Annual Report 2011 - SuperFacts.com

Annual Report 2011 - SuperFacts.com

Annual Report 2011 - SuperFacts.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

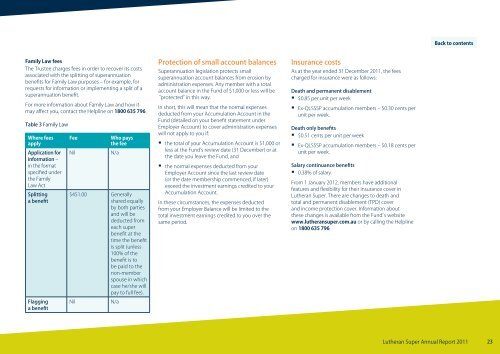

Back to contentsFamily Law feesThe Trustee charges fees in order to recover its costsassociated with the splitting of superannuationbenefits for Family Law purposes – for example, forrequests for information or implementing a split of asuperannuation benefit.For more information about Family Law and how itmay affect you, contact the Helpline on 1800 635 796.Table 3 Family LawWhere feesapplyApplication forinformation –in the formatspecified underthe FamilyLaw ActSplittinga benefitFlagginga benefitFeeNilWho paysthe feeN/a$451.00 Generallyshared equallyby both partiesand will bededucted fromeach superbenefit at thetime the benefitis split (unless100% of thebenefit is tobe paid to thenon-memberspouse in whichcase he/she willpay to full fee).NilN/aProtection of small account balancesSuperannuation legislation protects smallsuperannuation account balances from erosion byadministration expenses. Any member with a totalaccount balance in the Fund of $1,000 or less will be“protected”in this way.In short, this will mean that the normal expensesdeducted from your Accumulation Account in theFund (detailed on your benefit statement underEmployer Account) to cover administration expenseswill not apply to you if:• the total of your Accumulation Account is $1,000 orless at the Fund's review date (31 December) or atthe date you leave the Fund, and• the normal expenses deducted from yourEmployer Account since the last review date(or the date membership <strong>com</strong>menced, if later)exceed the investment earnings credited to yourAccumulation Account.In these circumstances, the expenses deductedfrom your Employer Balance will be limited to thetotal investment earnings credited to you over thesame period.Insurance costsAs at the year ended 31 December <strong>2011</strong>, the feescharged for insurance were as follows:Death and permanent disablement• $0.85 per unit per week• Ex-QLSSSP accumulation members – $0.30 cents perunit per week.Death only benefits• $0.51 cents per unit per week• Ex-QLSSSP accumulation members – $0.18 cents perunit per week.Salary continuance benefits• 0.38% of salary.From 1 January 2012, members have additionalfeatures and flexibility for their insurance cover inLutheran Super. There are changes to death andtotal and permanent disablement (TPD) coverand in<strong>com</strong>e protection cover. Information aboutthese changes is available from the Fund’s websitewww.lutheransuper.<strong>com</strong>.au or by calling the Helplineon 1800 635 796.Lutheran Super <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>23