Application to Register as a Casual Teacher - Education and ...

Application to Register as a Casual Teacher - Education and ...

Application to Register as a Casual Teacher - Education and ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

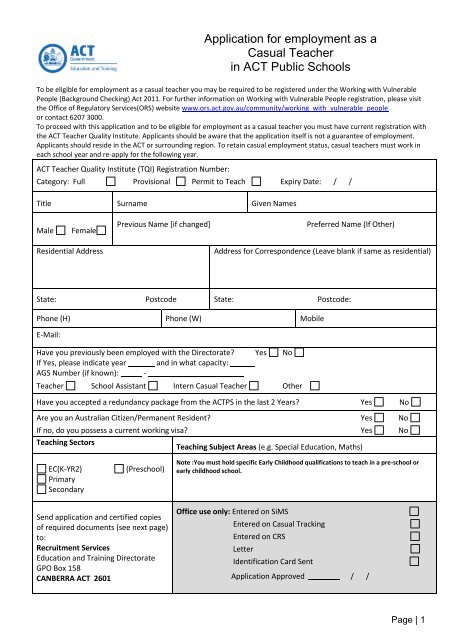

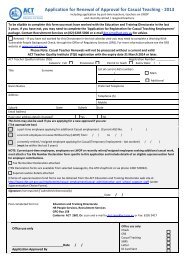

<strong>Application</strong> for employment <strong>as</strong> aC<strong>as</strong>ual <strong>Teacher</strong>in ACT Public SchoolsTo be eligible for employment <strong>as</strong> a c<strong>as</strong>ual teacher you may be required <strong>to</strong> be registered under the Working with VulnerablePeople (Background Checking) Act 2011. For further information on Working with Vulnerable People registration, ple<strong>as</strong>e visitthe Office of Regula<strong>to</strong>ry Services(ORS) website www.ors.act.gov.au/community/working_with_vulnerable_peopleor contact 6207 3000.To proceed with this application <strong>and</strong> <strong>to</strong> be eligible for employment <strong>as</strong> a c<strong>as</strong>ual teacher you must have current registration withthe ACT <strong>Teacher</strong> Quality Institute. Applicants should be aware that the application itself is not a guarantee of employment.Applicants should reside in the ACT or surrounding region. To retain c<strong>as</strong>ual employment status, c<strong>as</strong>ual teachers must work ineach school year <strong>and</strong> re-apply for the following year.ACT <strong>Teacher</strong> Quality Institute (TQI) Registration Number:Category: Full Provisional Permit <strong>to</strong> Teach Expiry Date: / /Title Surname Given NamesMale FemaleResidential AddressPrevious Name [if changed]Preferred Name (If Other)Address for Correspondence (Leave blank if same <strong>as</strong> residential)State: Postcode State: Postcode:Phone (H) Phone (W) MobileE-Mail:Have you previously been employed with the Direc<strong>to</strong>rate? Yes NoIf Yes, ple<strong>as</strong>e indicate year <strong>and</strong> in what capacity:AGS Number (if known): - __________________<strong>Teacher</strong> School Assistant Intern C<strong>as</strong>ual <strong>Teacher</strong> OtherHave you accepted a redundancy package from the ACTPS in the l<strong>as</strong>t 2 Years? Yes NoAre you an Australian Citizen/Permanent Resident? Yes NoIf no, do you possess a current working visa? Yes NoTeaching Sec<strong>to</strong>rsTeaching Subject Are<strong>as</strong> (e.g. Special <strong>Education</strong>, Maths)EC(K-YR2)PrimarySecondary(Preschool)Note :You must hold specific Early Childhood qualifications <strong>to</strong> teach in a pre-school orearly childhood school.Send application <strong>and</strong> certified copiesof required documents (see next page)<strong>to</strong>:Recruitment Services<strong>Education</strong> <strong>and</strong> Training Direc<strong>to</strong>rateGPO Box 158CANBERRA ACT 2601Office use only: Entered on SiMSEntered on C<strong>as</strong>ual TrackingEntered on CRSLetterIdentification Card Sent<strong>Application</strong> Approved / /Page | 1

<strong>Education</strong> <strong>and</strong> Training Direc<strong>to</strong>rateDocuments required when submitting your application for employment <strong>as</strong> a C<strong>as</strong>ual <strong>Teacher</strong>Do not send original personal documents. Personal documents should be copied <strong>and</strong> certified <strong>as</strong> instructed below *.Final Academic Transcripts** - These may not be au<strong>to</strong>matically issued, so you may need <strong>to</strong> request transcripts from awardinginstitutions. Statements of results will not be accepted in place of Final Academic Transcripts.Office of Regula<strong>to</strong>ry Services (ORS), Working With Vulnerable People Background Check. - all applicants working or seeking <strong>to</strong>work in a teaching position/role in the ACT may need be registered with ORS. Registration processes <strong>and</strong> conditions can befound on the website www.ors.act.gov.au.ACT <strong>Teacher</strong> Quality Institute (TQI) – all applicants working or seeking <strong>to</strong> work in a teaching position/role in the ACT must beregistered with the TQI. Registration processes <strong>and</strong> conditions can be found on the website www.tqi.act.edu.au. Applicants willbe required <strong>to</strong> provide details of their registration at the time of employment.Identity <strong>and</strong> Citizenship/or Residency StatusProof of Date of Birth Birth Certificate or extract or valid p<strong>as</strong>sport. A current driver’s licence is not acceptable.Change of Name If you have ever changed your name you must verify this by producing a marriage certificate or Change ofName Deed Poll.Australian Citizens Birth Certificate from an Australian State/Terri<strong>to</strong>ry, a Certificate of Australian Citizenship or anAustralian p<strong>as</strong>sport.Non-Australian Citizens You must demonstrate your residency status by providing certified true copies of the relevant pagesfrom your p<strong>as</strong>sport.Statements of Prior Teaching Service - Salary increments are awarded for each completed year of recognised teaching. It isessential that statements of service be provided in order for a salary <strong>to</strong> be accurately <strong>as</strong>sessed. If official statements of serviceare not provided, no recognition can be given for prior service, nor will back payment of salary be made for any period ofwork undertaken with the Direc<strong>to</strong>rate at a lower rate of pay prior <strong>to</strong> the provision of complete statements of service. It isyour responsibility <strong>to</strong> provide this evidence from other employers. That is, where Statements of Service are produced afterthe commencement of teaching, any alteration <strong>to</strong> incremental level will occur only from the date such evidence is received byRecruitment Services.A Statement of Service must be on the letterhead of a recognised employing authority <strong>and</strong> indicate:i. the date of commencementii. the date of cessationiii. leave without pay indicating the <strong>to</strong>tal number of days taken (if nil, the statement must indicate this)iv. where the employment w<strong>as</strong>, <strong>and</strong> whether full-time or part-timev. if part-time, the <strong>to</strong>tal number of days/hours or fraction employed.Statements of Service from previous employers are used <strong>to</strong> determine the appropriate salary rate. Statements of Service maybe submitted by either:1. The original hard copy orA facsimile transmission which is sent directly <strong>to</strong> the Direc<strong>to</strong>rate by the previous employer. For a faxeddocument <strong>to</strong> be accepted, it must clearly indicate that the sender is the previous employer.* A "certified true copy" can be certified <strong>as</strong> true by a Justice of the Peace, a Commissioner forDeclarations or a school principal. The copy must be marked "certified true copy, original sighted" be signed by <strong>and</strong>provide the details of the person making the certification.** As the <strong>as</strong>sessment of overse<strong>as</strong> qualifications may take some time, in some instances this may cause delays infinalising an application.Page | 2

Professional Teaching Referees (ple<strong>as</strong>e provide two teaching referees who reside in Australia)Name Address / E-mail address Phone (b/h) Phone (a/h)1.2.Teaching Employment His<strong>to</strong>ry: if insufficient space, attach details.(refer <strong>to</strong> ‘Statements of Prior Teaching Service’, Page 2)Employer/SchoolDatecommencedDate ce<strong>as</strong>edLength ofServiceYears MonthsF/T or P/TS of Sprovided(Yes / No)Teaching <strong>and</strong> other Tertiary QualificationsCourse Name Institution Commenced Completed Awarded1.2.3.Employment (i.e. other than teaching) you consider relevant (optional).e-mail: det.sims@act.gov.auRecruitment Services Web <strong>and</strong> e-mail AddressesWeb: http://www.det.act.gov.au/employment/c<strong>as</strong>ual_employment.I underst<strong>and</strong> the above information will be available <strong>to</strong> the <strong>Education</strong> <strong>and</strong> Training Direc<strong>to</strong>rate <strong>and</strong> on the SchoolStaffing Integrated Management System (SiMS) website for the purpose of operating the c<strong>as</strong>ual teacher system.The information contained on this form will be s<strong>to</strong>red, used <strong>and</strong> disclosed in accordance with the Privacy Act 1988<strong>and</strong> the Freedom of Information Act 1989.I underst<strong>and</strong> that I am not able <strong>to</strong> work <strong>as</strong> a c<strong>as</strong>ual teacher without a current TQI registration card <strong>and</strong> c<strong>as</strong>ualemployment approval, <strong>and</strong> that this card will not be issued without the successful completion of all preemploymentchecks including, but not limited <strong>to</strong>, <strong>as</strong>sessment of qualifications.In submitting this form, which places no obligation on me, I certify that this information is, <strong>to</strong> the best of myknowledge, accurate <strong>and</strong> complete........................................................................................……................ .........../........../…......Applicant’s SignatureDatePage | 3

Health QuestionnaireTo be completed by all applicants for employmentwith the <strong>Education</strong> <strong>and</strong> Training Direc<strong>to</strong>rateThe purpose of this questionnaire is <strong>to</strong> <strong>as</strong>certain that applicants are fit <strong>to</strong> undertake the duties of theposition/s for which they are applying. Applicants should be aware that the Direc<strong>to</strong>rate may request anexamination by a medical adviser nominated by the Direc<strong>to</strong>rate on the b<strong>as</strong>is of information provided inthis questionnaire.1. Angina, heart dise<strong>as</strong>e, persistent chest pain, heart operation?2. High or low blood pressure, frequent palpitations?Ple<strong>as</strong>e Tick: Yes No3. Pain or disability in the lower back or neck?4. Pain or limitation on use of the upper limbs?5. Pain or limitation on use of the lower limbs?6. Occupational Overuse Syndrome or Repetitive Strain Injury?7. Anxiety state, stress, difficulty with concentration or memory?8. Depression or difficulty in sleeping?9. Excessive fatigue/unusual weakness or tiredness?10. Do you have a current work related injury or illness?Are you aware of any medical condition or other fac<strong>to</strong>r relating <strong>to</strong> your health <strong>and</strong> physicalfitness which may prevent you from performing the duties of the position/s for which youare applying?If yes, ple<strong>as</strong>e state:I declare that I have supplied all information required <strong>and</strong> have not provided any false information.Signed: ______________________________________________________ Date: ____ / ____ / ________Name: ____________________________________________________________________ (Ple<strong>as</strong>e Print)This form requests information about you, which will be held securely by the Direc<strong>to</strong>rate. Theinformation is collected <strong>as</strong> a lawful administrative function of the <strong>Education</strong> <strong>and</strong> Training Direc<strong>to</strong>rate <strong>and</strong>will be used for employment matters.Page | 4

Acceptable Use of ICT Resources PolicyACT Public ServiceInstructionsTo view the Acceptable Use of ICT Resources Policy in its entirety go <strong>to</strong>http://www.sharedservices.act.gov.au/docs/Acceptable_ICT_Use_Policy.docAcknowledgementI, …………………………………………………………………..………………….(PRINT FULL FIRST, MIDDLE & SURNAME – BLOCK LETTERS <strong>and</strong> in INK)Acknowledge that I have read <strong>and</strong> unders<strong>to</strong>od the Whole-of-Government Acceptable Use of ICTResources Policy agree <strong>to</strong> abide by the requirements for access <strong>and</strong> use of these resourcesacknowledge that the ACT Government may authorise access <strong>to</strong> user logs in the event that there is aperceived threat <strong>to</strong> the:System securityPrivacy of staffPrivacy of othersLegal liability of the ACT Government.This signed acceptance is valid for the period of employment with the ACT Government, or until a revisedstatement is deemed <strong>to</strong> be necessary <strong>as</strong> determined by the ACT Government.Signature: …………………………………………………………………………..Date: …………………………………...................................................Position Held: ……………………………………………………………….....Note: Use of the full name is important. Do not use abbreviated or nicknames (e.g. Shelley for Michelle,Meg for Margaret, etc.) unless it is your formal name.Page | 5

Workplace Privacy PolicyACT Public ServiceInstructionsTo view the Workplace Privacy Policy statement in its entirety go <strong>to</strong>:http://www.cmd.act.gov.au/__data/<strong>as</strong>sets/pdf_file/0007/230758/ps012011.pdfAcknowledgementI, …………………………………………………………………..…………………..(PRINT FULL FIRST, MIDDLE & SURNAME – BLOCK LETTERS <strong>and</strong> in INK)Acknowledge that I have read <strong>and</strong> unders<strong>to</strong>od the Whole-of-Government Workplace Privacy Policystatement.Acknowledge that in the course of my employment with the ACT Government, I may be moni<strong>to</strong>red <strong>and</strong>my workplace may be under surveillance through:Data SurveillanceOptical Surveillance (camer<strong>as</strong> <strong>and</strong> CCTV)Tracking SurveillanceThis signed acceptance is valid for the period of employment with the ACT Government, or until a revisedstatement is deemed <strong>to</strong> be necessary <strong>as</strong> determined by the ACT Government.Signature: ………………………………………………………………………….Date: …………………………………...................................................Position Held: ………………………………………………………………......Note: Use of the full name is important.Do not use abbreviated or nicknames (e.g. Shelley for Michelle, Meg for Margaret, etc.) unless it is yourformal name.Page | 6

Employment His<strong>to</strong>ryOnly complete this form if you have previously workedfor an Australian State <strong>Education</strong> Department.The information supplied on this form is used <strong>to</strong> conduct employment checks with Australian educationdepartments you have previously been employed with in order <strong>to</strong> <strong>as</strong>sess that you meet the Direc<strong>to</strong>rate’srequirements for employment under the Public Sec<strong>to</strong>r Management Act 1994.Personal details of the applicant <strong>to</strong> be checked Match No MatchFamily NamePrevious Name/sGiven NameDate of BirthPlace of BirthDetails of Interstate AddressQualifications Institution DateEmployment His<strong>to</strong>ry (in chronological order)Any other details:Signature: Date: / /The information contained on this form is personal information <strong>and</strong> will be s<strong>to</strong>red, used <strong>and</strong> disclosed inaccordance with the requirements of the Privacy Act 1988 <strong>and</strong> the Freedom of Information Act 1989 <strong>and</strong>I consent <strong>to</strong> its rele<strong>as</strong>e.Page | 7

Fair WorkOmbudsmanFair WorkInformation StatementFrom 1 January 2010, this Fair Work Information Statement is <strong>to</strong> be provided <strong>to</strong> all new employees by their employer <strong>as</strong> soon <strong>as</strong>possible after the commencement of employment. The Statement provides b<strong>as</strong>ic information on matters that will affect youremployment. If you require further information, you can contact the Fair Work Infoline on 13 13 94 or visitwww.fairwork.gov.au.The National Employment St<strong>and</strong>ardsThe Fair Work Act 2009 provides you with a safety net of minimum terms <strong>and</strong> conditions of employment through the NationalEmployment St<strong>and</strong>ards (NES).There are 10 minimum workplace entitlements in the NES:1. A maximum st<strong>and</strong>ard working week of 38 hours for full-time employees, plus ‘re<strong>as</strong>onable’ additional hours.2. A right <strong>to</strong> request flexible working arrangements <strong>to</strong> care for a child under school age, or a child (under 18)with a disability.3. Parental <strong>and</strong> adoption leave of 12 months (unpaid), with a right <strong>to</strong> request an additional 12 months.4. Four weeks paid annual leave each year (pro rata).5. Ten days paid personal/carer’s leave each year (pro rata), two days paid comp<strong>as</strong>sionate leave for each permissibleocc<strong>as</strong>ion, <strong>and</strong> two days unpaid carer’s leave for each permissible occ<strong>as</strong>ion.6. Community service leave for jury service or activities dealing with certain emergencies or natural dis<strong>as</strong>ters.This leave is unpaid except for jury service.7. Long service leave.8. Public holidays <strong>and</strong> the entitlement <strong>to</strong> be paid for ordinary hours on those days.9. Notice of termination <strong>and</strong> redundancy pay.10. The right for new employees <strong>to</strong> receive the Fair Work Information Statement.A complete copy of the NES can be accessed at www.fairwork.gov.au. Ple<strong>as</strong>e note that some conditions or limitations mayapply <strong>to</strong> your entitlement <strong>to</strong> the NES. For instance, there are some exclusions for c<strong>as</strong>ual employees.If you work for an employer who sells or transfers their business <strong>to</strong> a new owner, some of your NES entitlements may carryover <strong>to</strong> the new employer. Some NES entitlements which may carry over include personal/carer’s leave, parental leave, <strong>and</strong>your right <strong>to</strong> request flexible working arrangements.Modern awardsIn addition <strong>to</strong> the NES, you may be covered by a modern award. These awards cover an industry or occupation <strong>and</strong> provideadditional enforceable minimum employment st<strong>and</strong>ards. There is also a Miscellaneous Award that covers employees who arenot covered by any other modern award.Modern awards may contain terms about minimum wages, penalty rates, types of employment, flexible workingarrangements, hours of work, rest breaks, cl<strong>as</strong>sifications, allowances, leave <strong>and</strong> leave loading, superannuation, <strong>and</strong> proceduresfor consultation, representation, <strong>and</strong> dispute settlement. They may also contain terms about industry specific redundancyentitlements.If you are a manager or a high income employee, the modern award that covers your industry or occupation may not apply <strong>to</strong>you. For example, where your employer guarantees in writing that you will earn more than $108,300 annually (indexed), amodern award will not apply, but the NES will.Transitional arrangements <strong>to</strong> introduce the modern award system may affect your coverage or entitlements under a modernaward.Agreement makingYou may be involved in an enterprise bargaining process where your employer, you or your representative (such <strong>as</strong> a union orother bargaining representative) negotiate for an enterprise agreement. Once approved by Fair Work Australia, an enterpriseagreement is enforceable <strong>and</strong> provides for changes in the terms <strong>and</strong> conditions of employment that apply at your workplace.There are specific rules relating <strong>to</strong> the enterprise bargaining process. These rules are about negotiation, voting, matters thatcan <strong>and</strong> cannot be included in an enterprise agreement, <strong>and</strong> how the agreement can be approved by Fair Work Australia. You<strong>and</strong> your employer have the right <strong>to</strong> be represented by a bargaining representative <strong>and</strong> must bargain in good faith whennegotiating an enterprise agreement. There are also strict rules for taking industrial action. If you have enquiries about making,varying, or terminating enterprise agreements, you should contact Fair Work Australia.Page | 8

Individual flexibility arrangementsYour modern award or enterprise agreement must include a flexibility term. This term allows you <strong>and</strong> your employer <strong>to</strong> agree<strong>to</strong> an Individual Flexibility Arrangement (IFA), which varies the effect of terms of your modern award or enterprise agreement.IFAs are designed <strong>to</strong> meet the needs of both you <strong>and</strong> your employer. You cannot be forced <strong>to</strong> make an IFA, however, if youchoose <strong>to</strong> make an IFA, you must be better off overall. IFAs are <strong>to</strong> be in writing, <strong>and</strong> if you are under 18 years of age, your IFAmust also be signed by your parent or guardian.Freedom of <strong>as</strong>sociation <strong>and</strong> workplace rights (general protections)The law not only provides you with rights, it ensures you can enforce them. It is unlawful for your employer <strong>to</strong> take adverseaction against you because you have a workplace right. Adverse action could include dismissing you, refusing <strong>to</strong> employ you,negatively altering your position, or treating you differently for discrimina<strong>to</strong>ry re<strong>as</strong>ons. Some of your workplace rights includethe right <strong>to</strong> freedom of <strong>as</strong>sociation (including the right <strong>to</strong> become or not <strong>to</strong> become a member of a union), <strong>and</strong> the right <strong>to</strong> befree from unlawful discrimination, undue influence <strong>and</strong> pressure.If you have experienced adverse action by your employer, you can seek <strong>as</strong>sistance from the Fair Work Ombudsman or FairWork Australia (applications relating <strong>to</strong> general protections where you have been dismissed must be lodged with Fair WorkAustralia within 60 days).Termination of employmentTermination of employment can occur for a number of re<strong>as</strong>ons, including redundancy, resignation <strong>and</strong> dismissal. When youremployment relationship ends, you are entitled <strong>to</strong> receive any outst<strong>and</strong>ing employment entitlements. This may includeoutst<strong>and</strong>ing wages, payment in lieu of notice, payment for accrued annual leave <strong>and</strong> long service leave, <strong>and</strong> any applicableredundancy payments.Your employer should not dismiss you in a manner that is ‘harsh, unjust or unre<strong>as</strong>onable’. If this occurs, this may constituteunfair dismissal <strong>and</strong> you may be eligible <strong>to</strong> make an application <strong>to</strong> Fair Work Australia for <strong>as</strong>sistance. It is important <strong>to</strong> notethat applications must be lodged within 14 days of dismissal. Special provisions apply <strong>to</strong> small businesses, including the SmallBusiness Fair Dismissal Code. For further information on this code, ple<strong>as</strong>e visit www.fairwork.gov.au.Right of entryRight of entry refers <strong>to</strong> the rights <strong>and</strong> obligations of permit holders (generally a union official) <strong>to</strong> enter work premises. A permit holdermust have a valid <strong>and</strong> current entry permit from Fair Work Australia <strong>and</strong>, generally, must provide 24 hours notice of their intention <strong>to</strong>enter the premises. Entry may be for discussion purposes, or <strong>to</strong> investigate suspected contraventions of workplace laws that affect amember of the permit holder’s organisation or occupational health <strong>and</strong> safety matters. A permit holder can inspect or copy certaindocuments, however, strict privacy restrictions apply <strong>to</strong> the permit holder, their organisation, <strong>and</strong> your employer.The Fair Work Ombudsman <strong>and</strong> Fair Work AustraliaThe Fair Work Ombudsman is an independent statu<strong>to</strong>ry agency created under the Fair Work Act 2009, <strong>and</strong> is responsible forpromoting harmonious, productive <strong>and</strong> cooperative Australian workplaces. The Fair Work Ombudsman educates employers<strong>and</strong> employees about workplace rights <strong>and</strong> obligations <strong>to</strong> ensure compliance with workplace laws. Where appropriate, the FairWork Ombudsman will commence proceedings against employers, employees, <strong>and</strong>/or their representatives who breachworkplace laws.If you require further information from the Fair Work Ombudsman, you can contact the Fair Work Infoline on 13 13 94 or visitwww.fairwork.gov.au.Fair Work Australia is the national workplace relations tribunal established under the Fair Work Act 2009. Fair Work Australiais an independent body with the authority <strong>to</strong> carry out a range of functions relating <strong>to</strong> the safety net of minimum wages <strong>and</strong>employment conditions, enterprise bargaining, industrial action, dispute resolution, termination of employment, <strong>and</strong> otherworkplace matters.If you require further information, you can contact Fair Work Australia on 1300 799 675 or visit www.fwa.gov.au.The Fair Work Information Statement is prepared <strong>and</strong> published by the Fair Work Ombudsman in accordance with section 124 of the Fair Work Act 2009.© Copyright Fair Work Ombudsman. L<strong>as</strong>t updated: December 2009.Page | 9

Employee Details FormACT Public ServiceInstructionsAll new ACT Public Service employees must complete a Pre-employment Check Package prior <strong>to</strong> commencing employment. The purpose ofthe package is <strong>to</strong>: facilitate m<strong>and</strong>a<strong>to</strong>ry ACTPS pre-employment checks <strong>as</strong> required by the Public Sec<strong>to</strong>r Management Act 1994 (Section 5.3, Clause 68); provide employees with important information regarding their obligations <strong>as</strong> public service employees; <strong>and</strong> collect personal information necessary for the commencement of salary action including superannuation, taxation <strong>and</strong> bankingarrangements <strong>and</strong> employee equity <strong>and</strong> diversity details <strong>to</strong> meet ACTPS reporting requirements.Personal information is collected by Shared Services on behalf of ACTPS agencies. Information collected will only be used for the purpose forwhich you gave it <strong>and</strong> will not be disclosed <strong>to</strong> other persons or organisations without your prior consent unless where required by law.Offers of employment are made on the b<strong>as</strong>is that the applicant/employee satisfies all pre-employment checks relevant <strong>to</strong> the ACTPS <strong>and</strong> anyother identified position specific requirements. Further information about the ACTPS Pre-employment Package is provided on the SharedServices website at http://www.sharedservices.act.gov.au/resources.<strong>as</strong>pEmployee ChecklistM<strong>and</strong>a<strong>to</strong>ry Documents – you must complete <strong>and</strong> return the following documents with your employment contract oracceptance of appointment<strong>Application</strong> Coversheets (3 Pages)Health Questionnaire FormAcceptable Use of IT Resources Policy FormWorkplace Privacy Policy FormEmployment His<strong>to</strong>ry FormEmployee Details Form (3 Pages)General Obligations of Public Employees FormSuperannuation Documents:Acknowledgement of Receipt of InformationEmployer Contribution Rate FormChoice of Superannuation Fund form – St<strong>and</strong>ard FormSelf Disclosure FormTax File Number Declaration Form (available from selected newsagents, the ATO shopfront or via phone 1300 720092)M<strong>and</strong>a<strong>to</strong>ry Evidentiary Documents – you must provide a certified true copy (i.e. original document sighted, copied <strong>and</strong> signed by a Justice ofthe Peace, Police Officer or a Public Servant with 5 years service) of the following documentation.Proof of Date of BirthProof of Change of NameProof of AustralianCitizenshipQualifications <strong>and</strong>Registration CertificationsBirth Certificate or a Current P<strong>as</strong>sport.Marriage Certificate, Change of Name Deed Poll or Decree NisiPersons with residency status may apply for Permanent Employment in the ACTPS.Persons without residency status may be eligible <strong>to</strong> apply for temporary or c<strong>as</strong>ualemployment depending on the provisions of their Visa.Agencies may wish <strong>to</strong> sight original documents for positions that require qualificationsor registration.Optional Documents – these documents may be provided at any time prior <strong>to</strong> or after commencement <strong>and</strong> should be forwardeddirectly <strong>to</strong> the relevant Payroll team in the Payroll & Personnel Services Section.Recognition of Prior Service – Information & InstructionsRecognition of Prior Service - Sample LetterRecognition of Prior Service for Long Service Leave <strong>and</strong> Sick Leave Purposes – <strong>Application</strong> FormPage | 10

Personal DetailsFamily Name:Title:Given Names:Preferred Name:Date of Birth: / / Gender: Male / FemaleResidential Address:Postal Address:Tel (after hours): Tel (business hours): Mob:Email:Important Information regarding Payslip/Payment Summary distributionWhere possible the ACT Government prefers <strong>to</strong> distribute payslips <strong>and</strong> payment summaries (formerly referred <strong>to</strong> <strong>as</strong> GroupCertificates) via email, in PDF (portable document file) format.Electronic distribution is speedier than a paper-b<strong>as</strong>ed version.Once you have been allocated an ACT Government email address, this address can be used <strong>to</strong> distribute payslips<strong>and</strong> payment summaries.Using an ACT Government email address ensures protection of your email.Payment Summaries can only be delivered <strong>to</strong> an ACT Government email address. If you elect <strong>to</strong> receive anelectronic payslip <strong>to</strong> an ACT Government email address you will also receive your Payment Summary <strong>to</strong> this emailaddress.If you elect <strong>to</strong> receive a paper-b<strong>as</strong>ed payslip or electronic <strong>to</strong> a private email address you will receive a paper-b<strong>as</strong>edPayment Summary <strong>to</strong> your residential address.Preferred method of delivery for payslip (tick box):electronic <strong>to</strong> above email accountelectronic <strong>to</strong> above email account <strong>and</strong> when available change <strong>to</strong> ACT Government email accountDisclaimer: Employees who elect <strong>to</strong> receive their payslips at a private email address outside the ACT Governmentnetworks, acknowledge that the ACT Government is not able <strong>to</strong> protect your email once it leaves the secure network.paper-b<strong>as</strong>ed <strong>to</strong> residential / postal address abovepaper-b<strong>as</strong>ed <strong>to</strong> residential / postal address above <strong>and</strong> when available change <strong>to</strong> electronic version delivered <strong>to</strong> an ACTGovernment email account.Emergency Contact DetailsName:Relationship:Residential Address:Email:Tel (after hours): Tel (business hours): Mob:Bank Account DetailsProvide the details of the account that your pay is <strong>to</strong> be deposited in<strong>to</strong>.Name of Financial Institution:Branch number (BSB):Branch name:Account number:Account name:Provide the details of an account if you wish <strong>to</strong> commence a fixed deduction from your fortnightly pay.Name of Financial Institution: Amount <strong>to</strong> be deducted: $Branch number (BSB):Account number:Branch name:Account name:Page | 11

Superannuation DetailsAre you currently contributing or have current membership in either of the following schemes?What is your current employment status?If no, will you be working for both agencies?Are you on Leave Without Pay from your current employer?Ple<strong>as</strong>e provide your AGS or Superannuation contribu<strong>to</strong>r number.Ple<strong>as</strong>e provide the date you ce<strong>as</strong>ed employment with a previous employer where youcontributed <strong>to</strong> the CSS/PSSdb:CSS / PSSdbSelectYes / NoYes / NoIf you have a preserved/deferred PSSdb membership you must complete a Confidential Medical <strong>and</strong> Personal Statement(CMAPS) available at http://www.pss.gov.au/documents/forms/CMAPS.pdf. The completed CMAPS should be returned with allother pre-employment documents.Equity <strong>and</strong> Diversity DetailsCompletion of this section of the form is encouraged but is not compulsoryThe ACT Public Service collects information on EEO groups for statistical purposes only. This information is used for reportingpurposes <strong>and</strong> for the development of equity <strong>and</strong> diversity programs. All reporting is in the form of aggregate tables from whichindividuals cannot be identified. Information collected from this section will only be used in accordance with the provisions ofthe Commonwealth Privacy Act 1988 <strong>and</strong> will be held <strong>as</strong> Staff In Confidence. Information from this section will not be used forfuture employment or selection purposes.Are you an Aboriginal or Torres Strait Isl<strong>and</strong>er?Were you born in Australia?If you were not born in Australia, in what year did you arrive?W<strong>as</strong> English the first language you spoke?If English w<strong>as</strong> not the first language you spoke, what w<strong>as</strong> the other language?W<strong>as</strong> English the first language spoken by your mother?W<strong>as</strong> English the first language spoken by your father?Do you have a disability (note definition below)?If you answered yes <strong>to</strong> having a disability, what is the nature of the disability?Yes / NoYes / NoYes / NoYes / NoYes / NoYes / NoDisability is defined <strong>as</strong>: <strong>to</strong>tal or partial loss of a bodily function <strong>to</strong>tal or partial loss of a part of the body malfunction of a part of the body malformation or disfigurement of a part of the body an intellectual disability or developmental delay the presence in the body of organisms that cause or are capable of causing dise<strong>as</strong>e an illness or condition that impairs a person’s thought processes, perception of reality, emotions or judgement orwhich results in disturbed behaviourEmployee DeclarationI declare that the information provided on this form <strong>and</strong> given in my application including my employment his<strong>to</strong>ry is true <strong>and</strong>correct.I declare that any academic <strong>and</strong>/or professional qualifications submitted with my application are genuine.I give permission for the relevant educational/training institution <strong>to</strong> be contacted for verification of my qualifications.I underst<strong>and</strong> that giving false or misleading information may result in prosecution, fines <strong>and</strong>/or termination of employment.Signed: Date: / /Page | 12

General Obligations of Public Employees FormInstructionsOfficers <strong>and</strong> employees are <strong>as</strong>ked <strong>to</strong>: read the following two pages regarding;o General Obligations of Public Employeeso Second Jobso Unauthorised Disclosure of Information sign the acknowledgement at the foot of this form.Public Sec<strong>to</strong>r Management Act 1994Division 2.1 Section 9 - General obligations of public employeesA public employee shall, in performing his or her duties:(a) exercise re<strong>as</strong>onable care <strong>and</strong> skill;(b) act impartially;(c) act with probity;(d) treat members of the public <strong>and</strong> other public employees with courtesy <strong>and</strong> sensitivity <strong>to</strong> their rights, duties <strong>and</strong><strong>as</strong>pirations;(e) in dealing with members of the public, make all re<strong>as</strong>onable efforts <strong>to</strong> <strong>as</strong>sist them <strong>to</strong> underst<strong>and</strong> their entitlementsunder the laws of the Terri<strong>to</strong>ry <strong>and</strong> <strong>to</strong> underst<strong>and</strong> any requirements which they are obliged <strong>to</strong> satisfy under thoselaws;(f) not har<strong>as</strong>s a member of the public or another public employee, whether sexually or otherwise;(g) not unlawfully coerce a member of the public or another public employee;(h) comply with this Act, the management st<strong>and</strong>ards <strong>and</strong> all other Terri<strong>to</strong>ry laws;(i) comply with any lawful <strong>and</strong> re<strong>as</strong>onable direction given by a person having authority <strong>to</strong> give the direction;(j) if the employee h<strong>as</strong> an interest, pecuniary or otherwise, that could conflict, or appear <strong>to</strong> conflict, with the properperformance of his or her duties—(i) disclose the interest <strong>to</strong> his or her supervisor; <strong>and</strong>(ii) take re<strong>as</strong>onable action <strong>to</strong> avoid the conflict;<strong>as</strong> soon <strong>as</strong> possible after the relevant facts come <strong>to</strong> the employee’s notice(k) not take, or seek <strong>to</strong> take, improper advantage of his or her position in order <strong>to</strong> obtain a benefit for the employeeor any other person;(l) not take, or seek <strong>to</strong> take, improper advantage, for the benefit of the employee or any other person, of anyinformation acquired, or any document <strong>to</strong> which the employee h<strong>as</strong> access, <strong>as</strong> a consequence of his or heremployment;(m) not disclose, without lawful authority—(i) any information acquired by him or her <strong>as</strong> a consequence of his or her employment; or(ii) any information acquired by him or her from any document <strong>to</strong> which he or she h<strong>as</strong> access <strong>as</strong> a consequence of hisor her employment;(n) not make a comment that he or she is not authorised <strong>to</strong> make where the comment may be expected <strong>to</strong> be taken<strong>to</strong> be an official comment;(o) not make improper use of the property of the Terri<strong>to</strong>ry;(p) avoid w<strong>as</strong>te <strong>and</strong> extravagance in the use of the property of the Terri<strong>to</strong>ry;(q) report <strong>to</strong> an appropriate authority—(i) any corrupt or fraudulent conduct in the public sec<strong>to</strong>r that comes <strong>to</strong> his or her attention; or(ii) any possible maladministration in the public sec<strong>to</strong>r that he or she h<strong>as</strong> re<strong>as</strong>on <strong>to</strong> suspectJobsPage | 13

Second JobsSection 244 of the Public Sec<strong>to</strong>r Management Act 1994.(1) An officer shall not, except in accordance with the written approval of the relevant Chief Executive or <strong>as</strong> otherwise providedby the management st<strong>and</strong>ards:-(a) accept or continue in employment:-(i) with the Commonwealth, a State, another Terri<strong>to</strong>ry or the government of a foreign country; or(ii) in or under any public or municipal corporation;b) accept or continue <strong>to</strong> hold or discharge the duties of, or be employed in a paid office in connection with, any businesswhether carried on by any corporation, company firm or individual;c) engage in or undertake business of the kind referred <strong>to</strong> in paragraph (b), whether <strong>as</strong> principal or agent;d) engage or continue in the private practice of any profession or trade, or enter in<strong>to</strong> any employment, whetherremunerative or not, with any person, company or firm who or which is so engaged;e) act <strong>as</strong> a direc<strong>to</strong>r of a company or incorporated society, otherwise than in accordance with the requirements of theduties of the office held by the officer or otherwise on behalf of the Terri<strong>to</strong>ry; orf) accept or engage in any other remunerative employment.(2) Nothing in subsection (1) shall be deemed <strong>to</strong> prevent an officer from becoming a member or shareholder only of anyincorporated company or of any company or society of persons registered under any law in any State or elsewhere.In addition, section 35 of the Act makes the same provision for Chief Executives:A Chief Executive shall not, except in accordance with the written approval of the Chief Minister, accept or engage in anyremunerative employment other than in connection with the performance of his or her duties in the Service.Unauthorised Disclosure of InformationUnauthorised disclosure, or leaking, of official information is a breach of the Code of Ethics (Section 9 of the Act) <strong>and</strong>potentially of the Crimes Act 1900 (ACT).Section 153(1) of the Crimes Act 1900 (ACT), states:‘(1) A person who, being an officer of the Terri<strong>to</strong>ry, publishes or communicates except <strong>to</strong> some person <strong>to</strong> whom he orshe is authorised <strong>to</strong> publish or communicate it, any fact or document which comes <strong>to</strong> his or her knowledge, or in<strong>to</strong> his orher possession, by virtue of him or her being an officer of the Terri<strong>to</strong>ry <strong>and</strong> which it is his or her duty not <strong>to</strong> disclose, isguilty of an offence punishable, on conviction, by imprisonment for a period not exceeding 2 years.’AcknowledgementI,............................................................................................................…...hereby acknowledge I have read the provisions of Section9 of the Public Sec<strong>to</strong>r Management Act 1994, Section 153(1) of the Crimes Act 1900 (ACT) <strong>and</strong> Section 244 of the Public Sec<strong>to</strong>rManagement Act 1994. I underst<strong>and</strong> that if I breach the Public Sec<strong>to</strong>r Management Act 1994 I may be subject <strong>to</strong> disciplinaryaction under the relevant industrial instrument. Such action may include a range of penalties up <strong>to</strong> <strong>and</strong> including termination ofmy employment. However, nothing in this acknowledgement should be taken <strong>to</strong> discourage the disclosure of conduct that is“disclosable conduct” within the meaning of the Public Interest Disclosure Act 1994.(Signature)…../……/………Page | 14

InstructionsDeduction Authority Form1. This form is used if you wish <strong>to</strong> commence a deduction from your fortnightly pay <strong>to</strong> a nominated FinancialInstitution (bank or credit union).2. New employees - the completed form may be sent with other documents required <strong>as</strong> part of the Pre-Employment Check Package.3. Existing ACTPS employees - the completed form should be forwarded <strong>to</strong> SSC Payroll & Personnel Services forrelevant action.Agency:Family name:Given names:AGS/Employee number:Amount <strong>to</strong> be deducted: $Name of Financial Institution (bank or credit union):Branch number:Account number:Account name:Page | 15

Acknowledgement of Receipt of Superannuation InformationI (print name)…………………………………………………………….acknowledge that I have been provided with the followingdocumentation:Superannuation Entitlements (2 pages)Choice of Superannuation Fund – St<strong>and</strong>ard Form (2 pages)Superannuation – Employer Contribution Rate FormI underst<strong>and</strong> that it is my responsibility <strong>to</strong> read the information provided <strong>and</strong> complete the required forms <strong>and</strong>return them with my Pre-employment Check Package.Ple<strong>as</strong>e note that if you do not nominate a superannuation fund of your choice within 28 days of commencement,the Payroll <strong>and</strong> Personnel team will commence employer superannuation contributions <strong>to</strong> the ACT Public Servicedefault fund, First State Super.Signed …………………………………………………………..Date……………………………………………………………..Page | 16

SUPERANNUATION ENTITLEMENTSSuperannuation choiceIn accordance with Australian Government legislation from 1 July 2006 employers (including ACT Governmentagencies) must offer new employees superannuation fund of choice arrangements.You may or may not wish <strong>to</strong> contribute a percentage of your earnings <strong>to</strong> a superannuation fund of your choice.If you do wish <strong>to</strong> contribute you must choose a fund that is a complying fund: i.e. a fund that complies with theSuperannuation Industry (Supervision) Act 1993 <strong>and</strong> Regulations. To <strong>as</strong>certain whether a superannuation fund isa complying fund, ple<strong>as</strong>e check the Super Fund Lookup website(http://www.abn.business.gov.au/(tk5btliwsdpcefqxrb0rkazy)/super.<strong>as</strong>px).You must complete <strong>and</strong> sign the St<strong>and</strong>ard Choice Form (which is included with this Superannuation InformationPack). Once completed <strong>and</strong> signed you should return it <strong>to</strong> Shared Services with the rest of your Pre-employmentCheck Package.If you are already a member of a complying superannuation fund you may continue <strong>to</strong> contribute <strong>to</strong> that fund.However, you still must nominate that fund on the St<strong>and</strong>ard Choice Form (excluding the PSSap, see furtheradvice below).Deductions from your earnings will commence on the next available payday.It is possible that the fund you select will not have Electronic Fund Transfer (EFT) access. Therefore funds maynot be able <strong>to</strong> be au<strong>to</strong>matically transferred from your earnings <strong>to</strong> the fund of your choice. Should this be thec<strong>as</strong>e the Payroll <strong>and</strong> Personnel team will arrange with InTACT for the processing of a fortnightly cheque <strong>to</strong> thefund.You are encouraged <strong>to</strong> read all information available <strong>to</strong> employees on the official superannuation sitehttp://www.superchoice.gov.au/employees/ especially the information under the Employees link. As thisinformation does not consider your own financial situation you are strongly encouraged <strong>to</strong> seek your ownfinancial advice.Commonwealth Superannuation Scheme (CSS) & Public Sec<strong>to</strong>r Superannuation Scheme – Defined Benefit(PSSdb) (including preserved/deferred benefit)If you are currently contributing <strong>to</strong> the either the CSS or the PSSdb or have a preserved/deferred benefit in eitherscheme you may continue or resume contributions <strong>to</strong> these funds on commencement of permanent ortemporary employment 1 with the ACT Government.Alternatively, under ACT Government superannuation arrangements, current members of the CSS/PSSdb ormembers with a preserved/deferred benefit are also eligible <strong>to</strong> participate in superannuation fund of choicearrangements <strong>as</strong> outlined above.Page | 17

Public Sec<strong>to</strong>r Superannuation Accumulation Plan (PSSap)Access <strong>to</strong> the PSSap w<strong>as</strong> formally closed for new employees of the ACT Government from 6 Oc<strong>to</strong>ber 2006 bydeclaration of the Commonwealth Minister for Finance <strong>and</strong> Administration. Accordingly, from 6 Oc<strong>to</strong>ber 2006,all new ACT Government employees are not eligible <strong>to</strong> become a member of the PSSap nor can they continue <strong>to</strong>contribute <strong>to</strong> an existing membership with the PSSap.If you are currently contributing <strong>to</strong> the PSSap you will be required <strong>to</strong> choose an alternate superannuation fund inline with the superannuation fund of choice arrangements <strong>as</strong> outlined above.Employer ContributionsIn addition <strong>to</strong> your own personal contribution (if any) employers are required <strong>to</strong> contribute a minimum employerpayment of 9% (b<strong>as</strong>ed on a percentage of your earnings) for you in<strong>to</strong> the fund of your choice. This is called anemployer contribution.If you choose <strong>to</strong> personally contribute 3% or more of your salary in<strong>to</strong> a superannuation fund your employer (thisagency) will contribute a further 1% in<strong>to</strong> your fund bringing the overall employer contribution rate up <strong>to</strong> 10%.You need <strong>to</strong> complete the Employer Superannuation Contribution Rate form (included with this SuperannuationInformation Pack) if you wish <strong>to</strong> contribute a percentage of your earnings <strong>to</strong> a superannuation fund of yourchoice. This will enable the Payroll <strong>and</strong> Personnel team <strong>to</strong> identify your level of personal contribution <strong>and</strong> <strong>to</strong>process the additional 1% employer contribution if your level of personal contribution is 3% or more.If you reduce your personal superannuation contribution <strong>to</strong> below 3% you should immediately inform the Payroll<strong>and</strong> Personnel team <strong>and</strong> it will ce<strong>as</strong>e the additional 1% employer contribution made in<strong>to</strong> your fund.Board / Committee MembersIn accordance with Australian Government legislation the ACT Government is required <strong>to</strong> make employercontributions on behalf of all Board / Committee Members. Board / Committee Members are eligible <strong>to</strong>participate in the superannuation fund of choice arrangements <strong>as</strong> outlined above.However, <strong>as</strong> c<strong>as</strong>ual office holders Board / Committee Members are not eligible <strong>to</strong> resume contributions <strong>to</strong> apreserved/deferred CSS or PSSdb fund <strong>and</strong> must therefore make a choice for an alternate superannuation fund.Deductions from your earnings will commence on the next available payday or following advice of attendance inrelation <strong>to</strong> Board / Committee activities.Default fund arrangementsShould you decide not <strong>to</strong> nominate a superannuation scheme the employer contribution of 9% will go <strong>to</strong> theTerri<strong>to</strong>ry’s default fund provider First State Super. A Product Disclosure Statement for First State Super isavailable at www.firststatesuper.com.au/Tools/BrochuresForms.You can decide <strong>to</strong> make personal contributions <strong>to</strong> the default fund provider. However you must still decide whatpercentage of salary you wish <strong>to</strong> contribute.Page | 18

SUPERANNUATION - EMPLOYER CONTRIBUTION RATE FORMIn addition <strong>to</strong> your own personal contribution (if any) employers are required <strong>to</strong> contribute a minimum employerpayment of 9% (b<strong>as</strong>ed on your earnings) for you in<strong>to</strong> the fund of your choice. This is called an employercontribution.If you choose <strong>to</strong> personally contribute 3% or more of your earnings in<strong>to</strong> a superannuation fund your employer(this agency) will contribute a further 1% in<strong>to</strong> your fund bringing the overall employer contribution rate up <strong>to</strong>10%.You should complete this form if you intend <strong>to</strong> personally contribute any percentage of your earnings in<strong>to</strong> <strong>as</strong>uperannuation fund.Employee’s name:………………………………………..Commencement date:……………………………………….Agency name:…………………………………………..Personal superannuation contribution rate:……..%NB: If you reduce your personal superannuation contribution <strong>to</strong> below 3% you will no longer be eligible for theadditional 1% employer contribution <strong>and</strong> the Payroll <strong>and</strong> Personnel team will immediately ce<strong>as</strong>e the additional1% employer contribution made in<strong>to</strong> your fund.It is your responsibility <strong>to</strong> inform the Payroll <strong>and</strong> Personnel team of any reduction in your personalsuperannuation contribution below 3%.I have read <strong>and</strong> fully underst<strong>and</strong> all of the above.Signature of employee:…………………………………….. / /20 .FOR PERSONNEL SECTION USE ONLYIs employee eligible for incre<strong>as</strong>ed employer contribution? YES/NOBy: Post tax deduction?YES/NOSalary packaging arrangement? YES/NOProcessed for Pay No………….Form placed on employee’s file / /20Signature of Payroll Officer:………………………………………..Page | 19

Choice of superannuation fundSt<strong>and</strong>ard choice form –information for employeesYou can choose the superannuation fund or retirement savings account (referred <strong>to</strong> below <strong>as</strong> superannuationfunds) <strong>to</strong> which your employer will make future superannuation guarantee contributions (9%).Option 1:You do not have <strong>to</strong> choose a fund.If you do not make a choice, your employer's contributions will be paidin<strong>to</strong> the fund that your employer h<strong>as</strong> chosen (see Part A on the reverseside of this form). This may not be the same <strong>as</strong> your current fund.Your employer's chosen fund may be suitable for your needs. You canchoose a different fund later if you like.If you do not want <strong>to</strong> choose a fund, you do not have <strong>to</strong> complete thisform.Your employer is not liable for the performance ofsuperannuation funds that you choose or they choose on yourbehalf.Do not seek financial advice from your employer unlessthey are licensed <strong>to</strong> provide it.Option 2:Choose a fundYou can choose the superannuation fund where you want your futureemployer contributions <strong>to</strong> be paid.Your employer is only required <strong>to</strong> accept one choice every 12 months.Step 1Gather information – work out what's best for youYou will need <strong>to</strong> find out what superannuation options are available <strong>to</strong>you.Find out about the features <strong>and</strong> benefits of your current fund, thefund chosen by your employer <strong>and</strong> any other funds you areconsidering. Your current fund may be different <strong>to</strong> the fund chosen byyour employer.The tips section highlights key issues you should considerwhen comparing funds.MORE INFORMATIONYou can get more information about choice of superannuationfund or superannuation in general from:■ www.superchoice.gov.au, or■ by phoning 13 28 64If you do not speak English well <strong>and</strong> want <strong>to</strong> talk <strong>to</strong> an Australiangovernment officer, phone the Translating <strong>and</strong> Interpreting Serviceon 13 14 50 for help with your call.If you have a hearing or speech impairment <strong>and</strong> have access <strong>to</strong>appropriate TTY or modem equipment, phone 13 36 77. If you do nothave access <strong>to</strong> TTY or modem equipment, phone the Speech <strong>to</strong>Speech Relay Service on 1300 555 727.TIPS FOR COMPARING FUNDSFeesMost funds charge fees. Differences in the fees funds charge can have abig effect on what you may have <strong>to</strong> retire on. This effect may be morethan you think <strong>and</strong> for this re<strong>as</strong>on you need <strong>to</strong> consider what fees arebeing charged. For example, your final return could be reduced by up <strong>to</strong>20% over 30 years if your <strong>to</strong>tal amount of fees <strong>and</strong> costs are 2% ratherthan 1% (eg, from $100,000 <strong>to</strong> $80,000). Some funds may also charge anexit fee if you leave the fund.Death <strong>and</strong> disability insuranceYour current fund may insure you against death or an illness or accidentthat makes you unable <strong>to</strong> return <strong>to</strong> work. Other funds may not offerinsurance, or you may have <strong>to</strong> p<strong>as</strong>s a medical examination before theycover you. Check if you'll be covered in any new fund, <strong>and</strong> the costs <strong>and</strong>amount of cover, before leaving your current fund.Step 2What do I need <strong>to</strong> tell my employer?Give your employer details of your chosen fund by completing Part B ofthis form or by a written statement including the necessaryinformation. This information may be provided by your chosen fund.Part A shows details of your employer’s superannuation arrangements.This includes the fund that your employer h<strong>as</strong> chosen <strong>to</strong> make all futuresuperannuation guarantee contributions <strong>to</strong>. If your employer h<strong>as</strong>changed funds recently, the previous fund will also be shown. You maychoose <strong>to</strong> remain in this previous fund.Step 3What happens <strong>to</strong> any superannuation I have in existing funds?Any money you have in existing funds will remain there unless you makearrangements <strong>to</strong> transfer it (roll over) <strong>to</strong> another fund. Check the impac<strong>to</strong>f any exit fees or benefits you may lose before leaving the fund. Youremployer cannot do this for you.Investment choiceSome funds let you choose where the fund will invest your super. Somechoices offer higher returns, but with a higher risk that investmentsmay go down <strong>as</strong> well <strong>as</strong> up. Other choices offer greater security butwith lower expected returns. Choose the level of risk <strong>and</strong> return thatyou are comfortable with.Investment performanceSuperannuation is a long term investment for your retirement, so itsinvestment performance needs <strong>to</strong> be judged over the long term. Shortterm performance, whether good or bad, may not be repeated. Thereis no guarantee that a fund that h<strong>as</strong> performed well in the p<strong>as</strong>t will doso in the future.The information you'll need <strong>to</strong> make these checks is in each fund'sproduct disclosure statement which you can get from the fund. Forfurther information on choosing a fund go <strong>to</strong> the websitewww.superchoice.gov.au or phone 13 28 64.Page | 20

Page | 21

Page | 22

Self Disclosure FormTo be completed by all applicants for employment with the <strong>Education</strong> <strong>and</strong> Training Direc<strong>to</strong>rateschools/workplaces.The Direc<strong>to</strong>rate must take appropriate steps <strong>to</strong> be <strong>as</strong>sured that any applicant for employment is a fit <strong>and</strong> properperson. This form must be used <strong>to</strong> self disclose incidents, fac<strong>to</strong>rs, police records or any other information thatmay be relevant in determining your suitability <strong>to</strong> work with children in schools <strong>and</strong> other direc<strong>to</strong>rateworkplaces. Applicants should be aware that the Direc<strong>to</strong>rate may also access information from referees, p<strong>as</strong>temployers <strong>and</strong> police records.Failure <strong>to</strong> adequately disclose relevant information may result in denial or termination of c<strong>as</strong>ual employment,<strong>and</strong>/or cancellation of any offer of contract or permanent employment.Signing of this form also consents <strong>to</strong> the collection of further information relating <strong>to</strong> any disclosed matter or <strong>to</strong>your general suitability. Referees <strong>and</strong> other information sources will be contacted at the discretion of theDirec<strong>to</strong>rate. It is the applicant’s responsibility <strong>to</strong> disclose <strong>to</strong> the Manager, Human Resources, subsequentincidents, fac<strong>to</strong>rs or criminal his<strong>to</strong>ry records that may affect suitability <strong>to</strong> work with children in schools <strong>and</strong>other Direc<strong>to</strong>rate workplaces.I have no matters <strong>to</strong> disclose.Signature of Applicant: ..................................................Date: ........../........../..............Ple<strong>as</strong>e Print Name:.......................................................……………………………………ORI wish <strong>to</strong> disclose the following matters:Signature of Applicant: ..................................................Date: ........../........../..............Ple<strong>as</strong>e Print Name:.........................................................If space is not sufficient, ple<strong>as</strong>e attach additional sheet <strong>and</strong> sign it <strong>to</strong>o.This form requests information about you which will be held securely by the Direc<strong>to</strong>rate. The information iscollected <strong>as</strong> a lawful administrative function of the <strong>Education</strong> <strong>and</strong> Training Direc<strong>to</strong>rate <strong>and</strong> will be used foremployment matters.Page | 23

Examples of Documents approved by Austracfor use <strong>as</strong> proof of identificationDocuments with a value of 70 pointsPle<strong>as</strong>e note: only one document from this group can be counted <strong>to</strong>wards the 100 point <strong>to</strong>tal.NAME of the signa<strong>to</strong>ry verified from one of the following: Birth Certificate Birth Card issued by the New South Wales Registry of Births, Deaths <strong>and</strong> Marriages Citizenship Certificate International Travel Document:o A current p<strong>as</strong>spor<strong>to</strong> Expired p<strong>as</strong>sport which h<strong>as</strong> not been cancelled <strong>and</strong> w<strong>as</strong> current within the preceding 2 yearso Other document of identity having the same characteristics <strong>as</strong> a p<strong>as</strong>sportDocuments with a value of 40 pointsPle<strong>as</strong>e note: more than one document from this group may be counted <strong>to</strong>wards the 100 point <strong>to</strong>tal however,each additional document is only valued at 25 points.NAME of the signa<strong>to</strong>ry verified from one of the following (but only where they contain a pho<strong>to</strong>graph or signaturethat can be matched <strong>to</strong> the signa<strong>to</strong>ry): A licence of permit issued under a law of the Commonwealth, a State or Terri<strong>to</strong>ry (e.g. an Australi<strong>and</strong>river’s licence) An identification card issued <strong>to</strong> a public employee An identification card issued by the Commonwealth, a State or Terri<strong>to</strong>ry <strong>as</strong> evidence of the person’sentitlement <strong>to</strong> a financial benefit An identification card issued <strong>to</strong> a student at a tertiary education institutionDocuments with a value of 35 pointsPle<strong>as</strong>e note: more than one document from this group may be counted <strong>to</strong>wards the 100 point <strong>to</strong>tal.NAME <strong>and</strong> ADDRESS of the signa<strong>to</strong>ry verified from any of the following: A current employer, or a previous employer within the l<strong>as</strong>t 2 years A rating authority (e.g. l<strong>and</strong> rates) The Credit Reference Association of Australia (subject <strong>to</strong> the Privacy Act 1988) L<strong>and</strong> Titles Office RecordsDocuments with a value of 25 pointsPle<strong>as</strong>e note: more than one document may be counted <strong>to</strong>wards the 100 point <strong>to</strong>tal but points scored from aparticular source may only be counted once, e.g. if a Credit Card <strong>and</strong> ATM Card are issued from the samefinancial institution , only one may be counted. Telephone Account with Name, Address <strong>and</strong> Phone Number Marriage Certificate (for maiden name only) Credit Card Council Rates Notice Foreign Driver’s Licence Medicare Card ATM CardThe Final Academic Transcripts of a primary, secondary or tertiary educational institution attended by thesigna<strong>to</strong>ry within the l<strong>as</strong>t 10 years (where they contain NAME <strong>and</strong> DATE of BIRTH)Page | 24

Authorised Persons under the Statu<strong>to</strong>ry Declarations Act 1959(1) a person who is currently licensed or registered under a law <strong>to</strong> practise in one of the following occupations:Chiroprac<strong>to</strong>r Dentist Legal practitioner Medical practitioner NurseOp<strong>to</strong>metrist Patent at<strong>to</strong>rney Pharmacist Physiotherapist PsychologistTrade marks at<strong>to</strong>rneyVeterinary surgeon(2) a person who is enrolled on the roll of the Supreme Court of a State or Terri<strong>to</strong>ry, or the High Court of Australia, <strong>as</strong> alegal practitioner (however described);(3) a person who is in the following list:Agent of the Australian Postal Corporation who is incharge of an office supplying postal services <strong>to</strong> thepublicAustralian Consular Officer or Australian DiplomaticOfficer (within the meaning of the Consular Fees Act1955)BailiffBank officer with 5 or more continuous years ofserviceBuilding society officer with 5 or more years ofcontinuous serviceChief executive officer of a Commonwealth courtClerk of a courtCommissioner for AffidavitsCommissioner for DeclarationsCredit union officer with 5 or more years ofcontinuous serviceEmployee of the Australian Trade Commission whois:o in a country or place outside Australia; <strong>and</strong>o authorised under paragraph 3 (d) of theConsular Fees Act 1955; <strong>and</strong>o exercising his or her function in that placeEmployee of the Commonwealth who is:o in a country or place outside Australia; <strong>and</strong>o authorised under paragraph 3 (c) of theConsular Fees Act 1955; <strong>and</strong>o exercising his or her function in that placeFellow of the National Tax Accountants’ AssociationFinance company officer with 5 or more years ofcontinuous serviceHolder of a statu<strong>to</strong>ry office not specified in anotheritem in this listJudge of a courtJustice of the PeaceMagistrateMarriage celebrant registered under Subdivision Cof Division 1 of Part IV of the Marriage Act 1961M<strong>as</strong>ter of a courtMember of Chartered Secretaries AustraliaMember of Engineers Australia, other than at thegrade of studentMember of the Association of Taxation <strong>and</strong>Management AccountantsMember of the Austral<strong>as</strong>ian Institute of Mining <strong>and</strong>MetallurgyMember of the Australian Defence Force who is:ooan officer; ora non-commissioned officer within themeaning of the Defence Force DisciplineAct 1982 with 5 or more years ofcontinuous service; oro a warrant officer within the meaning ofthat ActMember of the Institute of Chartered Accountantsin Australia, the Australian Society of CertifiedPractising Accountants or the National Institute of Accountants Member of:o the Parliament of the Commonwealth; oro the Parliament of a State; oro a Terri<strong>to</strong>ry legislature; oro a local government authority of a State orTerri<strong>to</strong>ry Minister of religion registered under Subdivision Aof Division 1 of Part IV of the Marriage Act 1961 Notary public Permanent employee of the Australian PostalCorporation with 5 or more years of continuousservice who is employed in an office supplyingpostal services <strong>to</strong> the public Permanent employee of:o the Commonwealth or a Commonwealthauthority; oro a State or Terri<strong>to</strong>ry or a State or Terri<strong>to</strong>ryauthority; oro a local government authority;with 5 or more years of continuous service who is notspecified in another item in this list Person before whom a statu<strong>to</strong>ry declaration maybe made under the law of the State or Terri<strong>to</strong>ry inwhich the declaration is made Police officer Registrar, or Deputy Registrar, of a court Senior Executive Service employee of:o the Commonwealth or a Commonwealthauthority; oro a State or Terri<strong>to</strong>ry or a State or Terri<strong>to</strong>ryauthority Sheriff Sheriff’s officer <strong>Teacher</strong> employed on a full-time b<strong>as</strong>is at a school ortertiary education institutionPage | 25

Identity Documentation FormA *100 point identity check needs <strong>to</strong> be undertaken before this request can be processed.1. Record the details of the identity documents <strong>to</strong>talling 100 points2. Attach certified true copies of these documents <strong>to</strong> this applicationThe points value for approved documents <strong>and</strong> a list of Authorised Persons under the Statu<strong>to</strong>ry Declarations Act1959 are provided with this package.Note: Certified copies of all identity documents listed below MUST be attachedI _________________________________________________ (full name of applicant) have provided the followingdocuments:Each document is valued at a certain number of points <strong>and</strong> you must provide a combination of documents <strong>to</strong> <strong>to</strong>tal100 points (e.g.: a p<strong>as</strong>sport <strong>and</strong> driver’s licence).You must write the details of the documents that you are providing in the space provided below. For example:Type: What the document is e.g. Australian p<strong>as</strong>sport, NSW Birth certificateRef: Reference number on the documentPoints: e.g. 70 points for a p<strong>as</strong>sportType:____________________________________Points: ___________Type:____________________________________Points: ___________Type:____________________________________Points: ___________Type:____________________________________Points: ___________Type:____________________________________Points: ___________TOTAL NUMBER OF POINTS: _______________*<strong>Education</strong> <strong>and</strong> Training Direc<strong>to</strong>rate utilises a 100 Point Identification Check <strong>to</strong> establish identify b<strong>as</strong>ed on Form201 from the Financial Transactions Reports Regulations 1990.Page | 26