Volume 5 Issue 1 - Operating Engineers Local 520

Volume 5 Issue 1 - Operating Engineers Local 520

Volume 5 Issue 1 - Operating Engineers Local 520

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

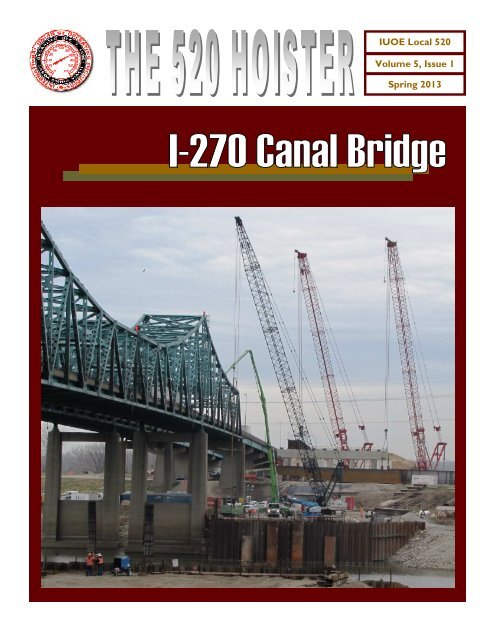

IUOE <strong>Local</strong> <strong>520</strong><strong>Volume</strong> 5, <strong>Issue</strong> 1Spring 2013

Inside this <strong>Issue</strong>...Per Capita Tax IncreaseDUES INCREASE— Effective July 1, 2012Ron Johnson,Business ManagerRon Kaempfe, PresidentChad Goldschmidt,Vice PresidentMike Parkinson,TreasurerVern Parmley,Financial SecretaryMark Johnson,Recording-CorrespondingSecretaryNews & EventsJob Site Photos34566-77Delegates at the 37th General Convention of the InternationalUnion of <strong>Operating</strong> <strong>Engineers</strong>, held in April 2008,voted unanimously for a Per Capita Tax Increase of FiftyCents ($0.50) per month, effective July first for the nextfive years (through 2012).The following monthly dues rates went into effectJuly 1, 2012 for <strong>Local</strong> <strong>520</strong> <strong>Operating</strong> <strong>Engineers</strong>.<strong>520</strong>, <strong>520</strong>A, <strong>520</strong>R...............................................$33.75<strong>520</strong>B, <strong>520</strong>C........................................................$29.00<strong>520</strong>D ...................................................................$34.00Retirees (low dues) .........................................$10.75Please note: Union dues are due by the first of eachmonth. After that time, there will be a $1.50 late fee permonth.Schedule of EventsMember meetings take place at 7 PM on the second Fridayof each month. Specific dates for the next 4 months are asfollows:Friday, May 10Friday, June 14Nomination of CandidatesHealth & Welfare8-11Friday, July 12Training DepartmentRetiree Recognition1112-13Friday, August 9THIS IS ELECTION NIGHT** Polling hours are 6 AM to 10 PM **There will be no regular meeting2012 Christmas PartiesOfficers, Retirees andObituaries1416The Retiree group meets twice a year.Future meeting dates are:Monday, June 3, 2013andMonday, December 2, 2013 (Christmas Celebration)* Please see page 6 for further Retiree information.

Page 3THE <strong>520</strong> HOISTERRon Johnson,Business ManagerBrothers and Sisters,Winter seemed to have an extra tight grip on us this year, not allowing us to move into spring as quickly as I would have liked.The winter precipitation did bring some badly needed ground moisture and has brought the river levels up to better support theboat and barge traffic. With that being said, I’m ready for the kind of weather that allows our members to get back to work.During 2012, we had a record 59 members retire, and we have 19 so far in 2013. Of those retirees, three were members ofour Executive Board—Steve Wolff, Terry MacZura and Marlene Krotz. In the last Hoister I congratulated Steve and Terry on theirretirement and thanked them for serving on <strong>Local</strong> <strong>520</strong>’s Executive Board. Now I want to do the same for Marlene. Marlene is a30-plus-year member of <strong>Local</strong> <strong>520</strong> and has served two terms on our Executive Board. Marlene, congratulations on your retirementand thank you for your many years of service. And to all of our retirees, I wish a long, happy and healthy retirement!I also want to welcome the members who have been appointed to fill the vacancies on <strong>Local</strong> <strong>520</strong>’s Executive Board. They are:Conductor — David “Kelly” BrownAuditor — Joe ThyerTrustee — Raymond “Alex” BurrisCongratulations on your appointments!At our March meeting we had representatives, Greg Gosney and Sandra Wendling,from Investment Consultants and Jamie Hemken from Great West. They gave an overviewof The Annuity Plan and talked about some changes that have been made. We hadexcellent participation from our members during the question and answer session. Themeeting was well-attended and informative.Greg and Sandra from Investment Consultants are a very aggressive and hardworkingteam and I feel very confident that they are looking out for our best interestswith our investments. They were introduced to the The Fund trustees by our long-timeattorney, Cary Hammond.I’d like to say a few words about Cary Hammond before I close. We lost Cary, ourfund attorney of many years, on January 21, 2013 to cancer. Cary represented dozens oflabor unions throughout the St. Louis area and was known to be a lawyer who believed inthe Labor Movement and what it stands for. Cary’s knowledge of multi-employer benefitplans and skills as a labor lawyer were second to none. Cary was a caring and compassionateperson who continually looked out for the working middle class families and theunions who represent them. We lost a great attorney and a true friend with the passingof Cary Hammond, and he will be greatly missed.Have a safe and prosperous year!Respectfully,Ron Johnson“Labor is prior to, and independent of, capital. Capital is only the fruit of labor, and couldnever have existed if Labor had not first existed. Labor is superior to capital, and deservesmuch the higher consideration.”— Abraham Lincoln , 16th President of the United States, 1861-1865

Page 4THE <strong>520</strong> HOISTERRon Kaempfe,PresidentChadGoldschmidt,Vice-PresidentBrothers and Sisters,There is nothing like a late March snow to prolong theagony of the worst winter work-wise that <strong>Local</strong> <strong>520</strong> has had in5 or 6 years. Even though the calendar says it’s Spring andPunxsutawney Phil predicted an early Spring, I have yet to see it.We are just starting to get some of the operators backfrom the Phillips 66 Refinery turnaround and by the time thisissue reaches you, all work should be completed on it. At thispoint Phillips 66, along with the contractors working there,report that they have been pleased with the work of <strong>Local</strong> <strong>520</strong>operators. My thanks to all who contributed to this successfulturnaround.Work on the New Mississippi River Bridge and the rampsleading to it continue to progress. The bridge is scheduled toopen about 1 year from now.The Sec. 408 permits from the Corps of <strong>Engineers</strong> are theprincipal remaining regulatory obstacles on our levee work. TheRiver and Harbors Act of 1899 Sec.408 provides for approval bythe Secretary of the Army to make alterations to the levee system“when in the judgment of the Secretary such occupation oruse will not be injurious to the public interest and will not impairthe usefulness of such work.” In other words, the Corps of <strong>Engineers</strong>will have final say on anything that is to happen on thislevee work, no matter that the Southwestern Illinois Flood PreventionDistrict Council has secured the means to get the workdone. Not only will this levee work provide jobs for the membersof <strong>Local</strong> <strong>520</strong>, but the work that will come to the area from majorcorporations when there is a secure levee system and affordableflood insurance, will provide <strong>Local</strong> <strong>520</strong> with much more work inthe future.Be safe at work and at home. If I can help with anything,please call.Always,RonDear Brothers and Sisters,I hope everyone has had an excellent start to their new year.I would like to begin by informing everyone of work thathas already started or will be beginning soon in my counties.For those of you who don’t know, the counties that have beenassigned to me are Jefferson, Marion, Clinton, Bond, and Fayette.I’m also helping Mark with some of his projects in the easternpart of Madison.In Mt. Vernon, as some of you already know, construction isto start on a new Drury Inn Suites and Convention Center. Thehotel will be seven stories with indoor and outdoor pools, and, alarge convention center with two to three restaurants on site.The demolition on the old hotel and surrounding buildings isbeing executed by Premier Demolition. Construction is to starthopefully by early May, depending on the progress of the demowork.Continental Tire has begun work on their facility east ofMt. Vernon. The company plans to spend $129 million in retooling,renovation work on existing buildings, and adding new buildingsto the plant.Although slowed due to the weather, other projects inMt. Vernon are still underway. The Aquatic Center, 34 streetupgrades, Casey School and the I-57 project are yet to becompleted, just to name a few.Shore’s Builders have been awarded a $2.5 million contracton the Salem Hospital. The addition/renovation is to begin sometimein early April.Haye’s Excavating was awarded a mine shaft reclamationproject to the south of Salem. The contractor is waiting on plansfrom the state so the start date of the project is yet undetermined.The site work on the Trenton Wesclin School is far enoughalong to soon begin with the structural work, weather permitting.Also Kaskaskia College’s Trenton location will be starting anaddition/remodel. There has already been some preliminary workstarted on this project.Poettker Construction has been awarded the RamseySchool project. Work is scheduled to begin in early April.There are also a good number of small street, road andbridge jobs that are scattered through this territory. These jobsare to start somewhere in the near future, basically waiting onweather, permits or funding.Please, if there are any of you that have any concerns orquestions, do not hesitate to call me, (618) 967-1966.In Solidarity,Chad R. Goldschmidt

Page 5 <strong>Volume</strong> 5, <strong>Issue</strong> 1Mike Parkinson,TreasurerVern Parmley,Financial SecretaryBrothers and Sisters,Winter has not released us from its’ grip yet, proven by the twoto seventeen inches of snow depending on your location in SW Illinoison March 24 th . I have no doubt that spring will arrive, followed bysummer and the hot days in July and August. By that time we will betrying to make up some hours lost to the long winter. The questionon everybody’s mind is will there be work so hours can be made up.<strong>Local</strong> <strong>520</strong> has without question not participated in the employmentdecline experienced by the rest of the country. In 2008 whenthe financial collapse trigged by the bursting of the housing and realestate bubble occurred, considered to be the worst financial crisissince the Great Depression of the 1930’s, <strong>Local</strong> <strong>520</strong> was well intowhat would become five years of near record hours.The average annual hours worked from 2002-2006 was 1.42million hours. The average annual hours worked from 2007-2011 was2.3 million. As predicted 2012 was a big step moving back to normalwork load, 1.5 million hours reported.Prairie State Energy Campus is a project that largely contributedto the hours reported in that five year run. It continues to providework for <strong>Local</strong> <strong>520</strong> members and other trades with the outage workbeing done under the National Maintenance Agreement. In addition tothe ongoing maintenance work, other projects have developed there.In mid-2011 Plocher Construction was awarded the construction ofthe Nearfield West Sediment Pond. Later that year they wereawarded and began construction on a “temporary ash storage area”.Early in 2012 they again were awarded and began to install foundationpiers for the new Nearfield Bulk Material Handling Conveyor. In Julyof 2012 Bloomsdale Excavating started construction of a 61 acre landfillcell with an estimated 1million yds. of dirt to move. The cell issimilar to the ones public landfills build with a liner barrier of clay, adrainage layer and a leachate collection system. This cell is to receivefly-ash from the power plant. The project provided great work fromJuly until December for 25 operators. Two more projects wereawarded in March 2013 to Plocher Construction. The first was theNearfield and Fuels Maintenance Buildings and the second is anotherlandfill cell. Cell #2 is smaller in scope with an estimated 400,000 yds.of dirt, with a completion target of September 1, 2013. All of theseprojects were worked under <strong>Local</strong> <strong>520</strong>’s Building and Heavy Agreementthrough the Southwestern Illinois Building Trades PLA.Private work is a vital segment that provides employment formembers of <strong>Local</strong> <strong>520</strong>. Public work on roads and bridges is an equallyimportant provider of work. The inability of our state to pass a CapitalPlan that includes a Road Program jeopardizes work in the nearfuture. Information taken from a consulting firm reported that by 2018nearly 1 in 3 miles of state roads and 1 in 10 state bridges will beunacceptable. The work is there, it’s a question of priority and funding.The continued raiding of Road Tax Funds must be stopped, if notit will become as big a problem as the under-funded Pension Plans.Thank you, have a safe summer.Respectfully,Michael ParkinsonBrothers and Sisters,Once again, thank you for taking the time out to read your <strong>520</strong>Hoister. It allows you and your family an overview of updates andevents for the upcoming work season. Please take a moment toreview the on-going and upcoming proposed work. Gillespie Middle School: Estimated at 90% complete. This job isprojected to be 100% complete before the 2013/2014 school year. Contegra: Work has not yet commenced. This project has a proposed1 million sq. ft. Logistics building site. Work is planned tobegin this Spring, Summer and Fall, 2013 as soon as weather permits. Kamadulski Excavating: Work has not yet commenced; however,it will begin very soon. This project has a 200,000 sq. ft. Fed Exbuilding in Sauget, IL. In addition, a new Fire Station in FairviewHeights, IL has recently begun. Keeley & Sons and Kilian Corporation: Will soon start patching,milling and resurfacing work at Collinsville, IL on I-255 in bothnorthbound and southbound lanes. It is estimated over $15 millionon this 2 mile section of Interstate between Route 40 andHorseshoe Lake Road. This work will commence soon. Illinois Valley Paving: Beginning early May, 2013, with weatherpermitting, this job will consist of paving and shoulder work onRoute 67 North. This job will cover approximately 6.5 miles inboth northbound and southbound lanes. Foltz Welding: There is on-going work on the Marathon PetroleumLine between Wood River, IL and Patoka Tank Farm. It isundetermined how much time this project has remaining for the58 mile stretch of 22” line of anomaly digs. In addition, Foltz hasbeen installing 20” and 30” lines in Hartford, IL from Robins Roadto 7 th Street. Accurate Underground Boring Company is boringroad and railroad bores. This job employs together 7 to 8 operatorsfor this phase 1 project. Enbridge Pipeline Company: Beginning early next year, Enbridgewill be installing a 36” line through Fayette and Marion countiesinto Patoka Tank Farm. It has an estimated cost of $700 millionfor this 160 mile project.I hope to keep you updated on future information throughupcoming Hoisters.Apprentices: Unfortunately, this winter has been slow. We arehopeful this spring and summer will be much more promising formany of our fellow apprentices.I would personally like towish you all a safe and profitablework season. I look forwardto seeing you at the nextunion meeting!Respectfully,Vern Parmley

Page 6THE <strong>520</strong> HOISTERMark Johnson,Recording-CorrespondingSecretaryWELCOME NEWSIGNATORY CONTRACTORSK.R.B. Excavation, Inc.Winstead Excavating, Inc.Atlanta AsphaltMarschel Wrecking, LLCBrothers and Sisters,In late 2012 the Illinois Department of Transportation founditself looking at a 2013 budget that fell far short of the fundsneeded to maintain the infrastructure that IDOT is responsiblefor. Fortunately, by early February the Illinois Legislature passed asupplemental plan that would add $675 million to IDOT’s budget.These actions are starting to yield some much needed additionalroad work for the contractors that employ <strong>Operating</strong> <strong>Engineers</strong>.About $50 million of the $675 million are planned to be spent inIDOT’s 8th district. This district covers 11 of the 16 countiesthat <strong>Local</strong> <strong>520</strong> represents.There is no doubt that the Illinois Legislature is going to belooking at a wide range of spending cuts to help shore up themounting debt that this State finds itself up against. Let’s hopethat during this process they can find a way to properly fund thegrowing needs of Illinois’ transportation infrastructure.I would like to thank recently retired Financial Secretary,Steve Wolff, Recording-Corresponding Secretary, Terry MacZuraand Conductor, Marlene Krotz for their many years of dedicatedservice to <strong>Local</strong> <strong>520</strong>. Terry, Steve and Marlene have all threebeen excellent representatives of <strong>Local</strong> <strong>520</strong>, both on the job andon the Executive Board. I wish all of them a long, healthy andhappy retirement.In Solidarity,MarkHappy Anniversary!Denny & Mary Kee of Collinsville, IL55 years of marriage on December 28, 2012Clarence & Mary Stehl of Smithton, IL55 years of marriage on January 9, 2013Kenneth “Gail” & Karen Tinker of Shobonier, IL55 years of marriage on December 24, 2012Lewis & Barbara Lorenzini of Centralia, IL50 years of marriage on February 2, 2013 Lunch each Wednesday at the Golden Corral,3360 Green Mt. Crossing Road in Shiloh, ILat 11:00 A.M. Monday, June 3, 2013 at 10:00 A.M. , at the Hall."The most important word in the language of theworking class is SOLIDARITY."- Harry Bridges, Australian-born American labor leader,president of the San Francisco-based InternationalLongshoremen’s and Warehousemen’s Union (ILWU) ,1937 to 1977Please check your receipt!If you have a large credit, it may be because you havesent in the old dues rate.Dues increased $.50 per month effective for July dues.If you are unsure of the amount of dues to send in,please feel free to call the office.

Page 8THE <strong>520</strong> HOISTERHEALTH & WELFARE, PENSION, ANNUITY, AND VACATION FUNDSBENEFIT REPORTAdministrative Manager – David GlastetterI am pleased to have this opportunity to provide an update on matters relating to your Health & Welfare, Pension, Annuity, and Vacation Funds.HEALTH & WELFARE FUND:The Health & Welfare Fund processed 47,258 claims (45,295-Medical and 1,963-Optical) during calendar year 2012 and paid benefits totaling $13,489,878.15($11,955,841.84-Medical, $1,185,068.83-Dental, and $348,967.48-Optical) compared to $13,345,117.56 that was paid out during 2011, an increase of$144,760.59 or 1%. Also, Death Benefits totaling $302,000 were paid to 44 eligible beneficiaries during 2012 as a result of the death of retired members or theirsurviving spouse. The Pharmacy Benefit program administered by CVS/Caremark processed 53,609 prescriptions during calendar year 2012 at a cost of$2,538,193.29, a decrease of $91,270.34 or 3.5% from the previous year.As of January 31, 2013, the Health & Welfare Fund had Total Assets of $32,613,103.23 compared to $34,737,987.46 as of January 31, 2012, adecrease of $2,124,884.23 or 6%. As of December 31, 2012, the Health & Welfare Fund had a Reserve Bank liability of approximately $11.9million covering 725 individuals. As of February 1, 2013, the Health & Welfare Fund was providing coverage to 1,519 families (893 Actives,444 Retirees, and 182 Widows) representing 3,367 individuals.You will find listed below a summary of Health & Welfare Plan benefit maximum limits and their corresponding coverage period at the presenttime. For other Plan limits and coverage periods, please refer to the Schedule of Benefits contained in the Summary Plan Descriptionand Plan Document or contact the Fund Office.Benefit Maximum Limit (PER PERSON) Coverage PeriodMedical $2,000,000 Annual (June-May)Dental $5,000 Two-year (6/1/11-5/31/13)Dental $25,000 LifetimeHearing Aid $4,000 Three-year (6/1/11-5/31/14)Prescription Drug $4,050 Annual (June-May)Optical $600 Two-year (6/1/12-5/31/14)Chiropractic $500 Annual (June-May)WORKER’S COMPENSATION MATTERS:No benefits are payable under the Plan for any expense covered by a Worker’s Compensation Act or similar legislation or any injury arising out of or in thecourse of any employment for wage or profit. Once you file a Claim Form with the Fund Office indicating your condition is the result of a work-related accidentor injury, the Health & Welfare Fund will not be in a position to consider any related medical expenses. Should your Worker’s CompensationClaim be denied, you must file an Appeal with the Industrial Commission for a final determination. If your claim is found not to bework-related, then the Health & Welfare Fund will be in a position to re-evaluate the submitted medical expenses.THIRD-PARTY LIABILITY MATTERS:The Health & Welfare Fund will be the secondary payer in those situations where the injury or illness of a covered individual (member ordependent) is the result of a negligent or wrongful act by a third party (automobile accident, etc.) who is primarily responsible for thepayment of medical expenses incurred by that covered individual. Once you notify the Fund Office your condition is the result of an injuryor illness caused by a liable third party, the Health & Welfare Fund will not be in a position to consider any related medical expenses for payment until the responsiblethird party or their insurer have paid up to the maximum limit of their liability in the matter. You should promptly notify the Fund Office of the name,address, and phone of the responsible third party, attorneys, and insurance companies involved in such matters, as well as keeping us informed when legal actionis instituted and the progress of that legal action. The Health & Welfare Fund, at your request, will notify medical providers that the Fund will be in a position toprocess all eligible claims in accordance with Plan Provisions after the maximum amount has been paid by the liable third party.COORDINATION OF BENEFITS WITH MEDICARE (CARVE-OUT):Benefits otherwise payable by the Plan after any deductible will be reduced by the amount paid by Medicare. In determining benefits payable under this Plan,benefits are limited to Medicare’s limiting charge. This Plan will also pay Medicare Part A and Part B deductibles, subject to satisfaction of the Plan’s deductibles.Medicare does not cover medical expenses incurred outside of the United States. You will owe an additional premium when traveling outside of the country.Please contact the Fund Office to determine the amount of your revised self-pay premium.If you are enrolled in Medicare at the time you retire, Part B coverage must be in place on your retirement date; otherwise, benefits will bereduced up to the amount Medicare would have paid if Part B should have been the primary payer. The cost of Medicare Part B premiumsis $104.90 per month in 2013, based on income. See p. 11 in the 2013 Medicare guide book, which is available in the Fund Office.Coordination of Benefits with Medicare Part DCurrently, the Plan’s existing prescription drug benefits are, on average for all Plan participants, expected to pay out as much as the standard Medicare PrescriptionDrug Coverage will pay, which means that the Plan’s prescription drug coverage is considered to be “creditable coverage.” Because current prescriptiondrug benefits under the Plan are, on average, more generous than Medicare standard coverage, you can choose to stay covered under the Plan and join a Medicareplan later and not be subject to higher premiums. You should review the annual notice sent to you by the Plan which informs you whether your Plan coverageconstitutes “creditable coverage.” The notice will help you determine whether or not to enroll in Medicare Part D coverage.

Page 9 <strong>Volume</strong> 5, <strong>Issue</strong> 1If you are eligible for Medicare Part D coverage, you may want to compare your current coverage, including which medications arecovered, with the coverage and cost of the Medicare plans in your area. Remember that for most people there is a monthly premiumfor Medicare Prescription Drug Coverage.Eligible Active Employees and DependentsIf you are an active participant or the dependent of an active participant and are eligible for and enroll in Medicare Prescription DrugCoverage, you will continue to be eligible for the Plan’s prescription drug benefits. However, your benefits will be coordinated withMedicare, in accordance with the Plan’s and Medicare’s coordination provisions.Eligible Retired Employees and DependentsIf you are a Medicare-eligible Retired Employee or Medicare-eligible dependent of an eligible Retired Employee and enroll for Medicare Prescription Drug Coverage,you will no longer receive prescription drug benefits under the Plan. However, your monthly premium for coverage under the Plan will not be reduced.If you or your dependent enroll for Medicare Prescription Drug Coverage, lose Plan prescription drug benefits, and later decide to drop Medicare PrescriptionDrug Coverage, you will be given the opportunity to re-enroll for the Plan’s prescription drug benefits. Contact the Fund Office for more information.++ HEALTH AND WELFARE FUND CHANGES EFFECTIVE JUNE 1, 2013 ++Deductibles for Each Coverage Period (June-May)In-Network………….Out-of-Network…….$500 per individual/$1,000 per family$750 per individual/$1,500 per familyOut-of-Pocket Maximum for Each Coverage Period (June-May)In-Network………….Out-of-Network…….$2,000 per individual/$4,000 per family$4,000 per individual/$8,000 per familyAs of result of these changes to the Plan Deductibles and Out-of-Pocket maximums, there will be a number of other changes as a consequence of losing“Grandfathered Status” under the provisions of the Patient Protection and Affordable Care Act (PPACA). Listed below are some of the modifications that willneed to be made to the Health and Welfare Plan effective June 1, 2013, to be in compliance with federal regulations:‣ The Plan must cover dependent children to age 26, regardless of their employment status and regardless of whether they have coverage under theirown employer’s group health plan; however, such coverage will be subject to Coordination of Benefits.‣ The Plan must cover network preventive services without cost-sharing, including women’s health services, as prescribed by the ACA. Coverageguidelines are provided at http://www.hrsa.gov/womensguidelines/ and http://www.dol.gov/ebsa/faqs/faq-aca12.html and are summarized below:Well-woman visits: This includes an annual well-woman preventive care visit for adult women to obtain the recommended preventiveservices, and additional visits if women and their health care providers determine they are necessary.Gestational Diabetes screening: This screening is for women 24 to 28 weeks pregnant, and those at high risk of developing gestationaldiabetes.HPV DNA testing: Women who are 30 or older have access to high-risk human papillomavirus (HPV) DNA testing every three years,regardless of Pap smear results.STI counseling: Women have access to annual counseling on sexually transmitted infections (STIs).HIV screening and counseling: Women have access to annual counseling on HIV.Contraception and contraceptive counseling: Women with reproductive capacity have access to all Food and Drug Administration-approvedcontraceptive methods, sterilization procedures, and patient education and counseling, as prescribed by a health care provider.These recommendations do not include abortifacient drugs. Breastfeeding support, supplies, and counseling: Pregnant and postpartum women have access to comprehensive lactation supportand counseling from trained providers, as well as breastfeeding equipment. Interpersonal and domestic violence screening and counseling: Screening and counseling for interpersonal and domestic violencewill be covered for all adolescent and adult women.‣ The Plan must cover out-of-network Emergency Room services at the same coinsurance at which it covers network Emergency Room services.‣ The Plan must modify its internal review procedures and provide procedures for external review of adverse benefit determinations (claim denials),using Independent Review Organizations (IROs) with which the Fund needs to contract for such review services.‣ The Plan must notify Plan participants of material modifications to the terms of the Plan and Plan coverage that are reflected in the Summary ofBenefits and Coverage (SBC) at least 60 days prior to the date the modification becomes effective.If you are covered by the Health and Welfare Fund at the present time, you will receive a Summary of Material Modifications (SMM) from the Fund Officewithin the next few weeks explaining any changes that will take place effective June 1, 2013.PENSION FUND:As of January 31, 2013, the Pension Fund had Total Assets of $156,492,002 compared to $143,852,379 as of January 31, 2012, anincrease of $12,639,623 or 8.8% during that 12-month period. The Fund is currently paying benefits to 840 Retirees or their survivingBeneficiaries, such payments totaling $10,720,209 during calendar year 2012 or approximately $950,000 per month at thepresent time. During 2012, we had 59 members retire after having 40 members retire during calendar year 2011. If you plan toretire in the near future, you may want to contact me to request a draft of your Pension Quotation detailing the various benefitoptions that will be available to you at the time of your retirement. When you file your Application for Pension Benefits, you willneed to provide a copy of your Birth Certificate, your spouse’s Birth Certificate, and a copy of your Marriage license, if applicable,

Page 10THE <strong>520</strong> HOISTERin order for us to process your retirement papers. Once you make your benefit selection and begin receiving payments, you are not permitted to change yourpension option. Pension payments are made on the first day of each month, for that month, either by Direct Deposit or check. Currently 70% of the pensionpayments are being made by Direct Deposit, which reduces the amount of clerical work and eliminates concerns about timely mail delivery. If you need aDirect Deposit Authorization Form to initiate direct deposit or notify us of a change in your bank account information, please contact the Fund Office. If youneed information about Social Security benefits, the 2013 Guide to Social Security is available in the Fund Office.ANNUITY FUND:The Annuity Fund assets continue to grow at a steady rate. As of January 31, 2013, the Market Value of Plan Assets was $112,144,558 compared to$102,765,345 as of January 31, 2012, an increase of $9,379,211 or 9%. We have listed below the year-to-date and 1-year, 5-year, and 10-year Average Returnsas of 2/28/13 for the 17 Mutual Fund selections that are currently available to you under the Daily Valuation Investment Program:Fund Name1-YearReturn5-Year AverageReturn10-Year/SinceInception Avg.ReturnYear-to-DateReturnas of 2/28/13Distribution OfInvestmentsFederated Capital Preservation (IP) 1.57% 2.80% 3.36% .21% 31.8%Federated U.S. Gov’t: 2-5 years .51% 3.36% 3.64% -.11% 3.2%T. Rowe Price U.S. Treasury Intermediate 2.45% 5.40% 4.74% -.03% 1.6%Dodge & Cox Income 6.17% 6.85% 5.54% .36% 2.6%Dodge & Cox Balanced 5.32% 4.48% 7.72% 5.32% 3.4%Vanguard 500 Index 13.29% 4.85% 8.12% 6.58% 2.3%Dodge & Cox Stock 18.12% 3.04% 8.60% 6.92% 4.0%American Century Ultra 6.94% 5.06% 6.84% 4.61% .9%T. Rowe Price Mid-Cap Growth 10.51% 8.53% 12.75% 7.56% 3.8%Fidelity Low-Priced Stock 12.00% 7.28% 12.41% 5.37% 3.2%Fidelity Diversified International 8.91% -1.90% 9.47% 2.07% 2.1%Accessor Aggressive Growth Fund 10.11% .29% 6.80% 4.09% .7%Accessor Growth Allocation Fund 9.17% 1.57% 6.84% 4.26% .9%Accessor Growth & Income Fund 8.37% 2.63% 6.25% 3.52% 2.0%Accessor Balanced Allocation Fund 7.23% 3.01% 5.98% 2.73% .65%Accessor Income Allocation Fund 12.86% 6.95% 5.06% 3.11% .25%Buffalo Flexible Income Fund * 10.83% 6.63% 10.37% 4.92% 36.1%*Default FundDESIGNATION OF BENEFICIARY:With the transition to Great West Retirement Services on October 1, 2012, it became necessary to complete and file new designation of beneficiary information,since that information was not transferred to Great West by the prior record-keeper. You can file your Beneficiary Designation on the Great Westwebsite at www.oe<strong>520</strong>annuity.com or you can obtain a paper form from Great West or the Fund Office, which should be completed and returned as soon aspossible if you have not already done so.Target Date Funds:The Trustees of your Annuity Fund are in the process of researching the possibility of adding Target Date Funds as an investment option under the Daily ValuationInvestment Program. Each specific Target Date Fund represents a year a participant may be retiring (i.e., 2030 Fund, 2035 Fund, etc.), and a specific assetallocation strategy to gradually reduce market risk as the target date approaches and after it arrives. Under this type of investment strategy, you are not requiredto select a mix of specific mutual funds for your annuity account or re-balance your asset allocation on an ongoing basis, since the Target Date Fund willdo that automatically. We will keep you informed of the Trustees’ decision with respect to Target Date Funds as more information becomes available.VACATION FUND:On November 8, 2012, the Fund Office mailed Vacation Benefit checks to 1,670 Participants, such payments totaling $1.6 million. The Vacation Benefit amountwas determined by the number of hours reported and paid by Contributing Employers for the work period October 2011 through September 2012. If youworked for an employer that is delinquent in the payment of fringe benefits for any month(s) during that period, you will receive an adjustment Vacation checkwhen the Fund Office collects those deductions from that employer. If you did not receive your Vacation check, please let us know as soon as possible.

Page 11 <strong>Volume</strong> 5, <strong>Issue</strong> 1MISCELLANEOUS INFORMATION:A copy of your Work History Report and Dues check-off report for calendar year 2012, detailing those hours reported on your behalf by Contributing Employers,was mailed to all Participants during February 2013 along with your Health and Welfare Fund coverage letter (if applicable) for the period March 2013through May 2013. Since your Health & Welfare eligibility and level of Pension and Annuity benefits directly relate to the number of hours worked, we ask thatyou carefully review the Quarterly Work History Reports and notify the Fund Office of any discrepancies as soon as possible. It is very important that youkeep your check stubs as it may become necessary to use them to verify the number of hours that you worked for a particular employer.As always, we ask that you notify the Fund Office of any changes in your mailing address, phone number, marital status, beneficiary status, etc. If you have anyquestions about your fringe benefits or need a current Summary Plan Description (SPD) please let us know. The Fund Office is open from 7:00 a.m.-4:00 p.m.Monday through Friday to assist you and your dependents in whatever way possible.TRAINING DEPARTMENTOur winter training schedule has recently come to an end. We kept busy this winter with numerous classes and participationhas been fair. For any additional training be sure to call the Training Office at (618) 644-1969.We have purchased a Linkbelt LS-128 DLC to train clamming and dragline in crane class. We have also purchased theGPS system for the John Deere 650K. We are in the process of installing the system and are looking forward to puttingit to good use.We would like to get some more participation for the OECP Crane Certification, so if you think you are qualified toget your crane certification, stop by the Training Department to pick up your application packet.Our apprenticeship applications are still closed at this time. We are currently in the process of rewriting thestandards. We expect the applications to be open in the near future.We have had two apprentices graduate since the last Hoister was out. They are:November 2012We hope that they have a long and prosperous career as Journeymen for <strong>Local</strong> <strong>520</strong>.We appreciate all of those who participated in the classes this year. Training is the KEY to our future!December 2012Thank you,<strong>Local</strong> <strong>520</strong> JATCJohn Deere 650KThomas KlossTravis MooreLinkbelt LS-128 DLC40 Hr. Hazmat Class (2/1/13)Left to right:Holly Hug, Marty Withouse,Ken Netemeyer,Ron Place (Instructor),John Mars, and Steve Galle

Page 12THE <strong>520</strong> HOISTERRETIREESLyle Schicker — 43 yearsDecember, 2012David Meyer — 42 yearsDecember, 2012Wayne Schubert — 35 yearsDecember, 2012Terry MacZura — 44 yearsJanuary, 2013Left to right: Blake Wolff presenting watch toSteve Wolff — 44 yearsJanuary, 2013Edward Krieg — 43 yearsJanuary, 2013Ronald Peppenhorst — 43 yearsJanuary, 2013Walter Bertelsman — 39 yearsJanuary, 2013

Page 13 <strong>Volume</strong> 5, <strong>Issue</strong> 1RETIREESGary Toberman — 33 yearsFebruary, 2013William Blackwell — 2 yearsFebruary, 2013Richard Showalter — 49 yearsMarch, 2013Dennis Frey — 34 yearsMarch, 2013Janet Redman — 5 yearsMarch, 2013NEW MEMBERSMontrell WilsonDecember, 2012Robert D. Young ofNew Douglas, ILwon the drawing for1 year of membership duesat the December 2012meeting!Congratulations!!

Page 14THE <strong>520</strong> HOISTER2012 Christmas Party2012 Retirees Christmas Party

Page 15<strong>Volume</strong> 5, <strong>Issue</strong> 1ATTENTION LOCAL <strong>520</strong> MEMBERSPlease contact the Union Hall or any agent in the event of an illness or death of anymember or any member of their family.Please make sure that the Union Hall, Health & Welfare Fund Office and TrainingDepartment have your correct address, phone numbers and beneficiaries on file.DOYOU HAVE OLD PHOTOS ?We may include them in an issue ofThe Hoister!Please contact the office or email:awilson@iuoelocal<strong>520</strong>.comIMPORTANT NOTICEAt the May 13, 2011 meeting, a motion was made,seconded and carried to charge $25.00, levied againstany member writing a “Bad Check” to pay their dues,and thereafter, only cash, certified check or moneyorder would be accepted from the same member.MONTHLY CARD CHECKPlease make sure you haveyour card with you and thatyour dues are paid up when you come to theunion meetings.REMINDERSA late charge of $1.50 will be added todues if received after the second Friday of themonth. If you are mailing in your dues,please keep this in mind.IUOE WEBSITEVisit www.iuoe.org for information regarding the International Union of<strong>Operating</strong> <strong>Engineers</strong> and the latest in labor news. Also visitwww.oe<strong>520</strong>.org/news.deceased.php to stay informed of member deaths.<strong>Operating</strong> <strong>Engineers</strong> <strong>Local</strong> <strong>520</strong><strong>520</strong> Engineer RoadGranite City, IL 62040618-931-0500Office Hours - 7:00 A.M. to 4:00 P.M.LOCAL <strong>520</strong> CONTACT INFORMATIONwww.oe<strong>520</strong>.orgHealth and Welfare Office8 Executive Woods CourtSwansea, IL 62226618-233-7978Office Hours - 7:00 A.M. to 4:00 P.M.Training Department<strong>Operating</strong> <strong>Engineers</strong> <strong>Local</strong> <strong>520</strong> J.A.T.C.1969 Triad RoadSt Jacob, IL 62281618-644-1969 and 644-JATC (5282)Office Hours - 7:00 A.M. to 4:00 P.M.

<strong>Operating</strong> <strong>Engineers</strong> <strong>Local</strong> <strong>520</strong><strong>520</strong> Engineer RoadGranite City, IL 62040618-931-0500NONPROFIT ORGPRSRT STDU.S. POSTAGE PAIDEDWARDSVILLE, ILPERMIT NO. 88ADDRESS SERVICE REQUESTEDIUOE <strong>Local</strong> <strong>520</strong>OfficersBusiness Manager ..................................... Ron JohnsonPresident...................................................... Ron KaempfeVice-President...................................Chad GoldschmidtRecording-CorrespondingSecretary ..............................................Mark JohnsonFinancial Secretary .................................... Vern ParmleyTreasurer .................................................Mike ParkinsonConductor .................................... David “Kelly” BrownGuard ..............................................................Rick CicardiTrustee ........................................................... Jim StevensTrustee ..................................................... Don RobinsonTrustee ......................................Raymond “Alex” BurrisAuditor .................................................. Bryan AndersonAuditor ........................................................ Joseph ThyerAuditor ........................................................... Steve SmithRetireesWalter Bertelsman 12/01/2012Lyle Schicker 12/01/2012Edward Krieg, Jr. 12/01/2012Victor Masters 12/01/2012Ronald Peppenhorst 12/01/2012Steve Wolff 12/01/2012Terry MacZura 01/01/2013William R. Blackwell 01/01/2013Larry Brown 01/01/2013Janet Redman 01/01/2013Jerome Kuhl 01/01/2013Daryl A. Wharry 02/01/2013Gary L. Toberman 02/01/2013David Behrmann 02/01/2013Dennis J. Frey 02/01/2013Joseph Mayer 02/01/2013Marlene M. Krotz 02/01/2013James A. Kirchhoefer 02/01/2013Robert Payne 02/01/2013Richard Showalter 03/01/2013Vickie Keeley 04/01/2013Carl O. Bannister 04/01/2013James E. Thomas 04/01/2013Thomas G. Petroff, Jr. 05/01/2013Richard G. Georgewitz 05/01/2013ObituariesWe extend our condolences to the families of:Tom Leffner 09/20/2012Richard Awalt 09/24/2012Nolan Feldt 09/25/2012Betty Nicol (Dale) 10/18/2012Edgar “Eddie” Awalt 10/19/2012Gary Dorries 11/27/2012Norman Neff 12/13/2012Oscar Ambry 12/17/2012Fred Hoeffken 12/25/2012Esther M. Knowles 01/06/2013Joseph Frank Bullock 01/08/2013Richard A. Emig 01/11/2013Bernice Riechmann 01/16/2013Charles E. Chrisman 01/19/2013Dennis J. Ross 01/29/2013Dora MaeCohlmeyer (Roger)02/02/2013Harvey Brock, Jr. 02/09/2013Preston D. Dunaway 02/10/2013Dorothy F. Foster 02/15/2013Ramona Sandusky (Fred) 02/15/2013Darvin D. Lochmann 02/21/2013Harold G. James 02/23/2013Thomas L. Aldridge 02/24/2013John I. Benjamin 03/07/2013Billie J. Hasty 03/10/2013Rotha L. Walton (Burl) 03/16/2013William Schaffner, Jr. 03/24/2013Theodore R. Brown 03/30/2013