Download Now - The Burrill Report

Download Now - The Burrill Report

Download Now - The Burrill Report

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

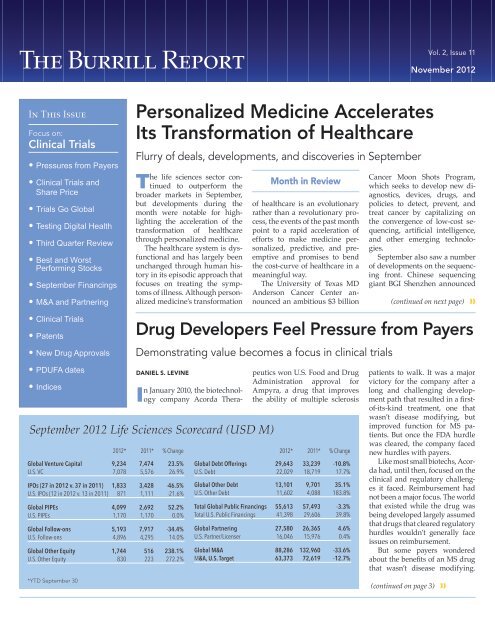

<strong>The</strong> <strong>Burrill</strong> <strong>Report</strong><strong>The</strong> <strong>Burrill</strong> <strong>Report</strong>tPUBLISHERG. Steven <strong>Burrill</strong>EDITORDaniel S. LevineMANAGING EDITORMarie DaghlianASSOCIATE EDITORMichael FitzhughRESEARCHERVinay SinghGRAPHIC DESIGNERSCarol CollierDeven CaoSALESBryan Plescia(415) 591-5471bplescia@b-c.comtISSN:1943-7617PUBLISHED MONTHLY BY:BURRILL & COMPANYONE EMBARCADERO CENTERSUITE 2700SAN FRANCISCO, CA 94111T: 415-591-5400EMAIL: dlevine@b-c.comMonth in Review❱❱ (continued from page 1)a $117.6 million acquisition ofthe struggling next-generationsequencing company CompleteGenomics. Mountain View, California-basedComplete Genomics,which has been working toprovide whole genome sequencingthrough a service-basedbusiness model, announced a restructuringin June that includeda shift in focus to the developmentof clinical applications forits whole genome sequencingservice. BGI-Shenzhen providesdeep pockets that should acceleratethe clinical applications ofComplete Genomic’s technology.Complete Genomics’ largercompetitors also announced developmentsthat should acceleratethe clinical utility of genomicsequencing. Life Technologiesbegan shipping its low-cost IonProton sequencing system. <strong>The</strong>company said the chip-basedsystem cost about a third of genomescale sequencing systemsthat rely on light to read a genome.<strong>The</strong> device sits on a desktopand can sequence exomesand transcriptomes in two tofour hours at a cost of $1,000 perrun. Life Technologies expects torelease a second-generation chipfor the system around the end ofthe first quarter of 2013 that willbe able to sequence the humangenome in a few hours for $1,000.At the same time, the geneticsequencing tools company Illuminaand the non-profit healthcaresystem Partners Healthcareannounced an agreement toprovide geneticists and pathologistsnetworking tools and infrastructureto report and interpretdata from genetic sequencing.By pairing Illumina’s expertisein sequencing with PartnersHealthcare’s understanding ofwhat’s needed for clinical utility,the two hope to leverageeach other’s strengths to delivera comprehensive sequencing andclinical reporting solution.Others are also taking stepsto apply new personalized medicineapproaches to clinical care.<strong>The</strong> Big Data analytics companyGNS Healthcare in Septemberannounced a new program withthe healthcare insurance companyAetna to use GNS’ supercomputingcapabilities to helpidentify Aetna members at riskfor heart and metabolic disordersthat can result in stroke, heart attackor diabetes, earlier than itdoes today. GNS will develop data-drivenmodels that will definea person’s risk for developingmetabolic syndrome using Aetnaclaims data as well as healthrecords. A separate agreementbetween GNS and the contractresearch organization Covanceseeks to improve drug developmentby using GNS’ modelingto predict the safety and efficacyof a drug candidate against differentpatient characteristics. Onthe research side, September alsosaw major advances in understandingthe genetics underlyingdisease.<strong>The</strong> Encode Project, an ambitiousinternational effort to characterizeand publish all of thefunctional elements in the humangenome, found that the 80percent of DNA once thought ofas “junk” actually plays a criticalrole in regulating genes and canalso play a part in the onset of disease.Researchers identified morethan 4,000 switches involved ingene regulation. <strong>The</strong> findings notonly create a new understandingof the role of some 80 percent ofDNA once thought to serve nofunctional role, but also providea new source of potential targetsfor drugs, and new insight intohow genes are regulated andhow people become ill.Separately, a collaborative effortfunded by the National CancerInstitute and the NationalHuman Genome Research Institute,using data generated as partof <strong>The</strong> Cancer Genome Atlas, hasprovided a new understandingLife Technologies expects to releasea second-generation chip for its IonProton sequencing system around theend of the first quarter of 2013 that willbe able to sequence the human genomein a few hours for $1,000.of the four major subtypes ofbreast cancer finding shared geneticfeatures between the formof breast cancer known as “Basallike”or “Triple Negative” breastcancer and serious ovarian cancer.<strong>The</strong> findings will lead to researcherscomparing treatmentsand outcomes for patients withthe two forms of cancer andcould lead to new therapeutic approaches.New research findingsare a reminder about how muchwe still don’t know, but also reflectthe rapid progress beingmade. <strong>The</strong>re are real examples ofpersonalized medicine movingfrom idea to practice in meaningfulways.<strong>The</strong> Dow Jones Industrial Averageand the Standard & Poor’s500 both hit five-year highs inSeptember, and the NasdaqComposite Index hit a 12-yearhigh. <strong>The</strong> <strong>Burrill</strong> Biotech SelectIndex outpaced the major indicesin September as it posted a4.4 percent gain compared to a2.6 percent rise in the Dow, a 2.4(continued on page 4) ❱❱November 2012 2

<strong>The</strong> <strong>Burrill</strong> <strong>Report</strong>Clinical Trials and Payers❱❱ (continued from page 1)Ampyra is a potassium channel blockerthat essentially restores the ability to conductelectrical signals to nerve fibers thathave lost their protective myelin insulation.In retrospect, Ron Cohen, CEO ofAcorda says, if the company knew whatit was going to encounter, it likely wouldhave added elements to its clinical developmentprogram that would have beengeared toward managed care acceptance,but might not necessarily have improvedits chances of regulatory approval.“This is not your grandfather’s Buickanymore. If you grew up in biotech anytime prior to the last five years, youneed to reexamine your assumptionsabout the world of reimbursement. Ithas changed dramatically and it is continuingto change at really stunningspeed,” says Cohen, who says Acordanow engages payers in presentations ofthe company’s early-stage pipeline inpreparation for later discussion on clinicaltrial design once proof-of-concept isestablished. “If you are a developer, youneed to understand it and if you don’thave that expertise in house, go get it,or hire it as a consultant at a minimum,because you need to do it.”Such discussions are not unusual forBig Pharma today, which has not onlyengaged with payers to get their inputon clinical trials designs, but has alsoentered into research partnerships toaddress a variety of concerns and builda deeper dialogue with payers, whonow exert a greater influence on themarket success or failure of a drug.AstraZeneca and Wellpoint announceda four-year collaboration in2011 to study use of already-marketeddrugs. Sanofi and Medco, now part ofExpress Scripts, also in 2011 announcedan agreement that gives Sanofi accessto Medco’s comparative data to helpshape its drug development strategy.And Pfizer that same year announcedseparate agreements with Humana andMedco. <strong>The</strong> Humana collaboration isfocused on improving healthcare for seniorswhile the Medco collaboration focuseson identifying patient subgroupsthat both experimental and marketeddrugs would benefit.In other cases, drugmakers and payershave entered novel collaborationsto share risks by linking the price paidfor drugs to actual outcomes. A 2009agreement between Merck and CIGNA,described as “the first national outcomebasedcontract between a pharmaceuticalcompany and a pharmacy benefitmanagement company,” provides paymentsto Merck that are based on howwell its type 2 diabetes drugs Januviaand Janumet improve blood glucose levelsin patients using the drugs. A separateagreement that same year betweenpartners Procter & Gamble and Sanofiwith the insurer Health Alliance callsfor the drugmakers to cover the cost oftreating patients covered by the insurerwho use the osteoporosis drug Actonelwho develop bone fractures.Payers say what they want to understandis the value of new medications.Ideally, they say what they would like tosee is clinical trials of new medicationsagainst standard of care to establishsuperiority, something they say pharmaceuticalcompanies are reluctant todo because failure to demonstrate thatcould kill the market for a drug.“<strong>The</strong> value of the medication needsto be established. A lot of times a pharmaceuticalfirm will do some economicmodeling for a drug and make some assertionthat you can reduce other medicalcosts,” says Edmund Pezalla, nationalmedical director for pharmacy policyand strategy for Aetna. He says this caninclude claims of medical costs offsets,such as a patient’s use of a drug wouldhelp avoid having a stroke, other medicalevent, or the need to go to an emergencyroom. “But randomized clinicaltrials are not the best place to look forPayers say they want to understand the value ofnew medications. <strong>The</strong>y would like to see clinicaltrials of new medications against standard ofcare to establish superiority, something they saypharmaceutical companies are reluctant to dobecause failure could kill the market for a drug.those medical costs offsets,” he says.In the absence of comparative effectivenessdata, or data on offsets andactual use by patients that are better determinedin real-world studies, there arethings that payers would like to gatherfrom clinical trials. <strong>The</strong>se include understandingif there are subgroups of patientsthat benefit from a drug, not onlythrough the use of biomarkers, but othermeasures such as medical histories orphenotypic data. <strong>The</strong>y are also interestedin measures of quality of life, such aswhether the use of a drug improves theability of someone to stay employed, doactivities around the home, and remainproductive.“It’s not just a matter of, ‘here’s a medicineand you can use it.’ What we aretrying to determine is where does thatmedicine go?” says Pezella. “Is it a medicationthat is for a niche population andthat’s how we should treat it; or is it amedication for a broader audience and itshould be used after an existing generic;or is it a brand new sort of medicationthat really changes patient outcomes, reallychanges patient quality of life?”Roger Longman, CEO of Real Endpoints,a reimbursement-focused informationcompany, said for the most part,there’s a significant difference betweenwhat payers and regulators want fromclinical trials and trying to satisfy bothpresents a challenge. While drug developersare certainly moving toward takinginto account payer concerns in clinicaltrials designs, the data payers mostcare about are still questions answeredonly after an approval.(continued on next page) ❱❱November 2012 3

<strong>The</strong> <strong>Burrill</strong> <strong>Report</strong><strong>The</strong> Risk and Rewards of Clinical Trials Results to InvestorsValue shifts to earlier stages for biotech companiesBY VINAY SINGHWhile biotech stocks are not immuneto the vagaries of the broader market,they tend to rise and fall with companies’prospects as clinical and other developmentsmove them toward success or failure. <strong>The</strong>re’slong been a common wisdom among biotechinvestors about what events create the mostvalue, but as business models have changed,what creates value for a company appears tobe changing as well.<strong>The</strong> <strong>Burrill</strong> <strong>Report</strong> examined clinical trialdata results since the beginning of 2010 forpublicly traded biotechnology companieswith drugs in mid- and late-stage trials. BigPharma companies were excluded from thedata as were companies that did not trade onU.S. exchanges. <strong>The</strong> stock price at the close oftrading on both the day a clinical trial resultwas announced and the day after was usedto measure the impact, as well as the lowestand highest share price from those two days,for our analysis.Biotech investors generally expect that positivelate-stage clinical trial results most propelstocks. But such assumptions may be rooted indifferent times for biotech when companies’fortunes were more closely tied to an FDAapproval. Today, with many smaller biotechsnot planning to commercialize products themselves,critical partnering deals and financingshave increasingly been tied to proof-of-conceptresults.In fact, <strong>The</strong> <strong>Burrill</strong> <strong>Report</strong> found that latestageclinical trial results pose less upside andgreater risk for investors than mid-stage trialresults in recent years. On average, late-stageclinical trials that resulted in positive data leadto only a 5.9 percent increase in the company’sstock price. That compared to an 8 percent increasein stock price, on average, for all companiesthat received positive mid-stage data.Companies that had the misfortune ofTop 20 Positive Movers From Mid- and Late-StageClinical Trial Results (2010-2012)Bottom 20 Negative Movers From Mid- and Late-StageClinical Trial Results (2010-2012)failing a late-stage trial saw more dramaticmoves as their shares fell, on average, 25.8percent. A failed mid-stage trial, on the otherhand, only meant an average 11 percent dropin a company’s share price.What’s more, of the 46 companies that hadlate-stage trial failures, 18, or nearly 40 percentsaw their shares slip 33 percent or more.Companies that had mid-stage trial failures,only 11 percent saw one-third or more oftheir value lost.<strong>The</strong> effect of a failed clinical trial on a company’sstock varied depending on the market-capof the company. Mid-cap companies(companies with market caps of $500 millionor more) proved to be more resilient thansmall or micro-cap companies. <strong>The</strong>re were30 companies that failed a late-stage trial thatsaw their share price drop 10 percent or more.Of those companies, only 5 had market-capsof $500 million or more the day before thefailed clinical trial was announced. Likewise,among the 17 companies that failed a midstagetrial and saw their stock price sink 10percent or more, only 2 had market caps of$500 million or more.A larger market-cap company likely has astronger fundamental business, with deeperpipelines, a stronger, more proven managementteam, or even a product or products onthe market and thus is more resilient to badnews. This, however, also may serve to hurtthe upside potential of a big price pop on goodnews as the perceived success has alreadybeen priced into the company’s shares.This analysis suggests that Wall Street hasadjusted its perception of biotechnology companiesto be more in line with the new valuechain of the life sciences industry. Traditionallya biotechnology company’s value wouldhave been correlated with its ability to becomea fully integrated pharmaceutical company.That is to say a biotech company’s value wouldincrease as it successfully moved through theclinical-stage trials, gained approval, andbrought its product to market. <strong>Now</strong>, though,as the biotech business model has adjustedand value is no longer just a derivative of salesand revenue, Wall Street is putting greater emphasison companies that successfully reachthe proof-of-concept stage with successfulmid-stage data, a point at which they are ableto raise significant money, enter a major partnership,or find a buyer.nNovember 2012 5

<strong>The</strong> <strong>Burrill</strong> <strong>Report</strong>XXXXXXSa world of trustin a drop ofdistinctionTrust your workforce to an industry leaderCompanies everywhere are facing a common challenge: grow their businesseswhile minimizing fixed costs. Many life sciences companies achieve this balancethrough a highly skilled workforce of specialized experts who are easily engaged,scaled, and reassigned for specific processes. A workforce with this kind ofversatility can shorten your projected timelines, increase productivity, keepingexpenses down.Kelly ® has the kind of functional and flexible workforce solutions you need toenjoy a distinct competitive advantage in today’s workforce transformation.We are the world’s most recognized scientific staffing provider and a respectedworkforce partner to hundreds of companies around the globe. We understandthat access to skilled professionals remains the catalyst of success in all lifesciences environments, and with more scientific professionals turning to Kellyevery day, you can trust us to deliver workforce solutions that work for you.Key areas of focus::: Bioprocessing:: Molecular and cellular biology:: Protein Synthesis:: Clinical Research:: Biochemistry:: QA/QC:: Regulatory affairsTransform your workforceContact any of our global offices. Send us an e-mail or visit ourWeb site today to find the office nearest you.E-mail: scientific@kellyservices.com :: Web: kellyservices.us/scienceContract :: Contract to hire :: Direct hireKelly Scientific Resources® is a registered trademark of Kelly Services.An Equal Opportunity Employer © 2012 Kelly Services, Inc. X1494Visit us onNovember 2012 9

<strong>The</strong> <strong>Burrill</strong> <strong>Report</strong>THIRD QUARTER STATISTICSMid-Cap Biotechs Attract Big Pharma CashGSK snaps up Human Genome Sciences and AstraZeneca partners with AmylinBY MARIE DAGHLIANThird Quarter ReviewQ3 Financing by type: globalQ3 Financing by type: U.S.Third Quarter 2012 Financings by TypeGLOBAL4%78%10%5%1%2%U.S.1%81%10%5%1%2%2012 U.S. Venture FinancingsBy Category<strong>The</strong> third quarter of 2012 saw GlaxoSmithKline acquireits long-time partner Human Genome Sciences, endinga three-month battle between the two companies.GlaxoSmithKline succeeded by raising its all cash offerto $14.25 per share from the $13.00 per share offer it hadmade in April 2012. A premium of 99 percent to HGS’s closingprice on April 18 before GSK’s initial offer was madepublic. <strong>The</strong> deal values HGS at approximately $3.6 billionon an equity basis, or about $3 billion net of cash and debt.GSK gained complete ownership of Benlysta, albiglutide,and darapladib, all of which were the subject of an existingpartnership between GSK and HGS. GSK expects to achieveat least $200 million in cost synergies to be fully realizedby 2015, and expects the transaction to be accretive to coreearnings beginning in 2013.Benlysta, the first new treatment for lupus in more than50 years, won U.S. regulatory approval in the spring of 2011amid a lot of hope and expectation. At the time, analystsexpected peak sales of more than $2 billion a year. But ithas had disappointing sales due to a poor roll-out and pushback in Europe over its high cost. Both the German and theUK health systems refused to reimburse for the drug.<strong>The</strong> final agreement between the two partners put to resta hostile back-and-forth. GSK made repeated attempts to acquireHGS after its initial $2.6 billion buyout offer. <strong>The</strong> boardof directors at HGS promptly rebuffed the offer believing itto be too low and even claimed to have other suitors, such asCelgene. <strong>The</strong> maneuvers included GSK attempting to buyHGS stock directly from investors and a “poison pill” strategyemployed by HGS that would liquidate all of its assetsand make acquiring its stock nearly impossible.In the end, however, a sweetened pot of $400 million andthe lack of other legitimate buyers (likely due to GSK alreadyowning licensing rights to all of HGS’s drugs) wasenough for HGS to accept to GSK’s bid.Interestingly, after the GSK bid was accepted by HGS, itwas reported that the company had rebuffed a $7 billionbuyout offer from Amgen in 2010. <strong>The</strong> high bid was probablydue to expectations of blockbuster status for Benlystabefore its approval.Human Genome’s shares had been languishing in thewake of weak Benlysta sales until the GSK offer becamepublic. <strong>The</strong> same was true for Amylin, another mid-capbiotech that gained the interest of Big Pharma after it shedits diabetes alliance with Eli Lilly in late 2011 and gainedapproval of Bydureon, its once-weeklydiabetes drug, in January 2012. Shares ofAmylin languished at $10 for a long timeuntil it was leaked that Bristol-MyersSquibb had made a private offer to buythe company in February for $22 a share.Bristol-Myers eventually sweetened itsVCoffer and snapped up Amylin for $31 aIPO share at the end of June in a complicatedPIPE deal that involved a partnering agreementFollow on between Amylin and AstraZeneca. In Julywhen the sale was completed, AstraZenecapaid Amylin $3.4 billion to becomeDebtOther eq. an equal partner in its diabetes program,which besides Amylin’s diabetes franchise,includes BMS compounds alreadypartnered with AstraZeneca.nNovember 2012 10

THIRD QUARTER STATISTICS<strong>The</strong> <strong>Burrill</strong> <strong>Report</strong>Biggest Movers in Third Quarter of 2012TICKER COMPANY PRICE8/31/2012PRICE9/28/2012PRICECHANGEPERCENTCHANGEREASONADVANCERSSRPTGNMKSNSSSarepta<strong>The</strong>rapeuticsGenMarkDiagnosticsSunesisPharmaceuticals3.76 15.53 11.77 313.5% Announced clinical benefit with Eteplirsen, its experimentaldrug for the treatment of muscular dystrophy, in a mid-stagestudy.4.34 9.21 4.87 112.2% Receives FDA 510(k) clearance for its respiratory virus panel test.2.87 5.63 2.76 96.2% Shares surge after company said it would add more patients toits late-stage study of its cancer drug vosaroxin.XNPT Xenoport 6.04 11.45 5.41 89.6% Released favorable data from early-stage clinical trial for its oralrelapsing-remitting multiple sclerosis treatment, XP23829.CLSN Celsion 3.07 5.44 2.37 77.2% CEO positioned liver cancer drug <strong>The</strong>rmoDox has potential tobe a blockbuster drug with over $1B in sales.NGNM Neogenomics 1.70 3.01 1.31 77.1% Company is initiated with a “buy” at Craig-Hallum.INFIInfinityPharmaceuticals13.56 23.51 9.95 73.4% Stock rallies on the prospects of its mid-stage combination IPI-504 with docetaxel experimental treatment for lung cancer.IRIS IRIS International 11.30 19.52 8.22 72.7% Agreed to be acquired by Danaher Corporation for $19.50 ashare.TKMRCBLIDECLINERSPGNXTekmiraPharmaceuticalsClevelandBioLabsProgenicsPharmaceuticals2.11 3.63 1.52 72.0% Shares jumped after Alnylam Pharmaceuticals announcedpositive results of its early-stage RNAi therapeutic which utilizesTekmira’s technology.1.57 2.68 1.11 70.7% Received FDA agreement on pivotal animal efficacy studies forthe development of entolimed as a radiation countermeasure.9.78 2.88 -6.9 -70.6% FDA did not approve its constipation drug for use in a widerpopulation.PURE PURE Bioscience 3.52 1.05 -2.47 -70.2% Announced pricing of 3.7 million shares of common stock at$1.10 a share.QCOROXBTQuestcorPharmaceuticalsOxygenBiotherapeutics53.24 18.47 -34.77 -65.3% Announced that the U.S. government was investigating thecompany’s promotional practices.1.57 0.60 -0.97 -61.8% <strong>Report</strong>ed increases in net loss and less revenue for Q3.GEVO Gevo 4.97 2.14 -2.83 -56.9% Announced plans to stop producing isobutanol and shifting toethanol production at its Minnesota facility.MAXY Maxygen 5.96 2.64 -3.32 -55.7% Company declares special dividend after reporting that Q2 EPSfell 47% compared to the same quarter the year before.IDIXIdenixPharmaceuticals10.28 4.56 -5.72 -55.6% Announced pricing of 22 million shares of common stock at $8a share.TNGN Tengion 2.95 1.35 -1.60 -54.2% Delisted from the NASDAQ stock exchange due to noncompliancewith minimum shareholder’s equity requirement.HBP Helix Biopharma 1.27 0.6 -0.67 -52.8% Announced filing of form 15F to terminate SEC reportingobligations.HZNP Horizon Pharma 7.13 3.50 -3.63 -50.9% Shares fell despite receiving FDA approval for its delayedreleaseRayos tablets for the treatment of a range of diseasesincluding rheumatoid arthritis and chronic obstructivepulmonary disease.nNovember 2012 11

THIRD QUARTER STATISTICS<strong>The</strong> <strong>Burrill</strong> <strong>Report</strong>Q3 2012 Top FinancingsCOMPANY TICKER CAPITAL RAISED(USD M)PRINCIPAL FOCUSVENTURENantpharma 125.0 <strong>The</strong>rapeuticsCurevac (Germany) 104.9 <strong>The</strong>rapeuticsElevance Renewable Sciences 104.0 Industrial/Agbluebird bio 60.0 <strong>The</strong>rapeuticsCardiodx 58.0 DiagnosticsTriplex International Biosciences (China) 50.0 DiagnosticsAragon Pharmaceuticals 50.0 <strong>The</strong>rapeuticsOnconova <strong>The</strong>rapeutics 50.0 <strong>The</strong>rapeuticsRelypsa 49.7 <strong>The</strong>rapeuticsIntarcia <strong>The</strong>rapeutics 45.8 <strong>The</strong>rapeuticsBest Doctors Inc 45.5 Healthcare ItFoundation Medicine 42.5 DiagnosticsGenomatica 41.5 Industrial/AgAgile <strong>The</strong>rapeutics 40.0 <strong>The</strong>rapeuticsCell Mdx 40.0 DiagnosticsIPOSGlobus Medical NYSE:GMED 99.6 Spine Repair DevicesHainan Shuangcheng Pharma (China) SHE:002693 94.0 PharmaceuticalsHangzhou Tigermed (China) SHE:300347 80.0 CroJinhe Biotechnology (China) SHE:002688 78.6 Animal AntibioticsDurata <strong>The</strong>rapeutics DRTX 77.6 AntibioticsHyperion <strong>The</strong>rapeutics HPTX 57.5 Hepatic DrugsPharmaengine (Taiwan) GRETAI:4162 31.7 Cancer DrugsClinigen (United Kingdom) AIM:CLIN 16.2 Specialty PharmaPIPESA.P. Pharma OTC:APPA 53.6 <strong>The</strong>rapeuticsChina Cord Blood Corp (China) CO 50.0 Tools/TechnologyAchillion Pharmaceuticals ACHN 41.8 <strong>The</strong>rapeuticsAlimera Sciences ALIM 40.0 <strong>The</strong>rapeuticsBiotie <strong>The</strong>rapies HSE:BTHIV 37.8 <strong>The</strong>rapeuticsPalatin Technologies PTN 35.0 <strong>The</strong>rapeuticsNupathe PATH 28.0 <strong>The</strong>rapeuticsMologen (Germany) XETRA:MGN 27.1 <strong>The</strong>rapeuticsInsmed INSM 26.0 <strong>The</strong>rapeuticsSynta Pharmaceuticals SNTA 25.8 <strong>The</strong>rapeuticsRepros <strong>The</strong>rapeutics RPRX 23.6 <strong>The</strong>rapeuticsOxford Biomedica (United Kingdom) LSE:OXB 18.1 <strong>The</strong>rapeutics(continued) ❱❱November 2012 12

THIRD QUARTER STATISTICS<strong>The</strong> <strong>Burrill</strong> <strong>Report</strong>❱❱ (continued)Q3 2012 Top FinancingsCOMPANY TICKER CAPITAL RAISED(USD M)PRINCIPAL FOCUSFOLLOW-ONSIdenix Pharmaceuticals IDIX 202.4 <strong>The</strong>rapeuticsExelixis EXEL 127.5 <strong>The</strong>rapeuticsSynageva Biopharma GEVA 115.0 <strong>The</strong>rapeuticsImmunogen IMGN 100.0 <strong>The</strong>rapeuticsInfinity Pharmaceuticals INFI 88.4 <strong>The</strong>rapeuticsHorizon Pharma HZNP 86.2 <strong>The</strong>rapeuticsOrasure Technologies OSUR 75.0 DiagnosticsZogenix ZGNX 65.0 <strong>The</strong>rapeuticsExact Sciences EXAS 61.7 DiagnosticsFluidigm FLDM 60.0 Tools/TechnologyMap Pharmaceuticals MAPP 59.8 <strong>The</strong>rapeuticsCorcept <strong>The</strong>rapeutics CORT 46.4 <strong>The</strong>rapeuticsXenoport XNPT 40.0 <strong>The</strong>rapeuticsDEBTWatson Pharmaceuticals WPI 3,900.0 <strong>The</strong>rapeuticsMerck MRK 2,500.0 <strong>The</strong>rapeuticsValeant Pharmaceuticals (Canada) VRX 2,300.0 <strong>The</strong>rapeuticsBristol-Myers Squibb BMY 2,000.0 <strong>The</strong>rapeuticsCelgene CELG 1,500.0 <strong>The</strong>rapeutics<strong>The</strong>rmo Fisher Scientific NYSE:TMO 1,300.0 Tools/TechnologyHologic HOLX 1,000.0 DiagnosticsBiomet PRIVATE 1,000.0 Medical DevicesLabcorp LH 1,000.0 DiagnosticsElan (Ireland) ELN 600.0 <strong>The</strong>rapeuticsMonsanto MON 500.0 Industrial/AgAgilent Technologies NYSE:A 400.0 Tools/TechnologynNovember 2012 13

THIRD QUARTER STATISTICS<strong>The</strong> <strong>Burrill</strong> <strong>Report</strong>Q3 2012 Top US FinancingsCOMPANY TICKER CAPITAL RAISED(USD M)PRINCIPAL FOCUSVENTURENantPharma 125.0 <strong>The</strong>rapeuticsElevance Renewable Sciences 104.0 Industrial/Agbluebird bio 60.0 <strong>The</strong>rapeuticsCardioDx 58.0 DiagnosticsAragon Pharmaceuticals 50.0 <strong>The</strong>rapeuticsOnconova <strong>The</strong>rapeutics 50.0 <strong>The</strong>rapeuticsRelypsa 49.7 <strong>The</strong>rapeuticsIntarcia <strong>The</strong>rapeutics 45.8 <strong>The</strong>rapeuticsBest Doctors Inc 45.5 Healthcare ITFoundation Medicine 42.5 DiagnosticsIPOSGlobus Medical NYSE:GMED 99.6 Spine repair devicesDurata <strong>The</strong>rapeutics DRTX 77.6 AntibioticsHyperion <strong>The</strong>rapeutics HPTX 57.5 Hepatic drugsPIPESA.P. Pharma OTC:APPA 53.6 <strong>The</strong>rapeuticsAchillion Pharmaceuticals ACHN 41.8 <strong>The</strong>rapeuticsAlimera Sciences ALIM 40.0 <strong>The</strong>rapeuticsBiotie <strong>The</strong>rapies HSE:BTHIV 37.8 <strong>The</strong>rapeuticsPalatin Technologies PTN 35.0 <strong>The</strong>rapeuticsNuPathe PATH 28.0 <strong>The</strong>rapeuticsInsmed INSM 26.0 <strong>The</strong>rapeuticsSynta Pharmaceuticals SNTA 25.8 <strong>The</strong>rapeuticsRepros <strong>The</strong>rapeutics RPRX 23.6 <strong>The</strong>rapeuticsFOLLOW-ONSIdenix Pharmaceuticals IDIX 202.4 <strong>The</strong>rapeuticsExelixis EXEL 127.5 <strong>The</strong>rapeuticsSynageva BioPharma GEVA 115.0 <strong>The</strong>rapeuticsImmunoGen IMGN 100.0 <strong>The</strong>rapeuticsInfinity Pharmaceuticals INFI 88.4 <strong>The</strong>rapeuticsHorizon Pharma HZNP 86.2 <strong>The</strong>rapeuticsOraSure Technologies OSUR 75.0 DiagnosticsZogenix ZGNX 65.0 <strong>The</strong>rapeuticsExact Sciences EXAS 61.7 DiagnosticsFluidigm FLDM 60.0 Tools/Technology(continued) ❱❱November 2012 14

THIRD QUARTER STATISTICS<strong>The</strong> <strong>Burrill</strong> <strong>Report</strong>❱❱ (continued)DEBTWatson Pharmaceuticals WPI 3,900.0 <strong>The</strong>rapeuticsMerck MRK 2,500.0 <strong>The</strong>rapeuticsBristol-Myers Squibb BMY 2,000.0 <strong>The</strong>rapeuticsCelgene CELG 1,500.0 <strong>The</strong>rapeutics<strong>The</strong>rmo Fisher Scientific NYSE:TMO 1,300.0 Tools/TechnologyHologic HOLX 1,000.0 DiagnosticsBiomet Private 1,000.0 Medical devicesLabCorp LH 1,000.0 DiagnosticsMonsanto MON 500.0 Industrial/AgAgilent Technologies NYSE:A 400.0 Tools/TechnologynTop M&A in the Third Quarter of 2012ACQUIRER TARGET DEALVALUE(USD M)GlaxoSmithKline(United Kingdom)ValeantPharmaceuticals(Canada)TPGRoper IndustriesHuman GenomeSciencesMedicisPharmaceuticalParPharmaceuticalSunquestInformationSystemsUPFRONT(USD M)PRINCIPALFOCUS/ STAGE OFDEVELOPMENTRATIONALE/PRINCIPAL ASSET3,000.0 Biopharmaceuticals GlaxoSmithKline will acquire Human Genome Sciences for$14.25 per share in cash, a premium of 99 percent to HGS’sclosing price on April 18 before GSK’s initial offer was madepublic. <strong>The</strong> deal values HGS at approximately $3.6 billion on anequity basis, or approximately $3 billion net of cash and debt.GSK will gain complete ownership of Benlysta, albiglutide anddarapladib, all of which were previously partnered with HGS.GSK expects to achieve at least $200 million in cost synergiesto be fully realized by 2015, and expects the transaction to beaccretive to core earnings beginning in 2013.2,600.0 Dermatology Valeant Pharmaceuticals will acquire all of the outstandingcommon stock of Medicis for $44.00 per share in cash,representing a 39 percent premium to Medicis’ closing priceon August 31, before the deal was announced. <strong>The</strong> transactionis expected to close in the first half of 2013. Medicis’ portfolioincludes leading prescription brands solodyn, Restylane,Perlane, Diana, Dysport and Zyclara.1,840.0 Generics Private equity firm TPG will take Par Pharmaceutical private ina $50 per share all cash deal that puts Par’s equity value at $1.9billion. <strong>The</strong> deal represents a premium of approximately 37percent over the closing share price on July 13, before the dealwas made public.1,415.0 Healthcare softwaresolutionsRoper Industries will acquire Sunquest Information Systems,the leading provider of diagnostic and laboratory softwaresolutions to healthcare providers, in an all cash transactionvalued at $1.415 billion, including $25 million in cash taxbenefits. Sunquest provides a comprehensive suite of clinicaland anatomic laboratory software solutions that are used bymore than 1,700 hospitals worldwide. Sunquest also provides agrowing suite of software solutions with a focus on point-of-carepatient safety and physician outreach.(continued) ❱❱November 2012 15

THIRD QUARTER STATISTICS<strong>The</strong> <strong>Burrill</strong> <strong>Report</strong>❱❱ (continued)Top M&A in the Third Quarter of 2012ACQUIRER TARGET DEALVALUE(USD M)Fresenius Kabi(Germany)BASF (Germany)<strong>The</strong>rmo FisherScientificMedtronicCinven (Europe)DSM(Netherlands)UPFRONT(USD M)PRINCIPALFOCUS/ STAGE OFDEVELOPMENTRATIONALE/PRINCIPAL ASSETFenwal 1,100.0 Tools/Technology Fresenius Kabi, a leading provider of infusion therapy andclinical nutrition, will acquire Fenwal, a global leader specializingin separation technologies for blood and cell collection andtherapy. <strong>The</strong> acquisition brings together two leaders in healthcare with complementary products, strategies and geographicpresence.BeckerUnderwood1,020.0 Crop protection German chemicals company BASF will acquire privately-heldU.S. crop technology company Becker Underwood for $1.02billion (€785 million), in a deal that would continue consolidationin the seed-treatment market and bolster BASF’s existingbusiness in crop protection, including chemical coatings andother treatments applied to seeds before they are planted,to protect crops from pests and other harm. other crops areencouraging farmers in the U.S. and elsewhere to invest in newseeds and other technologies designed to increase yields andrevenue. Becker Underwood is expected to generate $240million in annual sales, mainly in the United States, and BASFplans to use the company’s technology to enhance offeringsaround the world, especially in South America, Europe and partsof Asia. Becker Underwood produces beneficial nematodes,which are tiny worms that can help control pests such as weevilsand moths.One Lambda 925.0 TransplantdiagnosticsChina KanghuiHoldingsMercury Pharma(United Kingdom)<strong>The</strong>rmo Fisher Scientific will acquire privately-held One Lambda,a leader in transplant diagnostics, for $925 million in cash. OneLambda’s diagnostic tests are used by transplant centers fortissue typing, primarily to determine the compatibility of donorsand recipients pre-transplant, and to detect the presence ofantibodies that can lead to transplant rejection. <strong>The</strong> business,which generated revenue of $182 million in 2011, will becomepart of <strong>The</strong>rmo Fisher’s Specialty Diagnostics segment.816.0 Orthopedic devices Medtronic will acquire China Kanghui Holdings forapproximately $816 million in cash ($30.75 per Americandepository share). <strong>The</strong> total value of the transaction, net ofKanghui’s cash, is expected to be approximately $755 million.As a leading provider of orthopedic devices in China, Kanghuibrings a strong product portfolio and new product pipelinein trauma, spine and joint reconstruction. <strong>The</strong> combinedportfolio expands Medtronic’s offerings in orthopedic surgeryand complements the company’s existing presence in spine,neurosurgery, neuromodulation, advanced energy and surgicalnavigation.732.0 Generics Investor HgCapital has sold British pharmaceutical companyMercury Pharma to private equity firm Cinven for 465 millionpounds ($732 million). HgCapital bought the 25-year-oldpharmaceutical firm, which sells niche prescription off-patentproducts in the United Kingdom, Ireland and the Netherlands,in 2009.Tortuga (Brazil) 578.0 Animal nutrition Dutch food and chemicals group DSM will buy privately-heldBrazilian animal nutrition company Tortuga for about $578million (465 million euros) to strengthen its presence in LatinAmerica. DSM, the world’s largest vitamin maker, has sold off itslower-margin bulk chemicals businesses to focus on less cyclicalareas including food ingredients and high-end plastics. Tortuga,which sells nutritional supplements for chickens, swine, cowsand other cattle animals in Latin America, is expected to havesales of 385 million euros this year and an operating profit ofabout 60 million euros.(continued) ❱❱November 2012 16

THIRD QUARTER STATISTICS<strong>The</strong> <strong>Burrill</strong> <strong>Report</strong>❱❱ (continued)Top M&A in the Third Quarter of 2012ACQUIRER TARGET DEALVALUE(USD M)SunPharmaceuticals(India)Syngenta(Switzerland)BayerCropScience(Germany)TaroPharmaceuticals(Israel)UPFRONT(USD M)PRINCIPALFOCUS/ STAGE OFDEVELOPMENTRATIONALE/PRINCIPAL ASSET571.0 Generics Sun Pharmaceutical Industries takes Taro Pharmaceutical for$39.50 a share in cash for the 34 percent of the company it didn’talready own. Sun closed the deal after raising its offer from$24.50 per share. <strong>The</strong> new offer amounts to $571 million. Whenthe merger is completed, Taro will become a private company.Devgen (Belgium) 523.0 Agbiotech Syngenta will acquire Belgian company Devgen, a global leaderin hybrid rice and RNAi technology, to enable Syngenta tocombine its leading crop protection portfolio with Devgen’sbest-in-class rice hybrids and broad germplasm diversity.Devgen also brings proven expertise in RNAi-based insectcontrol, for which the two companies signed a global licenseand research agreement to develop spray applications fourmonths previously.AgraQuest 500.0 425 Biopesticides Bayer CropScience, a division of Bayer AG, will acquirebiopesticide developer AgraQuest for close to $500 million.Bayer will pay AgraQuest $425 million upfront, plus milestonepayments. <strong>The</strong> acquisition will enable Bayer CropScience tobuild a leading technology platform for green products andto strengthen its strategically important fruits and vegetablesbusiness, while also opening new opportunities in other cropsand markets.SAIC maxIT Healthcare 473.0 Healthcare IT Science Applications International will acquire maxIT HealthcareHoldings for $473 million. <strong>The</strong> acquisition more than doublesSAIC’s commercial healthcare business, and will make up themajority of revenue for the company’s overall health care unit.maxIT provides clinical, business and information technologyservices for health care companies.SunovionPharmaceuticals(DainipponSumitomoPharma)Hill-RomElevationPharmaceuticalsAspen SurgicalProducts430.0 100 Respiratory/ Phase 2 Sunovion Pharmaceuticals will acquire privately-held ElevationPharmaceuticals, which is focused on the development of newaerosol therapies for patients with respiratory diseases. <strong>The</strong>acquisition includes Elevation’s EP-101, an inhalation solutionof a long-acting muscarinic antagonist bronchodilator thatis in phase 2b clinical trials for the treatment of patients withmoderate to severe chronic obstructive pulmonary disease.Sunovion will make an upfront payment of $100 million, plusmilestones based on the development and commercializationof EP-101.400.0 Tools/Technology Hill-Rom Holdings acquires privately held Aspen SurgicalProducts for $400 million. Aspen Surgical provides a portfolioof well-established surgical consumable and specialty medicalproducts focused on improving the safety of patients and healthcare professionals. <strong>The</strong> deal further develops Hill-Rom’s surgicalbusiness, adding a portfolio of consumable products andexpanding its position in North American and European surgicalmarkets.Danaher Iris International 338.0 Diagnostics Danaher will acquire IRIS International, a leading manufacturerof automated in-vitro diagnostics systems and consumables,and a provider of high value personalized medicine solutions,for $19.50 per share in cash, representing an approximate 45percent premium over the closing price of IRIS’s common stockon September 14, 2012. Upon closing, IRIS will become part ofDanaher’s Beckman Coulter Diagnostics business.(continued) ❱❱November 2012 17

THIRD QUARTER STATISTICS<strong>The</strong> <strong>Burrill</strong> <strong>Report</strong>❱❱ (continued)Top M&A in the Third Quarter of 2012ACQUIRER TARGET DEALVALUE(USD M)ConvaTecPerrigoTeleflex108 MedicalHoldingsSergeant’s PetCare ProductsLMA International(Singapore)UPFRONT(USD M)PRINCIPALFOCUS/ STAGE OFDEVELOPMENTRATIONALE/PRINCIPAL ASSET321.0 Medical supplies ConvaTec, a world-leading developer and marketer of innovativemedical technologies for community and hospital care, willacquire all of the capital stock of 180 Medical Holdings for $321million. 180 Medical is a leading U.S. provider of disposable,intermittent catheters and urologic medical supplies.285.0 OTC pet care Perrigo will acquire substantially all of the assets of privatelyheldSergeant’s Pet Care Products, a manufacturer of overthe-countercompanion animal healthcare products, forapproximately $285 million in cash. Perrigo expects to receive asignificant tax benefit valued at approximately $50 million as aresult of the acquisition of Sergeant’s assets.276.0 Medical devices Teleflex, a global provider of medical devices for criticalcare and surgery, will acquire substantially all of the assetsof LMA International for approximately $276 million. LMA isa global market leader in laryngeal masks with a portfolioof innovative products used extensively in anesthesia andemergency care. <strong>The</strong> proposed acquisition will expandTeleflex’s anesthesia franchise.nQ3 2012 Top Partnering DealsCOMPANY/LI-CENSEEAmylin (Bristol-Myers-Squibb)COMPANY/LICENSERAstraZeneca(United Kingdom)TOTALDEALVALUE(USD M)UPFRONT(USD M)PRINCIPAL FO-CUS/ STAGE OFDEVELOPMENTRATIONALE/PRINCIPAL ASSET3,400.0 Diabetes AstraZeneca will enter into a collaboration with Amylin, followingcompletion its sale to Bristol-Myers Squibb, for an approximately$3.4 billion payment to Amylin. Profits and losses arising fromthe collaboration will be shared equally. AstraZeneca also hasthe option, exercisable at its sole discretion following the closingof the acquisition, to establish equal governance rights over keystrategic and financial decisions regarding the collaboration,upon the payment to Bristol-Myers Squibb of an additional $135million. Amylin’s primary focus is on the research, developmentand commercialization of a franchise of GLP-1 agonists, for thetreatment of type 2 diabetes.Molecular Partners(Germany)Allergan 1,462.5 62.5 Ophthalmic/ discovery,preclinicalAllergan and Molecular Partners expand their existing relationshipby entering into two separate agreements to discover,develop, and commercialize proprietary therapeutic DARPinproducts for the treatment of serious ophthalmic diseases.Molecular Partners will receive combined upfront paymentsof $62.5 million under the two agreements and is eligible toreceive additional success-based payments, including up to$1.4 billion in aggregate development, regulatory and salesmilestones, and tiered royalties up into the low double-digitsfor future product sales.(continued) ❱❱November 2012 18

THIRD QUARTER STATISTICS<strong>The</strong> <strong>Burrill</strong> <strong>Report</strong>❱❱ (continued)Q3 2012 Top Partnering DealsCOMPANY/LI-CENSEECOMPANY/LICENSERTOTALDEALVALUE(USD M)UPFRONT(USD M)PRINCIPAL FO-CUS/ STAGE OFDEVELOPMENTRATIONALE/PRINCIPAL ASSETGenmab (Denmark) Janssen (J&J) 1,100.0 135 Cancer/ phase 2 Genmab grants Janssen exclusive worldwide license to developand commercialize daratumumab, currently in phase 2 developmentfor multiple myeloma with potential in other cancerindications, as well as a backup human CD38 antibody. Genmabwill receive an upfront license fee of $55 million and Johnson &Johnson Development Corporation will invest about $80 millionfor 5.4 million new shares of Genmab at a price of DKK 88 pershare. Genmab’s closing share price on August 29, 2012 wasDKK 67.85. Genmab could also be entitled to up to $1 billionin development, regulatory and sales milestones, in additionto tiered double digit royalties. Janssen will be responsible forall costs associated with developing and commercializing daratumumabgoing forward, including the costs of two ongoingphase 1/2 studies.MacroGenicsRegulus<strong>The</strong>rapeuticsSelexys PharmaceuticalsSymphogen (Denmark)Servier(France)AstraZeneca(UnitedKingdom)Novartis(Switzerland)Merck KGaA(Germany)1,100.0 20 Cancer/ preclinical MacroGenics and Servier enter into an option agreement for thedevelopment and commercialization of Dual-Affinity Re-Targeting(DART) products directed at three undisclosed tumor targets.MacroGenics’ DART technology is a proprietary, bi-specificantibody platform in which a single recombinant molecule is ableto target two different antigens. MacroGenics will receive a $20million upfront payment. MacroGenics retains full developmentand commercialization rights to the three pre-clinical DART programsin the U.S., Canada, Mexico, Japan, Korea and India, whileServier has the option to obtain an exclusive license covering therest of the world. Prior to the exercise of Servier’s option, bothparties will fund and conduct specified research and developmentactivities.882.0 3 microRNA therapeutics/discovery665.0 Sickle cell disease/preclinicalRegulus <strong>The</strong>rapeutics, the Alnylam/Isis joint venture, entersinto a strategic alliance with AstraZeneca to discover, develop,and commercialize microRNA therapeutics for three exclusivetargets in pre-clinical development, focused on cardiovascularand metabolic diseases and oncology. AstraZeneca will pay $28million which includes an equity investment and a $3 millionupfront payment to Regulus. <strong>The</strong> targets include Regulus’ leadcardiovascular/metabolic disease program for the treatment ofatherosclerosis. Regulus will lead preclinical development whileAstraZeneca will lead and fund the clinical development andcommercialization. Regulus may also receive up to $509 million indevelopment milestones and up to $370 million in commercializationmilestones, plus royalties on commercialized microRNAtherapeutic products.As part of the completion of its Series A financing, Selexys grantsNovartis an exclusive option to acquire Selexys and its lead asset,the anti-P-selectin antibody SelG1, following the successfulcompletion of a phase 2 clinical study in patients with sickle celldisease. Including upfront, acquisition and milestone payments,the agreement with Novartis could reach up to $665 million.625.0 25 Cancer/ phase 2 Symphogen grants Merck KGaA exclusive worldwide rights todevelop and commercialize Sym004, an investigational antibodymixture targeting the epidermal growth factor receptor, which iscurrently being evaluated in a phase1/2 trial for the treatment ofpatients with advanced KRAS wild-type metastatic colorectal cancerwho have previously progressed on treatment with standardchemotherapy and a marketed anti-EGFR monoclonal antibody.Symphogen will receive $25 million upfront and is elgivle for clinical,regulatory, and sales milestones, plus royalties.nNovember 2012 19

THIRD QUARTER STATISTICS<strong>The</strong> <strong>Burrill</strong> <strong>Report</strong>❱❱ (continued)Q3 2012 Top Partnering DealsCOMPANY/LI-CENSEEOnconovaEvotec (Germany)AstraZeneca(United Kingdom)Rhizen Pharmaceuticals(Switzerland)Inspiration BiopharmaceuticalsCOMPANY/LICENSERBaxter InternationalJanssen Pharmaceuticals(J&J)TOTALDEALVALUE(USD M)UPFRONT(USD M)PRINCIPAL FO-CUS/ STAGE OFDEVELOPMENTRATIONALE/PRINCIPAL ASSET565.0 50 Cancer/ phase 3 Baxter and Onconova <strong>The</strong>rapeutics enter into a European licensingagreement for rigosertib, a novel targeted anti-cancer compoundcurrently in a phase 3 study for the treatment of a groupof rare hematologic malignancies and in a Phase 2/3 study forpancreatic cancer. Baxter will obtain commercialization rights inthe European Union and other countries in Europe for an upfrontpayment of $50 million plus up to $515 million in pre-commercialdevelopment and regulatory milestones for the two cancer indications,in addition to sales milestones and royalties. Baxter hasthe option to participate in the development and commercializationof rigosertib in additional indications.308.0 8 Insulin production/preclinicalPfizer 250.0 250 Gastrointestinal/marketedTG <strong>The</strong>rapeutics250.0 N/A Cancer; autoimmune/preclinicalIpsen (France) 215.0 30 Hemophilia/phase 3Evotec AG licenses to Janssen Pharmaceuticals a portfolio ofsmall molecules and biologics designed to trigger the regenerationof insulin-producing beta cells. Janssen will receive exclusiveaccess to a series of candidates designed to trigger the regenerationof insulin-producing beta cells. <strong>The</strong> small molecules andbiologics were identified by scientists in the Harvard Universitylaboratory of Douglas Melton, and further analyzed in collaborationwith scientists from Evotec, as part of the CureBeta researchand development program.Pfizer will acquire the exclusive global rights to market gastroesophagealreflux disease drug Nexium for the approved overthe-counterindications in the United States, Europe and the restof the world. Pfizer will make an upfront payment of $250 millionto AstraZeneca, and AstraZeneca is eligible to receive milestoneand royalty payments based on product launches and sales.Nexium, a proton pump inhibitor, was launched by AstraZenecain Europe in 2000 and the U.S. in 2001. AstraZeneca will continueto manufacture and market the prescription product, as well assupply Pfizer with the OTC product upon the receipt of regulatoryapproval.TG <strong>The</strong>rapeutics and Rhizen Pharmaceuticals have entered intoan exclusive global agreement to collaborate on the developmentand commercialization of Rhizen’s lead product candidate,a novel PI3K delta inhibitor, TGR-1202. <strong>The</strong> companies will jointlydevelop the product on a worldwide basis, excluding India,initially focusing on indications in the area of hematologic malignanciesand autoimmune disease. Beyond TGR-1202, Rhizenwould contribute backup molecules providing multiple opportunitiesfor TG to develop differentiated therapies against hematologiccancers and autoimmune diseases. TG <strong>The</strong>rapeutics will beresponsible for the costs of clinical development of the productsthrough phase 2, after which TG <strong>The</strong>rapeutics and Rhizen will bejointly responsible for all development costs of the product.Ipsen renegotiates its 2010 strategic partnership agreementwith Inspiration Biopharmaceuticals for the development andcommercialization of Inspiration’s recombinant product portfolio:OBI-1, a recombinant porcine factor VIII being developed for thetreatment of patients with acquired hemophilia A and congenitalhemophilia A with inhibitors, and IB1001, a recombinant factorIX for the treatment and prevention of bleeding in patients withhemophilia B. <strong>The</strong> new agreement aims to establish an effectivestructure whereby Ipsen gains commercial rights in key territories.Inspiration remains responsible for the world-wide developmentof OBI-1 and IB1001. As part of the renegotiation, Inspirationgets $30.0 million upfront, and is eligible for $185 million in additionalmilestones.nNovember 2012 20

THIRD QUARTER STATISTICS<strong>The</strong> <strong>Burrill</strong> <strong>Report</strong>Q3 2012 Select Pharma/Biotech Alliances With Academia And NonprofitsCOMPANY ACADEMIA/ NONPROFIT PRINCIPAL FOCUS TERMSADC <strong>The</strong>rapeutics(Switzerland)Cancer Research Technology(United Kingdom)Antibody drugconjugatesFluxion Biosciences Stanford University CancerpharmacogeneticsAstraZenecaCornell University; FeinsteinInstitute for Medical Research;University of British Columbia;Washington UniversityAlzheimer’s diseaseBoehringer Ingelheim Harvard University TranslationalresearchAbbott Laboratories;AstraZeneca; Bayer; EliLilly; GlaxoSmithKline;Merck; SanofiSanofi (France)Life TechnologiesBGI (China)Bill & Melinda GatesFoundation; InfectiousDisease Research Institute;National Institute of Allergyand Infectious Diseases; TexasA&M University; Weill CornellMedical CollegeBrigham and Women’sHospital (Harvard)Structural GenomicsConsortiumUniversity of Edinburgh(United Kingdom)TB researchaccelerationType 1 diabetesresearchEpigenetic antibodymaster listGenomicsCipla (India) Drugs for Neglected Diseases HIV anti-retroviraltherapyNovartis (Switzerland) University of Pennsylvania PersonalizedimmunotherapyCollaboration to develop cancer treatments called antibody drugconjugates using cancer research technology antibodies andpeptides, and ADC <strong>The</strong>rapeutic’s ‘warhead’ and linker chemistries.Partnership with Stanford’s School of Medicine to develop tests tosubtype different forms of disease and to develop more effective,individualized treatments for breast and lung cancer patients.Drug discovery partnership focused on apolipoprotein E (APOE)epsilon 4 in Alzheimer’s disease. <strong>The</strong> pharma’s neuroscienceinnovative medicines unit (iMED) will provide programmanagement and scientific expertise.Collaboration to identify signaling pathways and drug targetsfor cancer, cardiometabolic, fibrotic, and infectious diseases. Ajoint research committee will award funds to selected proposals.<strong>The</strong> collaboration is already supporting eight projects in cancerstem cell survival, replication of detrimental viruses, and fibroticprocesses.<strong>The</strong> seven pharmas have opened up sections of their compoundlibraries and agreed to share data with each other and the researchinstitutions under the Gates Foundation’s TB Drug Acceleratorprogram to discover treatments for tuberculosis.Research collaboration focused on immunology of type 1 diabeteswit both organizations sharing knowledge and applying theirrespective expertise in basic and applied research regardingdiabetes and drug target and candidate development. Researchersfrom both organizations will undertake proof-of-concept, safetyand functional studies for a novel immunomodulatory approachto treat type 1 diabetes. Sanofi has an option to exclusively licenseintellectual property emerging from this collaboration.Partnership to generate a first-ever master set of quality epigeneticrecombinant antibodies for use in disease-related research.Partners also include scientists at the Universities of Chicago andToronto.Partnership aimed at enhancing the university’s genomics andbioinformatics activities in biomedical research and livestockstudies.Partnership to develop by 2015 a low-cost, four-drug antiretroviralcombination therapy to treat HIV infection in children less thanthree years old.University of Pennsylvania grants Novartis an exclusive worldwidelicense to the technologies used in an ongoing trial of patientswith chronic lymphocytic leukemia as well as future cellularimmunotherapies using chimeric antigen receptor technologies.Penn and Novartis will build a first-of-its-kind Center for AdvancedCellular <strong>The</strong>rapies on the Penn campus in Philadelphia. Novartiswill invest in the establishment of the CACT and future research ofthe technology. Additional milestone and royalty payments to Pennare also part of the agreement.GNS Healthcare CHDI Foundation Neurology Data analytics company GNS Healthcare and CHDI will createa computer model of Huntington’s disease using GNS’ REFSmodeling technology with CHDI providing genomic, expression,and cell-signaling data. GNS will transfer the model to CHDI andaffiliated researchers after it is completed.(continued) ❱❱November 2012 21

THIRD QUARTER STATISTICS<strong>The</strong> <strong>Burrill</strong> <strong>Report</strong>❱❱ (continued)Q3 2012 Select Pharma/Biotech Alliances With Academia And NonprofitsCOMPANY ACADEMIA/ NONPROFIT PRINCIPAL FOCUS TERMSPerkinElmerTakeda Pharmaceutical(Japan)Astex PharmaceuticalsMassachusetts GeneralHospitalBritish Columbia CancerAgency (Canada)Cancer Research Technology(United Kingdom)Tumor profilingCancer researchEpigenetic drugCollaboration to develop a sequencing informatics system forprofiling the genetic changes in tumors for use in advanced cancerresearch.Research partnership to discover and develop cancer targets basedon gene analysis. <strong>The</strong> deal is the first for Takeda’s new ShonanIncubation Laboratories program, under which the pharma invitesdistinguished researchers from external institutions to lead projectsat the Shonan Research Center.Collaboration to discover and develop drug candidates targetingan undisclosed epigenetic target in a blood cancer with high unmetmedical need, combining Astex’s fragment-based drug discoveryplatform and epigenetic drug development experience withthe expertise in blood cancer biology at <strong>The</strong> Institute of CancerResearch and proven success in drug discovery at the CancerResearch UK Cancer <strong>The</strong>rapeutics Unit at the ICR.AstraZeneca Broad Institute Infectious disease Collaboration to identify new chemical compounds targetingbacterial and viral infections that could speed the development ofnew antibacterial and antiviral drugs. <strong>The</strong> chemical library, createdat the Broad Institute, comprises 100,000 customized moleculesknown as Diversity-Oriented Synthesis (DOS) compounds.Screening and hit-to-lead chemistry will take place in the Broad’sChemical Biology Platform and AstraZeneca will optimize, developand commercialize potential compounds from identified, highqualityleads.Abbott, AstraZeneca,Boehringer Ingelheim,Bristol-Myers Squibb,Eli Lilly and Company,GlaxoSmithKline, Johnson& Johnson, Pfizer,Genentech, and SanofiSanofi (France)TransCelerate BioPharmaGlobal Alliance for TB DrugDevelopmentSolving R&DchallengesTB drugdevelopmentBristol-Myers Squibb Vanderbilt University Parkinson’stherapiesTen biopharmas form a non-profit organization to accelerate thedevelopment of new medicines called TransCelerate BioPharma,to identify and solve common drug development challengeswith the end goals of improving the quality of clinical studies andbringing new medicines to patients faster. Ech of the ten foundingcompanies will combine financial and other resources, includingpersonnel, to solve industry-wide challenges in a collaborativeenvironment.Research collaboration agreement to accelerate the discovery anddevelopment of novel compounds against tuberculosis. Sanofiand TB Alliance will collaborate to further optimize and developseveral novel compounds in Sanofi’s library that have demonstratedactivity against Mycobacterium tuberculosis, the bacterium thatcauses TB.Partnership to discover, develop, and commercialize positiveallosteric modulators of mGluR4 to treat Parkinson’s disease. <strong>The</strong>university’s Center for Neuroscience Drug Discovery will receivean upfront payment and multi-year research funding from BMS toidentify drug candidates from the center’s preclinical mGluR4 PAMprogram; plus is eligible for milestones and royalties. BMS will haverights to develop and commercialize products resulting from the deal.nNovember 2012 22

<strong>The</strong> <strong>Burrill</strong> <strong>Report</strong>SEPTEMBER STATISTICSFinancings: Early-stage <strong>The</strong>rapeutic Financings Pull RankFunding is available for innovative startupsVenture capitalistswant companies tohave differentiatedproducts forunmet needs thattarget a definedpatient population.<strong>The</strong>y also want amanagement teamof businessmenand scientists thathave already beensuccessful movingother companiesforward.BY MARIE DAGHLIANAlthough the financing outlook forearly-stage biotech firms remainsdifficult, they are getting funded, especiallyif they have a novel technologythat can result in breakthrough treatmentsfor unmet needs. Of the $307 millionraised by U.S. privately held therapeuticbiotechs during September, $121million, or 39.4 percent, were raised infirst round venture financings or seriesA rounds.Series A financings of therapeuticsdevelopers accounted for 17.6 percent ofthe total $689 million raised in financingsof privately-held U.S. life sciencescompanies in September, includingtherapeutics, diagnostics, tools/technology,medical devices, and digital healthand healthcare IT.Even with a dwindling number ofventure firms willing to invest in earlystagedeals, the appetite to build companieshas not gone away. However, venturecapitalists want companies to havedifferentiated products for unmet needsthat target a defined patient population.<strong>The</strong>y also want to build companies witha management team of businessmen andscientists that have already been successfulmoving other companies forward.Third Rock Ventures exemplifiesa new breed of venture firm that islaunching new companies, sometimeson its own, but more often with otherinvestors that often include Big Pharma.In September, Third Rock launched SanFrancisco-based MyoKardia with a $38million series A financing of the company.MyoKardia uses a genetically targetedapproach to develop novel smallmolecule therapeutics for patients withfrom genetic heart disease. Its first programsfocus on hypertrophic and dilatedcardiomyopathy, which togetherafflict approximately 1 million peoplein the United States, and for which nonovel therapeutics have been brought tomarket in over a decade.“<strong>The</strong> last decade has been challengingfor those pursuing novel therapeuticsin the cardiovascular space, in partbecause most treatments target symptomsfar downstream of the root cause,”says Leslie Leinwand, one of MyoKardia’sco-founders and a professor ofmolecular, cellular, and developmentalbiology at the University of Colorado.“MyoKardia’s approach addresses thischallenge head on by employing geneticsto more precisely define the diseaseand ‘who we want to treat,’ and by employingcutting-edge muscle biochemistryand a novel platform to determine‘how we want to treat.’”Though the company’s inititial targetsare genetic cardiomyopathies,Leinwand said this could be a noveland tractable therapeutic discovery approachto even larger diseases, such asheart failure.MPM Capital led a $23 million seriesA financing round for SelexysPharmaceuticals, which is developinga treatment for sickle cell disease. <strong>The</strong>financing closed concurrent with theannouncement that the Oklahoma Citybasedbiotech had entered into an agreementwith Novartis potentially worthup to $665 million that includes an optionfor Novartis to buy the companyand its lead asset, which is completed aphase 1 safety study. <strong>The</strong> option is triggeredfollowing the successful completionof a phase 2 study. Selexys’ leadcompound SelG1 is a first-in-class therapeuticapproach for treating vasoocclusivecrisis, a painful chronic occurrencethat requires frequent hospitalizationfor sickle cell patients.“Vaso-occulsive crises represent asignificant healthcare problem for sicklecell disease patients, and we wereimpressed by the early data for SelG1and the quality of the Selexys team,”says Todd Foley, a managing director ofMPM Capital who has joined the boardof Selexys. “We are pleased to be a partof this successful financing structure,and I look forward to working closelywith Selexys.”nNovember 2012 23

SEPTEMBER STATISTICS<strong>The</strong> <strong>Burrill</strong> <strong>Report</strong>Biggest Advancers and Decliners, September 2012TICKER COMPANY PRICE8/31/2012PRICE9/28/2012PRICECHANGEPERCENTCHANGEREASONADVANCERSSVNTSavientPharmaceuticals1.32 2.50 1.18 89.4 Won in court against Tang Capital’s accusations ofinsolvency.APPY AspenBio Pharma 1.50 2.77 1.27 84.7 Announced that it will begin a key clinical trial of itsproduct, AppyScore.SNSSSunesisPharmaceuticals3.17 5.63 2.46 77.6 Announced plans to add 225 patients to its on-going latestagetrial for Voxaroxin after receiving positive efficacydata in interim analysis.CBLI Cleveland BioLabs 1.65 2.68 1.03 62.4 Received FDA agreement on pivotal animal efficacystudies for the development of Entolimed as a radiationcountermeasure.IRIS IRIS International 12.70 19.52 6.82 53.7 Agreed to be acquired by Danaher Corporation for $19.50a share.ACHNAchillionPharmaceuticals7.03 10.41 3.38 48.0 Excitement over its non-interferon hepatitis C treatmentlead Bank of America and Deutsche Bank to raise rating to“buy”.AEZS Æterna Zentaris 2.86 4.20 1.34 47.0 “Buy” rating from Roth Capital propelled stock forward.SNTS Santarus 6.18 8.88 2.7 43.7 Announced positive top-line results from late-stage trial ofRifamycin SV MMX for the treatment of diarrhea.PRANACADDECLINERSPrana BiotechnologyLimitedACADIAPharmaceuticals1.66 2.37 0.71 42.8 Received recommendation to proceed with Alzheimer’sclinical trial from data safety monitoring board.1.78 2.53 0.75 42.1 Announced completion of patient enrollment in a late-stagetrial of its experimental Parkinson’s drug pimavanserin.PURE PURE Bioscience 2.81 1.05 -1.76 -62.6 Announced pricing of 3.7 million shares of common stock at$1.10 a share.PPHMQCORPeregrinePharmaceuticalsQuestcorPharmaceuticals2.54 1.03 -1.51 -59.4 Shares plunged after company reported that previouslyreleased mid-stage cancer drug data was unreliable due tothird-party error in conducting study.43.44 18.47 -24.97 -57.5 Announced that the U.S. government was investigating thecompany’s promotional practices.MAXY Maxygen 6.14 2.64 -3.50 -57.0 Company declared special dividend after reporting that Q2EPS fell 47 percent compared to the same quarter the yearbefore.ZLCS Zalicus 1.48 0.74 -0.74 -50.0 <strong>Report</strong>ed that its experimental rheumatoid arthritis drug,Synavive, missed key secondary endpoint of meaningfulclinical benefit in a mid-stage study.GEVO Gevo 3.54 2.14 -1.4 -39.5 Announced plans to stop temporarily producing isobutanoland shift to ethanol production at its Minnesota facility.GERN Geron 2.76 1.71 -1.05 -38.0 Announded two setbacks for its experimental cancer drug,imetelstat, as it halted one mid-stage study and said that itdid not expect the drug to succeed in a second study.NDZ Nordion 10.43 6.75 -3.68 -35.3 Company was unsuccessful in its claims for performanceand monetary damages relating to AECL’s cancelledconstruction of its MAPLE facilities.PGNXProgenicsPharmaceuticals4.08 2.88 -1.20 -29.4 Eliminated a quarter of its staff and announced departureof CFO.nNovember 2012 24

SEPTEMBER STATISTICS<strong>The</strong> <strong>Burrill</strong> <strong>Report</strong>September 2012 Venture FinancingsCOMPANYRAISED(USD M)PRINCIPAL FOCUSFINANCINGROUNDINVESTORSAragon Pharmaceuticals 50.0 <strong>The</strong>rapeutics Series D Topspin Fund; Aisling Capital; OrbiMed Advisors; <strong>The</strong> ColumnGroupFoundation Medicine 42.5 Diagnostics Series B Deerfield Managemenet; Casdin Capital; Redmile Group;Roche Venture Fund; WuXi Corporate Venture Fund; ThirdRock Ventures; Google Venture; Kleiner Perkins Caufield &ByersMyoKardia 38.0 <strong>The</strong>rapeutics Series A Third Rock VenturesTandem Diabetes Care 36.4 Medical devices Series D TPG Biotech; Delphi Ventures; Domain AssociatesIlluminOss Medical 28.0 Medical devices Series C Tekla Capital Management; Life Sciences Partners; FoundationMedical Partners; Mieza Capital; New Leaf Venture Partners;SR One; Excel Venture Management; Pappas Ventures; SlaterTechnology FundBioFire Diagnostics 25.0 Diagnostics Athyrium Opportunities FundSelexys Pharmaceuticals 23.0 <strong>The</strong>rapeutics Series A MPM Capital; other investorsBioMotiv 21.0 <strong>The</strong>rapeutics Series A, Part of$100M offeringAclaris <strong>The</strong>rapeutics 20.9 <strong>The</strong>rapeutics Series A Not disclosedTorax Medical 19.3 Medical devices Series D, part of$30M roundUniversity Hospitals; Harrington FamilyPiper Jaffray Merchant Banking; Sanderling Ventures; Thomas,McNerney & Partners; Accuitive Medical Ventures; KaiserPermanente; Mayo Medical VenturesiWalk 17.0 Medical devices Series D Gilde Healthcare Partners; WFD Ventures; General CatalystPartners; Sigma PartnersVital <strong>The</strong>rapies 16.0 <strong>The</strong>rapeutics First tranche of$76M roundExisting investorsArgos <strong>The</strong>rapeutics 16.0 <strong>The</strong>rapeutics 24 investorsIntercept Pharmaceuticals 15.0 <strong>The</strong>rapeutics Series C; secondclose of $50M roundOriGene Technologies 15.0 Tools/Technology Equity only Not disclosedOrbiMed Advisors; Genextra S.p.A [Italy]Agrivida 15.0 Industrial/Ag Series C Bright Capital Partners; Kleiner Perkins Caufield & Byers; DAGVentutres; Prairie Gold; Presidio; Gentry Venture Partners;Northgate Capital; Alexandria Real Estate Equities; SyngentaVenturesCatalyst Biosciences 13.4 <strong>The</strong>rapeutics Equity only <strong>Burrill</strong> & Company; other investorsClinipace 13.3 Tools/Technology Venture debt Six investorsCebix 13.0 <strong>The</strong>rapeutics Series B Sofinnova Ventures; InterWest Partners; Thomas McNereny &PartnersSteadyMed 12.8 <strong>The</strong>rapeutics Includes $2.4 raisedearlier in 2012BiO2 Medical 11.9 Medical devices Series C, part of$20M offeringInnovative PulmonarySolutions10.6 Medical devices Series B [closed inMarch]Forma <strong>The</strong>rapeutics 10.0 <strong>The</strong>rapeutics Existing investorsKB Partners; Samson Ventures; other investorsRemeditex Ventures; existing investorsAdvanced Technology Ventures; existing investorsWikiCell Designs 10.0 Industrial/Ag Series A Flagship Ventures; Polaris Venture PartnersApnex Medical 10.0 Medical devices New Enterprise AssociatesTactile Systems Technology 9.1 Medical devices Not disclosedAnnovation BioPharma 8.0 <strong>The</strong>rapeutics Series A Atlas Venture; Partners Innovation Fund; <strong>The</strong> MedicinesCompany(continued) ❱❱November 2012 25

SEPTEMBER STATISTICS<strong>The</strong> <strong>Burrill</strong> <strong>Report</strong>❱❱ (continued)September 2012 Venture FinancingsCOMPANYRAISED(USD M)PRINCIPAL FOCUSFINANCINGROUNDINVESTORSEGEN 7.5 <strong>The</strong>rapeutics Not disclosedHealthsense 7.0 Digital Health Merck Global Health Innovation Fund; Fallon CommunityHealth Plan; other investorsLanx 6.7 Medical devices Part of $15MofferingNot disclosedIntraPace 6.2 Medical devices Oxford Bioscience Partners; DFJ E Planet Ventures; L CapitalPartnersTribogenics 6.2 Tools/Technology Series A Founders FundABT Molecular Imaging 6.1 Tools/Technology Equity Intersouth Partners; other investorsVascular Pharmaceuticals 6.0 <strong>The</strong>rapeutics Series A, firsttranche of $16MIntersouth Partners; MPM CapitalPredilytics 6.0 Healthcare IT Series A Flybridge Capital Partners; Highland Capital Partners; GoogleVenturesXcovery Holdings 6.0 <strong>The</strong>rapeutics Series B Private investorsRevance <strong>The</strong>rapeutics 5.9 <strong>The</strong>rapeutics Series E extension[rest raised in 2011]Cardiac Dimensions 5.8 Medical devices Equity, debt,warrantsAushon Biosystems 5.5 Tools/Technology Part of $8.3M round Not disclosedInvestors include Essex Woodlands; NovaQuest; CNFInvestments; Vivo Ventures; Technology Partners; ShepherdVentures; Palo Alto Investors; Pac-Link Ventures; Essex Capital17 investors; previous investors include Lumira Capital; FrazierHealthcare Ventures; Clarus Ventures; InterWest Partners;Johnson & Johnson Development Corp.Exagen Diagnostics 5.3 Diagnostics Tullis Health Investors; Sun Mountain Capital; CottonwoodTechnology Fund; Mesa Verda Venture partners; Epic VenturesIntelliRad Control 5.3 Medical devices Not disclosedNorthStar MedicalTechnologies5.2 Tools/Technology Series D Stateline Angel Investors; Hendricks Holding; other investorsStation X 5.0 Tools/Technology Series B Runa Capital; Genomic Health; other investorsDiffusion Pharmaceuticals 5.0 <strong>The</strong>rapeutics Convertible notes Existing investorsRxAnte 4.6 Healthcare IT Series A Aberdare Ventures; West Health Investment FundCardeas Pharma 4.6 <strong>The</strong>rapeutics Not disclosedConfluence Life Sciences 4.0 <strong>The</strong>rapeutics Series A DFJ Mercury; BioGenerator; Missouri Technology; Helix FundmBio 3.9 Diagnostics Not disclosedEverest Genomics 3.1 Diagnostics Not disclosedGenometry 3.0 Tools/Technology Seed stage Not disclosedProvista Diagnostics 2.5 Diagnostics Series A extension Existing shareholdersMicrodermis 2.4 <strong>The</strong>rapeutics Part of $4.9MofferingNot disclosedCellerant <strong>The</strong>rapeutics 2.1 <strong>The</strong>rapeutics Camelot Ventures; Allen & Company; Sagamore Bio Ventures;Gbr InvestmentsSerina <strong>The</strong>rapeutics 2.0 <strong>The</strong>rapeutics Equity Not disclosediSpecimen 2.0 Tools/Technology Not disclosedProtea Biosciences 1.3 Tools/Technology Three equityofferings in 2012Not disclosedFlexuspine 1.1 Medical devices Venture debt Not disclosed(continued) ❱❱November 2012 26

SEPTEMBER STATISTICS<strong>The</strong> <strong>Burrill</strong> <strong>Report</strong>❱❱ (continued)September 2012 Venture FinancingsCOMPANYRAISED(USD M)PRINCIPAL FOCUSFINANCINGROUNDINVESTORSSalutaris Medical Devices 1.1 Medical devices Venture debt Not disclosedTissue RegenerationSystems1.0 Tools/Technology Part of $5M offering Not disclosedEchoPixel 1.0 Tools/Technology Part of $2M offering Not disclosedPharmatrophiX 0.8 <strong>The</strong>rapeutics Debt financing Not disclosedOpsonic <strong>The</strong>rapeutics 0.8 <strong>The</strong>rapeutics Venture debt Private investorGI <strong>The</strong>rapeutics 0.6 <strong>The</strong>rapeutics Hatteras Venture PartnersKewl Innovations 0.6 Medical devices Equity Not disclosedCytodyn 0.6 <strong>The</strong>rapeutics Equity only Not disclosedINRange Systmes 0.6 Digital Health Debt only Not disclosedAesRx 0.5 <strong>The</strong>rapeutics Debt financing Not disclosedLabStyle Innovations 0.5 Tools/Technology Part of $1.5M round Not disclosedCapso Vision 0.5 Medical devices Venture debt Not disclosedAgeneBio 0.5 <strong>The</strong>rapeutics Venture debt Not disclosedWindmill CardiovascularSystems0.4 Medical devices Equity Not disclosedCardiac Insight 0.3 Digital Health Venture debt Not disclosedSpectraScience 0.3 Medical devices Part of $1.5M round Not disclosedPro<strong>The</strong>ra Biologics 0.3 <strong>The</strong>rapeutics Slater Technology FundBioKier 0.2 <strong>The</strong>rapeutics Seed stage Not disclosedNasseo 0.2 Tools/Technology Part of $0.308MroundAngel investorsGlySens N/A Digital Health West Health Investment Fund; undisclosed investorsSense4Baby N/A Digital Health Seed stage West Health Investment FundTOTAL U.S VENTUREFINANCINGS 667.9CureVac (Germany) 104.9 <strong>The</strong>rapeutics Series D dievini Hopp BiotechTriplex InternationalBiosciences (China)F2G Limited (UnitedKingdom)50.0 Diagnostics Private equityinvestmentRRJ Capital (Hong Kong)30.0 <strong>The</strong>rapeutics Advent Life Sciences; Novartis Bioventures; Sunstone Capital;Merifin Capital; K Nominees; Astellas Venture FundMainstay Medical (Ireland) 20.0 Medical devices Series B Fountain Healthcare Partners; Medtronic; Capricorn VenturePartners; Seventure Partners; Sofinnova Partners; Twin CityAngelsWaterstonePharmaceuticals (China)19.0 Tools/Technology Debt financing Not disclosed<strong>The</strong>ravectys (France) 9.4 <strong>The</strong>rapeutics Series C Guy Paillaud; John Pieters; Bettencourt family; Philippe Oddo;Richard Hennessy; other private investorsKarus <strong>The</strong>rapeutics (UnitedKingdom)7.6 <strong>The</strong>rapeutics Series B, firsttrancheSV Life Sciences; New Leaf Ventures; Novo A/S; InternationalBiotechnology TrustLaurantis Pharma (Finland) 7.0 <strong>The</strong>rapeutics Broadview Ventures; Inveni Capital; Aloitusrahasto Vera;Helsinki University Funds; VeritasOx<strong>The</strong>ra (Sweden) 5.9 <strong>The</strong>rapeutics HealthCap; Industrifonden; Q-Med(continued) ❱❱November 2012 27

SEPTEMBER STATISTICS<strong>The</strong> <strong>Burrill</strong> <strong>Report</strong>❱❱ (continued)September 2012 Venture FinancingsCOMPANYAyoxxA Biosystems(Germany)RAISED(USD M)PRINCIPAL FOCUSFINANCINGROUNDINVESTORS3.4 Tools/Technology Series A Wellington Partners; NRW.Bank; High-Tech Gruenderfonds;private investorscerbomed (Germany) 2.9 Medical devices Strategicinvestment, part ofup to $7.2MCyberonics (CYBX)Nexvet (Australia) 2.6 <strong>The</strong>rapeutics Seed stage Trans Tasman Commercialisation Fund; other investorsOramed Pharmaceuticals(Israel)1.0 <strong>The</strong>rapeutics Equity Not disclosedMolplex (United Kingdom) 0.6 Tools/Technology Seed stage North West Fund for BiomedicalQuartz Bio (Switzerland) N/A Tools/Technology Spin out by MerckSeronocCAM Biotherapeutics(Israel)Merck SeronoN/A <strong>The</strong>rapeutics Series A Arkin Holdings; OrbiMed’s Israel Partners; Pontifax; F.Hoffmann La RocheOsteros Biomedica (Russia) N/A <strong>The</strong>rapeutics Seed stage Maxwell Biotech Venture FundTOTAL NON-U.S.VENTURE FINANCINGS 264.2TOTAL SEPTEMBERVENTURE FINANCINGS 932.1nSeptember 2012 Public FinancingsCOMPANY TICKER AMOUNT RAISED (USD M) PRINCIPAL FOCUSIPOSPharmaEngine (Taiwan) GreTai:4162 31.7 <strong>The</strong>rapeuticsClinigen (United Kingdom) AIM:CLIN 16.2 <strong>The</strong>rapeuticsTOTAL NON U.S. IPOS 47.9TOTAL SEPTEMBER IPOS 47.9PIPESNuPathe PATH 28.0 <strong>The</strong>rapeuticsInsmed INSM 26.0 <strong>The</strong>rapeuticsRepros <strong>The</strong>rapeutics RPRX 23.6 <strong>The</strong>rapeuticsTranzyme Pharma TZYM 11.5 <strong>The</strong>rapeuticsResponse Genetics RGDX 8.8 Diagnostics<strong>The</strong>rapeuticsMD OTC:TXMD 8.5 <strong>The</strong>rapeuticsNeuralStem CUR 7.0 <strong>The</strong>rapeuticsTitan Pharmaceuticals OTC:TTNP 4.2 <strong>The</strong>rapeuticsImprimis Pharmaceuticals OTC:IMMY 4.0 <strong>The</strong>rapeutics(continued) ❱❱November 2012 28

SEPTEMBER STATISTICS<strong>The</strong> <strong>Burrill</strong> <strong>Report</strong>❱❱ (continued)September 2012 Public FinancingsCOMPANY TICKER AMOUNT RAISED (USD M) PRINCIPAL FOCUSOlympus (Japan) Tokyo:7733 645.0 Sony takes 11.5 percent stakeBioLineRx (Israel) BLRX 15.0 Stock purchase agreementDiaMedica (Canada) TSX-V:DMA 1.7 Warrant exerciseTOTAL NON-U.S. OTHER EQUITY 661.7TOTAL SEPTEMBER OTHER EQUITY 738.9DEBTWatson Pharmaceuticals WPI 3,900.0 <strong>The</strong>rapeuticsMerck MRK 2,500.0 <strong>The</strong>rapeuticsAgilent Technologies NYSE:A 400.0 Tools/TechnologyCatalent Pharma Solutions Private 350.0 Tools/TechnologySequenom SQNM 130.0 DiagnosticsMedPro Safety Products OTC:MPSP 0.7 Medical devicesTOTAL U.S. DEBT 7,280.7Valeant Pharmaceuticals (Canada) VRX 2,300.0 <strong>The</strong>rapeuticsAlkermes (Ireland) ALKS 375.0 <strong>The</strong>rapeuticsElan (Ireland) ELN 600.0 <strong>The</strong>rapeuticsTOTAL NON-U.S. DEBT 3,275.0TOTAL SEPTEMBER DEBT 10,555.7OTHER DEBTXDx Private 15.0 Senior credit facilityKaloBios Private 10.0 Long-term debt financingAviir Diagnostic Laboratories Private 8.0 Growth debt capital and credit lineUnigene Laboratories OTC:UGNE 4.0 Forebearance agreement and loanFreedom Meditech Private 2.0 Credit facilityTengion OTC:TNGN 1.0 Bridge loanHemoShear Private 1.0 Loan backed by VirginiaTOTAL U.S. OTHER DEBT 41.0TOTAL SEPTEMBER OTHER DEBT 41.0nNovember 2012 30