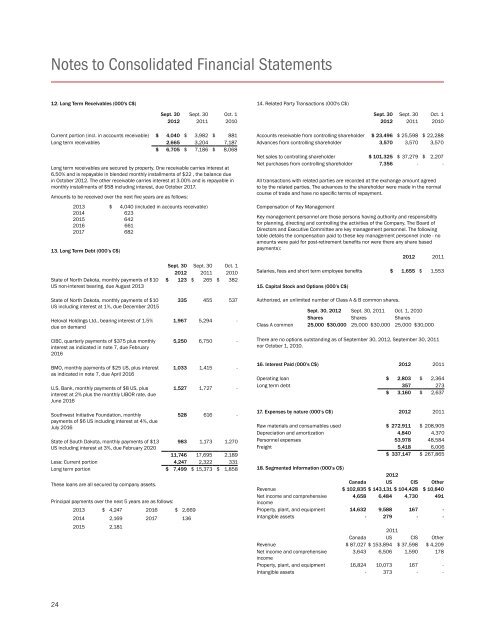

Notes to Consolidated Financial Statements12. Long Term Receivables (000's C$)14. Related Party Transactions (000's C$)Sept. 30 Sept. 30 Oct. 12012 2011 2010Current portion (incl. in accounts receivable) $ 4,040 $ 3,982 $ 881Long term receivables 2,665 3,204 7,187$ 6,705 $ 7,186 $ 8,068Long term receivables are secured by property. One receivable carries interest at6.50% and is repayable in blended monthly installments of $22 , the balance duein October 2012. The other receivable carries interest at 3.00% and is repayable inmonthly installments of $58 including interest, due October 2017.Amounts to be received over the next five years are as follows:2013 $ 4,040 (included in accounts receivable)2014 6232015 6422016 6612017 68213. Long Term Debt (000’s C$)State of North Dakota, monthly payments of $10US non-interest bearing, due August 2013Sept. 30 Sept. 30 Oct. 12012 2011 2010$ 123 $ 265 $ 382Sept. 30 Sept. 30 Oct. 12012 2011 2010Accounts receivable from controlling shareholder $ 23,496 $ 25,598 $ 22,288Advances from controlling shareholder 3,570 3,570 3,570Net sales to controlling shareholder $ 101,325 $ 37,279 $ 2,207Net purchases from controlling shareholder 7,356 - -All transactions with related parties are recorded at the exchange amount agreedto by the related parties. The advances to the shareholder were made in the normalcourse of trade and have no specific terms of repayment.Compensation of Key ManagementKey management personnel are those persons having authority and responsibilityfor planning, directing and controlling the activities of the Company. The Board ofDirectors and Executive Committee are key management personnel. The followingtable details the compensation paid to these key management personnel (note - noamounts were paid for post-retirement benefits nor were there any share basedpayments):2012 2011Salaries, fees and short term employee benefits $ 1,655 $ 1,55315. Capital Stock and Options (000’s C$)State of North Dakota, monthly payments of $10US including interest at 1%, due December 2015Heloval Holdings Ltd., bearing interest of 1.5%due on demandCIBC, quarterly payments of $375 plus monthlyinterest as indicated in note 7, due February2016BMO, monthly payments of $25 US, plus interestas indicated in note 7, due April 2016U.S. Bank, monthly payments of $8 US, plusinterest at 2% plus the monthly LIBOR rate, dueJune 2016335 455 5371,967 5,294 -5,250 6,750 -1,033 1,415 -1,527 1,727 -Authorized, an unlimited number of Class A & B common shares.Sept. 30, 2012 Sept. 30, 2011 Oct. 1, 2010Shares Shares SharesClass A common 25,000 $30,000 25,000 $30,000 25,000 $30,000There are no options outstanding as of September 30, 2012, September 30, 2011nor October 1, 2010.16. Interest Paid (000’s C$) 2012 2011Operating loan $ 2,803 $ 2,364Long term debt 357 273$ 3,160 $ 2,637Southwest Initiative Foundation, monthlypayments of $6 US including interest at 4%, dueJuly 2016528 616 -State of South Dakota, monthly payments of $13 983 1,173 1,270US including interest at 3%, due February 202011,746 17,695 2,189Less: Current portion 4,247 2,322 331Long term portion $ 7,499 $ 15,373 $ 1,858These loans are all secured by company assets.Principal payments over the next 5 years are as follows:2013 $ 4,247 2016 $ 2,6692014 2,169 2017 1362015 2,18117. Expenses by nature (000’s C$) 2012 2011Raw materials and consumables used $ 272,911 $ 208,905Depreciation and amortization 4,840 4,370Personnel expenses 53,978 48,584Freight 5,418 6,006$ 337,147 $ 267,86518. Segmented Information (000’s C$)2012Canada US CIS OtherRevenue $ 102,835 $ 143,131 $ 104,428 $ 10,840Net income and comprehensive 4,658 6,484 4,730 491incomeProperty, plant, and equipment 14,632 9,588 167 -Intangible assets - 279 - -2011Canada US CIS OtherRevenue $ 87,027 $ 153,894 $ 37,598 $ 4,209Net income and comprehensive 3,643 6,506 1,590 178incomeProperty, plant, and equipment 16,824 10,073 167 -Intangible assets - 373 - -24

Notes to Consolidated Financial Statements18. Segmented Information (000’s C$) - continuedCIS is the Commonwealth of Independent States, including Russia, Kazakhstan andUkraine.The Company has organized its business between agricultural and non-agriculturaloperations due to the differences in the products and approaches in marketing andmanufacturing in both segments. The agricultural equipment segment producesa wide variety of agricultural equipment, whereas the non-agricultural operationsconsist primarily of custom metal fabrication.2012 2011Ag Non-Ag Ag Non-AgRevenue $ 357,054 $ 4,180 $ 279,061 $ 3,667Interest revenue 61 492 103 454Interest expense 3,507 - 3,004 -Net income and15,187 1,176 11,852 65comprehensive incomeAssets 243,247 7,508 232,534 9,199The accounting policies of the segments are the same as described in the note forsignificant accounting policies. The Company accounts for inter-segment sales atcurrent market prices. Revenue from the top two customers were $101.3 millionand $6.0 million, both in the agricultural segments. For the same period of fiscal2011, the top two customers were $37.3 million and $13.7 million, also both in theagricultural segments.19. Business Acquisition (000’s C$)Effective February 3, 2011, the Company acquired certain assets of Ezee-OnManufacturing.The aggregate purchase price was $14,500 comprised of cash. The acquisition hasbeen accounted for using the purchase method, whereby the total of the acquisitionhas been allocated to the assets acquired and liabilities assumed based upon theirrespective fair values at the effective date.The following table summarizes the estimated fair value of the assets acquired andliabilities assumed on the date of acquisition. The purchase price has been allocatedto the assets acquired based on their fair values and management’s best estimates,as follows:Accounts receivable $ 5,353Inventory 5,553Prepaids 26Lands 130Buildings 798Equipment 2,950Accounts payable (310)Net assets acquired $ 14,50020. Deferred Profit Sharing PlanIn 1995, the Company established a Deferred Profit Sharing Plan for its employees.The Company can contribute funds to the plan annually as determined by theBoard of Directors, subject to certain maximum limits established by the plan.Contributions are used to purchase common shares of the Company for theemployees from the plan trust. The plan trust owns approximately 252,000 <strong>Buhler</strong><strong>Industries</strong> <strong>Inc</strong>. shares. During the year, the company contributed $Nil to the plan(2011 - $Nil).21. Contingent Liability (000’s C$)In a prior year, a loan from Industry Canada in the amount of $9,300 was forgiven.Should the Company fail to maintain certain tractor production levels in Winnipeguntil October 22, 2017, $5,000 of the amount forgiven may become payable by theCompany.22. Capital ManagementThe Company’s fundamental objectives in managing capital are to maintain<strong>financial</strong> flexibility in order to preserve its ability to meet <strong>financial</strong> obligations, ensureadequate liquidity and <strong>financial</strong> flexibility at all times, and deploy capital to providean appropriate investment return to its shareholders while maintaining prudentlevels of <strong>financial</strong> risk.The Company believes that the aforementioned objectives are appropriate in thecontext of the Company’s business. The Company defines its capital as cash, bankindebtedness, shareholders’ equity, long term debt including the current portion,net of any cash and cash equivalents. The Company’s <strong>financial</strong> strategy is designedto maintain a flexible capital structure consistent with the objectives stated aboveand to respond to changes in economic conditions and the risk characteristics ofunderlying assets. In order to maintain or adjust its capital structure, the Companymay purchase shares for cancellation pursuant to normal course issuer bids, issuenew shares, raise debt (secured, unsecured, convertible and/or other types ofavailable debt instruments), enter into hedging arrangements and refinance existingdebt with different characteristics, amongst others.The Company constantly monitors and assesses its <strong>financial</strong> performance andeconomic conditions in order to ensure that its net debt levels are prudent.The Company’s <strong>financial</strong> objectives and strategy are reviewed on an annual basis.The Company believes that its ratios are within reasonable limits, in light of therelative size of the Company and its capital management objectives.As part of the lending agreements for the financing facility and long term debt, theCompany is subject to certain covenants. These are reviewed monthly to ensurecompliance. As at September 30, 2012 all covenants were met.There are no externally imposed capital restrictions on the Company.There were no changes in the Company’s approach to capital management duringthe current period.23. Financial Instruments (000’s C$)The following presents the carrying value and fair value of the Company’s <strong>financial</strong>instruments:September 30, 2012Carried at cost/ Carrying/Financial Asset/Liability Classification Amortized cost Fair ValueCash Loans and receivables $ 19,293Accounts receivable Loans and receivables 54,388Long term receivables Loans and receivables 2,665Interest in other entities FVTPL 149Accounts payable and accrued Other liabilities (62,502)liabilitiesAdvances from related party Loans and receivables (3,570)Long term debt Other liabilities (11,746)September 30, 2011Carried at cost/ Carrying/Financial Asset/Liability Classification Amortized cost Fair ValueBank indebtedness Loans and receivables $ (10,515)Accounts receivable Loans and receivables 71,339Long term receivables Loans and receivables 3,204Interest in other entities FVTPL 146Accounts payable and accrued Other liabilities (57,293)liabilitiesAdvances from related party Loans and receivables (3,570)Long term debt Other liabilities (17,695)As at September 30, 2012, the Company was in compliance with this requirement,and management believes that productions levels will continue to be met during thetime period set out in the contract with Industry Canada.25