Hill lFarm Allowance Explanatory Booklet.pdf - The Rural Payments ...

Hill lFarm Allowance Explanatory Booklet.pdf - The Rural Payments ...

Hill lFarm Allowance Explanatory Booklet.pdf - The Rural Payments ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

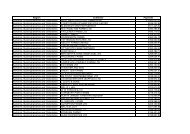

<strong>Hill</strong> Farm <strong>Allowance</strong> <strong>Explanatory</strong> <strong>Booklet</strong>ACTION REQUIRED NOW – PLEASE COMPLETE AND RETURN THE DECLARATION FORM BY19 JANUARY 2007If you have not previously provided details of the eligible animals and land areas, please tick theappropriate option on the declaration and we will send you a blank HFA application form (HFA 007).Alternatively, a blank copy of the form can be downloaded from the RPA internet site, which can thenbe printed and submitted at the same time as the declaration.Please return this declaration to the RPA HFA Processing Team at the following address using thepre-addressed envelope provided:HFA,PO Box 23,Exeter,EX5 1WE.Details of eligible land and animal numbers should reach the RPA no later than 19 January 2007.Please allow enough time for us to return you a blank form and for you to submit it by 19 January2007. Please also return your completed declarations early, as we are unable to issue any reminders.2.3 What is eligible LFA forage area?Eligible LFA forage land is any land with a cover of either permanent or temporary grass, which is withinthe LFA boundaries and is available to be grazed or have a grass cut taken from it for a period of sevencontinuous months, starting between 1 January 2006 and 31 March 2006.In order for you to claim HFA on the land it must be available to you for four of the seven months,although the four months need not be consecutive. Where applicable, the ten hectares minimum mayinclude LFA common land.If your holding includes land in Wales, Scotland or Northern Ireland (the Devolved Administrations), anypayments due to that land will be dealt with by the Devolved Administrations.Land used for milk production is not eligible for HFA payment. <strong>The</strong>refore we will obtain details of any MilkQuota that you held on 31 March 2006, which will be used in determining the amount you are entitled tofor HFA 2007. See Annex A for an explanation of how this applies.Statements of Milk Quota should be checked to ensure that the correct amount of quota has beenattributed to the business. Failure to do so may complicate the processing of your application andultimately may result in recovery of any payments to which you are not entitled.42.4 How will my land be classified?<strong>The</strong> declared forage area from your SPS 2006 form will be divided into the following categories:●●land within the Moorland Line;other LFA common land;