Annual Report 2011 - TIO

Annual Report 2011 - TIO

Annual Report 2011 - TIO

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

1“I had my car booked in for repair the verynext morning – it was so simple! It’s great toknow I have my insurance in the right place.Judith CampbellPolicy holder, pictured withher children Miles and Stella“

The Territory way. <strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong>About <strong>TIO</strong>Our Charter<strong>TIO</strong> was established under Section 4 of the Territory Insurance Office Act 1979 andcommenced operations on 1 July 1979. Its policies and contracts of insurance orindemnity, deposits placed with it and liabilities in relation to the Motor AccidentsCompensation business are guaranteed by the Northern Territory Government underSection 30 of the Act. The functions of <strong>TIO</strong> are defined under Section 5.2They are:››To act as an insurer in respect ofthe assets and prospective liabilitiesof the Territory and statutorycorporations.››To transact Workers Compensationinsurance in respect of personsrequired by the Workers Rehabilitationand Compensation Act, or any Actreplacing that Act, to insure.››To administer a Motor AccidentCompensation Scheme in accordancewith an Act or an agreementbetween <strong>TIO</strong> and the person orbody responsible for the scheme.››To carry out such functions in relationto the management and controlof moneys and other assets of theTerritory and statutory corporations,and on such terms and conditionsas the Minister directs.››To provide such financial servicesas are approved by the Minister.››To transact such general businessof insurance as the Minister directs.››To promote and participatein the promotion of road andindustrial safety.››Such other functions as are, from timeto time, imposed upon it by or underany other Act.From comprehensive and disasterinsurance through to home loans,<strong>TIO</strong>’s complete range of productshelps to build confidence andresilience among Territorians.Our Business<strong>TIO</strong> is a statutory corporation owned bythe NT Government. It provides insuranceand financial services to Territorians andoperates on a commercial basis.It was established by the NorthernTerritory Government in 1979 to provideinsurance cover within the NorthernTerritory. It particularly focuses on meetingthe unique needs of the Territory.Over the years, the business hasdiversified and now includes financialservices, insurance, the administration anddelivery of NT schemes for compulsorypersonal injury motor accidentscompensation and Government homeloans for low to middle income earners.While <strong>TIO</strong> is “guaranteed” by theGovernment, the organisation operateson a commercial basis and is committedto complying with Australian PrudentialRegulation Authority (APRA) standards andachieving key industry benchmarks.

Our Purpose<strong>TIO</strong>’s purpose is to help build confidence and resilience in the Territory. It does so byconcentrating on three areas:››Road Safety – educate and influencecommunity attitudes to reducethe number and severity of roadaccidents and improve motoraccident compensation andinsurance claim outcomes.››Community Resilience – promoteand support community preparation,property maintenance and insurancecover to build resilience againsteconomic loss, resume their lifestyleafter loss, and reduce the severityof insurance claims as a result ofsevere events.››Home Ownership – promotethe benefits of and pathways tohomeownership to increase family,social, and financial stability andstrengthen the community byincreasing access to home ownership.In addition to these key themes <strong>TIO</strong> also recognises its role in the community in supportof all of the NT population.3<strong>TIO</strong>’s Branches at Alice Springs, Katherine,Palmerston and Darwin City are complementedby extensive on-line and telephone access options.This <strong>Report</strong>Under Section 27 of the Territory InsuranceOffice Act 1979, the Board is required toprepare an annual report and financialstatements for submission to the Minister,who is required to present them tothe Legislative Assembly. This reportis prepared in accordance with thoserequirements.This report is also intended to inform<strong>TIO</strong> customers, other stakeholders andinterested parties of the performanceof <strong>TIO</strong> during the 2010/<strong>2011</strong> year asit relates to our purpose, values andstrategic goals.

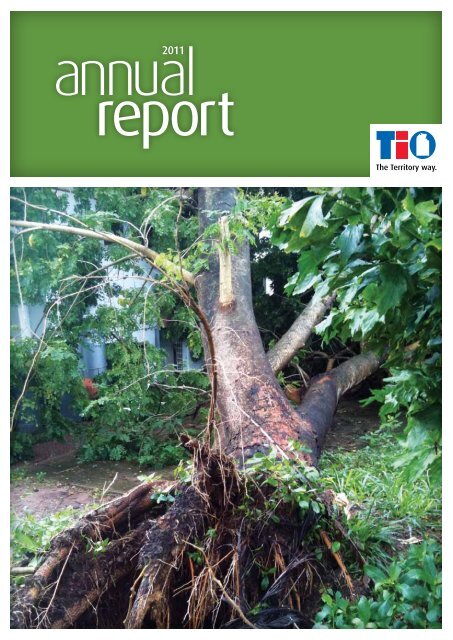

The Territory way. <strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong>4Chairman’s OverviewThe past year has seen <strong>TIO</strong> consolidatestrategies put in place to focus oncontinuing to improve the strengthand sustainability of our business forTerritorians. The results we see now aretestament to a journey we began severalyears ago to refocus our purpose andrealign our business.Net profit after tax increased comparedto the previous year. Most pleasingwas the contribution that all threebusinesses made to the group position.It is also pleasing to see that underlyingperformance has made a majorcontribution to profit and surplus results.Although investment returns play animportant part in company profitability,we only need to consider the impact theinvestment market had on our companytwo years ago to underline the need toensure our businesses are performingat a high level.The nature of our business means wewill always be subject to the volatilityof investment markets. However, strongunderlying profitability and the capitalstrength of our business ensures <strong>TIO</strong> is ina good position to weather future events.Of particular note this year was theimpact of Cyclone Carlos and heavy rainfallin the Top End. Cyclone Carlos resulted in$9.57 million in claims, one of the largestevents in recent <strong>TIO</strong> history. While thispales into insignificance against a globalbackdrop of natural disasters this pastyear, it is a reminder that the Territory issubject to extreme weather events andunderlines our role in helping Territoriansbuild resilience against such impacts.Board ChangesIn last year’s <strong>Annual</strong> <strong>Report</strong>, our thenChairman John Flynn talked of the needfor renewal on the Board. This year, muchof that renewal was achieved, with fivemembers retiring and five new Boardmembers welcomed.focus that he was so well respected for,both within our business and the broadercommunity. We wish him well in hisretirement in Darwin and I am sure he willcontinue to take a strong interest in theactivities of <strong>TIO</strong>.Our Deputy Chairman John Messengeralso retired this year after nine years onthe Board, four as Deputy Chairman. Inaddition, Denise Fincham retired after8 years service on the Board. I know allthe Board would join me in thanking themfor their valuable contributions.It was with great sadness and regret thatwe farewelled former <strong>TIO</strong> Board DeputyChairman David Farquhar who passedaway after a long illness. David wasa champion of <strong>TIO</strong> values and culture,and worked tirelessly to ensure that <strong>TIO</strong>evolved with “heart and soul”.To honour David’s contribution to <strong>TIO</strong> as aBoard member and trusted legal advisor,as well as his efforts on Motor AccidentCompensation reform, <strong>TIO</strong> has developeda law scholarship to be offered annually atCharles Darwin University.This year we welcomed Julia Davison,Julie-Anne Schafer, George Venardos,Peter Caldwell and Paul Tyrrell to the <strong>TIO</strong>Board. Collectively they bring a wealth ofexperience from various business sectorsto the Board.Looking forward, <strong>TIO</strong> has been through aperiod of significant renewal and changeover the past few years, and this journeywill continue. Our business is morefocused and relevant to Territorians, witha strong outlook and sustainable position.I would like to thank my fellow Boardmembers for their support, as well as theefforts of our management team and allemployees who have demonstrated theircommitment to the company.John Flynn retired in April <strong>2011</strong> afterleading the Board for almost nine years.John always showed a strong interest inour people and achievements. It was thisBruce CarterChair

The Territory way. <strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong>6Chief Executive’s OverviewSince joining <strong>TIO</strong> three years ago we havebeen on a journey to become a strongerand more sustainable business, here tobuild confidence and resilience amongTerritorians. This year we have seennumerous demonstrations that we arewell down the path to achieve this.Net profit after tax has grown 47 percent, mostly driven by improvements inoperational performance. Our people aredelivering more and are more engaged.With that comes a reduced reliance onexternally-driven investment income anda better overall result. All three businesseshave contributed to the profit result, againa pleasing trend.<strong>TIO</strong> has cemented its place as a companythat supports Territorians in buildingconfidence and resilience.Our commitment to road safety, buildingresilience to extreme weather events andsupporting home ownership have shownTerritorians that <strong>TIO</strong> is much more than aninsurance and banking business.Nowhere was this displayed moretangibly than our response to CycloneCarlos and associated heavy rainfall in theTop End in February this year. During theaftermath of the event, our Call Centreand Claims Centre staff handled 1,781claims totaling $9.57 million and reassuredcountless other Territorians about theirinsurance cover.I would like to thank our staff whoworked to support our customers duringthis very trying and busy time. Providingunderstanding and reassurance to ourcustomers is as much a part of our roleand value proposition as is handling claimsand issuing insurance policies.Overall PerformanceIt is pleasing to report a net profit after tax across all parts of the business this year, withgroup profit up from $35 million to $52 million after tax.Group Operating ResultsOperating Results08/09$m09/10$m10/11$mUnderlying operating performance 12 34 50Difference between actual investment returnsand expected returns (66) 23 13Change in inflation assumptions and discount rates (3) (17) (8)Restructure and one-off costs (2) (3) -Net profit before tax (59) 37 55Tax (6) 2 3Net profit after tax (53) 35 52

The Territory way. <strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong>Home OwnershipThe great Australian dream of owning your own home seems to be harder to achieve thanever before. Uncertain financial times have seen a flattening of the real estate market withdemand being dampened by both higher interest rates and economic uncertainty.Banking Financial PerformanceAn overall flattening of the home loanmarket across Australia and generalmoderation of real estate values werereflected in reduced home loan demandthis year and lower than expected lending.<strong>TIO</strong>’s response has been to continue tofocus on close management of interestmargins and costs. With both lendingand deposits down on last year, Bankingfinancial performance was maintainedthrough operational efficiency gains. Wealso maintained our responsible lendingpractices, with bad debts well belowindustry standards.Surplus and Loss Summary2009$m2010$m<strong>2011</strong>$m18Interest Income 47.1 41.7 44.1Interest Expense 37.9 29.8 32.6Net Interest Income 9.2 11.9 11.5Profit/(Loss) Before Tax (0.2) 3.8 3.7Profit/(Loss) from normal operations before tax 2.7 3.8 3.5Deposits and Loans2009$m2010$m<strong>2011</strong>$mDeposits 448.4 531.3 497.7Loans 544.2 564.1 525.9Balance Summary2009$m2010$m<strong>2011</strong>$mTotal Assets 618.3 655.9 605.6Total Liabilities 592.2 626.8 573.9Total Equity 26.1 29.1 31.7The HOMESTART NT initiative allows eligible Territoriansearning low-to-middle incomes to buy their own homeusing up to 30 per cent of their income.

23<strong>TIO</strong> interacts with customers and the communitythrough a wide variety of channels, includingthe Darwin Home Show.

Financial Statements2010/<strong>2011</strong>

Territory Insurance OfficeBoard Members’ <strong>Report</strong>Chief Executive Officerand Board Members' StatementThe Chief Executive Officer and members of the Board are of the opinion that to the best oftheir belief:The Statement of Comprehensive Income, the Statement of Financial Position, theStatement of Changes in Equity, the Statement of Cash Flows and Notes to theFinancial Statements of the Territory Insurance Office are drawn up so as to presentfairly <strong>TIO</strong> and the MAC Fund’s financial position as at 30 June <strong>2011</strong> and theirperformance for the year ended on that date.The financial statements are drawn up in accordance with Australian Accounting Standardsand Interpretations, International Financial <strong>Report</strong>ing Standards, other mandatoryprofessional reporting requirements, and the Territory Insurance Office Act, as amended.R M HardingChief Executive OfficerB J CarterChairman of the BoardJ F HandDeputy Chairman of the Board16 September <strong>2011</strong><strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong> 31

Board Members' <strong>Report</strong>Territory Insurance OfficeBoard Members’ <strong>Report</strong>The Board Members present their report on the financial statements for the year ended 30June <strong>2011</strong> in accordance with a resolution of the Board members and the auditor’s reportthereon.Board membersThe Board Members of the Territory Insurance Office at any time during or since the end ofthe financial year and up to the date of this report are:B J Carter appointed Chairperson 1 st April <strong>2011</strong>P J Caldwell retired 31 st January <strong>2011</strong>, reappointed 1 st May <strong>2011</strong>R A Davis unchangedJ H Davison appointed 1 st October 2010D L Fincham retired 31 st July 2010J G Flynn AM retired 31 st March <strong>2011</strong>J F Hand appointed Deputy Chairperson 1 st April <strong>2011</strong>J I Messenger retired 31 st January <strong>2011</strong>J Schafer appointed 1 st October 2010P C W Tyrrell AO appointed 1 st May <strong>2011</strong>G Venardos appointed 1 st October 2010Details of Board Members, their directorships/experience and any special responsibilities areset out in the board members section of the annual report.Corporate structureThe Territory Insurance Office is a statutory body established under Section 4 of theTerritory Insurance Office Act, and is domiciled in Australia. <strong>TIO</strong> employed 237 employeesas at 30 June <strong>2011</strong> (2010: 231 employees).Principal activitiesThe principal continuing activities during the year of <strong>TIO</strong> are the provision of directinsurance business and related investment activities, and the administration of the MotorAccidents Compensation Scheme on behalf of the Northern Territory Government. <strong>TIO</strong> alsooperates a Banking business, which accepts deposits, makes loans and administers theHomestart loan scheme.There was no significant change in the nature of these activities during the year.ResultsNet profit after tax / (loss) forthe year<strong>TIO</strong><strong>2011</strong> 2010<strong>TIO</strong>Insurance& BankingMACFund<strong>TIO</strong><strong>TIO</strong>Insurance& BankingMACFund$’000 $’000 $’000 $’000 $’000 $’00051,987 7,720 44,267 35,456 3,290 32,166DividendsThe Board has not provided for a dividend in respect of the 2010/<strong>2011</strong> financial year.<strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong> 32

Territory Insurance OfficeBoard Members’ <strong>Report</strong>Review of operationsInsurance and Banking performance has resulted in an after tax profit for the year of $7.7mcompared to an after tax profit of $3.3m for the year ended 30 June 2010. The MotorAccidents Compensation Fund [MAC Fund], managed by <strong>TIO</strong>, reported a surplus of $44.3mcompared to a surplus of $32.2m for the year ended 30 June 2010.A full report on the operations of <strong>TIO</strong> is provided within the <strong>Annual</strong> <strong>Report</strong> section.Impact of legislation and other external requirementsThe Board does not believe that there have been any significant impacts of legislation orother external requirements imposed on <strong>TIO</strong> during the year that are not otherwisedisclosed in this report.Significant changes in the state of affairsIn the opinion of the Board Members there have been no significant changes in the state ofaffairs of <strong>TIO</strong> that occurred during the year under review not otherwise disclosed in thisreport.Matters subsequent to the end of the financial yearIn the interval between the end of the financial year and the date of this report, there havebeen no matters or circumstances that have arisen, which have significantly affected or maysignificantly affect:(a)(b)(c)<strong>TIO</strong>’s operations;the results of those operations; or<strong>TIO</strong>’s state of affairs.Likely developments and expected results of operationsThe Board does not believe that it would be in the best interests of <strong>TIO</strong> to discloseinformation other than that disclosed elsewhere in this report.Indemnification and insurance of officersDuring the financial year ended 30 June <strong>2011</strong>, <strong>TIO</strong> paid an insurance premium in respect ofa contract insuring the Board Members and officers of <strong>TIO</strong> against certain liabilities that maybe incurred in discharging their duties and responsibilities as a Board Member or officer of<strong>TIO</strong>. The insurance contract prohibits the disclosure of the nature of the liabilities insuredagainst and the premium paid in respect of that insurance.<strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong> 33

Territory Insurance OfficeBoard Members’ <strong>Report</strong>Meetings of board membersThe number of meetings of the <strong>TIO</strong> Board and of each Board committee held during the yearended 30 June <strong>2011</strong>, and the numbers of meetings attended by each Board Member were:Meetings ofBoardMembersMeetings ofAudit & RiskCommitteeMeetings ofInvestmentCommitteeMeetings ofReinsuranceCommitteeMeetings ofPeople,RemunerationNomination &SuccessionCommitteeMeetings ofMAC AppealsCommittee *A B A B A B A B A B A BB J Carter 8 7 7 7 x x 3 2 3 3 x xP J Caldwell 6 5 x x x x x x x x x xR A Davis 8 7 x x 5 5 x x 2 2 x xJ H Davison 5 4 2 2 x x x x 2 2 x xD L Fincham 1 1 1 1 1 1 x x 0 0 1 1J G Flynn AM 7 6 x x 4 4 x x 2 2 3 3J F Hand 8 8 7 7 5 5 3 3 x x 3 3J I Messenger 6 5 5 4 x x 3 3 1 0 x xJ Schafer 5 4 x x 2 2 x x 2 2 x xP C W Tyrrell AO 1 0 x x x x x x x x x xG Venardos 5 4 2 2 2 2 x x x x x xNote: Peter Caldwell attended the strategy session in March as the shareholderrepresentative.A = Number of meetings held during the time the board member held office or was amember of the committee during the year.B = Number of meetings attendedx = Not a member of the relevant committee* = The MAC Appeals Committee had limited tenure of 24 months from 29 April 2009<strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong> 34

Territory Insurance OfficeBoard Members’ <strong>Report</strong>Board members’ benefitsNo Board Member of <strong>TIO</strong> has received, or has become entitled to receive, a benefit (otherthan a remuneration benefit included in the financial statements) because of a contractthat:(a) the Board Member; orwith:(b)(c)(i)(ii)a firm of which the Board Member is a member; oran entity in which the Board Member has a substantial financial interest;has made (during the year ended 30 June <strong>2011</strong> or at any time)<strong>TIO</strong>; oran entity that <strong>TIO</strong> controlled, or a body corporate that was related to <strong>TIO</strong>,when the contract was made or when the Board Member received, or becameentitled to receive, the benefit (if any).B J CarterChairman of the BoardJ F HandDeputy Chairman of the Board16 September <strong>2011</strong><strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong> 35

Statement of Comprehensive Incomefor the year ended 30 June <strong>2011</strong>Territory Insurance OfficeFinancial StatementsProfit and lossNotes <strong>2011</strong> 2010<strong>TIO</strong><strong>TIO</strong>Insurance& BankingMAC Fund<strong>TIO</strong><strong>TIO</strong>Insurance& BankingMAC Fund$’000 $’000 $’000 $’000 $’000 $’000Revenue 5 295,167 198,798 105,612 280,411 182,797 106,673Outwards reinsurancepremium expense(46,012) (39,544) (6,468) (45,050) (37,421) (7,629)Claims expense 21 (122,231) (78,191) (44,040) (130,985) (76,088) (54,897)Acquisition costs (6,305) (5,933) (372) (5,143) (4,461) (682)Grants provided to fund roadsafety programs(2,843) - (2,843) (2,273) - (2,273)Finance costs (32,491) (32,491) - (29,779) (29,779) -Depreciation and amortisationexpense(2,007) (1,395) (612) (3,304) (1,224) (2,080)Salaries and employeebenefits expense(21,670) (21,670) - (21,088) (21,088) -Other expenses (6,508) (8,741) (7,010) (6,116) (8,229) (6,946)Profit/(Loss) beforeincome tax55,100 10,833 44,267 36,673 4,507 32,166Income tax benefit/(expense) 10 (3,113) (3,113) - (1,217) (1,217) -Net profit/(loss) for theperiod51,987 7,720 44,267 35,456 3,290 32,166Other comprehensiveincomeRevaluation of property, plantand equipment1,389 347 1,042 1,395 349 1,046Cash Flow Hedges:Gain/(Loss) taken on Equity (166) (166) - 892 892 -Transferred to Statement ofFinancial Position197 197 - (470) (470) -Income tax on items of othercomprehensive income(113) (113) - (231) (231) -Other comprehensiveincome for the period, net1,307 265 1,042 1,586 540 1,046of taxTotal comprehensiveincome for the period53,294 7,985 45,309 37,042 3,830 33,212Profit and total comprehensive income for the period are attributable to the owner.The above Statement of Comprehensive Income should be read in conjunction with the accompanying notes.<strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong> 36

Statement of Financial Positionas at 30 June <strong>2011</strong>Territory Insurance OfficeFinancial StatementsNotes <strong>2011</strong> 2010<strong>TIO</strong><strong>TIO</strong>Insurance &BankingMACFund<strong>TIO</strong><strong>TIO</strong>Insurance& BankingMAC Fund$’000 $’000 $’000 $’000 $’000 $’000CURRENT ASSETSCash and cash equivalents 11 26,543 20,951 5,592 30,215 27,855 2,360Trade and other receivables 12 53,563 51,043 3,820 52,418 50,486 2,959Other financial assets 13 617,366 226,182 391,184 567,016 224,803 342,213Loans 14 11,973 11,973 - 14,333 14,333 -Reinsurance and otherrecoveries receivable17 23,138 21,686 1,452 17,439 13,719 3,720Deferred reinsurance expense 18 19,704 19,704 - 27,344 27,344 -Deferred acquisition costs 18 4,289 4,119 170 4,804 4,559 245Current tax assets 10 - - - 1,364 1,364 -Total Current Assets 756,576 355,658 402,218 714,933 364,463 351,497NON-CURRENT ASSETSIntangible assets 15 1,251 1,116 135 1,784 1,390 394Loans 14 513,923 513,923 - 549,742 549,742 -Property, plant and equipment 16 47,324 14,895 32,429 46,282 14,299 31,983Reinsurance and otherrecoveries receivable17 47,711 17,914 29,797 45,043 16,072 28,971Deferred tax assets 10 4,082 4,082 - 5,965 5,965 -Total Non-Current Assets 614,291 551,930 62,361 648,816 587,468 61,348Total Assets 1,370,867 907,588 464,579 1,363,749 951,931 412,845CURRENT LIABILITIESOutstanding claims liability 19 81,700 47,904 33,796 71,628 40,106 31,522Trade and other payables 22 29,085 27,763 2,622 39,054 37,569 2,512Deposits 23 497,688 497,688 - 531,309 531,309 -Other financial liabilities 13 - - - 102 102 -Current tax liabilities 10 221 221 - - - -Provisions 24 4,092 4,092 - 4,742 4,742 -Unearned premium liability 20 88,212 62,023 26,189 82,921 58,472 24,449Securitisation liabilities 25 1,333 1,333 - 1,562 1,562 -Total Current Liabilities 702,331 641,024 62,607 731,318 673,862 58,483NON-CURRENT LIABILITIESOutstanding claims liability 19 329,457 90,563 238,894 327,240 90,647 236,593Deferred tax liabilities 10 2,103 2,103 - 2,345 2,345 -Provisions 24 792 792 - 649 649 -Securitisation liabilities 25 64,640 64,640 - 83,948 83,948 -Total Non-Current Liabilities 396,992 158,098 238,894 414,182 177,589 236,593Total Liabilities 1,099,323 799,122 301,501 1,145,500 851,451 295,076Net Assets 271,544 108,466 163,078 218,249 100,480 117,769EQUITYRetained earnings 27 215,868 65,197 160,990 163,881 57,477 116,723Asset revaluation reserve 27 16,336 3,929 2,088 15,049 3,684 1,046Contributed equity 27 39,340 39,340 - 39,340 39,340 -Hedging Reserve 27 - - - (21) (21) -Total Equity 271,544 108,466 163,078 218,249 100,480 117,769The above statement of financial position should be read in conjunction with the accompanying notes.<strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong> 37

Statement of Changes in Equityfor the year ended 30 June <strong>2011</strong>Territory Insurance OfficeFinancial Statements<strong>TIO</strong>NotesRetainedEarningsAssetRevaluationReserveContributedEquityHedgingReserveTotal$’000 $’000 $’000 $’000 $’000Balance as at 1 July 2009 128,425 13,759 39,340 (317) 181,207Profit for the period 35,456 - - - 35,456Other comprehensive incomeRevaluation of property, Plant andequipment- 1,395 - - 1,395Cash flow HedgesGain/(Loss) taken on Equity - - - 892 892Transferred to Statement ofFinancial Position- - - (470) (470)Income tax on items of othercomprehensive income- (105) - (126) (231)Total comprehensive income for theperiod attributable to the owner35,456 1,290 - 296 37,042Balance as at 30 June 2010 163,881 15,049 39,340 (21) 218,249Profit for the period 51,987 - - - 51,987Other comprehensive incomeRevaluation of property, Plant andequipment- 1,391 - - 1,391Cash flow HedgesGain/(Loss) taken on Equity - - - (166) (166)Transferred to Statement ofFinancial Position- - - 196 196Income tax on items of othercomprehensive income- (104) - (9) (113)Total comprehensive income for theperiod attributable to the owner51,987 1,287 - 21 53,295Balance as at 30 June <strong>2011</strong> 215,868 16,336 39,340 - 271,544The above Statement of Changes in Equity should be read in conjunction with the accompanying notes.<strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong> 38

Statement of Changes in Equityfor the year ended 30 June <strong>2011</strong> continued…Territory Insurance OfficeFinancial Statements<strong>TIO</strong> Insurance & BankingNotesRetainedEarningsAssetRevaluationReserveContributedEquityHedgingReserveTotal$’000 $’000 $’000 $’000 $’000Balance as at 1 July 2009 54,187 3,440 39,340 (317) 96,650Profit for the period 3,290 - - - 3,290Other comprehensive incomeRevaluation of property, Plant andequipment- 349 - - 349Cash flow HedgesGain/(Loss) taken on Equity - - - 892 892Transferred to Statement ofFinancial Position- - - (470) (470)Income tax on items of othercomprehensive income- (105) - (126) (231)Total comprehensive income for theperiod attributable to the owner3,290 244 - 296 3,830Balance as at 30 June 2010 57,477 3,684 39,340 (21) 100,480Profit for the period 7,720 - - - 7,720Other comprehensive incomeRevaluation of property, Plant andequipment- 349 - - 349Cash flow HedgesGain/(Loss) taken on Equity - - - (166) (166)Transferred to Statement ofFinancial Position- - - 196 196Income tax on items of othercomprehensive income- (104) - (9) (113)Total comprehensive income for theperiod attributable to the owner7,720 245 - 21 7,986Balance as at 30 June <strong>2011</strong> 65,197 3,929 39,340 - 108,466The above Statement of Changes in Equity should be read in conjunction with the accompanying notes.<strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong> 39

Statement of Changes in Equityfor the year ended 30 June <strong>2011</strong> continued…MAC FundNotesRetainedEarningsAssetRevaluationReserveTerritory Insurance OfficeFinancial StatementsContributedEquityHedgingReserveTotal$’000 $’000 $’000 $’000 $’000Balance as at 30 June 2009 84,557 - - - 84,557Profit for the period 32,166 - - - 32,166Other comprehensive incomeRevaluation of property, Plant andequipment- 1,046 - - 1,046Total comprehensive income for theperiod attributable to the owner32,166 1,046 - - 33,212Balance as at 30 June 2010 116,723 1,046 - - 117,769Profit for the period 44,267 - - - 44,267Other comprehensive incomeRevaluation of property, Plant andequipment- 1,042 - - 1,042Total comprehensive income for theperiod attributable to the owner44,267 1,042 - - 45,309Balance as at 30 June <strong>2011</strong> 160,990 2,088 - - 163,078The above Statement of Changes in Equity should be read in conjunction with the accompanying notes.<strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong> 40

Statement of Cash Flows for the year ended30 June <strong>2011</strong>Territory Insurance OfficeFinancial StatementsCash flows from operating activitiesNotes <strong>2011</strong> 2010<strong>TIO</strong><strong>TIO</strong>Insurance &BankingMAC Fund<strong>TIO</strong><strong>TIO</strong>Insurance& BankingMAC Fund$’000 $’000 $’000 $’000 $’000 $’000Premiums received 184,429 114,488 69,941 172,829 107,129 65,700Outwards reinsurance premiums paid (51,299) (44,012) (7,287) (44,428) (36,945) (7,483)Claims paid (109,401) (69,005) (40,396) (104,974) (63,620) (41,354)Reinsurance recoveries received 13,827 10,538 3,289 15,378 11,282 4,096Trust distributions received 25,673 5,577 20,096 17,665 3,934 13,731Interest received 16,849 9,474 7,375 14,227 8,621 5,606Operating lease income received 3,344 1,299 2,045 2,571 888 1,683Other income received 6,463 5,297 1,166 8,384 7,813 571Acquisition costs paid (6,523) (6,173) (350) (8,325) (7,575) (750)General and administration expensespaid(29,593) (23,661) (5,932) (25,327) (18,918) (6,409)Funding for road safety programs paid (2,669) - (2,669) (3,261) - (3,261)Goods and services tax paid (8,058) (4,267) (3,791) (8,502) (5,103) (3,399)Monies held on trust received / (paid) (46) (46) - (3,891) (3,891) -Interest expense paid on deposits (32,905) (32,905) - (30,018) (30,018) -Unrealised Investment Income - - - - - -Interest income received from loans 38,860 38,860 - 36,554 36,554 -Income Tax paid - - - 1,415 1,415 -Net cash inflow from/(used in)operating activities 3148,951 5,464 43,487 40,297 11,566 28,731Cash flows from investing activitiesNet loans extended to customers 38,600 38,600 - (19,680) (19,680) -Net (payments) / receipts forinvestments(37,239) 3,010 (40,249) (59,081) (24,015) (35,066)Payments for property, plant andequipment(1,646) (1,640) (6) (2,654) (2,615) (39)Proceeds from sale of embeddedderivative- - - 1,320 1,320 -Proceeds from property, plant andequipment101 101 - - - -Net cash flow from/(used in)investing activities(184) 40,071 (40,255) (80,095) (44,990) (35,105)Cash flows from financing activitiesNet increase/(decrease) in savings andother deposit accounts(32,855) (32,855) - 86,021 86,021 -Repayments of securitisation funding (19,584) (19,584) - (48,786) (48,786) -Net cash flow from/(used in)financing activities(52,439) (52,439) - 37,235 37,235 -Net increase/(decrease) in cashheld(3,672) (6,904) 3,232 (2,565) 3,810 (6,375)Cash at the beginning of the period 30,215 27,855 2,360 32,780 24,045 8,735Cash at the end of the period 11 26,543 20,951 5,592 30,215 27,855 2,360The above Statement of cash flows should be read in conjunction with the accompanying notes.<strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong> 41

Territory Insurance OfficeNotes to the Financial Statements30 June <strong>2011</strong>1. Corporate InformationThe Territory Insurance Office [<strong>TIO</strong>] was established in 1979 by virtue of section 4 of theTerritory Insurance Office Act [<strong>TIO</strong> Act]. <strong>TIO</strong> is domiciled in the Northern Territory. Theprincipal activities of the office are the operation of the following businesses; Insurance,Banking and administration of the MAC Scheme.<strong>TIO</strong> is only authorised to transact business and carry out functions as provided in the<strong>TIO</strong> Act or as approved or directed by the Minister. Its policies and contracts of insuranceor indemnity and deposits placed with it are fully guaranteed by the Northern TerritoryGovernment under section 30 of the <strong>TIO</strong> Act.<strong>TIO</strong> Head Office & Principal Place of Business24 Mitchell StreetDARWIN2. Summary of significant accounting policies2.1 Basis of PreparationThe financial statements are general purpose financial statements which have beenprepared in accordance with the requirements of <strong>TIO</strong> Act, Australian AccountingStandards and other authoritative pronouncements of the Australian AccountingStandards Board (AASB). The principal accounting policies adopted are consistent withthose of the previous year, except where otherwise stated. The financial statementscomply with Australian Accounting Standards and International Financial <strong>Report</strong>ingStandards (IFRS) as issued by the International Accounting Standards Board.These general purpose financial statements were authorised by the Board for issue on 16September <strong>2011</strong>.The financial statements have been prepared in accordance with the fair value basis ofaccounting with certain exceptions as described in the accounting policies set below atNote 2.3. Balances among <strong>TIO</strong> Insurance & Banking and the MAC Fund are gross ofinter-business transactions and in the <strong>TIO</strong> balance (which is the combined total of <strong>TIO</strong>Insurance & Banking and the MAC Fund as a whole) the inter-business transactions areeliminated.Fiduciary Responsibilities in respect of the Motor AccidentsCompensation Fund<strong>TIO</strong> administers the MAC Scheme pursuant to section 5(c) of the <strong>TIO</strong> Act. The MACscheme is created by the Motor Accidents (Compensation) Act. <strong>TIO</strong> Act has establishedthe Motor Accidents Compensation Fund [MAC Fund] and other requirements around theoperation of the fund. The establishment of the MAC Fund on 1 July 2006 did not createa trust and <strong>TIO</strong>, and the Board members are not trustees in relation of the MAC Fund.<strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong> 42

Territory Insurance OfficeNotes to the Financial Statements30 June <strong>2011</strong>Pursuant to Section 22C of the <strong>TIO</strong> Act, the assets of the fund must be solely applied forthe following purposes• Operating the MAC scheme;• The promotion of road safety;• The acquisition of assets for the MAC Fund;• The discharge of liabilities in relation to the MAC businessUnder the <strong>TIO</strong> Act, the <strong>Annual</strong> report of <strong>TIO</strong> must consist of:a) a report for the Territory Insurance Office as a whole; andb) a separate report for the commercial business andc) a separate report for the MAC business.<strong>TIO</strong> has addressed its obligations under the <strong>TIO</strong> Act by segregating the assets andliabilities of the MAC Fund and presenting in the financial statements the aboveinformation requirements using a 6 column approach.The disclosures for both <strong>TIO</strong> [Insurance and Banking] and the MAC Fund are their standalone results and balances and necessarily disclose all transactions that occur betweenthe two business activities.Accounting policies applicable to both <strong>TIO</strong> and the MAC Fund are outlined throughoutNote 2.3.2.2 New and Revised Accounting StandardsThe following new and revised Standards and Interpretations have not resulted insignificant changes to the financial statements.AmendmentsAASB 2009-5AASB 2009-8AASB 2009-9AASB 2009-10Interpretation 19AASB 2009-13AASB 2010-1AASB 2010-3TitleAmendments to Australian Accounting Standards - <strong>Annual</strong>Improvements ProcessAmendments to Australian Accounting Standards - Group Cash-Settled Share-based Payment TransactionsAmendments to Australian Accounting Standards – AdditionalExemptions for First-time AdoptersAmendments to Australian Accounting Standards - Classificationof Rights IssuesAmendment to Australian Accounting Standards - ExtinguishingFinancial Liabilities with Equity InstrumentsLimited Exemption from Comparative AASB 7 Disclosures forFirst-time Adopters - Amendment to AASB 1Amendments to Australian Accounting Standards arising fromthe <strong>Annual</strong> Improvements Project<strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong> 43

Territory Insurance OfficeNotes to the Financial Statements30 June <strong>2011</strong>The following new and revised Standards and Interpretations have recently been issuedor amended but are not yet effective; however, are available for early adoption. <strong>TIO</strong> haselected early adoption for the reporting period ended 30 June <strong>2011</strong>. There is no financialimpact from the early adoption as the standard relates purely to disclosure.AmendmentsAASB 124 (revised)AASB 2009-12AASB 8 (asamended) andAASB 2009-12TitleAmendments to Australian AccountingStandards - Related Party DisclosuresOperating Segments as amended and theconsequential amendments to otherstandards resulting from its issue.Effective on orafter1 January <strong>2011</strong>1 January <strong>2011</strong>Other new and revised Standards and Interpretations that have been issued or amendedbut are not yet effective, have not been adopted for the reporting period ended 30 June<strong>2011</strong>. <strong>TIO</strong> will apply these standards for the annual reporting periods beginning on orafter the effective dates. It is expected that there will be no material financial impactfrom the application of these standards as they are primarily disclosure related.2.3 Significant Accounting PoliciesIn addition to <strong>TIO</strong>’s primary operations of providing Insurance and Banking services tothe Northern Territory, <strong>TIO</strong> administers the MAC Fund pursuant to the <strong>TIO</strong> Act. Theresults and balances are disclosed separately to fulfil the reporting obligations set out bythe Act.All accounting policies are consistent between <strong>TIO</strong> [Insurance and Banking] and the MACFund unless otherwise stated below. Accounting policies relating to Banking activities donot apply to the MAC Fund.a) Revenue recognitionRevenue is recognised to the extent that it is probable that the economic benefitswill flow to the entity and the revenue can be reliably measured. The followingspecific recognition criteria are also used before revenue is recognised:Premium revenuePremium is comprised of amounts charged to policyholders or other insurers, butexcludes stamp duties, GST and other amounts collected on behalf of third parties.The earned portion of premiums received and receivable, including unclosedbusiness, is recognised as revenue. Premium is treated as earned from the date ofattachment of risk. Premiums on unclosed business are estimated with reference tothe previous year's premium processing delays and the impact of recent trends andevents on the pattern of new business and renewals.<strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong> 44

Territory Insurance OfficeNotes to the Financial Statements30 June <strong>2011</strong>The pattern of recognition of income over the policy or indemnity periods is inaccordance with the pattern of the incidence of risk expected under the insurancecontracts. In most cases, time approximates the pattern of risks underwritten.Unearned premium liability, which is the proportion of premium received orreceivable not earned in the statement of comprehensive income, is determined byapportioning the premiums written in the year over the periods of indemnity fromthe attachment of risk, and is treated as a liability on the statement of financialposition at the reporting date.Reinsurance and other recoveries receivableReinsurance and other recoveries receivable on paid claims, reported claims not yetpaid, claims incurred but not reported and unexpired risk liabilities are recognisedas revenue.Recoveries receivable are assessed in a manner similar to the assessment ofoutstanding claims. Recoveries receivable in relation to "long-tail" classes aremeasured as the present value of the expected future receipts, calculated on thesame basis as the provision for outstanding claims. The details of discount andinflation rates applied are included in note 3.Interest, fees and commissionInterest income is recognised on an accrual basis. Banking related fees andcommissions are brought to account on an accrual basis whilst loan establishmentfees are brought to account over the estimated average life of the loan on aneffective interest rate basis.Rental revenueRental revenue is recognised as income on a straight line basis over the term of thelease. Lease incentives granted are recognised as an integral part of the total rentalincome.b) Unexpired risk liabilityThe adequacy of the unearned premium liability is assessed by considering currentestimates of all expected future cash flows relating to future claims covered bycurrent insurance contracts. This assessment is referred to as the liability adequacytest and is performed separately for each group of the contracts subject to broadlysimilar risks and managed together in a single portfolio.If the unearned premium liability less related intangible assets and related deferredacquisition costs is exceeded by the present value of the expected future cash flowsrelating to future claims plus the additional risk margin to reflect the inherentuncertainty in the central estimate, then the unearned premium liability is deemedto be deficient. <strong>TIO</strong> applies a risk margin to achieve the same probability ofsufficiency for future claims as is achieved on the outstanding claims liability.The entire deficiency, gross and net of reinsurance is recognised immediately in thestatement of comprehensive income. The deficiency is recognised first by writingdown any related intangible assets and then related deferred acquisition costs, withany excess being recorded in the statement of financial position as an unexpiredrisk liability.<strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong> 45

Territory Insurance OfficeNotes to the Financial Statements30 June <strong>2011</strong>c) Outwards reinsurancePremium ceded to reinsurers is recognised as an expense in the statement ofcomprehensive income from the attachment date over the period of indemnity ofthe insurance contract in accordance with the pattern of reinsurance protectionreceived. Where appropriate, an unearned portion of outwards reinsurance istreated at the reporting date as an asset.d) Outstanding claims liabilityThe liability for outstanding claims is measured as the central estimate of thepresent value of expected future payments against claims incurred at the reportingdate under insurance contracts issued by <strong>TIO</strong>, with an additional risk margin toallow for the inherent uncertainty in the central estimate.Claims expense and a provision for outstanding claims are recognised in respect ofdirect insurance and inwards reinsurance business and the Motor AccidentsCompensation Scheme. The provision covers claims reported but not yet paid,incurred but not reported claims ("IBNR") and the anticipated direct and indirectcosts of settling those claims. Claims outstanding are assessed by review ofindividual claim files and estimating changes in the ultimate cost of settling claims,IBNRs and settlement costs using statistics based on past experience and trends.Outstanding claims are subject to independent actuarial assessment.The provision for outstanding claims is measured as the present value of expectedfuture payments. These payments are estimated on the basis of the ultimate cost ofsettling claims, which is affected by factors arising during the period to settlementsuch as normal and "superimposed" inflation. The expected future payments arediscounted to present value at the statement of financial position date using a riskfree rate. The details of rates applied are included in note 3.e) ReceivablesReceivables comprise premium receivables, interest receivables, other debtors andreinsurance and other recoveries. These amounts are initially recognised at fairvalue.Premium receivables and reinsurance and other recoveries, which include amountsdue from policy holders, reinsurers and intermediaries, are subsequently measuredat fair value through the profit and loss section of the Statement of ComprehensiveIncome. Interest receivables and other debtors are subsequently measured atamortised cost using the effective interest rate method.An allowance for impairment of receivables is established when there is objectiveevidence that <strong>TIO</strong> will not be able to collect all moneys due. The amount of theallowance is equal to the difference between the carrying amount and the presentvalue of estimated future cash flows, discounted at the original effective interestrate. The impairment charge is recognised in the statement of comprehensiveincome.<strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong> 46

Territory Insurance OfficeNotes to the Financial Statements30 June <strong>2011</strong>f) Deferred acquisition costsAcquisition costs are costs associated with obtaining and recording generalinsurance contracts. These costs include commissions and brokerage paid,advertising, underwriting and other selling costs, premium collection costs andother administrative costs. Acquisition costs incurred in obtaining general insurancecontracts are deferred and recognised as assets where they can be reliablymeasured and where it is probable that they will give rise to premium revenue thatwill be recognised in the statement of comprehensive income in subsequentreporting periods.Deferred acquisition costs are amortised in accordance with the expected pattern ofthe incidence of risk under the general insurance contracts to which they relate.This pattern of amortisation corresponds to the earning pattern of thecorresponding premium revenue.Liability Adequacy TestThe liability adequacy test is an assessment of the carrying amount of the unearnedpremium liability and is conducted at each reporting date. If current estimates ofthe present value of the expected future cash flows relating to future claims arisingfrom the rights and obligations under current insurance contracts, plus an additionalrisk margin to reflect the inherent uncertainty in the central estimate, exceed theunearned premium liability (net of reinsurance) less related deferred acquisitioncosts, then the unearned premium liability is deemed to be deficient. The test isperformed at the level of a portfolio of contracts that are subject to broadly similarrisks and that are managed together as a single portfolio. Any deficiency arisingfrom the test is recognised in profit or loss with the corresponding impact on thestatement of financial position recognised first through the write down of deferredacquisition costs for the relevant portfolio of contracts, with any remaining balancebeing recognised on the statement of financial position as an unexpired risk liability.g) Assets backing insurance liabilities<strong>TIO</strong> actively manages its investment portfolio to ensure that investments mature inaccordance with the expected pattern of future cash flows arising from insuranceliabilities. <strong>TIO</strong> undertook a process of identifying and matching all assets whicharise from the issuing of insurance contracts. This review determined that thefollowing assets are held to back insurance liabilities. These assets comprise:Receivables: Premium receivables, reinsurance and other recoveries.Financial Assets: Investment assets, cash, cash equivalents and overdrafts.Owner-occupied property.ReceivablesRefer to note 2.3(e).<strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong> 47

Territory Insurance OfficeNotes to the Financial Statements30 June <strong>2011</strong>Financial AssetsInvestment assets held to back insurance liabilities, have been categorised as “atfair value through profit and loss”, as they are held for trading. They are part of aportfolio of identified financial instruments that are managed together and for whichthere is evidence of a recent actual pattern of short-term profit-taking.Initial recognition is at fair value in the statement of financial position andsubsequent measurement is at fair value with any resultant gains or lossesrecognised in the statement of comprehensive income.Details of fair value for financial assets are listed below:Financial assetListed fixed interest securities,Units in listed unit trusts,Government securities.Unlisted fixed interest securities.Units in unlisted unit trusts.Cash assets and bank overdrafts.Details of how fair value is determined.Initially recognised at cost and the subsequent fair value is taken asthe quoted bid price of the instrument at the reporting date.Initially recognised at cost and the subsequent fair value ismeasured based on valuations using rates of interest equivalent tothe yields obtainable on comparable investments at the reportingdate.Initially recognised at cost and the subsequent fair value ismeasured at fund manager’s valuation at the reporting date.Initially recognised at cost and the subsequent fair value ismeasured at face value of the amounts deposited or drawn.All purchases and sales of financial assets that require delivery of the asset withinthe time frame established by regulation or market convention (‘regular way’transactions) are recognised on the date of settlement, being the date the asset isdelivered to or by <strong>TIO</strong>.In cases where the period between trade and settlement exceeds this time frame,the transaction is also recognised at settlement date. Financial assets arederecognised when the rights to receive future cash flows from the assets haveexpired, or have been transferred, and <strong>TIO</strong> has transferred substantially all therisks and rewards of ownership or control of the asset.Finance revenue, comprising trust distributions and interest, is brought to accounton an accruals basis. Revenue on investments in unlisted unit trusts is deemed toaccrue on the date the distributions are declared.Owner-occupied property accounted for as Property, Plant and EquipmentThe owner-occupied property is valued using the revaluation model wherebymeasurement subsequent to initial recognition is at fair value at the date of thelatest revaluation less any subsequent accumulated depreciation and accumulatedimpairment losses.A valuation is conducted annually and is based on an external property valuationreport.When a revaluation increases the carrying value of a property, the increase iscredited directly to equity under the heading of asset revaluation reserve.<strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong> 48

Territory Insurance OfficeNotes to the Financial Statements30 June <strong>2011</strong>However, any increase is recognised in profit and loss to the extent that it reversesa revaluation decrease of the same asset previously recognised in profit and loss.When an asset’s carrying amount is decreased as a result of a revaluation, thedecrease is recognised in profit and loss. However, any decrease is debited directlyto equity under the heading of asset revaluation reserve to the extent of any creditbalance existing in the asset revaluation reserve in respect of that asset.Any remaining balance on the asset revaluation reserve is credited to retainedearnings when the corresponding property is realised by sale.h) Fire service levy and other charges - <strong>TIO</strong> Insurance & BankingA liability for fire service levy and other charges is recognised on certain businesswritten to the balance date. Levies and charges payable are expensed on the samebasis as the recognition of premium revenue, with the portion relating to unearnedpremium being recorded as an asset.i) TaxesIncome tax<strong>TIO</strong> is assessable for income tax by the Australian Taxation Office under theNational Tax Equivalent Regime (NTER). Under this arrangement, <strong>TIO</strong> is required tobe assessed in accordance with the Income Tax Assessment Act (as amended). <strong>TIO</strong>has elected under S148 (2) of the Income Tax Assessment Act, to have allowed asa deduction reinsurance payments to non-resident reinsurers.<strong>TIO</strong> Insurance & Banking:The income tax expense or revenue for the period is the tax payable on the currentperiod’s taxable income based on the applicable income tax rate adjusted bychanges in deferred tax assets and liabilities attributable to temporary differencesbetween the tax bases of assets and liabilities and their carrying amounts in thefinancial statements, and unused tax losses.Deferred tax assets and liabilities are recognised for temporary differences at thetax rates expected to apply when the assets are recovered or the liabilities aresettled. The tax rate is applied to the cumulative amounts of deductible andassessable temporary differences to measure the deferred tax asset or liability.Deferred tax assets are recognised for deductible temporary differences and unusedtax losses only if it is probable that future taxable amounts will be available toutilise those temporary differences and losses.Current and deferred tax balances attributable to amounts recognised directly inequity are also recognised directly in equity.MAC Fund:The MAC Fund is not subject to the National Tax Equivalents Regime andaccordingly the MAC Fund has no tax related balances or transactions reported.<strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong> 49

Territory Insurance OfficeNotes to the Financial Statements30 June <strong>2011</strong>Goods and Services Tax (GST)Revenues, expenses and assets are recognised net of the amount of GST except:• Where the GST incurred on a purchase of goods and services is not recoverablefrom the taxation authority, in which case the GST is recognised as part of thecost of acquisition of the asset or as part of the expense item as applicable; and• Receivables and payables are stated with the amount of GST included.The net amount of GST recoverable or payable to the taxation authority is includedas part of receivables or payables in the statement of financial position. Cash flowsare included in the statement of cash flows on a gross basis.j) Dividend – <strong>TIO</strong> Insurance & BankingPursuant to Section 26 of the Territory Insurance Office Act, the Minister may directthat any amount of funds held by <strong>TIO</strong> which, in his opinion, is in excess of thatrequired as adequate provision for actual and contingent liabilities or for thereasonable operating and other expenses of <strong>TIO</strong> shall be paid by <strong>TIO</strong> to theConsolidated Fund of the Territory.k) Transportation of accident victims – MAC FundPursuant to section 18 of the Motor Accidents (Compensation) Act there is payableto or on behalf of a person entitled to a benefit under this Act all reasonablemedical and rehabilitation expenses incurred in relation to treatment for injuriessustained in a motor vehicle accident. "Treatment" includes inter alia, theconveyance of that person to any place for the purpose of his/her receiving anytreatment or to a hospital. Reimbursements to the Territory during the year tocover intrastate transfer costs have been included in claims expense, along withambulance conveyance charges.l) Hospital bed days payments – MAC FundPayment for the treatment of MAC Fund patients in Northern Territory publichospitals occurs at the time of treatment.m) Property, plant and equipmentThe owner-occupied property located at 24 Mitchell Street is used in the supply ofservices and for administrative purposes and has been held to back insuranceliabilities. It is stated in the statement of financial position at its revalued amount,being the fair value at the date of revaluation, less any subsequent accumulateddepreciation and subsequent accumulated impairment losses. Revaluations areperformed annually at the reporting date. Property, plant and equipment are testedfor impairment whenever events or changes in circumstances indicate that thecarrying amount may not be recoverable.<strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong> 50

Territory Insurance OfficeNotes to the Financial Statements30 June <strong>2011</strong>Any revaluation increase arising on the revaluation of such land and buildings iscredited to the asset revaluation reserve, except to the extent that it reverses arevaluation decrease for the same asset previously recognised in profit and loss, inwhich case the increase is credited to profit and loss to the extent of the decreasepreviously charged. A decrease in carrying amount arising on the revaluation ofsuch land and buildings is charged to profit and loss to the extent that it exceedsthe balance, if any, held in the asset revaluation reserve relating to a previousrevaluation of that asset.Depreciation on revalued buildings is charged to the profit and loss. On thesubsequent sale or retirement of a revalued property, the attributable revaluationsurplus remaining in the asset revaluation reserve is transferred directly to retainedearnings. The effective useful life of the owner-occupied property has beenassessed at 50 years (2010: 50 years).Costs associated with the negotiation of operating leases associated with the owneroccupied property are capitalised and amortised over the term of the respectiveleases. These costs include the costs of fit outs and the accrual of rent during rentfree periods of occupation.Plant and equipment are stated at cost less accumulated depreciation and anyaccumulated impairment losses.Depreciation is charged so as to write off the cost or valuation of assets, other thanowner-occupied properties, over their estimated useful lives, using the straight-linemethod.Leasehold assets are depreciated over the life of the assets or term of the lease,whichever is shorter.The gain or loss arising on the disposal or retirement of an item of property, plantand equipment is determined as the difference between the sales proceeds and thecarrying amount of the asset and is recognised in the statement of comprehensiveincome.The expected useful lives for plant and equipment, other than owner-occupied landand buildings, range from 2.5 to 20 years (2010: 2.5 to 20 years).n) Financial instruments not held to back insurance liabilitiesFinancial assets not held to back insurance liabilities include financialinstruments used in the provision of banking services and assets not included innote 2.3(g). Financial assets and financial liabilities are recognised on <strong>TIO</strong>’sstatement of financial position when <strong>TIO</strong> becomes a party to the contractualprovisions of the instrument.<strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong> 51

Territory Insurance OfficeNotes to the Financial Statements30 June <strong>2011</strong>Trade receivables (excluding premium receivables)Trade receivables and other debtors are measured at initial recognition at fairvalue, and are subsequently measured at amortised cost using the effective interestrate method. Appropriate allowances for estimated irrecoverable amounts arerecognised in the statement of comprehensive income when there is objectiveevidence that the asset is impaired. The allowance recognised is measured as thedifference between the asset’s carrying amount and the present value of estimatedfuture cash flows discounted at the effective interest rate computed at initialrecognition.Loans <strong>TIO</strong> Insurance & BankingAll loans are measured at initial recognition at fair value, and are subsequentlymeasured at amortised cost using the effective interest rate method. The effectiveinterest rate calculation includes the contractual terms of loans together with feesand transaction costs.All loans are kept under continuous management review to assess whether there isany objective evidence that any loan or group of loans is impaired. A specificprovision is made for all identified impaired loans when there is reasonable doubtover the collectability of principal and interest in accordance with the loanagreement. All bad debts are written off against the specific provision in the periodin which they are classified as not recoverable. An appropriate collective impairmentprovision is determined by estimation of expected losses in relation to loanportfolios where specific identification is impractical, based on peer groupexperience. Adjustments to the collective impairment provision are accounted forthrough the statement of comprehensive income. The provision recognised ismeasured as the difference between the asset’s carrying amount and the presentvalue of estimated future cash flows discounted at the effective interest rate.Securitisation – <strong>TIO</strong> Insurance & Banking<strong>TIO</strong> has a sub origination and management agreement with Integris SecuritisationServices Pty Ltd (Master Servicer) and Cuscal Management Pty Limited (Manager)which are wholly owned subsidiaries of Cuscal Limited, to assign securitised homeloans with Integrity Trust, which is managed by Perpetual Trustee Company Limited(Trustee of the Trust).These securitised loans are reported as “on statement of financial position”mortgage products under AASB 139, and are subject to mortgage insurance. <strong>TIO</strong>recognises the financial liability to the Trust as a securitisation liability. Thecontractual arrangements of the securitisation program do not meet the criteriaoutlined in AASB139 Financial Instruments: Recognition and Measurement fortransferring assets off statement of financial position.<strong>TIO</strong> is the loan originator and it services and assigns selected loans to the Trusteeof the Trust in exchange for cash consideration. <strong>TIO</strong> passes on all cash flows of theloans to the Trust. <strong>TIO</strong> will continue to service these securitised loans on behalf ofthe trust and receives fee income for doing so. <strong>TIO</strong> receives interest from the loanportfolio and pays interest expense in relation to the funding costs of thesecuritisation. As loans are not derecognised, <strong>TIO</strong> will continue to recognise interestincome on an accrual basis.<strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong> 52

Territory Insurance OfficeNotes to the Financial Statements30 June <strong>2011</strong>In respect of insurance costs associated with mortgage insurance, <strong>TIO</strong> account forthese costs as a prepayment and they will be charged to the statement ofcomprehensive income over the life of the contract.Loan assets are assessed for impairment.InvestmentsAll purchases and sales of financial assets that require delivery of the asset withinthe time frame established by regulation or market convention (‘regular way’transactions) are recognised on the date of settlement, being the date the asset isdelivered to or by <strong>TIO</strong>. In cases where the period between trade and settlementexceeds this time frame, the transaction is also recognised at settlement date.Financial assets are derecognised when the rights to receive future cash flows fromthe assets have expired, or have been transferred, and <strong>TIO</strong> has transferredsubstantially all the risks and rewards of ownership.Investment assets other than those held to back insurance liabilities, have beencategorised as “at fair value through the profit and loss”, as they are held fortrading. They are part of a portfolio of identified financial instruments that aremanaged together and for which there is evidence of a recent actual pattern ofshort-term profit-taking.Cash and cash equivalentsCash and cash equivalents comprise cash on hand, demand deposits and short termhighly liquid investments that are readily convertible into known amounts of cashand which are subject to an insignificant risk of changes in value. Short term cashequivalents held for investment purposes and not to meet the short term cashcommitments of <strong>TIO</strong> are excluded from cash and cash equivalents.Subordinated loans and depositsInterest-bearing subordinated loan and deposits are initially measured at fair value,and are subsequently measured at amortised cost, using the effective interest ratemethod.Trade payablesTrade payables are initially measured at fair value, and are subsequently measuredat amortised cost, using the effective interest rate method.Derivative financial instruments - <strong>TIO</strong> Insurance & Banking<strong>TIO</strong>’s activities expose it primarily to the financial risk associated with changes ininterest rates.<strong>TIO</strong> uses interest rate swaps to hedge its risks associated with interest ratefluctuations relating to certain loans attracting a fixed rate of interest. <strong>TIO</strong>’s policyis to convert a proportion of its fixed rate loan assets to a variable rate of interest.<strong>TIO</strong>’s external investment managers utilise derivatives as part of the managementof exposures associated with those portfolios of investments held for trading.<strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong> 53

Territory Insurance OfficeNotes to the Financial Statements30 June <strong>2011</strong>The use of financial derivatives is governed by the <strong>TIO</strong>’s policies approved by <strong>TIO</strong>’sBoard, which provide written principles on the use of financial derivatives consistentwith the <strong>TIO</strong>’s risk management strategy. <strong>TIO</strong> does not use derivative financialinstruments for speculative purposes.Derivative financial instruments are initially measured at fair value on the contractdate, and are remeasured to fair value at subsequent reporting dates. Derivativesare carried as assets when their fair value is positive and as liabilities when theirfair value is negative.Hedge accounting<strong>TIO</strong> designates its interest rate swaps as cash flow hedges. The movement in fairvalue is recognised in the statement of comprehensive income for all derivativesother than those which qualify for hedge accounting.At the inception of the hedge relationship <strong>TIO</strong> documents the relationship betweenthe hedging instrument and hedged item, along with its risk managementobjectives and its strategy for undertaking the hedge transaction. Furthermore, atthe inception of the hedge and on an ongoing basis, <strong>TIO</strong> documents whether thehedging instrument that is used in a hedging relationship is highly effective inoffsetting changes cash flows of the hedged item.Note 33 includes details of the fair values of the derivative instruments used forhedging purposes. Movements in the hedging reserve in equity are also detailed inthe Statement of Changes in Equity.Cash flow hedgeThe effective portion of changes in the fair value of derivatives that are designatedand qualify as cash flow hedges are deferred in equity. The gain or loss relating tothe ineffective portion is recognised immediately in profit or loss as part of otherexpenses or other income. Amounts deferred in equity are recycled in profit or lossin the periods when the hedged item is recognised in profit or loss in the same lineof the statement of comprehensive income as the recognised hedged item. Hedgeaccounting is discontinued when <strong>TIO</strong> revokes the hedging relationship, the hedginginstrument expires or is sold, terminated, or exercised, or no longer qualifies forhedge accounting. Any cumulative gain or loss deferred in equity at that timeremains in equity and is recognised when the forecast transaction is ultimatelyrecognised in profit or loss. When a forecast transaction is no longer expected tooccur, the cumulative gain or loss that was deferred in equity is recognisedimmediately in profit or loss.o) Employee benefits<strong>TIO</strong> Insurance & Banking:Provision is made for employee benefits accumulated as a result of employeesrendering services up to the reporting date. These benefits include wages andsalaries, annual leave and long service leave.<strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong> 54

Territory Insurance OfficeNotes to the Financial Statements30 June <strong>2011</strong>Liabilities arising in respect of wages and salaries, all annual leave, and any otheremployee benefits expected to be settled within twelve months of the reportingdate are measured at their undiscounted amounts based on remuneration rateswhich are expected to be paid when the liability is settled.All other employee benefit liabilities are recognised, and are measured as thepresent value of expected future payments to be made in respect of servicesprovided by employees up to the reporting date. Consideration is given to theexpected future wage and salary levels, experience of employee departures andperiods of service. Expected future payments are discounted using interest rates onnational government guaranteed securities with terms to maturity that match, asclosely as possible, the estimated future cash outflows.MAC Fund:The MAC Fund does not employ staff in its own right; accordingly there are noemployee benefit liabilities.p) Translation of foreign currency transactionsForeign currency transactions are initially translated into Australian currency at therate of exchange at the date of the transaction. At balance date amounts payableand receivable in foreign currencies are translated to Australian currency at rates ofexchange at that date. Resulting exchange differences are recognised in thestatement of comprehensive income for the year.q) Cash and Cash EquivalentsCash and cash equivalents comprise cash on hand, demand deposits and short termhighly liquid investments that are readily convertible into known amounts of cashand which are subject to an insignificant risk of changes in value. Short term cashequivalents held for investment purposes and not to meet the short term cashcommitments of <strong>TIO</strong> are excluded from cash and cash equivalents.r) Intangible assetsIntangible assets are measured at cost. Following initial recognition, the intangibleasset is carried at cost less any accumulated amortisation and accumulatedimpairment losses. <strong>TIO</strong> amortises intangible assets on a basis which reflects thepattern of when expected economic benefits are likely to be realised.All intangible assets are not internally generated and are considered to have a finitelife. Software development expenditure that meets the criteria for recognition as anintangible asset is capitalised on the statement of financial position and amortisedover 1-4 years, subject to impairment testing.s) Funding for road safety programs – MAC FundPursuant to Sections 23 and 26 of the Territory Insurance Office Act, <strong>TIO</strong> providesthe Northern Territory Government with funds to meet certain costs in relation tothe operation of the road safety programs.t) Accounts payableThese amounts represent liabilities for goods and services provided to <strong>TIO</strong> prior tothe end of the financial year and which are unpaid. The amounts are unsecured andare usually paid within 30 days of recognition.<strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong> 55

Territory Insurance OfficeNotes to the Financial Statements30 June <strong>2011</strong>u) Deposits<strong>TIO</strong> Insurance & Banking:Interest-bearing deposits are initially measured at fair value, and are subsequentlymeasured at amortised cost, using the effective interest rate method.MAC Fund:This policy is not applicable to the MAC Fund.v) LeasesLeases are classified at their inception as either operating or finance leases basedon the economic substance of the agreement so as to reflect the risks and benefitsincidental to ownership.Operating leases where <strong>TIO</strong> is a lessee<strong>TIO</strong> enters into operating leases for office accommodation. Rentals payable underoperating leases are charged to the statement of comprehensive income on astraight-line basis over the term of the relevant lease. Benefits received andreceivable as an incentive to enter into an operating lease are also spread on astraight-line basis over the lease term.Operating leases where <strong>TIO</strong> is a lessor<strong>TIO</strong> is a lessor in respect of operating leases that are entered into with tenants whooccupy properties owned by <strong>TIO</strong>. Rental income from operating leases is recognisedon a straight-line basis over the term of the relevant lease. Initial direct costsincurred in negotiating and arranging operating leases are added to the carryingamount of the leased assets and recognised on a straight-line basis over the leaseterm.w) ProvisionsA Provision is a liability of uncertain timing or amount which is recognised in thestatement of financial position when:• <strong>TIO</strong> has a present obligation (legal or constructive) as a result of a past event;• It is probable that an outflow of economic benefits will be required to settle theobligation; and• The amount can be reliably measured.If the effect is material, provisions are determined by discounting the expectedfuture cash flows at a pre-tax rate that reflects current market assessments of thetime value of money and, when appropriate, the risks specific to the liability.x) Contingent liabilities and contingent assetsContingent liabilities are not recognised in the statement of financial position butare disclosed in the financial statements, unless the possibility of settlement isremote, in which case no disclosure is made. If settlement becomes probable, aprovision is recognised.Contingent assets are not recognised in the statement of financial position but aredisclosed in the financial statements when inflows are probable. If inflows becomevirtually certain, an asset is recognised.<strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong> 56

Territory Insurance OfficeNotes to the Financial Statements30 June <strong>2011</strong>The amount disclosed as a contingent liability or contingent asset is the bestestimate of the settlement or inflow.y) CommitmentsCommitments are not recorded on the statement of financial position but aredisclosed in the financial statements at their face value.z) ComparativesWhere necessary, comparatives have been reclassified and repositioned forconsistency with current year disclosures.aa) Rounding of amountsAmounts in the financial statements are presented in Australian dollars and havebeen rounded off to the nearest thousand dollars, or in certain cases, to the nearestdollar.2.4 Critical accounting judgments and estimates<strong>TIO</strong> makes estimates, judgments and assumptions in respect of certain key assetsand liabilities. Estimates and judgments are continually evaluated and are based onhistorical experience and other factors, including expectations of future events thatare believed to be reasonable under the circumstances. The key areas in whichcritical estimates are applied are described below and relate to outstanding claimsliabilities and reinsurance assets.a) The ultimate liability arising from claims made underinsurance contractsProvision is made at the year end for the estimated cost of claims incurred but notsettled at the statement of financial position date, including the cost of claimsincurred but not yet reported to <strong>TIO</strong>. The estimated cost of claims includes directexpenses to be incurred in settling claims gross of the expected value of salvageand other recoveries.<strong>TIO</strong> takes all reasonable steps to ensure that it has appropriate informationregarding its claims exposures. However, given the uncertainty in establishingclaims provisions, it is likely that the final outcome will prove to be different fromthe original liability established.The estimation of claims incurred but not reported ('IBNR') is generally subject to agreater degree of uncertainty than the estimation of the cost of settling claimsalready notified to <strong>TIO</strong>, where more information about the claim event is generallyavailable. IBNR claims may often not be apparent to the insured until many yearsafter the events giving rise to the claims have happened. In relation to the workerscompensation, liability and MAC Fund classes of businesses, there is typically agreater variation between initial estimates and final outcomes due to theuncertainty in estimating the ultimate cost of claims reported.<strong>TIO</strong> <strong>Annual</strong> <strong>Report</strong> 2010/<strong>2011</strong> 57