Guidelines on Processing under Customs Control Procedure – PCC ...

Guidelines on Processing under Customs Control Procedure – PCC ...

Guidelines on Processing under Customs Control Procedure – PCC ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

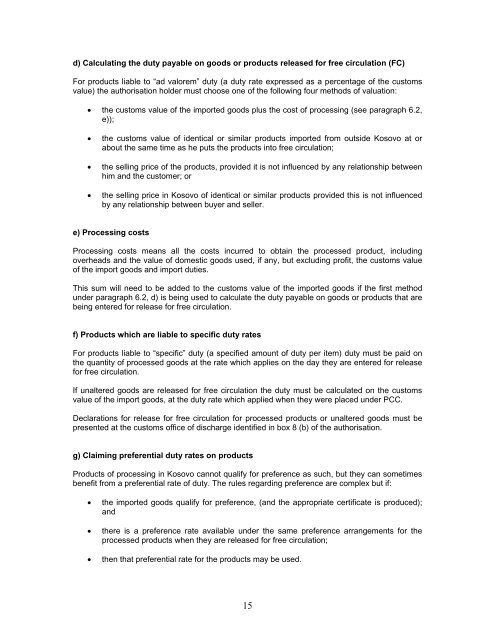

d) Calculating the duty payable <strong>on</strong> goods or products released for free circulati<strong>on</strong> (FC)For products liable to “ad valorem” duty (a duty rate expressed as a percentage of the customsvalue) the authorisati<strong>on</strong> holder must choose <strong>on</strong>e of the following four methods of valuati<strong>on</strong>:• the customs value of the imported goods plus the cost of processing (see paragraph 6.2,e));• the customs value of identical or similar products imported from outside Kosovo at orabout the same time as he puts the products into free circulati<strong>on</strong>;• the selling price of the products, provided it is not influenced by any relati<strong>on</strong>ship betweenhim and the customer; or• the selling price in Kosovo of identical or similar products provided this is not influencedby any relati<strong>on</strong>ship between buyer and seller.e) <strong>Processing</strong> costs<strong>Processing</strong> costs means all the costs incurred to obtain the processed product, includingoverheads and the value of domestic goods used, if any, but excluding profit, the customs valueof the import goods and import duties.This sum will need to be added to the customs value of the imported goods if the first method<strong>under</strong> paragraph 6.2, d) is being used to calculate the duty payable <strong>on</strong> goods or products that arebeing entered for release for free circulati<strong>on</strong>.f) Products which are liable to specific duty ratesFor products liable to “specific” duty (a specified amount of duty per item) duty must be paid <strong>on</strong>the quantity of processed goods at the rate which applies <strong>on</strong> the day they are entered for releasefor free circulati<strong>on</strong>.If unaltered goods are released for free circulati<strong>on</strong> the duty must be calculated <strong>on</strong> the customsvalue of the import goods, at the duty rate which applied when they were placed <strong>under</strong> <strong>PCC</strong>.Declarati<strong>on</strong>s for release for free circulati<strong>on</strong> for processed products or unaltered goods must bepresented at the customs office of discharge identified in box 8 (b) of the authorisati<strong>on</strong>.g) Claiming preferential duty rates <strong>on</strong> productsProducts of processing in Kosovo cannot qualify for preference as such, but they can sometimesbenefit from a preferential rate of duty. The rules regarding preference are complex but if:• the imported goods qualify for preference, (and the appropriate certificate is produced);and• there is a preference rate available <strong>under</strong> the same preference arrangements for theprocessed products when they are released for free circulati<strong>on</strong>;• then that preferential rate for the products may be used.15