Internal Controls Checklist - CompassPoint Nonprofit Services

Internal Controls Checklist - CompassPoint Nonprofit Services

Internal Controls Checklist - CompassPoint Nonprofit Services

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

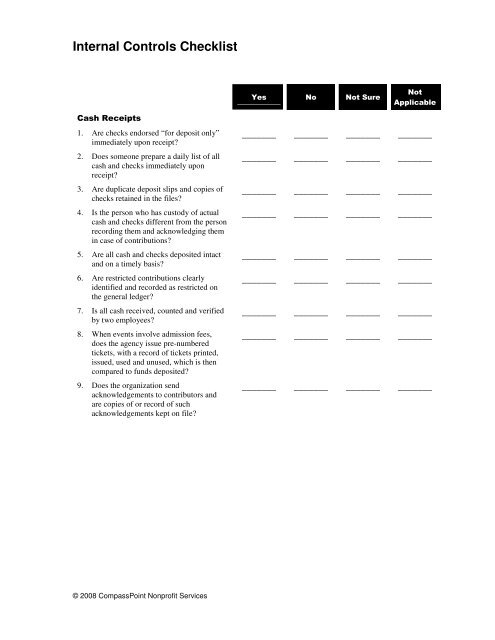

<strong>Internal</strong> <strong>Controls</strong> <strong>Checklist</strong>Yes No Not SureNotApplicableCash Receipts1. Are checks endorsed “for deposit only”immediately upon receipt?2. Does someone prepare a daily list of allcash and checks immediately uponreceipt?3. Are duplicate deposit slips and copies ofchecks retained in the files?4. Is the person who has custody of actualcash and checks different from the personrecording them and acknowledging themin case of contributions?5. Are all cash and checks deposited intactand on a timely basis?6. Are restricted contributions clearlyidentified and recorded as restricted onthe general ledger?7. Is all cash received, counted and verifiedby two employees?8. When events involve admission fees,does the agency issue pre-numberedtickets, with a record of tickets printed,issued, used and unused, which is thencompared to funds deposited?9. Does the organization sendacknowledgements to contributors andare copies of or record of suchacknowledgements kept on file?_______ _______ _______ ______________ _______ _______ ______________ _______ _______ ______________ _______ _______ ______________ _______ _______ ______________ _______ _______ ______________ _______ _______ ______________ _______ _______ ______________ _______ _______ _______© 2008 <strong>CompassPoint</strong> <strong>Nonprofit</strong> <strong>Services</strong>

<strong>Internal</strong> <strong>Controls</strong> <strong>Checklist</strong>Yes No Not SureNotApplicableCash Disbursements10. Are all disbursements, except those frompetty cash, made by pre-numberedchecks?11. Are void checks preserved and filed afterappropriate mutilation?12. Is there a written prohibition againstissuing checks payable to “cash”?13. Is there a written prohibition againstsigning checks in advance?14. Is a cash disbursement voucher preparedfor each invoice or request forreimbursement that details the descriptionof expense account to be charged andcontains authorization signature andaccompanying receipts and/or vendorinvoices?15. Are all expenses approved in advance byauthorized persons?16. Do the check signors review supportingdocumentation of expenses and approvalsat the time of signing checks?_______ _______ _______ ______________ _______ _______ ______________ _______ _______ ______________ _______ _______ ______________ _______ _______ ______________ _______ _______ ______________ _______ _______ _______17. Are signed checks mailed promptly? _______ _______ _______ _______18. Are paid invoices marked paid orattached to a copy of the check prior tofiling?19. Are requests for reimbursement checkedfor mathematical accuracy andreasonableness before approval?20. Is check-signing authority vested inpersons at appropriately high levels in theorganization who do not have anyaccounting responsibility?_______ _______ _______ ______________ _______ _______ ______________ _______ _______ _______21. Do checks require two signatures? _______ _______ _______ _______22. Are bank statements and cancelled checksreceived and reviewed by a personindependent of the accounting functions?23. Are unpaid invoices maintained in anunpaid invoice file?24. Is a list of unpaid invoices regularlyprepared, reviewed and compared tothose invoices in the unpaid invoice file?_______ _______ _______ ______________ _______ _______ ______________ _______ _______ _______© 2008 <strong>CompassPoint</strong> <strong>Nonprofit</strong> <strong>Services</strong>

<strong>Internal</strong> <strong>Controls</strong> <strong>Checklist</strong>25. If purchase orders are used, are allpurchases supported by a pre-numberedpurchase order?26. Are advance payments to vendors and/oremployees recorded as receivables andcontrolled in a manner which assures thatthey will be offset against invoices orexpense vouchers?27. Are employees required to submitexpense reports for all travel relatedexpenses on a timely basis?Petty Cash28. Is an imprest petty cash fund maintainedfor payment of small, incidentalexpenses?29. Does the organization follow a policylimiting the amount that can bereimbursed by the petty cash fund?30. Is supporting documentation required forall petty cash disbursements?31. Is a petty cash voucher filled out withsupporting documentation, name ofperson being reimbursed, and properauthorization?32. Is access to petty cash limited to oneperson who is the fund custodian?33. Are unannounced counts of petty cashmade by someone within the organizationother than the fund custodian?Payroll34. Are time sheets required documentingemployee hours, overtime and whatactivity the employee worked on?35. Are time sheets signed by employees andreviewed and signed by their immediatesupervisors?36. Are employment records maintained foreach employee that detail wage rates,benefits, tax rates, and other pertinentinformation?37. Are withheld employment taxes andemployer taxes paid on a timely basis tothe taxing authorities?Yes No Not SureNotApplicable_______ _______ _______ ______________ _______ _______ ______________ _______ _______ ______________ _______ _______ ______________ _______ _______ ______________ _______ _______ ______________ _______ _______ ______________ _______ _______ ______________ _______ _______ ______________ _______ _______ ______________ _______ _______ ______________ _______ _______ ______________ _______ _______ _______© 2008 <strong>CompassPoint</strong> <strong>Nonprofit</strong> <strong>Services</strong>

<strong>Internal</strong> <strong>Controls</strong> <strong>Checklist</strong>51. Does the chart of accounts provide fortracking unallowable costs if theorganization expends federal funds?52. Are accounting and program staffknowledgeable about all fund sourcerules, regulations and requirements?53. Is fund accounting used to track restrictedgrants and the spending related to them?54. Are accounting records up to date, andmonthly financial statements prepared ona timely basis (timely being defined as 10days to 3 weeks maximum)?55. Does the board of directors approve theannual budget?56. Does an accounting procedure andpolicies manual exist that is reviewed andrevised annually?57. Do accounting staff take annual vacationand are their basic duties performed bysomeone else in their absence?58. Are all appropriate federal, state, andlocal information returns filed on a timelybasis?Yes No Not SureNotApplicable_______ _______ _______ ______________ _______ _______ ______________ _______ _______ ______________ _______ _______ ______________ _______ _______ ______________ _______ _______ ______________ _______ _______ ______________ _______ _______ _______© 2008 <strong>CompassPoint</strong> <strong>Nonprofit</strong> <strong>Services</strong>