ITR-3 INDIAN INCOME TAX RETURN - TaxGuru

ITR-3 INDIAN INCOME TAX RETURN - TaxGuru

ITR-3 INDIAN INCOME TAX RETURN - TaxGuru

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

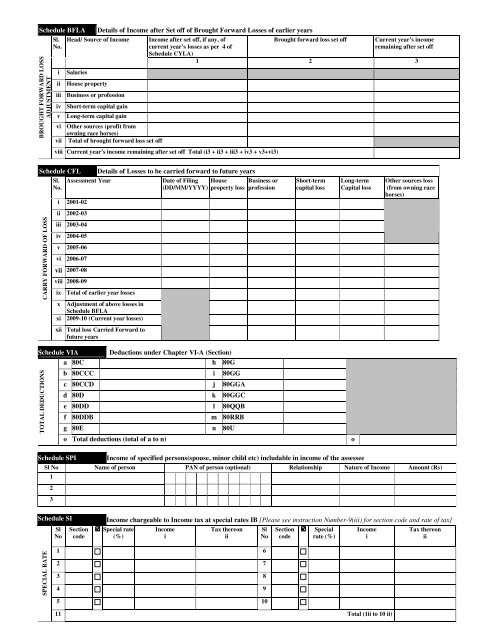

Schedule BFLABROUGHT FORWARD LOSSADJUSTMENTSl.No.iiiDetails of Income after Set off of Brought Forward Losses of earlier yearsHead/ Source of IncomeSalariesHouse propertyiii Business or professioniv Short-term capital gainvLong-term capital gainvi Other sources (profit fromowning race horses)vii Total of brought forward loss set offIncome after set off, if any, ofcurrent year’s losses as per 4 ofSchedule CYLA)viii Current year’s income remaining after set off Total (i3 + ii3 + iii3 + iv3 + v3+vi3)Brought forward loss set offCurrent year’s incomeremaining after set off1 2 3Schedule CFLSl.No.Assessment Yeari 2001-02Details of Losses to be carried forward to future yearsDate of Filing House(DD/MM/YYYY) property lossBusiness orprofessionShort-termcapital lossLong-termCapital lossOther sources loss(from owning racehorses)ii 2002-03CARRY FORWARD OF LOSSiii 2003-04iv 2004-05v 2005-06vi 2006-07vii 2007-08viii 2008-09ix Total of earlier year lossesx Adjustment of above losses inSchedule BFLAxi 2009-10 (Current year losses)xii Total loss Carried Forward tofuture yearsSchedule VIA Deductions under Chapter VI-A (Section)a 80C h 80GTOTAL DEDUCTIONSb 80CCC i 80GGc 80CCD j 80GGAd 80D k 80GGCe 80DD l 80QQBf 80DDBm 80RRBg 80E n 80Uo Total deductions (total of a to n)oSchedule SPI Income of specified persons(spouse, minor child etc) includable in income of the assesseeSl No Name of person PAN of person (optional) Relationship Nature of Income Amount (Rs)123Schedule SISlNoSectioncodeIncome chargeable to Income tax at special rates IB [Please see instruction Number-9(iii) for section code and rate of tax] Special rate IncomeTax thereon Sl Section Special IncomeTax thereon(%)iiiNo code rate (%)iiiSPECIAL RATE1 6 2 7 3 8 4 9 5 10 11 Total (1ii to 10 ii)