five current highest compensated employees (other than an officer, director, trustee, or key employee) who received reportablecompensation (Box 5 of <strong>Form</strong> W-2 and/or Box 7 of <strong>Form</strong> 1099-MISC) of more than $100,000 from the organization and any related organizations.¥ List all of the organization’s former officers, key employees, and highest compensated employees who received more than $100,000 ofreportable compensation from the organization and any related organizations.¥ List all of the organization’s former directors or trustees that received, in the capacity as a former director or trustee of the organization,more than $10,000 of reportable compensation from the organization and any related organizations.List persons in the following order: individual trustees or directors; institutional trustees; officers; key employees; highest compensated employees;and former such persons.Check this box if neither the organization nor any related organization compensated any current officer, director, or trustee.(A) (B) (C) (D) (E) (F)Name and TitleAveragehours perweek(describehours forrelatedorganizationsin ScheduleO)Position(check all that apply)Individual trustee or directorInstitutional trusteeOfficerKey employeeHighest compensatedemployee<strong>Form</strong>erReportablecompensationfromtheorganization(W-2/1099-MISC)Reportablecompensationfrom relatedorganizations(W-2/1099-MISC)Estimatedamount ofothercompensationfrom theorganizationand relatedorganizationsJAMES BERNARD MACHENBOARD MEMBER/UF PRESIDENT 1.00 X 0. 639,777. 53,948.TOM MITCHELLBOARD MEMBER/UFF VP OF DEVELOPMENT 1.00 X 0. 0. 0.JAMIE PRESSLYBOARD MEMBER 1.00 X 0. 0. 0.CHRISTINA "CHRIS" BRYANBOARD MEMBER 1.00 X 0. 0. 0.ERIC NICKELSENBOARD MEMBER 1.00 X 0. 0. 0.JEANNETTE CHAPMANBOARD MEMBER 1.00 X 0. 0. 0.JAY MOODY IVBOARD MEMBER 1.00 X 0. 0. 0.GARY CONDRONBOARD MEMBER 1.00 X 0. 0. 0.ANDY CRAWFORDBOARD MEMBER 1.00 X 0. 0. 0.DEXTER O'STEENBOARD MEMBER 1.00 X 0. 0. 0.THAD BOYD IIIBOARD MEMBER 1.00 X 0. 0. 0.KELLY SMITHBOARD MEMBER 1.00 X 0. 0. 0.JEFF PARKSBOARD MEMBER 1.00 X 0. 0. 0.TOM BALLBOARD MEMBER 1.00 X 0. 0. 0.ALBERT O'NEILBOARD MEMBER 1.00 X 0. 0. 0.PATTI BOSTICKBOARD MEMBER 1.00 X 0. 0. 0.MICHAEL CONNELLYBOARD MEMBER 1.00 X 0. 0. 0.032007 12-21-10<strong>Form</strong> <strong>990</strong> (<strong>2010</strong>)716080503 789407 500381 <strong>2010</strong>.05090 GATOR BOOSTERS, INC. 500381_1

<strong>Form</strong> <strong>990</strong> (<strong>2010</strong>)GATOR BOOSTERS, INC. 59-0737883 Page 8Part VII Section A. Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees (continued)(A) (B)(C)(D) (E) (F)Name and titleAverage PositionReportableReportable Estimatedhours per (check all that apply) compensation compensation amount ofweekfromfrom relatedother(describetheorganizations compensationhours fororganization (W-2/1099-MISC) from therelated(W-2/1099-MISC)organizationorganizationsand relatedin ScheduleorganizationsO)1b234cdSub-total~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ |Total from continuation sheets to Part VII, Section A ~~~~~~~~ |Total (add lines 1b and 1c) |Individual trustee or directorInstitutional trusteeDid the organization list any former officer, director or trustee, key employee, or highest compensated employee online 1a? If "Yes," complete Schedule J for such individual ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~5 Did any person listed on line 1a receive or accrue compensation from any unrelated organization or individual for servicesrendered to the organization? If "Yes," complete Schedule J for such person Section B. Independent Contractors1Total number of individuals (including but not limited to those listed above) who received more than $100,000 in reportablecompensation from the organization |For any individual listed on line 1a, is the sum of reportable compensation and other compensation from the organizationand related organizations greater than $150,000? If "Yes," complete Schedule J for such individual~~~~~~~~~~~~~OfficerREX FARRIOR IIIBOARD MEMBER 1.00 X 0. 0. 0.ROB GIDELBOARD MEMBER 1.00 X 0. 0. 0.GRIER PRESSLYBOARD MEMBER 1.00 X 0. 0. 0.CHARLES "CHUCK" SYFRETTBOARD MEMBER 1.00 X 0. 0. 0.FRED RIDLEYBOARD MEMBER 1.00 X 0. 0. 0.MARSHALL M. CRISER IIIBOARD MEMBER 1.00 X 0. 0. 0.JOE DAVIS, JR.BOARD MEMBER 1.00 X 0. 0. 0.NATHAN COLLIERBOARD MEMBER 1.00 X 0. 0. 0.JERRY DAVISBOARD MEMBER 1.00 X 0. 0. 0.Complete this table for your five highest compensated independent contractors that received more than $100,000 of compensation fromthe organization.(A) (B) (C)Name and business address Description of services CompensationSTEWART’S CATERING AND EVENTS, 2106 NW67TH PLACE, STE 3, GAINESVILLE, FL 32653 CATERING SERVICES 292,386.TOTAL SPORTS TRAVEL, INC, 6983 HALCYONPARK DRIVE, MONTGOMERY, AL 36117 CHARTER TRAVEL 177,277.QUALITY WEB PLUS MAILING2401 NW 66TH TER, GAINESVILLE, FL 32606 PACKAGING SERVICES 104,232.Key employeeHighest compensatedemployee<strong>Form</strong>er0. 639,777. 53,948.390,628. 0. 78,013.390,628. 639,777. 131,961.345YesXNoXX32 Total number of independent contractors (including but not limited to those listed above) who received more than$100,000 in compensation from the organization |3SEE PART VII, SECTION A CONTINUATION SHEETS<strong>Form</strong> <strong>990</strong> (<strong>2010</strong>)032008 12-21-10816080503 789407 500381 <strong>2010</strong>.05090 GATOR BOOSTERS, INC. 500381_1

<strong>Form</strong> <strong>990</strong> (<strong>2010</strong>)Part VII Section A.Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees (continued)(A) (B) (C) (D) (E) (F)Name and titleGATOR BOOSTERS, INC. 59-0737883AveragehoursperweekPosition(check all that apply)Individual trustee or directorInstitutional trusteeOfficerKey employeeHighest compensated employee<strong>Form</strong>erReportablecompensationfromtheorganization(W-2/1099-MISC)Reportablecompensationfrom relatedorganizations(W-2/1099-MISC)Estimatedamount ofothercompensationfrom theorganizationand relatedorganizationsW. C. GENTRYBOARD MEMBER 1.00 X 0. 0. 0.JAMES R. HARPERBOARD MEMBER 1.00 X 0. 0. 0.EMMITT SMITHBOARD MEMBER 1.00 X 0. 0. 0.WAYNE WILESBOARD MEMBER 1.00 X 0. 0. 0.DON DIZNEYBOARD MEMBER 1.00 X 0. 0. 0.HJALMA JOHNSONBOARD MEMBER 1.00 X 0. 0. 0.TOM DONAHOOBOARD MEMBER 1.00 X 0. 0. 0.JOHN FROST IIBOARD MEMBER 1.00 X 0. 0. 0.PAT LLOVERASBOARD MEMBER 1.00 X 0. 0. 0.JUDY BOLESBOARD MEMBER 1.00 X 0. 0. 0.WARREN CASONBOARD MEMBER 1.00 X 0. 0. 0.DUKE CRITTENDENBOARD MEMBER 1.00 X 0. 0. 0.BRUCE CULPEPPERBOARD MEMBER 1.00 X 0. 0. 0.STEVE DEMONTMOLLINBOARD MEMBER 1.00 X 0. 0. 0.ROGERS HOLMESBOARD MEMBER 1.00 X 0. 0. 0.JIM KIMBROUGHBOARD MEMBER 1.00 X 0. 0. 0.LEONARD LEVYBOARD MEMBER 1.00 X 0. 0. 0.BILL LLOYDBOARD MEMBER 1.00 X 0. 0. 0.STEVE MELNYKBOARD MEMBER 1.00 X 0. 0. 0.VIC MIRANDABOARD MEMBER 1.00 X 0. 0. 0.Total to Part VII, Section A, line 1c032201 12-21-10916080503 789407 500381 <strong>2010</strong>.05090 GATOR BOOSTERS, INC. 500381_1

<strong>Form</strong> <strong>990</strong> (<strong>2010</strong>)Part VII Section A.Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees (continued)(A) (B) (C) (D) (E) (F)Name and titleGATOR BOOSTERS, INC. 59-0737883AveragehoursperweekPosition(check all that apply)Individual trustee or directorInstitutional trusteeOfficerKey employeeHighest compensated employee<strong>Form</strong>erReportablecompensationfromtheorganization(W-2/1099-MISC)Reportablecompensationfrom relatedorganizations(W-2/1099-MISC)Estimatedamount ofothercompensationfrom theorganizationand relatedorganizationsGENE PEEK IIIBOARD MEMBER 1.00 X 0. 0. 0.M. G. SANCHEZBOARD MEMBER 1.00 X 0. 0. 0.BRYANT SKINNERBOARD MEMBER 1.00 X 0. 0. 0.WARD WAGNERBOARD MEMBER 1.00 X 0. 0. 0.AL WARRINGTONBOARD MEMBER 1.00 X 0. 0. 0.GUY BOSTICKBOARD MEMBER 1.00 X 0. 0. 0.MARK BOSTICKBOARD MEMBER 1.00 X 0. 0. 0.JACK BERRY IIIBOARD MEMBER 1.00 X 0. 0. 0.PAT BREWSTERBOARD MEMBER 1.00 X 0. 0. 0.WAYNE CARSEBOARD MEMBER 1.00 X 0. 0. 0.JERRY CHICONE, JR.BOARD MEMBER 1.00 X 0. 0. 0.IRENE DIZNEYBOARD MEMBER 1.00 X 0. 0. 0.ED EVANSBOARD MEMBER 1.00 X 0. 0. 0.MARY LEE FARRIORBOARD MEMBER 1.00 X 0. 0. 0.BEN HILL GRIFFIN IIIBOARD MEMBER 1.00 X 0. 0. 0.STUMPY HARRISBOARD MEMBER 1.00 X 0. 0. 0.JAMES "BILL" HEAVENERBOARD MEMBER 1.00 X 0. 0. 0.DAVID "BUMPY" HUGHESBOARD MEMBER 1.00 X 0. 0. 0.TOM JOHNSONBOARD MEMBER 1.00 X 0. 0. 0.BRYAN KORNBLAUBOARD MEMBER 1.00 X 0. 0. 0.Total to Part VII, Section A, line 1c032201 12-21-101016080503 789407 500381 <strong>2010</strong>.05090 GATOR BOOSTERS, INC. 500381_1

<strong>Form</strong> <strong>990</strong> (<strong>2010</strong>)Part VII Section A.Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees (continued)(A) (B) (C) (D) (E) (F)Name and titleGATOR BOOSTERS, INC. 59-0737883AveragehoursperweekPosition(check all that apply)Individual trustee or directorInstitutional trusteeOfficerKey employeeHighest compensated employee<strong>Form</strong>erReportablecompensationfromtheorganization(W-2/1099-MISC)Reportablecompensationfrom relatedorganizations(W-2/1099-MISC)Estimatedamount ofothercompensationfrom theorganizationand relatedorganizationsGALE LEMERANDBOARD MEMBER 1.00 X 0. 0. 0.GREG MASTERSBOARD MEMBER 1.00 X 0. 0. 0.PAUL MCDONALDBOARD MEMBER 1.00 X 0. 0. 0.FRANK OLIVERBOARD MEMBER 1.00 X 0. 0. 0.KATIE PRESSLYBOARD MEMBER 1.00 X 0. 0. 0.STEVE VININGBOARD MEMBER 1.00 X 0. 0. 0.SETH ELLISBOARD MEMBER 1.00 X 0. 0. 0.DAVID THOMASBOARD MEMBER 1.00 X 0. 0. 0.ANDREA SPOTTSWOODBOARD MEMBER 1.00 X 0. 0. 0.RON COLEMANBOARD MEMBER 1.00 X 0. 0. 0.JACK KATZBOARD MEMBER 1.00 X 0. 0. 0.LOMAS BROWNBOARD MEMBER 1.00 X 0. 0. 0.WILLIAM DUDZIAKBOARD MEMBER 1.00 X 0. 0. 0.MARY JO WALKERBOARD MEMBER 1.00 X 0. 0. 0.KIMBERLY BEACH WALDENBOARD MEMBER 1.00 X 0. 0. 0.LARRY TRAVISBOARD MEMBER 1.00 X 0. 0. 0.PRINEET SHARMABOARD MEMBER 1.00 X 0. 0. 0.MAC MCGRIFFBOARD MEMBER 1.00 X 0. 0. 0.LYNN OAKLEYBOARD MEMBER 1.00 X 0. 0. 0.SAM BLOCKBOARD MEMBER 1.00 X 0. 0. 0.Total to Part VII, Section A, line 1c032201 12-21-101116080503 789407 500381 <strong>2010</strong>.05090 GATOR BOOSTERS, INC. 500381_1

<strong>Form</strong> <strong>990</strong> (<strong>2010</strong>)Part VII Section A.Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees (continued)(A) (B) (C) (D) (E) (F)Name and titleGATOR BOOSTERS, INC. 59-0737883AveragehoursperweekPosition(check all that apply)Individual trustee or directorInstitutional trusteeOfficerKey employeeHighest compensated employee<strong>Form</strong>erReportablecompensationfromtheorganization(W-2/1099-MISC)Reportablecompensationfrom relatedorganizations(W-2/1099-MISC)Estimatedamount ofothercompensationfrom theorganizationand relatedorganizationsWARREN MCKNIGHTBOARD MEMBER 1.00 X 0. 0. 0.CHIP TUCKERBOARD MEMBER 1.00 X 0. 0. 0.LEN JOHNSONBOARD MEMBER 1.00 X 0. 0. 0.WARREN WILTSHIREBOARD MEMBER 1.00 X 0. 0. 0.NANCY ANDERSONBOARD MEMBER 1.00 X 0. 0. 0.NANCY PERRYBOARD MEMBER 1.00 X 0. 0. 0.DIEDRE D. BRANDBOARD MEMBER 1.00 X 0. 0. 0.JOHN W. JAMES, JR.EXECUTIVE DIRECTOR 40.00 X 145,384. 0. 26,958.PHILLIP T. PHARRASSOC EXEC DIR. MAJOR GIVI 40.00 X 136,061. 0. 24,589.DOUGLAS F. BROWNASSOC EXEC DIR. ANNUAL GIV 40.00 X 109,183. 0. 26,466.Total to Part VII, Section A, line 1c390,628. 78,013.032201 12-21-101216080503 789407 500381 <strong>2010</strong>.05090 GATOR BOOSTERS, INC. 500381_1

<strong>Form</strong> <strong>990</strong> (<strong>2010</strong>)GATOR BOOSTERS, INC. 59-0737883 Page 9Part VIII Statement of Revenue(A) (B) (C)(D)Total revenue Related or UnrelatedRevenueexcluded fromexempt function business tax underrevenue revenue sections 512,513, or 514Contributions, gifts, grantsand other similar amountsProgram ServiceRevenueOther Revenue1 abcdefg Noncash contributions included in lines 1a-1f: $h2 a345bcdefg6 abcdbcd8 abc9 abc10 abc11 abcdFederated campaignsMembership dues~~~~~~~~~~~~~~Fundraising events ~~~~~~~~Related organizations~~~~~~Government grants (contributions)All other contributions, gifts, grants, andsimilar amounts not included above ~~1a1b1c1d1e1fTotal. Add lines 1a-1f |All other program service revenue ~~~~~Total. Add lines 2a-2f |abababBusiness Code<strong>Inc</strong>ome from investment of tax-exempt bond proceedsRoyalties |Gross Rents~~~~~~~Less: rental expenses~~~Rental income or (loss)~~Net rental income or (loss)7 a Gross amount from sales ofassets other than inventoryLess: cost or other basisand sales expenses~~~Gain or (loss) ~~~~~~~(i) Real|(ii) Personal |(i) Securities(ii) OtherNet gain or (loss) |Gross income from fundraising events (notincluding $ofcontributions reported on line 1c). SeePart IV, line 18 ~~~~~~~~~~~~~Less: direct expenses~~~~~~~~~~Net income or (loss) from fundraising events |Gross income from gaming activities. SeePart IV, line 19 ~~~~~~~~~~~~~Less: direct expenses~~~~~~~~~Net income or (loss) from gaming activitiesGross sales of inventory, less returnsand allowances ~~~~~~~~~~~~~Less: cost of goods sold~~~~~~~~ |Net income or (loss) from sales of inventory |Miscellaneous RevenueAll other revenue ~~~~~~~~~~~~~38615133.Business Code38615133.Investment income (including dividends, interest, andother similar amounts) ~~~~~~~~~~~~~~~~~ | 1,351,929. 1351929.70,039.54,510.5,521.7,384.15,529. 15,529.-1,863. -1,863.e Total. Add lines 11a-11d ~~~~~~~~~~~~~~~ |12 Total revenue. See instructions. | 39980728. -1,863. 0. 1367458.03200912-21-10<strong>Form</strong> <strong>990</strong> (<strong>2010</strong>)1316080503 789407 500381 <strong>2010</strong>.05090 GATOR BOOSTERS, INC. 500381_1

<strong>Form</strong> <strong>990</strong> (<strong>2010</strong>)GATOR BOOSTERS, INC. 59-0737883Part IX Statement of Functional ExpensesSection 501(c)(3) and 501(c)(4) organizations must complete all columns.All other organizations must complete column (A) but are not required to complete columns (B), (C), and (D).Do not include amounts reported on lines 6b,7b, 8b, 9b, and 10b of Part VIII.123456789101112131415161718192021222324abcdefgabcdeGrants and other assistance to governments andorganizations in the U.S. See Part IV, line 21 ~~Grants and other assistance to individuals inthe U.S. See Part IV, line 22 ~~~~~~~~~Grants and other assistance to governments,organizations, and individuals outside the U.S.See Part IV, lines 15 and 16 ~~~~~~~~~Benefits paid to or for members ~~~~~~~Compensation of current officers, directors,trustees, and key employees ~~~~~~~~Compensation not included above, to disqualifiedpersons (as defined under section 4958(f)(1)) andpersons described in section 4958(c)(3)(B)Other salaries and wages ~~~~~~~~~~Pension plan contributions (include section 401(k)and section 403(b) employer contributions)~~~~~~Other employee benefits ~~~~~~~~~~Payroll taxes ~~~~~~~~~~~~~~~~Fees for services (non-employees):Management ~~~~~~~~~~~~~~~~Legal ~~~~~~~~~~~~~~~~~~~~Accounting ~~~~~~~~~~~~~~~~~Lobbying ~~~~~~~~~~~~~~~~~~Professional fundraising services. See Part IV, line 17Investment management fees ~~~~~~~~Other ~~~~~~~~~~~~~~~~~~~~Advertising and promotion~~~~~~~~~Office expenses~~~~~~~~~~~~~~~Information technology ~~~~~~~~~~~Royalties ~~~~~~~~~~~~~~~~~~Occupancy ~~~~~~~~~~~~~~~~~Travel~~~~~~~~~~~~~~~~~~~Payments of travel or entertainment expensesfor any federal, state, or local public officialsConferences, conventions, and meetings ~~Interest~~~~~~~~~~~~~~~~~~Payments to affiliates ~~~~~~~~~~~~Depreciation, depletion, and amortization ~~Insurance ~~~~~~~~~~~~~~~~~Other expenses. Itemize expenses not coveredabove. (List miscellaneous expenses in line 24f. If line24f amount exceeds 10% of line 25, column (A)(A) (B) (C) (D)Total expenses Program serviceexpensesManagement andgeneral expensesFundraisingexpenses37,511,347. 37,511,347.Page 10170,765. 34,153. 136,612.715,326. 243,599. 176,387. 295,340.79,413. 33,916. 20,728. 24,769.93,809. 35,466. 23,829. 34,514.63,923. 22,373. 15,981. 25,569.110,500. 110,500.58,491. 58,491.651,661. 583,598. 2,434. 65,629.197,131. 121,102. 44,960. 31,069.7,176. 7,176.32,215. 10,078. 2,117. 20,020.49,563. 49,563.9,039. 9,039.19,391. 19,391.amount, list line 24f expenses on Schedule O.) ~~BULL GATOR TDT 128,625. 128,625.SUITE EXPENSES 72,427. 72,427.MISCELLANEOUS 35,023. 12,093. 8,723. 14,207.F CLUB EXPENSES 24,904. 24,904.f All other expenses25 Total functional expenses. Add lines 1 through 24f 40,030,729. 38,799,528. 583,472. 647,729.26 Joint costs. Check here | if following SOP98-2 (ASC 958-720). Complete this line only if theorganization reported in column (B) joint costs from acombined educational campaign and fundraisingsolicitation 03<strong>2010</strong> 12-21-10<strong>Form</strong> <strong>990</strong> (<strong>2010</strong>)1416080503 789407 500381 <strong>2010</strong>.05090 GATOR BOOSTERS, INC. 500381_1

<strong>Form</strong> <strong>990</strong> (<strong>2010</strong>)GATOR BOOSTERS, INC. 59-0737883 Page 11Part X Balance SheetNet Assets or Fund BalancesLiabilitiesAssets(A)(B)Beginning of yearEnd of year1 Cash - non-interest-bearing ~~~~~~~~~~~~~~~~~~~~~~~~~ 1,901,379. 1 1,155,032.2 Savings and temporary cash investments ~~~~~~~~~~~~~~~~~~ 520,969. 2 2,038,606.3 Pledges and grants receivable, net ~~~~~~~~~~~~~~~~~~~~~34 Accounts receivable, net ~~~~~~~~~~~~~~~~~~~~~~~~~~ 1,225,182. 4 1,595,393.5 Receivables from current and former officers, directors, trustees, keyemployees, and highest compensated employees. Complete Part IIof Schedule L ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~56 Receivables from other disqualified persons (as defined under section4958(f)(1)), persons described in section 4958(c)(3)(B), and contributingemployers and sponsoring organizations of section 501(c)(9) voluntaryemployees’ beneficiary organizations (see instructions) ~~~~~~~~~~~67 Notes and loans receivable, net ~~~~~~~~~~~~~~~~~~~~~~~78 Inventories for sale or use ~~~~~~~~~~~~~~~~~~~~~~~~~~10,700. 84,622.9 Prepaid expenses and deferred charges ~~~~~~~~~~~~~~~~~~13,045. 916,358.10aLand, buildings, and equipment: cost or otherbasis. Complete Part VI of Schedule D ~~~ 10a 373,184.b Less: accumulated depreciation ~~~~~~ 10b 354,989. 23,409. 10c 18,195.11 Investments - publicly traded securities ~~~~~~~~~~~~~~~~~~~1112 Investments - other securities. See Part IV, line 11 ~~~~~~~~~~~~~~ 1,699,895. 12 1,733,535.13 Investments - program-related. See Part IV, line 11 ~~~~~~~~~~~~~1314 Intangible assets ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~1415 Other assets. See Part IV, line 11 ~~~~~~~~~~~~~~~~~~~~~~ 459,339. 15 409,338.16 Total assets. Add lines 1 through 15 (must equal line 34) 5,853,918. 16 6,971,079.17 Accounts payable and accrued expenses ~~~~~~~~~~~~~~~~~~ 494,885. 17 283,312.18 Grants payable ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~1819 Deferred revenue ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~19 39,000.20 Tax-exempt bond liabilities ~~~~~~~~~~~~~~~~~~~~~~~~~2021 Escrow or custodial account liability. Complete Part IV of Schedule D ~~~~2122 Payables to current and former officers, directors, trustees, key employees,highest compensated employees, and disqualified persons. Complete Part IIof Schedule L ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~2223 Secured mortgages and notes payable to unrelated third parties ~~~~~~2324 Unsecured notes and loans payable to unrelated third parties ~~~~~~~~2425 Other liabilities. Complete Part X of Schedule D ~~~~~~~~~~~~~~~ 4,346,460. 25 5,686,195.26 Total liabilities. Add lines 17 through 25 4,841,345. 26 6,008,507.Organizations that follow SFAS 117, check here | and completelines 27 through 29, and lines 33 and 34.27 Unrestricted net assets ~~~~~~~~~~~~~~~~~~~~~~~~~~~2728 Temporarily restricted net assets ~~~~~~~~~~~~~~~~~~~~~~2829 Permanently restricted net assets ~~~~~~~~~~~~~~~~~~~~~29Organizations that do not follow SFAS 117, check here | X andcomplete lines 30 through 34.30 Capital stock or trust principal, or current funds ~~~~~~~~~~~~~~~0. 300.31 Paid-in or capital surplus, or land, building, or equipment fund ~~~~~~~~0. 310.32 Retained earnings, endowment, accumulated income, or other funds ~~~~ 1,012,573. 32 962,572.33 Total net assets or fund balances ~~~~~~~~~~~~~~~~~~~~~~ 1,012,573. 33 962,572.34 Total liabilities and net assets/fund balances 5,853,918. 34 6,971,079.<strong>Form</strong> <strong>990</strong> (<strong>2010</strong>)032011 12-21-101516080503 789407 500381 <strong>2010</strong>.05090 GATOR BOOSTERS, INC. 500381_1

<strong>Form</strong> <strong>990</strong> (<strong>2010</strong>)GATOR BOOSTERS, INC. 59-0737883 Page 12Part XI Reconciliation of Net AssetsCheck if Schedule O contains a response to any question in this Part XI 1 Total revenue (must equal Part VIII, column (A), line 12) ~~~~~~~~~~~~~~~~~~~~~~~~~~ 1 39,980,728.2 Total expenses (must equal Part IX, column (A), line 25) ~~~~~~~~~~~~~~~~~~~~~~~~~~ 2 40,030,729.3 Revenue less expenses. Subtract line 2 from line 1 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 3-50,001.4 Net assets or fund balances at beginning of year (must equal Part X, line 33, column (A)) ~~~~~~~~~~ 4 1,012,573.5 Other changes in net assets or fund balances (explain in Schedule O) ~~~~~~~~~~~~~~~~~~~ 50.6 Net assets or fund balances at end of year. Combine lines 3, 4, and 5 (must equal Part X, line 33, column (B)) 6962,572.Part XII Financial Statements and ReportingCheck if Schedule O contains a response to any question in this Part XII XYes No1 Accounting method used to prepare the <strong>Form</strong> <strong>990</strong>: Cash X Accrual Other2abcdbIf the organization changed its method of accounting from a prior year or checked "Other," explain in Schedule O.Were the organization’s financial statements compiled or reviewed by an independent accountant? ~~~~~~~~~~~~Were the organization’s financial statements audited by an independent accountant? ~~~~~~~~~~~~~~~~~~~If "Yes" to line 2a or 2b, does the organization have a committee that assumes responsibility for oversight of the audit,review, or compilation of its financial statements and selection of an independent accountant? ~~~~~~~~~~~~~~~If the organization changed either its oversight process or selection process during the tax year, explain in Schedule O.If "Yes" to line 2a or 2b, check a box below to indicate whether the financial statements for the year were issued on aseparate basis, consolidated basis, or both:X Separate basis Consolidated basis Both consolidated and separate basis3aAs a result of a federal award, was the organization required to undergo an audit or audits as set forth in the Single AuditAct and OMB Circular A-133? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~If "Yes," did the organization undergo the required audit or audits? If the organization did not undergo the required auditor audits, explain why in Schedule O and describe any steps taken to undergo such audits. 2a2b2c3aXXXX3b<strong>Form</strong> <strong>990</strong> (<strong>2010</strong>)032012 12-21-101616080503 789407 500381 <strong>2010</strong>.05090 GATOR BOOSTERS, INC. 500381_1

SCHEDULE A(<strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ)Department of the TreasuryInternal Revenue ServiceComplete if the organization is a section 501(c)(3) organization or a section4947(a)(1) nonexempt charitable trust.| Attach to <strong>Form</strong> <strong>990</strong> or <strong>Form</strong> <strong>990</strong>-EZ. | See separate instructions.OMB No. 1545-0047Open to PublicInspectionName of the organizationEmployer identification numberGATOR BOOSTERS, INC. 59-0737883Part I Reason for Public Charity Status (All organizations must complete this part.) See instructions.The organization is not a private foundation because it is: (For lines 1 through 11, check only one box.)1234567891011efghXA church, convention of churches, or association of churches described in section 170(b)(1)(A)(i).A school described in section 170(b)(1)(A)(ii). (Attach Schedule E.)A hospital or a cooperative hospital service organization described in section 170(b)(1)(A)(iii).A medical research organization operated in conjunction with a hospital described in section 170(b)(1)(A)(iii). Enter the hospital’s name,city, and state:An organization operated for the benefit of a college or university owned or operated by a governmental unit described insection 170(b)(1)(A)(iv). (Complete Part II.)A federal, state, or local government or governmental unit described in section 170(b)(1)(A)(v).An organization that normally receives a substantial part of its support from a governmental unit or from the general public described insection 170(b)(1)(A)(vi). (Complete Part II.)A community trust described in section 170(b)(1)(A)(vi). (Complete Part II.)An organization that normally receives: (1) more than 33 1/3% of its support from contributions, membership fees, and gross receipts fromactivities related to its exempt functions - subject to certain exceptions, and (2) no more than 33 1/3% of its support from gross investmentincome and unrelated business taxable income (less section 511 tax) from businesses acquired by the organization after June 30, 1975.See section 509(a)(2). (Complete Part III.)An organization organized and operated exclusively to test for public safety. See section 509(a)(4).An organization organized and operated exclusively for the benefit of, to perform the functions of, or to carry out the purposes of one ormore publicly supported organizations described in section 509(a)(1) or section 509(a)(2). See section 509(a)(3). Check the box thatdescribes the type of supporting organization and complete lines 11e through 11h.a Type I b Type II c Type III - Functionally integrated d Type III - OtherBy checking this box, I certify that the organization is not controlled directly or indirectly by one or more disqualified persons other thanfoundation managers and other than one or more publicly supported organizations described in section 509(a)(1) or section 509(a)(2).If the organization received a written determination from the <strong>IRS</strong> that it is a Type I, Type II, or Type IIIsupporting organization, check this boxSince August 17, 2006, has the organization accepted any gift or contribution from any of the following persons?(i)(ii)(iii)Public Charity Status and Public Support~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~A person who directly or indirectly controls, either alone or together with persons described in (ii) and (iii) below,the governing body of the supported organization?~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~A family member of a person described in (i) above? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~A 35% controlled entity of a person described in (i) or (ii) above? ~~~~~~~~~~~~~~~~~~~~~~~~Provide the following information about the supported organization(s).<strong>2010</strong>(iii) Type of(i) Name of supported (ii) EIN(iv) Is the organization (v) Did you notify the (vi) Is the(vii)organization in col. (i) listed in your organization in col.organization in col.Amount oforganization(described on lines 1-9(i) organized in the supportgoverning document? (i) of your support? U.S.?above or IRC section(see instructions) ) Yes No Yes No Yes No11g(i)11g(ii)11g(iii)YesNoTotalLHA For Paperwork Reduction Act Notice, see the Instructions for<strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ.Schedule A (<strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ) <strong>2010</strong>032021 12-21-101716080503 789407 500381 <strong>2010</strong>.05090 GATOR BOOSTERS, INC. 500381_1

Schedule A (<strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ) <strong>2010</strong> GATOR BOOSTERS, INC. 59-0737883 Page 2Part II Support Schedule for Organizations Described in Sections 170(b)(1)(A)(iv) and 170(b)(1)(A)(vi)(Complete only if you checked the box on line 5, 7, or 8 of Part I or if the organization failed to qualify under Part III. If the organizationfails to qualify under the tests listed below, please complete Part III.)Section A. Public SupportCalendar year (or fiscal year beginning in) |12345Total. Add lines 1 through 3 ~~~6 Public support. Subtract line 5 from line 4.(a) 2006 (b) 2007 (c) 2008 (d) 2009 (e) <strong>2010</strong> (f) TotalCalendar year (or fiscal year beginning in) | (a) 2006 (b) 2007 (c) 2008 (d) 2009 (e) <strong>2010</strong> (f) Total7 Amounts from line 4 ~~~~~~~ 37425467.45412190.38463879.41094585.38615133.<strong>2010</strong>112548910111213assets (Explain in Part IV.) ~~~~Total support. Add lines 7 through 10First five years. If the <strong>Form</strong> <strong>990</strong> is for the organization’s first, second, third, fourth, or fifth tax year as a section 501(c)(3)17a10% -facts-and-circumstances test - <strong>2010</strong>. If the organization did not check a box on line 13, 16a, or 16b, and line 14 is 10% or more,18Gifts, grants, contributions, andmembership fees received. (Do notinclude any "unusual grants.") ~~Tax revenues levied for the organization’sbenefit and either paid toor expended on its behalf ~~~~The value of services or facilitiesfurnished by a governmental unit tothe organization without charge ~The portion of total contributionsby each person (other than agovernmental unit or publiclysupported organization) includedon line 1 that exceeds 2% of theamount shown on line 11,column (f) ~~~~~~~~~~~~Section B. Total SupportGross income from interest,dividends, payments received onsecurities loans, rents, royaltiesand income from similar sources ~Net income from unrelated businessactivities, whether or not thebusiness is regularly carried on ~Other income. Do not include gainor loss from the sale of capital37425467.45412190.38463879.41094585.38615133.<strong>2010</strong>1125437425467.45412190.38463879.41094585.38615133.<strong>2010</strong>11254Gross receipts from related activities, etc. (see instructions) ~~~~~~~~~~~~~~~~~~~~~~~b 33 1/3% support test - 2009. If the organization did not check a box on line 13 or 16a, and line 15 is 33 1/3% or more, check this boxand stop here. The organization qualifies as a publicly supported organization ~~~~~~~~~~~~~~~~~~~~~~~~~~~~ |and if the organization meets the "facts-and-circumstances" test, check this box and stop here. Explain in Part IV how the organizationmeets the "facts-and-circumstances" test. The organization qualifies as a publicly supported organization ~~~~~~~~~~~~~~~ |b 10% -facts-and-circumstances test - 2009. If the organization did not check a box on line 13, 16a, 16b, or 17a, and line 15 is 10% ormore, and if the organization meets the "facts-and-circumstances" test, check this box and stop here. Explain in Part IV how theorganization meets the "facts-and-circumstances" test. The organization qualifies as a publicly supported organization ~~~~~~~~ |Private foundation. If the organization did not check a box on line 13, 16a, 16b, 17a, or 17b, check this box and see instructions |121805231.1992060231383044. 1494262. 1340037. 1144936. 1351929. 6714208.207725462413,157.organization, check this box and stop here |Section C. Computation of Public Support Percentage14 Public support percentage for <strong>2010</strong> (line 6, column (f) divided by line 11, column (f)) ~~~~~~~~~~~~ 1495.9015 Public support percentage from 2009 Schedule A, Part II, line 14 ~~~~~~~~~~~~~~~~~~~~~ 1595.7416a33 1/3% support test - <strong>2010</strong>. If the organization did not check the box on line 13, and line 14 is 33 1/3% or more, check this box andstop here. The organization qualifies as a publicly supported organization ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ | XSchedule A (<strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ) <strong>2010</strong>%%03202212-21-101816080503 789407 500381 <strong>2010</strong>.05090 GATOR BOOSTERS, INC. 500381_1

Schedule A (<strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ) <strong>2010</strong>Part III Support Schedule for Organizations Described in Section 509(a)(2)Calendar year (or fiscal year beginning in) |123456The value of services or facilitiesfurnished by a governmental unit tothe organization without charge ~Total. Add lines 1 through 5 ~~~7aAmounts included on lines 1, 2, and3 received from disqualified personsb Amounts included on lines 2 and 3 receivedfrom other than disqualified persons thatexceed the greater of $5,000 or 1% of theamount on line 13 for the year ~~~~~~c Add lines 7a and 7b ~~~~~~~8 Public support (Subtract line 7c from line 6.)Calendar year (or fiscal year beginning in) |9 Amounts from line 6 ~~~~~~~10a Gross income from interest,dividends, payments received onsecurities loans, rents, royaltiesand income from similar sources ~b Unrelated business taxable income(less section 511 taxes) from businessesacquired after June 30, 1975 ~~~~c111213(a) 2006 (b) 2007 (c) 2008 (d) 2009 (e) <strong>2010</strong> (f) Total(a) 2006 (b) 2007 (c) 2008 (d) 2009 (e) <strong>2010</strong> (f) Total14 First five years. If the <strong>Form</strong> <strong>990</strong> is for the organization’s first, second, third, fourth, or fifth tax year as a section 501(c)(3) organization,check this box and stop here |Section C. Computation of Public Support Percentage1516 Public support percentage from 2009 Schedule A, Part III, line 15 Section D. Computation of Investment <strong>Inc</strong>ome Percentage1718Page 3Public support percentage for <strong>2010</strong> (line 8, column (f) divided by line 13, column (f)) ~~~~~~~~~~~~ 15%19a33 1/3% support tests - <strong>2010</strong>. If the organization did not check the box on line 14, and line 15 is more than 33 1/3%, and line 17 is not20(Complete only if you checked the box on line 9 of Part I or if the organization failed to qualify under Part II. If the organization fails toqualify under the tests listed below, please complete Part II.)Section A. Public SupportGifts, grants, contributions, andmembership fees received. (Do notinclude any "unusual grants.") ~~Gross receipts from admissions,merchandise sold or services performed,or facilities furnished inany activity that is related to theorganization’s tax-exempt purposeGross receipts from activities thatare not an unrelated trade or businessunder section 513 ~~~~~Tax revenues levied for the organization’sbenefit and either paid toor expended on its behalf ~~~~Section B. Total SupportAdd lines 10a and 10b ~~~~~~Net income from unrelated businessactivities not included in line 10b,whether or not the business isregularly carried on ~~~~~~~Other income. Do not include gainor loss from the sale of capitalassets (Explain in Part IV.) ~~~~Total support (Add lines 9, 10c, 11, and 12.)Investment income percentage for <strong>2010</strong> (line 10c, column (f) divided by line 13, column (f))Investment income percentage from 2009 Schedule A, Part III, line 17 ~~~~~~~~~~~~~~~~~~16~~~~~~~~ 17%more than 33 1/3%, check this box and stop here. The organization qualifies as a publicly supported organization ~~~~~~~~~~ |b 33 1/3% support tests - 2009. If the organization did not check a box on line 14 or line 19a, and line 16 is more than 33 1/3%, andline 18 is not more than 33 1/3%, check this box and stop here. The organization qualifies as a publicly supported organization~~~~ |Private foundation. If the organization did not check a box on line 14, 19a, or 19b, check this box and see instructions |032023 12-21-10Schedule A (<strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ) <strong>2010</strong>1916080503 789407 500381 <strong>2010</strong>.05090 GATOR BOOSTERS, INC. 500381_118%%

SCHEDULE D(<strong>Form</strong> <strong>990</strong>) | Complete if the organization answered "Yes," to <strong>Form</strong> <strong>990</strong>,Part IV, line 6, 7, 8, 9, 10, 11, or 12.Department of the TreasuryInternal Revenue Service| Attach to <strong>Form</strong> <strong>990</strong>. | See separate instructions.OMB No. 1545-0047Open to PublicInspectionName of the organizationEmployer identification numberGATOR BOOSTERS, INC. 59-0737883Part I Organizations Maintaining Donor Advised Funds or Other Similar Funds or Accounts. Complete if theorganization answered "Yes" to <strong>Form</strong> <strong>990</strong>, Part IV, line 6.(a) Donor advised funds(b) Funds and other accounts1234561234567892abcdbabTotal number at end of year ~~~~~~~~~~~~~~~Aggregate contributions to (during year)Aggregate grants from (during year)Aggregate value at end of year(i)(ii)~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization inform all donors and donor advisors in writing that the assets held in donor advised fundsare the organization’s property, subject to the organization’s exclusive legal control?~~~~~~~~~~~~~~~~~~Did the organization inform all grantees, donors, and donor advisors in writing that grant funds can be used onlyfor charitable purposes and not for the benefit of the donor or donor advisor, or for any other purpose conferringimpermissible private benefit? Part II Conservation Easements. Complete if the organization answered "Yes" to <strong>Form</strong> <strong>990</strong>, Part IV, line 7.Purpose(s) of conservation easements held by the organization (check all that apply).Preservation of land for public use (e.g., recreation or education)Protection of natural habitatPreservation of open space2a2b2c2dYesYesPreservation of an historically important land areaPreservation of a certified historic structureComplete lines 2a through 2d if the organization held a qualified conservation contribution in the form of a conservation easement on the lastday of the tax year.Total number of conservation easements ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Total acreage restricted by conservation easements~~~~~~~~~~~~~~~~~~~~~~~~~~Number of conservation easements on a certified historic structure included in (a) ~~~~~~~~~~~~Number of conservation easements included in (c) acquired after 8/17/06, and not on a historic structurelisted in the National Register ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~NoNoHeld at the End of the Tax YearNumber of conservation easements modified, transferred, released, extinguished, or terminated by the organization during the taxyear |Number of states where property subject to conservation easement is located |Does the organization have a written policy regarding the periodic monitoring, inspection, handling ofviolations, and enforcement of the conservation easements it holds? ~~~~~~~~~~~~~~~~~~~~~~~~~Staff and volunteer hours devoted to monitoring, inspecting, and enforcing conservation easements during the year |Amount of expenses incurred in monitoring, inspecting, and enforcing conservation easements during the year | $Does each conservation easement reported on line 2(d) above satisfy the requirements of section 170(h)(4)(B)(i)and section 170(h)(4)(B)(ii)? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~In Part XIV, describe how the organization reports conservation easements in its revenue and expense statement, and balance sheet, andinclude, if applicable, the text of the footnote to the organization’s financial statements that describes the organization’s accounting forconservation easements.Part III Organizations Maintaining Collections of Art, Historical Treasures, or Other Similar Assets.Complete if the organization answered "Yes" to <strong>Form</strong> <strong>990</strong>, Part IV, line 8.1aIf the organization elected, as permitted under SFAS 116 (ASC 958), not to report in its revenue statement and balance sheet works of art,historical treasures, or other similar assets held for public exhibition, education, or research in furtherance of public service, provide, in Part XIV,the text of the footnote to its financial statements that describes these items.If the organization elected, as permitted under SFAS 116 (ASC 958), to report in its revenue statement and balance sheet works of art, historicaltreasures, or other similar assets held for public exhibition, education, or research in furtherance of public service, provide the following amountsrelating to these items:Revenues included in <strong>Form</strong> <strong>990</strong>, Part VIII, line 1 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~ | $Assets included in <strong>Form</strong> <strong>990</strong>, Part X~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ |If the organization received or held works of art, historical treasures, or other similar assets for financial gain, providethe following amounts required to be reported under SFAS 116 (ASC 958) relating to these items:Revenues included in <strong>Form</strong> <strong>990</strong>, Part VIII, line 1 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ | $Assets included in <strong>Form</strong> <strong>990</strong>, Part XSupplemental Financial Statements~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ |$$<strong>2010</strong>YesYesNoNoLHA For Paperwork Reduction Act Notice, see the Instructions for <strong>Form</strong> <strong>990</strong>. Schedule D (<strong>Form</strong> <strong>990</strong>) <strong>2010</strong>03205112-20-102016080503 789407 500381 <strong>2010</strong>.05090 GATOR BOOSTERS, INC. 500381_1

Schedule D (<strong>Form</strong> <strong>990</strong>) <strong>2010</strong> GATOR BOOSTERS, INC. 59-0737883 Page 2Part III Organizations Maintaining Collections of Art, Historical Treasures, or Other Similar Assets (continued)3 Using the organization’s acquisition, accession, and other records, check any of the following that are a significant use of its collection items45abcbcdefb If "Yes," explain the arrangement in Part XIV.Part V Endowment Funds. Complete if the organization answered "Yes" to <strong>Form</strong> <strong>990</strong>, Part IV, line 10.2bcdefgabcb(i)(ii)4 Describe in Part XIV the intended uses of the organization’s endowment funds.Part VI Land, Buildings, and Equipment. See <strong>Form</strong> <strong>990</strong>, Part X, line 10.1abcd(check all that apply):Public exhibitionScholarly researchPreservation for future generationsdeLoan or exchange programsProvide a description of the organization’s collections and explain how they further the organization’s exempt purpose in Part XIV.During the year, did the organization solicit or receive donations of art, historical treasures, or other similar assetsto be sold to raise funds rather than to be maintained as part of the organization’s collection? YesPart IV Escrow and Custodial Arrangements. Complete if the organization answered "Yes" to <strong>Form</strong> <strong>990</strong>, Part IV, line 9, orreported an amount on <strong>Form</strong> <strong>990</strong>, Part X, line 21.1aIs the organization an agent, trustee, custodian or other intermediary for contributions or other assets not includedon <strong>Form</strong> <strong>990</strong>, Part X? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~(a) Current year (b) Prior year (c) Two years back (d) Three years back (e) Four years back459,339. 479,018. 464,230.10,354. 14,330. 15,930.4,739. 54,249. -1,142.1c1d1e1fYesYes3a(i)3a(ii)(a) Cost or other (b) Cost or other (c) Accumulated (d) Book valuebasis (investment) basis (other)depreciatione Other Total. Add lines 1a through 1e. (Column (d) must equal <strong>Form</strong> <strong>990</strong>, Part X, column (B), line 10(c).) |OtherIf "Yes," explain the arrangement in Part XIV and complete the following table:Beginning balanceAdditions during the year ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Distributions during the year~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Ending balance ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~2aDid the organization include an amount on <strong>Form</strong> <strong>990</strong>, Part X, line 21? ~~~~~~~~~~~~~~~~~~~~~~~~~1aBeginning of year balanceContributions ~~~~~~~~~~~~~~Net investment earnings, gains, and lossesGrants or scholarshipsOther expenditures for facilitiesand programsAdministrative expensesEnd of year balance~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Provide the estimated percentage of the year end balance held as:Board designated or quasi-endowment | %Permanent endowment | 100.00 %Term endowment| %3aAre there endowment funds not in the possession of the organization that are held and administered for the organizationby:unrelated organizations ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~related organizations ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~If "Yes" to 3a(ii), are the related organizations listed as required on Schedule R? ~~~~~~~~~~~~~~~~~~~~~~Description of investmentLand ~~~~~~~~~~~~~~~~~~~~Buildings ~~~~~~~~~~~~~~~~~~Leasehold improvements ~~~~~~~~~~Equipment ~~~~~~~~~~~~~~~~~65,094. 88,258.409,338. 459,339. 479,018.Amount3bYesNoNoNoNoXX50,018. 50,018. 0.323,166. 304,971. 18,195.18,195.Schedule D (<strong>Form</strong> <strong>990</strong>) <strong>2010</strong>03205212-20-102116080503 789407 500381 <strong>2010</strong>.05090 GATOR BOOSTERS, INC. 500381_1

Schedule D (<strong>Form</strong> <strong>990</strong>) <strong>2010</strong> GATOR BOOSTERS, INC. 59-0737883Part VII Investments - Other Securities. See <strong>Form</strong> <strong>990</strong>, Part X, line 12.(a) Description of security or category(c) Method of valuation:(b) Book value(including name of security)Cost or end-of-year market value(1)(2)(3)Financial derivativesClosely-held equity interests~~~~~~~~~~~~~~~~~~~~~~~~~~Other(A) OPERATING FUND 1,733,535. END-OF-YEAR MARKET VALUE(B)(C)(D)(E)(F)(G)(H)(I)Total. (Col (b) must equal <strong>Form</strong> <strong>990</strong>, Part X, col (B) line 12.) | 1,733,535.Part VIII Investments - Program Related. See <strong>Form</strong> <strong>990</strong>, Part X, line 13.(1)(2)(3)(4)(5)(6)(7)(8)(9)(a) Description of investment type(b) Book value(c) Method of valuation:Cost or end-of-year market value(10)Total. (Col (b) must equal <strong>Form</strong> <strong>990</strong>, Part X, col (B) line 13.) |Part IX Other Assets. See <strong>Form</strong> <strong>990</strong>, Part X, line 15.(a) Description(b) Book value(1) LIFE INS ENDOWMENTS (CSV) 409,338.(2)(3)(4)(5)(6)(7)(8)(9)(10)Total. (Column (b) must equal <strong>Form</strong> <strong>990</strong>, Part X, col (B) line 15.) |Part X Other Liabilities. See <strong>Form</strong> <strong>990</strong>, Part X, line 25.1.(a) Description of liability(b) Amount(1)(2)(3)(4)(5)(6)(7)(8)(9)(10)Federal income taxesDUE TO UAA 5,641,384.DUE TO UFF 44,811.Page 3409,338.(11)Total. (Column (b) must equal <strong>Form</strong> <strong>990</strong>, Part X, col (B) line 25.) | 5,686,195.FIN 48 (ASC 740) Footnote. In Part XIV, provide the text of the footnote to the organization’s financial statements that reports the organization’s liability for uncertain tax positions under2. FIN 48 (ASC 740).03205312-20-10Schedule D (<strong>Form</strong> <strong>990</strong>) <strong>2010</strong>2216080503 789407 500381 <strong>2010</strong>.05090 GATOR BOOSTERS, INC. 500381_1