Annual Report 2011 - TIO

Annual Report 2011 - TIO

Annual Report 2011 - TIO

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

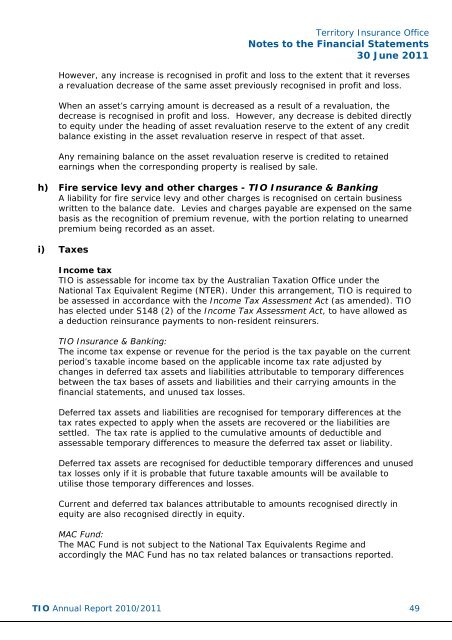

Territory Insurance OfficeNotes to the Financial Statements30 June <strong>2011</strong>However, any increase is recognised in profit and loss to the extent that it reversesa revaluation decrease of the same asset previously recognised in profit and loss.When an asset’s carrying amount is decreased as a result of a revaluation, thedecrease is recognised in profit and loss. However, any decrease is debited directlyto equity under the heading of asset revaluation reserve to the extent of any creditbalance existing in the asset revaluation reserve in respect of that asset.Any remaining balance on the asset revaluation reserve is credited to retainedearnings when the corresponding property is realised by sale.h) Fire service levy and other charges - <strong>TIO</strong> Insurance & BankingA liability for fire service levy and other charges is recognised on certain businesswritten to the balance date. Levies and charges payable are expensed on the samebasis as the recognition of premium revenue, with the portion relating to unearnedpremium being recorded as an asset.i) TaxesIncome tax<strong>TIO</strong> is assessable for income tax by the Australian Taxation Office under theNational Tax Equivalent Regime (NTER). Under this arrangement, <strong>TIO</strong> is required tobe assessed in accordance with the Income Tax Assessment Act (as amended). <strong>TIO</strong>has elected under S148 (2) of the Income Tax Assessment Act, to have allowed asa deduction reinsurance payments to non-resident reinsurers.<strong>TIO</strong> Insurance & Banking:The income tax expense or revenue for the period is the tax payable on the currentperiod’s taxable income based on the applicable income tax rate adjusted bychanges in deferred tax assets and liabilities attributable to temporary differencesbetween the tax bases of assets and liabilities and their carrying amounts in thefinancial statements, and unused tax losses.Deferred tax assets and liabilities are recognised for temporary differences at thetax rates expected to apply when the assets are recovered or the liabilities aresettled. The tax rate is applied to the cumulative amounts of deductible andassessable temporary differences to measure the deferred tax asset or liability.Deferred tax assets are recognised for deductible temporary differences and unusedtax losses only if it is probable that future taxable amounts will be available toutilise those temporary differences and losses.Current and deferred tax balances attributable to amounts recognised directly inequity are also recognised directly in equity.MAC Fund:The MAC Fund is not subject to the National Tax Equivalents Regime andaccordingly the MAC Fund has no tax related balances or transactions reported.<strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong> 49