Annual Report 2012-2013 - HDFC Bank

Annual Report 2012-2013 - HDFC Bank

Annual Report 2012-2013 - HDFC Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

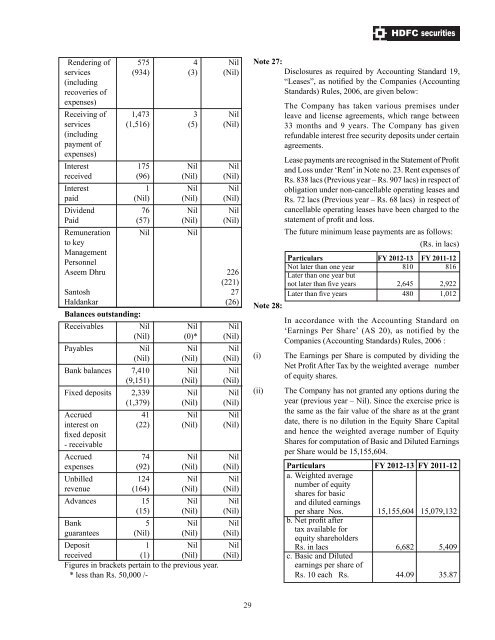

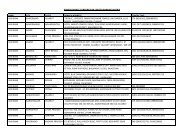

Rendering of 575 4 Nilservices (934) (3) (Nil)(includingrecoveries ofexpenses)Receiving of 1,473 3 Nilservices (1,516) (5) (Nil)(includingpayment ofexpenses)Interest 175 Nil Nilreceived (96) (Nil) (Nil)Interest 1 Nil Nilpaid (Nil) (Nil) (Nil)Dividend 76 Nil NilPaid (57) (Nil) (Nil)Remuneration Nil Nilto keyManagementPersonnelAseem Dhru 226(221)Santosh 27Haldankar (26)Balances outstanding:Receivables Nil Nil Nil(Nil) (0)* (Nil)Payables Nil Nil Nil(Nil) (Nil) (Nil)<strong>Bank</strong> balances 7,410 Nil Nil(9,151) (Nil) (Nil)Fixed deposits 2,339 Nil Nil(1,379) (Nil) (Nil)Accrued 41 Nil Nilinterest on (22) (Nil) (Nil)fixed deposit- receivableAccrued 74 Nil Nilexpenses (92) (Nil) (Nil)Unbilled 124 Nil Nilrevenue (164) (Nil) (Nil)Advances 15 Nil Nil(15) (Nil) (Nil)<strong>Bank</strong> 5 Nil Nilguarantees (Nil) (Nil) (Nil)Deposit 1 Nil Nilreceived (1) (Nil) (Nil)Figures in brackets pertain to the previous year.* less than Rs. 50,000 /-Note 27:Disclosures as required by Accounting Standard 19,“Leases”, as notified by the Companies (AccountingStandards) Rules, 2006, are given below:Note 28:(i)(ii)The Company has taken various premises underleave and license agreements, which range between33 months and 9 years. The Company has givenrefundable interest free security deposits under certainagreements.Lease payments are recognised in the Statement of Profitand Loss under ‘Rent’ in Note no. 23. Rent expenses ofRs. 838 lacs (Previous year – Rs. 907 lacs) in respect ofobligation under non-cancellable operating leases andRs. 72 lacs (Previous year – Rs. 68 lacs) in respect ofcancellable operating leases have been charged to thestatement of profit and loss.The future minimum lease payments are as follows:(Rs. in lacs)Particulars FY <strong>2012</strong>-13 FY 2011-12Not later than one year 810 816Later than one year butnot later than five years 2,645 2,922Later than five years 480 1,012In accordance with the Accounting Standard on‘Earnings Per Share’ (AS 20), as notified by theCompanies (Accounting Standards) Rules, 2006 :The Earnings per Share is computed by dividing theNet Profit After Tax by the weighted average numberof equity shares.The Company has not granted any options during theyear (previous year – Nil). Since the exercise price isthe same as the fair value of the share as at the grantdate, there is no dilution in the Equity Share Capitaland hence the weighted average number of EquityShares for computation of Basic and Diluted Earningsper Share would be 15,155,604.Particulars FY <strong>2012</strong>-13 FY 2011-12a. Weighted averagenumber of equityshares for basicand diluted earningsper share Nos. 15,155,604 15,079,132b. Net profit aftertax available forequity shareholdersRs. in lacs 6,682 5,409c. Basic and Dilutedearnings per share ofRs. 10 each Rs. 44.09 35.8729