ITR-3 INDIAN INCOME TAX RETURN - TaxGuru

ITR-3 INDIAN INCOME TAX RETURN - TaxGuru

ITR-3 INDIAN INCOME TAX RETURN - TaxGuru

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

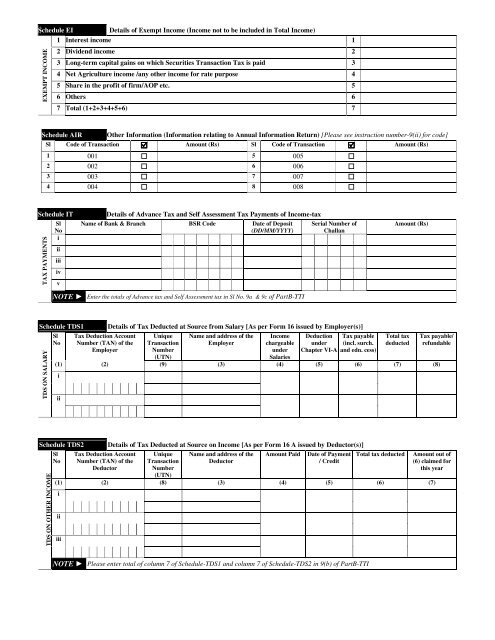

Schedule EIDetails of Exempt Income (Income not to be included in Total Income)1 Interest income 1EXEMPT <strong>INCOME</strong>2 Dividend income 23 Long-term capital gains on which Securities Transaction Tax is paid 34 Net Agriculture income /any other income for rate purpose 45 Share in the profit of firm/AOP etc. 56 Others 67 Total (1+2+3+4+5+6) 7Schedule AIROther Information (Information relating to Annual Information Return) [Please see instruction number-9(ii) for code]Sl Code of Transaction Amount (Rs) Sl Code of Transaction Amount (Rs)1 001 5 005 2 002 6 006 3 003 7 007 4 004 8 008 Schedule ITSlNoi<strong>TAX</strong> PAYMENTSiiiiiivvDetails of Advance Tax and Self Assessment Tax Payments of Income-taxName of Bank & Branch BSR Code Date of Deposit(DD/MM/YYYY)Serial Number ofChallanAmount (Rs)NOTE ► Enter the totals of Advance tax and Self Assessment tax in Sl No. 9a & 9c of PartB-TTISchedule TDS1TDS ON SALARYSlNoTax Deduction AccountNumber (TAN) of theEmployerDetails of Tax Deducted at Source from Salary [As per Form 16 issued by Employer(s)]UniqueTransactionNumber(UTN)Name and address of theEmployerIncomechargeableunderSalariesDeductionunderChapter VI-ATax payable(incl. surch.and edn. cess)Total taxdeductedTax payable/refundable(1) (2) (9) (3) (4) (5) (6) (7) (8)iiiSchedule TDS2TDS ON OTHER <strong>INCOME</strong>SlNoTax Deduction AccountNumber (TAN) of theDeductorDetails of Tax Deducted at Source on Income [As per Form 16 A issued by Deductor(s)]UniqueTransactionNumber(UTN)Name and address of theDeductorAmount PaidDate of Payment/ CreditTotal tax deductedAmount out of(6) claimed forthis year(1) (2) (8) (3) (4) (5) (6) (7)iiiiiiNOTE ► Please enter total of column 7 of Schedule-TDS1 and column 7 of Schedule-TDS2 in 9(b) of PartB-TTI