ITR-3 INDIAN INCOME TAX RETURN - TaxGuru

ITR-3 INDIAN INCOME TAX RETURN - TaxGuru

ITR-3 INDIAN INCOME TAX RETURN - TaxGuru

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

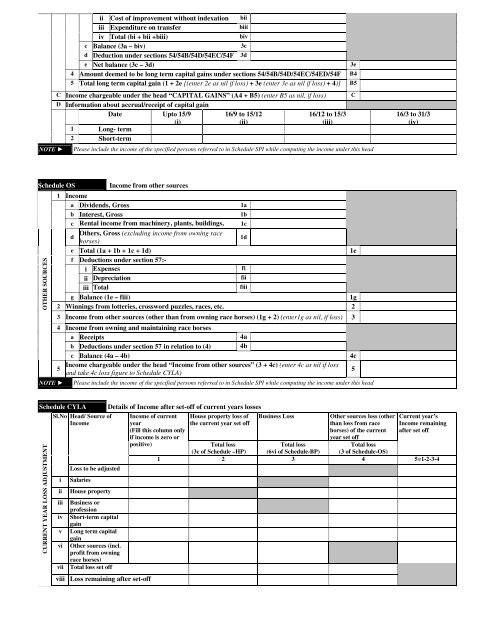

NOTE ►ii Cost of improvement without indexation biiiii Expenditure on transferbiiiiv Total (bi + bii +biii)bivc Balance (3a – biv)3cd Deduction under sections 54/54B/54D/54EC/54F 3de Net balance (3c – 3d)3e4 Amount deemed to be long term capital gains under sections 54/54B/54D/54EC/54ED/54F B45 Total long term capital gain (1 + 2e [(enter 2e as nil if loss) + 3e (enter 3e as nil if loss) + 4)] B5C Income chargeable under the head “CAPITAL GAINS” (A4 + B5) (enter B5 as nil, if loss)D Information about accrual/receipt of capital gainDate Upto 15/9 16/9 to 15/12(i)(ii)1 Long- termterm2 Short-term16/12 to 15/3(iii)Please include the income of the specified persons referred to in Schedule SPI while computing the income under this headC16/3 to 31/3(iv)Schedule OSOTHER SOURCESNOTE ►Income from other sources1 Incomea Dividends, Gross1ab Interest, Gross1bc Rental income from machinery, plants, buildings, 1cdetc., Others, Gross Gross (excluding income from owning racehorses)1de Total (1a + 1b + 1c + 1d)1ef Deductions under section 57:-i Expensesfiii Depreciationfiiiii Totalfiiig Balance (1e – fiii)1g2 Winnings from lotteries, crossword puzzles, races, etc. 23 Income from other sources (other than from owning race horses) (1g + 2) (enter1g as nil, if loss) 34 Income from owning and maintaining race horsesa Receipts4ab Deductions under section 57 in relation to (4) 4bc Balance (4a – 4b)Income chargeable under the head “Income from other sources” (3 + 4c) (enter 4c as nil if loss5and take 4c loss figure to Schedule CYLA)Please include the income of the specified persons referred to in Schedule SPI while computing the income under this head4c5Schedule CYLACURRENT YEAR LOSS ADJUSTMENTSl.NoiiiHead/ Source ofIncomeLoss to be adjustedSalariesHouse propertyiii Business orprofessioniv Short-term capitalgainv Long term capitalgainvi Other sources (incl.profit from owningrace horses)vii Total loss set offviii Loss remaining after set-offDetails of Income after set-off of current years lossesIncome of currentyear(Fill this column onlyif income is zero orpositive)House property loss ofthe current year set offBusiness LossOther sources loss (otherthan loss from racehorses) of the currentyear set offTotal loss(3 of Schedule-OS)Current year’sIncome remainingafter set offTotal lossTotal loss(3c of Schedule –HP) (6vi of Schedule-BP)1 2 3 4 5=1-2-3-4