Next Generation - KSEI

Next Generation - KSEI

Next Generation - KSEI

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CONTENTS<br />

1<br />

4<br />

5<br />

7<br />

8<br />

From The Editor<br />

In the middle of traffic jam or<br />

when waiting for departure at the<br />

airport, capital market investors<br />

now can monitor the position<br />

and movement of their securities<br />

portfolios in <strong>KSEI</strong>’s AKSes Facility<br />

easily and conveniently. Simply<br />

use the smart phones with RIM-<br />

BlackBerry, Android or Apple<br />

based. AKSes Mobile application<br />

are intentionally provided by<br />

<strong>KSEI</strong> as a facilitaty for investors to<br />

monitor their portfolio securities<br />

and funds. What comments does<br />

the investors give towards AKSes<br />

Mobile? See their stories in the<br />

main text this time.<br />

To continue the development<br />

of its facilities and services,<br />

<strong>KSEI</strong> has signed a cooperation<br />

agreement with Korea Securities<br />

Depository on mid March, 2012.<br />

Memorandum of Understanding<br />

is made in the context of capital<br />

market information exchange<br />

between the two countries. In<br />

addition to reviews about the<br />

cooperation, we also present a<br />

summary of a workshop on South<br />

Korean capital market which was<br />

held after the MoU. Consider also<br />

the development of C-BEST <strong>Next</strong><br />

<strong>Generation</strong> article.<br />

Happy Reading.<br />

Editor<br />

Website <strong>KSEI</strong><br />

www.ksei.co.id<br />

email<br />

helpdesk@ksei.co.id<br />

Toll Free<br />

0800 -1- 865734<br />

Call Center <strong>KSEI</strong><br />

021 - 515 2855<br />

Monitoring Securities Portofolio Anytime and Anywhere<br />

<strong>KSEI</strong> and KSD Strategic Alliance<br />

Workshop <strong>KSEI</strong>-KSD:<br />

Sharing Knowledge from South Korea<br />

C-BEST ‘<strong>Next</strong> <strong>Generation</strong>’<br />

ACTIvITIES & STATISTICS<br />

Monitoring Securities<br />

Portfolio Anytime & Anywhere<br />

Development of smart phones technology is applied by <strong>KSEI</strong> to<br />

facilitate investors to access information easily. Investors admitted<br />

that AKSes Mobile Facility has enabled them to monitor Securities<br />

portfolio and fund comfortably.<br />

As a housewife, Vivin Rogio wants<br />

to carry out positive activities that<br />

earn profit. She finally decided to<br />

invest in capital market in 2009 after her<br />

husband introduced her to his friend who<br />

worked in Securities Company. At the<br />

beginning, she felt a little bit worried for<br />

stock investment which was considered as<br />

02<br />

Edition<br />

2012<br />

high risk investment. But a year later, when<br />

she received AKSes (Securities Ownership<br />

Reference) Card, she managed to get out<br />

from such worries.<br />

After having the access to log in to<br />

AKSes Facility, Vivin always takes a chance<br />

to get into the internet and to log in,<br />

especially to check the Inquiry Securities

Fokuss 2nd Edition, 2012<br />

2<br />

Balance. “By opening that feature, I<br />

believe the funds I invest are in correct<br />

numbers based on order I delivered to<br />

Securities Company where I become<br />

client. And I feel secured,” she said.<br />

She even earned greater benefit of<br />

having AKSes Card when <strong>KSEI</strong> launched<br />

AKSes Mobile application. “Wherever I<br />

am, and anytime, if I have time, I always<br />

open AKSes Mobile. For instance, when<br />

I go to Jakarta, or during a trip that<br />

requires quite a long time and in traffic<br />

jam, AKSes Mobile is very helpful,” said<br />

the client who lives in Banjarmasin.<br />

Similar comment was delivered by<br />

Tiamto Rachman who started to invest<br />

in the capital market in 2001 and has<br />

“Anytime and<br />

anywhere, I always<br />

access to AKSes<br />

Mobile if there is a<br />

chance.”<br />

Tiamto Rachman<br />

Vivin Rogio<br />

owned AKSes Card since August 2009.<br />

The benefit of AKSes Card, according to<br />

him, it can directly monitor Securities<br />

portfolio and fund without Securities<br />

Company’s assistance. Additionally, this<br />

facility will improve the trust of Indonesia<br />

capital market investors in the future.<br />

Tiamto usually performs the<br />

monitoring by using AKSes Mobile<br />

application through Android-based<br />

tablet computer, which is considered<br />

easy instead of using personal computer<br />

(PC). If using PC, he said, investor has<br />

to answer certain questions (secret<br />

question) for security. “Almost everyday<br />

I access AKSes Mobile, I always go into<br />

Securities Balance and Fund Balance<br />

menu,” said the investor who won one of<br />

the grand prizes of AKSes Card Lottery<br />

Period I. But the display of AKSes Mobile<br />

application for Android, he added,<br />

must go through further modification,<br />

especially those with black background<br />

and font, so they can be easily read.<br />

Vivin explained that, at the<br />

beginning of AKSes Mobile application,<br />

she encountered a slight problem<br />

when using it. It was because she has<br />

two AKSes Cards from two Securities<br />

Companies. In fact, after attending <strong>KSEI</strong><br />

socialization in the city of her domicile,<br />

she started to realize that she needs only<br />

one card to access the information of her<br />

portfolio in both Securities Companies.<br />

Also, Vivin showed a positive<br />

welcome toward Separation of Client<br />

Fund Account (RDN) that was applied<br />

at the beginning of 2012. According<br />

to her, this policy will give benefit to<br />

investors. “We don’t have to transfer<br />

fund to Securities Company’s account,<br />

just simply transfer it to Client Fund<br />

Account. It will make investors feel more<br />

secure for the funds owned will be wellmanaged,”<br />

explained Vivin.<br />

Tiamto very much supports RDN<br />

separation. He once had unpleasant<br />

experience when he became the client<br />

of PT Sarijaya Sekuritas in 2009, in which<br />

clients’ funds were mismanaged by<br />

unauthorized officer in that company.<br />

Up to now, his fund settlement is not<br />

accomplishment yet. “I expect that<br />

with RDN, client’s cash fund recording<br />

will be transparent so it can prevent<br />

misapplication by unauthorized party. I<br />

also hope that the party who intends to<br />

conduct investor’s fund misapplication<br />

can be detected as early as possible with<br />

RDN,” he added.<br />

Easiness to check Securities portfolio<br />

was also confirmed by Choe Jim Fai,<br />

a guy from Medan who has become<br />

investor for four years. Security factor by<br />

using AKSes Facility and easiness to log<br />

in from anywhere by using AKSes Mobile<br />

application were quite impressive to<br />

Choe who won one of the grand prizes<br />

of AKSes Card Lottery Period I.<br />

Tiamto hoped that <strong>KSEI</strong> could actively<br />

participate in creating modern, reliable<br />

Indonesia capital market, and always<br />

Publisher: PT Kustodian Sentral Efek Indonesia (<strong>KSEI</strong>) • Advisor: <strong>KSEI</strong> Director • Editor: Zylvia<br />

Thirda, Dharma Setyadi, Susiyanti, Novian Harry Wibowo, Annisa Indri Hapsari, M. Ridwan, Rachmat<br />

Irfan, Adisty Widyasari, Dimas Prayoga • Address: Gedung Bursa Efek Indonesia, Tower I Lt.<br />

5, Jl. Jend. Sudirman Kav 52-53, Jakarta 12190, Phone. 52991099, Fax. 52991199 • Circulation:<br />

<strong>KSEI</strong> Corporate Communication Unit.

take future anticipation to protect the<br />

investors’ interest. “sometimes I found<br />

the fund balance displayed in AKSes<br />

Facility was not concurrent with the real<br />

records. Hopefully, <strong>KSEI</strong> can perform<br />

random and regular audit. Don’t’ expect<br />

it from the investor as most of them do<br />

not really care about RDN. They care<br />

only when they encounter problems, he<br />

said.<br />

He also had questions, with RDN<br />

implementation, T+3 recording process<br />

for client’s shares and cash funds can<br />

be directly monitored by investor<br />

through AKSes Facility. But, what about<br />

the recording of transaction which is<br />

still in settlement process? “I suggest<br />

that AKSes Facility can also record the<br />

process of such settlement. When<br />

problem occurs, what is the status of<br />

such transaction? Can investor directly<br />

monitor the transaction?” he affirmed.<br />

Tiamto also hoped that settlement<br />

process could be reduced to T+1, so<br />

today’s transaction can be monitored<br />

through AKSes Facility on the next day.<br />

AKSes Mobile was launched by <strong>KSEI</strong><br />

on January 10, 2012 as innovation toward<br />

AKSes Facility development covering<br />

major platforms of mobile hardware,<br />

e.g. RIM-BlackBerry, Android, and Apple.<br />

By using such application, the problem<br />

investor used to encounter in accessing<br />

AKSes Facility through internet browser<br />

in the form of limited screen size can be<br />

solved.<br />

AKSes Mobile application also<br />

provides information of Client Fund<br />

Account in <strong>KSEI</strong> Payment Bank. Investors<br />

who have owned Client Fund Account<br />

and AKSes Card, can automatically log<br />

in to AKSes Facility through internet<br />

browser or AKSes Mobile application,<br />

by which monitoring of fund record<br />

administered by Securities Company in<br />

<strong>KSEI</strong> Payment Bank can be performed.<br />

“Generally, information available<br />

in AKSes Mobile application are<br />

concurrent with those in web version,”<br />

said Syafruddin, Division Head of<br />

Research and Business Development.<br />

Since its launching, added Syafruddin,<br />

information that are mostly accessed are<br />

Securities balance and mutation, as well<br />

as fund balance and mutation in Client<br />

Fund Account in Payment Bank.<br />

On April 19, 2012, total number of<br />

AKSes Card user was 273,020 investors.<br />

From such figures, only 27,998 have<br />

logged in to AKSes Facility and 1,106 have<br />

Syafruddin<br />

logged in to AKSes Mobile application.<br />

“In the future, AKSes Mobile application<br />

will be developed and completed with<br />

real-time data from BEI and regional<br />

exchanges, e.g. price movement, index<br />

fluctuation, historical chart/graph, and<br />

others,” added Syafruddin.<br />

Syafruddin admits the number of<br />

investors which are logged in to AKSes<br />

Mobile is not much and still far from<br />

what he was expected. Socialization<br />

and information delivery need to be<br />

implemented soon to the investor,<br />

especially information convenience and<br />

benefit of AKSes Mobile.<br />

Other information that are still<br />

developed are information of status of<br />

transaction made by investor in Bursa<br />

Efek Indonesia (BEI), which are now<br />

available in web version AKSes Facility.<br />

Afterwards, development shall move<br />

into information provision of settlement<br />

right and obligation of investor on T+3,<br />

based on right and obligation calculation<br />

performed by KPEI.<br />

<strong>KSEI</strong> also disclose to any input and<br />

criticism from every capital market investors<br />

for futher development and improvement.<br />

“In the future, AKSes Mobile application<br />

will be developed and supports real time<br />

data from Indonesia Stock Exchange and<br />

regional market, such as price movement,<br />

index movement, chart or graphic history<br />

and others,” added Syafruddin.<br />

[ Editor ]<br />

“By using AKSes<br />

Mobile application,<br />

the problem investor<br />

used to encounter<br />

in accessing AKSes<br />

Facility through<br />

internet browser in<br />

the form of limited<br />

screen size can be<br />

solved.”<br />

Fokuss 2nd Edition 2012<br />

3

Fokuss 2nd Edition, 2012<br />

<strong>KSEI</strong> and KSD Strategic Alliance<br />

Together with Korea Securities Depository (KSD), <strong>KSEI</strong> has developed capital market<br />

industry in respective country. It is expected that the cooperation agreement that has<br />

been legalized in the form of MoU can give benefit to both countries.<br />

AAs the Central Securities Depository<br />

(CSD) in Indonesia capital<br />

market, PT Kustodian Sentral Efek<br />

Indonesia (<strong>KSEI</strong>) keeps conducting<br />

various developments, both internal<br />

and external aspects. One of the external<br />

developments was conducted through<br />

cooperation with CSD of other country, either<br />

in regional or international area.<br />

In regional aspect, Indonesia and<br />

South Korea, jointly with other 19 countries<br />

in Asia Pacific, have joined together and<br />

conducted cooperation in The Asia-Pacific<br />

Central Securities Depository Group (ACG).<br />

The organization, which was established<br />

in November 1997, has members from<br />

central custodian and clearing institution<br />

of each country and it was formed by the<br />

members to facilitate information and to<br />

improve cooperation among members.<br />

In order to improve the bilateral cooperation,<br />

especially in terms of capital<br />

market information exchange between<br />

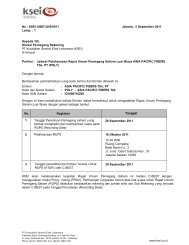

two countries, the signing of Memorandum<br />

of Understanding (MoU) between<br />

<strong>KSEI</strong> - KSD has been performed on March<br />

20, 2012 represented by Ananta Wiyogo,<br />

<strong>KSEI</strong>’s President Director, and Kim Kyung<br />

Dong, Chairman & CEO of KSD. It was held<br />

at BEI Gallery witnessed by Chairman of<br />

Indonesia Capital Market and Financial Institutions<br />

Supervisory Agency (Bapepam-<br />

LK) Nurhaida; President Director of BEI,<br />

Ito Warsito, and President Director of PT<br />

Kliring Penjaminan Efek Indonesia (KPEI),<br />

Hoesen.<br />

“The Objection is to turn<br />

<strong>KSEI</strong> and KSD into reliable,<br />

credible and competitive<br />

CSD both regionally or<br />

internationally, with best<br />

practice and internasional<br />

standard .”<br />

Ananta Wiyogo and Kim Kyung Dong after MoU Signing Ceremony, with President Director of BEI Ito Warsito (far<br />

left), Chairman of Bapepam- LK Nurhaida (center) and President Director of KPEI Hoesen (far right).<br />

Cooperation in capital market industry,<br />

developments of depository and transaction<br />

settlement service products as well<br />

as improvement of information exchange<br />

and knowledge between CDS are the main<br />

focuses of the MoU content. The purpose<br />

is to make <strong>KSEI</strong> and KSD into reliable and<br />

globally-competitive CSDs with services<br />

based on international standards and best<br />

practices.<br />

Chairman of Bapepam-LK, Nurhaida,<br />

showed her support toward cooperation<br />

of <strong>KSEI</strong> and KSD in her welcome speech at<br />

the beginning of the event. “Cooperation<br />

between capital market institutions is very<br />

important for the output can give contribution<br />

toward capital market development in<br />

both countries,” she said. Furthermore, she<br />

gave notice to maintain the cooperation<br />

built between <strong>KSEI</strong> and KSD.<br />

In his speech, Ananta expressed his<br />

expectation of establishing a more intensive<br />

and better communication between<br />

<strong>KSEI</strong> and KSD. “With this cooperation, it is<br />

expected that information and knowledge<br />

sharing can be performed easily so it can<br />

turn <strong>KSEI</strong> and KSD into reliable, credible,<br />

and regionally or internationally-competitive<br />

CSD,” said Ananta.<br />

Affirming Ananta’s statements, Kim<br />

Kyung Dong said that the collaboration<br />

between the two CSDs would give easiness<br />

to the development of capital market<br />

in Indonesia and South Korea. “The MoU<br />

signing between <strong>KSEI</strong> and KSD is a valuable<br />

progress where both institutions have<br />

stepped into a practical cooperation for<br />

capital market development,” he said.<br />

After the MoU signing, KSD delegation<br />

had a chance to share knowledge to capital<br />

market players. Helen Chai, Manager<br />

Global Securities Services Department<br />

of KSD, gave information about Korean<br />

Depository Receipt, while Emily Kim, Assistant<br />

Manager Derivative Services Department<br />

of KSD, explained the Securities<br />

Lending and Borrowing in South Korea<br />

capital market.<br />

Despite the signing with KSD, <strong>KSEI</strong> has<br />

previously conducted MoU signing with<br />

CSD in other countries, e.g. Thailand Securities<br />

Depository Co., Ltd. (TSD) on March<br />

2009 and Japan Securities Depository<br />

Center, Inc. (JASDEC) on November 2009.<br />

Through the signing of such MoU, development<br />

of Indonesia capital market industry<br />

can be more progressive and comply<br />

with the international standards.<br />

[ Editor ]<br />

Image:. <strong>KSEI</strong> doc

The workshop, which was held by<br />

<strong>KSEI</strong> and KSD on March 20, 2012<br />

at Auditorium, BEI Gallery, was<br />

attended by <strong>KSEI</strong>, representatives of<br />

Bapepam-LK, PT Bursa Efek Indonesia<br />

(BEI), PT Kliring Penjaminan Efek Indonesia<br />

(KPEI), Association of Indonesian<br />

Securities Companies (APEI), and Association<br />

of Indonesia Custodian Bank<br />

(ABKI).<br />

In the first session, Helen Chai,<br />

Manager of Global Securities Services<br />

Department of KSD, gave explanation<br />

about depositary receipt (DR) and its<br />

implementation in South Korea capital<br />

market. DR is a financial instrument issued<br />

in capital market of certain country<br />

upon underlying securities (main<br />

securities) issued by Issuer in other<br />

country.<br />

Based on historical record, DR was<br />

firstly issued by J.P Morgan in the United<br />

States of America on April 29, 1927.<br />

It was called American Depositary Receipt<br />

(ADR) with Selfridges Provincial<br />

Stores Limited of England issued in<br />

England as the main Securities. The<br />

reason for issuing DR, at that time, was<br />

due to prohibition from the Congress of<br />

England to transfer shares of company<br />

in England to other country. ADR was<br />

issued to deal with the need of American<br />

investors to invest in foreign shares<br />

in US Dollar with minimum fee.<br />

DR issuance can provide various<br />

benefits either to the Issuer of main<br />

Securities or the investors. To Issuer,<br />

DR can become the solution for legal<br />

conflict commonly revealed between<br />

the Issuer and local investor of different<br />

countries. Other benefits are to<br />

give capital access outside the market<br />

of Issuer, to extend the investor basis of<br />

main Securities holders, to broaden the<br />

market shares that potentially improve<br />

the liquidity and adjustment of main<br />

Securities price against DR ratio.<br />

In addition to benefits for the Issuer<br />

of main Securities, client of DR holder<br />

can also take benefits, they are:<br />

[1] Investment instrument on foreign<br />

shares get varied as DR is traded,<br />

cleared and settled in domestic<br />

capital market.<br />

[2] Total cost for cross-border custody<br />

safekeeping fee gets decreasing.<br />

[3] Research access on trading price<br />

and information get broader.<br />

[ ] Information of corporate action is in<br />

local language.<br />

Workshop <strong>KSEI</strong>-KSD:<br />

Sharing Knowledge<br />

from South Korea<br />

After the Memorandum of Understanding (MoU) signing, PT<br />

Kustodian Sentral Efek Indonesia (<strong>KSEI</strong>) and Korea Securities<br />

Depository (KSD) organized a workshop concerning South<br />

Korea capital market, Korean Depository Receipt, and<br />

Securities Lending and Borrowing (SLB).<br />

Issuing<br />

Company<br />

Deposit of<br />

Underlying<br />

Shares<br />

Domestic<br />

Custodian of<br />

Underlying<br />

Shares (KSD)<br />

Fund for Subscription<br />

Deposit<br />

Confirmation<br />

Roles of KSD in DR Issuance Process<br />

l Open safekeeping account at KSD<br />

l Open cash account at KSD’s settlement bank<br />

l Issue IRC Certificate (Investment Registration Number)<br />

l Register DR issuance details in the SAFE +<br />

Proses Penerbitan Depositary Receipt<br />

Sumber: Korea Securities Depository<br />

[5] Payment of devidend is made in<br />

local currency so it can reduce the<br />

currency exposure.<br />

[6] It gives chance to investors to invest<br />

in a more liquid market.<br />

Helen Chai added that, since 199<br />

up to now, KSD provides custody services<br />

on DR issued by Korean companies<br />

as main Securities in certain Exchanges<br />

in other countries, e.g. Samsung, Hyundai,<br />

LG, Lotte Shopping that are listed<br />

on London Stock Exchange, and LG, KB,<br />

SK telecom, Posco Hynix that are listed<br />

on New York Stock Exchange.<br />

For main Securities issued outside<br />

South Korea, KSD also provides depositary<br />

services on Korean Depository Receipt<br />

(KDR). As depositary, KSD serves<br />

as registrar, issues and cancels KDR,<br />

conducts the process of corporate ac-<br />

Overseas<br />

DR<br />

Depository<br />

DR<br />

Issuance<br />

DR<br />

Issuance<br />

Lead<br />

Manager<br />

Investor<br />

“Penerbitan Depository<br />

Receipt dapat<br />

memberikan beragam<br />

manfaat bagi pihak<br />

Emiten, penerbit<br />

Efek utama, maupun<br />

nasabah.”<br />

Fund for<br />

Subscription<br />

Fokuss 2nd Edition 2012<br />

5

Fokuss 2nd Edition, 2012<br />

6<br />

tion activity, acts as paying agent in<br />

dividend distribution, and coordinates<br />

voting rights activity for KDR holders.<br />

On second session, Emily Kim, Assistant<br />

Manager of Derivatives Services<br />

Department of KSD, shared her<br />

knowledge of SLB Services. In her<br />

presentation, Emily gave illustration<br />

of SLB market in South Korea and SLB<br />

services performed by KSD. Securities<br />

lending is temporary loan on Securities<br />

from lending party (lender) to borrowing<br />

party (borrower). Both parties can<br />

ask for or return the Securities lended<br />

anytime. Legally, the lender reserves<br />

the right to get all profit on Securities<br />

lended, except voting right.<br />

SLB program is very much required<br />

to improve the market efficiency and liquidity<br />

and gives additional benefits to<br />

the lender. For the borrower, SLB program<br />

is required to meet the obligation<br />

of transaction settlement in the market,<br />

to support short sell strategy, and to<br />

manage risk in protecting the portfolio<br />

value.<br />

In South Korea capital market, the<br />

lender generally comes from pension<br />

and insurance funding companies, in<br />

order to maximize the portfolio profit.<br />

While majority of borrowers are investment<br />

managers of Mutual Fund, protection<br />

fund service providers, and Securities<br />

Companies that take SLB program<br />

to prevent default, to support short sell,<br />

and hedges fund.<br />

Since 1996, KSD has provided centralized<br />

SLB intermediary system where<br />

the lender can directly contact the<br />

borrower with KSD acting as the intermediary.<br />

Through this system, the access<br />

to the lender and borrower gets<br />

broader and more efficient as it can<br />

“SLB program is<br />

needed to enhance<br />

market liquidities and<br />

efficiencies, and also to<br />

give additional benefit<br />

to lender.”<br />

1) Application<br />

1) Application<br />

2) Collateral<br />

Borrower KSD Lender<br />

) Credit (+)<br />

3) Matcing<br />

Report<br />

Borrower<br />

A/C Book<br />

reduce the cost for counter-party finding.<br />

Besides, the Securities lended will<br />

be more secure as they are kept in KSD<br />

as intermediary. It makes the transaction<br />

settlement process more secured<br />

as it is conducted through book-entry<br />

system in KSD, and information of corporate<br />

action activity will be more accurate<br />

and timely. By using this system,<br />

monitoring process of SLB transaction<br />

becomes easier and timely as it is conducted<br />

electronically.<br />

Securities offered by KSD in SLB program<br />

are varied, among others: shares<br />

listed on Korea Exchange (KRX), corporate<br />

and government bonds listed on<br />

KRX, exchange traded fund (ETF), and<br />

KDR. While transaction types of SLB in<br />

KSD are divided into five types, namely:<br />

settlement - coverage transaction, bidoffer<br />

transaction, customized transaction,<br />

arranged transaction, and bridge<br />

transaction. The purpose of SLB with<br />

settlement-coverage transaction type<br />

is to handle failure of Exchange transaction<br />

settlement on T+2 in 3 business<br />

days, while the purpose of other types<br />

of SLB is for investment strategy.<br />

By providing SLB facility, system in<br />

KSD is also equipped with collateral<br />

management system that enables calculating<br />

and evaluating process of collateral<br />

rate, daily mark-to-market, and<br />

margin call, by which KSD can check the<br />

SLB Transaction Flow<br />

Source: Korea Securities Depository<br />

3) Matcing<br />

Report<br />

Lender<br />

A/C Book<br />

) Debit (-)<br />

closing price of Securities lended and<br />

guaranteed, and perform exchange of<br />

shares placed as collateral when value<br />

declining of shares guaranteed occurs.<br />

At the end of session, Emily Kim said<br />

that SLB market grows well in South Korea<br />

due to improvement of hedge funds<br />

adopted by Korea since December<br />

2012. Unfortunately, Korean domestic<br />

financial institution acting as prime<br />

broker is currently facing credit risk on<br />

its trading with foreign party. Now, KSD<br />

is working on that matter.<br />

Information delivered by Helen Chai<br />

and Emily Kim are certainly new knowledge<br />

for Indonesia capital market players.<br />

Hopefully, similar workshop can be<br />

arranged continually as the basis for Indonesia<br />

capital market development.<br />

[ Dian Kurniasarie ]

C-BEST ‘<strong>Next</strong> <strong>Generation</strong>’<br />

<strong>KSEI</strong> is currently developing C-BEST <strong>Next</strong> <strong>Generation</strong>. This transformation of C-BEST system is<br />

not only more advanced in term of technology, but also provides various benefits.<br />

As part of Indonesia capital market<br />

big family, PT Kustodian Sentral<br />

Efek Indonesia (<strong>KSEI</strong>) continues to<br />

develop its facilities and services to give<br />

easiness to investors in conducting Securities<br />

buy-sell transactions. In 2000, a breakthrough<br />

has been successfully achieved by<br />

<strong>KSEI</strong> through development of The Central<br />

Depository and Book Entry Settlement<br />

System (C-BEST).<br />

C-BEST, which was developed by application<br />

developer from Belgium named<br />

Capital Market Company (Capco), is an integrated<br />

electronic platform that supports<br />

Securities transaction settlement by bookentry<br />

in Indonesia capital market. This<br />

system has converted script form trading<br />

in Indonesia Stock Exchange into scripless<br />

trading.<br />

The whole shares listed on Indonesia<br />

Stock Exchange have been completely<br />

converted into scripless two years after<br />

C-BEST operated, exactly on June 2002.<br />

With C-BEST application, traded Securities<br />

are kept in the form of electronic data.<br />

Transaction settlement process can be<br />

performed only by Securities book-entry<br />

through debit and credit processes in Securities<br />

account.<br />

In order to support integrated system<br />

in Indonesia capital market industry,<br />

C-BEST has been recently integrated through<br />

host-to-host connection with several<br />

other systems, namely Electronic Clearing<br />

and Guarantee System (e-CLEARS) of<br />

KPEI, BI-RTGS dan BI-SSSS system of Bank<br />

Indonesia, back office system of <strong>KSEI</strong> Payment<br />

Bank, and The Society for Worldwide<br />

Interbank Financial Telecommunication<br />

(SWIFT) system of <strong>KSEI</strong> to deliver message<br />

to certain market players.<br />

<strong>KSEI</strong> has also developed C-BEST Realtime<br />

Interface to support the integration<br />

with back office of Securities Companies<br />

and Custodian Banks. In the future, probably<br />

C-BEST will be integrated with other<br />

entities.<br />

Rapid technology enhancement and<br />

increasing number of transaction in Indonesia<br />

capital market require development<br />

of new C-BEST functions known as C-BEST<br />

<strong>Next</strong> <strong>Generation</strong>. It is part of <strong>KSEI</strong> commitment<br />

to perform continual development<br />

in Indonesia capital market and the<br />

company’s core value, which is Continual<br />

Development.<br />

As development of previous version,<br />

C-BEST <strong>Next</strong> <strong>Generation</strong> must keep providing<br />

the existing modules, functions, and<br />

processes with additional modifications to<br />

improve <strong>KSEI</strong> services. The modifications<br />

are certainly made to cope with the need<br />

of service users by using recent technol-<br />

ogy. Besides, application and data integration<br />

currently available in <strong>KSEI</strong> into the system<br />

must be easily arranged and operated<br />

to serve the need of service users.<br />

Implementation of recent technology<br />

in C-BEST <strong>Next</strong> <strong>Generation</strong> system becomes<br />

an important factor for it can give<br />

benefits, among others:<br />

l A more precise and accurate transaction<br />

settlement.<br />

l Faster system performance.<br />

l Better capacity in term of increasing<br />

transaction settlement frequency and<br />

volume to deal with capital market<br />

transactions which keep increasing<br />

from time to time.<br />

l Well-maintained system availability to<br />

prevent disruption in daily operational<br />

activities of <strong>KSEI</strong>.<br />

l Recent technology enables continual<br />

and sustained system development in<br />

the future.<br />

C-BEST <strong>Next</strong> <strong>Generation</strong> also needs<br />

modular Application Development System.<br />

It is required to enable new module<br />

addition as modification toward the need<br />

of company’s business change. Module<br />

addition is also required when technology<br />

enhancement is performed as the impact<br />

of sophisticated technology development.<br />

C-BEST <strong>Next</strong> <strong>Generation</strong> system must<br />

be supported by Business Contigency Plan<br />

(BCP) with high SLA (Services Level Agreement)<br />

to maintain the system confidentiality,<br />

integrity, and availability. Therefore,<br />

implementation of Disaster Recovery Center<br />

(DRC) to protect the operational continuity<br />

of <strong>KSEI</strong> services with its capacity to<br />

minimize downtime when disaster occurs<br />

becomes a mandatory to this system.<br />

Based on plan, development of C-<br />

BEST <strong>Next</strong> <strong>Generation</strong> system will be<br />

started next year by appointed vendor.<br />

This year will be focused on selecting<br />

consultant vendor to perform the system<br />

development. When C-BEST <strong>Next</strong> <strong>Generation</strong><br />

system is operated, it is expected that<br />

relevant stakeholders in the capital market<br />

industry will get lots of benefit and<br />

the system can provide better easiness to<br />

capital market investors to perform buysell<br />

transactions.<br />

[ Asep P. Suryana ]<br />

“C-BEST <strong>Next</strong> <strong>Generation</strong><br />

provides previous module,<br />

fuction dan system<br />

process, with additional<br />

improvement to enhance<br />

<strong>KSEI</strong>’s services.”<br />

Fokuss 2nd Edition 2012<br />

7

Fokuss 2nd Edition, 2012<br />

8<br />

<strong>KSEI</strong> Socialization<br />

Since February - April 2012, <strong>KSEI</strong>, jointly with BEI and<br />

KPEI, has arranged journalist workshop and Investor Candidate<br />

Forum (ICF) in several cities in Indonesia. Series of<br />

journalist workshop were held in Palembang (February 23,<br />

2012), Bengkulu (March 7, 2012), Jambi (March 29, 2012) and<br />

Bangka (April , 2012), while ICF was held in Kudus (March<br />

19, 2012) and Gorontalo (March 30, 2012). These activities<br />

were the socialization and education form conducted continually<br />

by the SRO to give information and knowledge concerning<br />

capital market. <strong>KSEI</strong> representatives who attended<br />

the event gave explanation about the benefit and the function<br />

of AKSes Card and AKSes Mobile. The activities will be<br />

carried out throughout 2012.<br />

‘Investor Club’<br />

To provide precise and accurate information to capital<br />

market investors, since January 2012, <strong>KSEI</strong> has participated<br />

in Investor Club activity organized by BEI monthly. In that<br />

activity, <strong>KSEI</strong> exhibits booth where investors can ask questions<br />

about <strong>KSEI</strong>’s products and services, especially AKSes<br />

Card. Investor Club is a media established by BEI to serve as<br />

interaction media of investors in sharing their investment<br />

experiences in the capital market through training, education,<br />

and general information dissemination.<br />

AC TIvITIES<br />

STATISTICS<br />

2012 Capital Market School<br />

In order to improve the number of investor in Indonesia<br />

capital market and to provide comprehensive information<br />

concerning investment world, <strong>KSEI</strong>, cooperated with BEI and<br />

KPEI, arranged Capital Market School (CMS). The event, which<br />

has been conducted since 2006, was held in Jakarta and Surabaya<br />

on March 28, 2012. Several Securities Companies have become<br />

partners in 2012 CMS, namely: PT CIMB Securities Indonesia,<br />

PT eTrading Securities, PT Indo Premier Securities, PT Bahana<br />

Securities, PT Profindo Internasional Securities, and PT Kresna<br />

Graha Sekurindo Tbk. Similar to previous CMS, it was opened for<br />

free for general public in three different classes, they were: level<br />

1, level 2, and level 3. Especially for Jakarta, there was also haria<br />

capital market class. l